Abound pet food has emerged as a number one selection for puppy homeowners in the hunt for top rate diet for his or her bushy partners. This complete information delves into the important thing options, advantages, elements, and critiques of Abound pet food, offering precious insights that will help you make knowledgeable choices about your puppy’s vitamin.

Abound pet food sticks out available in the market with its dedication to the use of top quality, herbal elements and a focal point on optimum diet. Its distinctive mix of proteins, fat, carbohydrates, and very important nutrients and minerals is designed to beef up the well being and well-being of canines of every age and job ranges.

Abound Canine Meals Evaluation

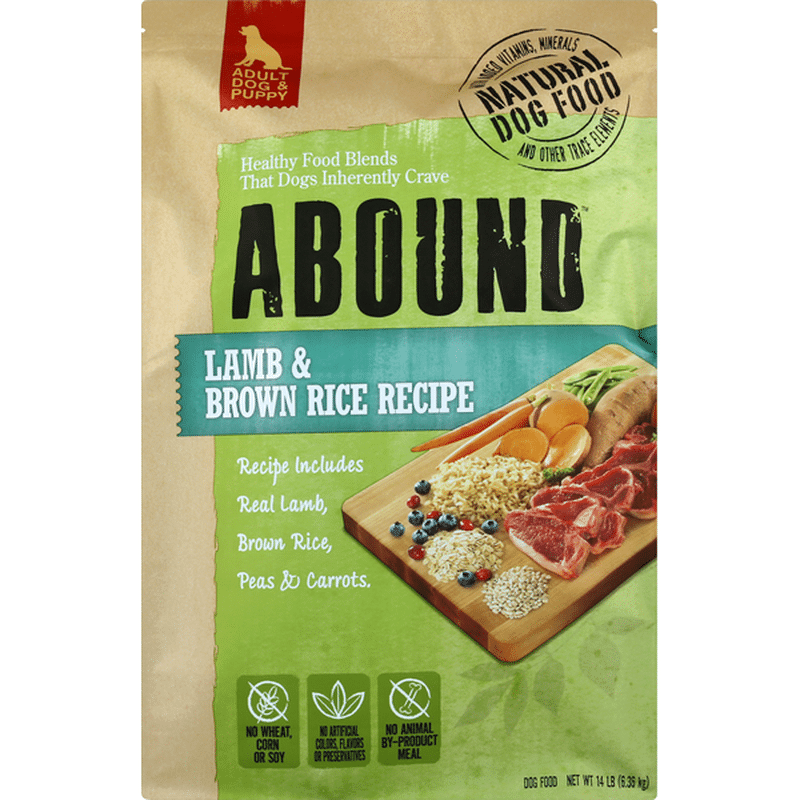

Abound pet food is a premium-quality dry pet food this is made with actual meat, entire grains, and contemporary greens. This can be a whole and balanced vitamin this is formulated to satisfy the dietary wishes of all canines, irrespective of age or job stage.

Abound pet food is made with top quality elements which are sparsely sourced from depended on providers. The beef is human-grade and the greens are contemporary and freed from insecticides. The meals could also be unfastened of man-made flavors, colours, and preservatives.

Abound pet food is a extremely digestible meals this is simple for canines to digest. It’s also an excessively palatable meals that canines like to devour. The meals is to be had in a lot of flavors and sizes to satisfy the wishes of all canines.

Comparability to Identical Merchandise

Abound pet food is a similar product to different premium-quality dry canine meals available on the market. It’s made with equivalent elements and has a equivalent dietary profile. On the other hand, Abound pet food is extra inexpensive than many different premium-quality canine meals.

Abound pet food could also be a extra sustainable product than many different canine meals. The meals is made with elements which are sourced from sustainable resources and the packaging is recyclable.

Abound Canine Meals Substances

Abound pet food is formulated with a mix of top quality elements to supply whole and balanced diet to your dog better half. The sparsely decided on elements in Abound pet food be offering a variety of dietary advantages, supporting your canine’s general well being and well-being.

Meat and Animal-Based totally Substances

- Rooster meal:A concentrated supply of protein and very important amino acids, rooster meal is very digestible and gives a flavorful base for the meals.

- Red meat meal:Some other very good supply of protein and amino acids, red meat meal contributes to sturdy muscular tissues and a wholesome coat.

- Beef meal:Wealthy in protein, nutrients, and minerals, red meat meal supplies a well-rounded dietary profile.

- Lamb meal:A hypoallergenic protein supply, lamb meal is delicate on delicate stomachs and gives a unique protein possibility for canines with hypersensitive reactions.

- Fish meal:A very good supply of omega-3 fatty acids, fish meal helps wholesome pores and skin, coat, and cognitive serve as.

Grains and Carbohydrates

- Brown rice:An entire grain that gives a supply of fiber, carbohydrates, and antioxidants.

- Oatmeal:A soluble fiber that helps digestive well being and gives a sense of fullness.

- Barley:A low-glycemic grain that gives sustained power and is helping control blood sugar ranges.

- Candy potato:A posh carbohydrate that gives power, fiber, and antioxidants.

- Peas:A legume that gives protein, fiber, and nutrients.

Culmination and Greens

- Apples:Wealthy in antioxidants and fiber, apples beef up a wholesome immune gadget and digestive tract.

- Carrots:A supply of beta-carotene, diet A, and antioxidants, carrots beef up eye well being and pores and skin well being.

- Blueberries:Wealthy in antioxidants and flavonoids, blueberries beef up cognitive serve as and immune well being.

- Spinach:A leafy inexperienced that gives nutrients, minerals, and antioxidants.

- Broccoli:A cruciferous vegetable that gives nutrients, minerals, and antioxidants.

Possible Allergens and Considerations

Whilst Abound pet food is formulated to be extremely palatable and nutritious, it is crucial to pay attention to possible allergens or considerations related to positive elements.

- Grains:Some canines is also allergic to positive grains, reminiscent of wheat or corn. Abound pet food makes use of brown rice, oatmeal, barley, and candy potato as its number one grain resources, that are typically well-tolerated by means of maximum canines.

- Rooster:Rooster is a commonplace allergen in canines. In case your canine has a recognized rooster hypersensitivity, you will have to steer clear of feeding them Abound pet food.

- Red meat:Red meat is any other possible allergen in canines. In case your canine has a recognized red meat hypersensitivity, you will have to steer clear of feeding them Abound pet food.

- Lamb:Lamb is a hypoallergenic protein supply, however some canines might nonetheless be allergic to it.

- Fish:Fish is a possible allergen in canines, particularly the ones with a historical past of fish hypersensitive reactions.

You probably have any considerations about possible allergens or your canine’s person nutritional wishes, it is at all times beneficial to seek advice from your veterinarian for customized recommendation.

Abound Canine Meals Feeding Information

To make sure optimum diet to your canine, it is important to observe the feeding pointers supplied by means of Abound. Those pointers are sparsely designed in keeping with your canine’s age, weight, and job stage.

Overfeeding or underfeeding could have destructive penalties to your canine’s well being. Overfeeding may end up in weight problems, joint issues, and different well being problems, whilst underfeeding may end up in malnutrition and a weakened immune gadget.

Feeding Tips

The next desk supplies a complete feeding information for Abound pet food:

| Age | Weight (lbs) | Process Degree | Day-to-day Feeding Quantity (cups) |

|---|---|---|---|

| Pet (8-12 weeks) | 10-20 | Reasonable | 1/2

|

| Pet (12-16 weeks) | 20-30 | Reasonable | 1

|

| Grownup (1 yr and older) | 30-50 | Reasonable | 1 1/2

|

| Grownup (1 yr and older) | 50-70 | Reasonable | 2

|

| Grownup (1 yr and older) | 70-90 | Reasonable | 2 1/2

|

Observe:Those are simply pointers, and you will wish to alter the feeding quantity in keeping with your canine’s person wishes and urge for food.

You probably have any questions or considerations about feeding your canine Abound, seek advice from your veterinarian for customized recommendation.

Abound Canine Meals Opinions

Abound pet food has garnered a blended bag of critiques from consumers. Whilst some puppy homeowners have reported certain stories, others have expressed considerations concerning the product’s high quality and effectiveness.

Sure Opinions, Abound pet food

- Many shoppers have praised Abound pet food for its top quality elements and its certain affect on their canines’ well being. They document that their pets have skilled stepped forward digestion, pores and skin and coat well being, and general power ranges after switching to Abound.

- Different certain critiques spotlight the benefit of Abound’s subscription provider. Consumers admire the power to have contemporary pet food delivered immediately to their doorstep, getting rid of the desire for widespread journeys to the shop.

Damaging Opinions

- Some consumers have expressed considerations about the price of Abound pet food. They argue that the cost is simply too prime in comparison to different top rate pet food manufacturers.

- Different adverse critiques point out problems with the standard of the meals. Some consumers have reported discovering overseas gadgets, reminiscent of plastic and steel, of their canines’ meals.

- Moreover, some consumers have skilled issues of their Abound subscription provider. They’ve reported delays in supply, flawed orders, and problem canceling their subscriptions.

Total Sentiment

In accordance with buyer comments, the entire sentiment in opposition to Abound pet food is blended. Whilst many purchasers have had certain stories with the product, others have raised considerations about its high quality, value, and subscription provider. It is crucial for possible consumers to rigorously imagine those critiques and weigh the professionals and cons prior to you decide about whether or not or to not acquire Abound pet food.

Abound Canine Meals Pricing and Availability

Abound pet food is priced competitively available in the market, providing top rate high quality at an inexpensive value. When in comparison to different similar merchandise, Abound pet food supplies very good worth for cash.

On-line Availability

Abound pet food is comfortably to be had on-line during the authentic web site and quite a lot of e-commerce platforms. This guarantees simple get admission to for patrons preferring the benefit of on-line buying groceries.

Retail Shops

Moreover, Abound pet food is stocked in make a choice retail shops, making it available to consumers preferring to buy in individual. The corporate is actively increasing its retail presence to cater to a much broader buyer base.

Abound Canine Meals Choices

For canine homeowners who might not be absolutely glad with Abound pet food, a number of choice choices are to be had. Those possible choices be offering a variety of options, advantages, and elements that can higher go well with the precise wishes and personal tastes of canines.

When opting for an alternative choice to Abound pet food, it is very important imagine elements such because the canine’s age, measurement, job stage, and any explicit nutritional necessities. The next possible choices supply a complete evaluation of choices to be had available in the market.

Ollie Canine Meals

- Recent, human-grade elements:Ollie pet food is made with contemporary, entire elements which are sourced from depended on farms and providers.

- Custom designed meal plans:Ollie gives custom designed meal plans adapted to each and every canine’s person wishes, in keeping with their age, weight, and job stage.

- Handy supply:Ollie foods are delivered contemporary to the doorstep, getting rid of the desire for widespread journeys to the shop.

The Farmer’s Canine

- Human-grade, vet-formulated recipes:The Farmer’s Canine recipes are formulated by means of veterinary nutritionists and made with human-grade elements.

- Customized meal plans:The Farmer’s Canine gives customized meal plans in keeping with each and every canine’s age, weight, and well being stipulations.

- Handy subscription provider:The Farmer’s Canine foods are delivered on a subscription foundation, making sure a constant provide of unpolluted, wholesome meals to your canine.

JustFoodForDogs

- Human-grade, natural elements:JustFoodForDogs makes use of best human-grade, natural elements of their pet food recipes.

- Number of recipes:JustFoodForDogs gives all kinds of recipes to make a choice from, together with choices for pups, grownup canines, and senior canines.

- Cooked contemporary day-to-day:JustFoodForDogs foods are cooked contemporary day-to-day and delivered to the doorstep, making sure most freshness and high quality.

Useful Solutions

What makes Abound pet food distinctive?

Abound pet food is formulated with a novel mix of top quality, herbal elements, together with actual meat, entire grains, and very important nutrients and minerals. This mixture supplies an entire and balanced vitamin that helps the entire well being and well-being of canines.

How does Abound pet food examine to different manufacturers?

Abound pet food is analogous to different top rate pet food manufacturers in the case of high quality and dietary worth. On the other hand, it sticks out with its dedication to the use of herbal elements and its focal point on optimum diet for canines of every age and job ranges.

The place can I buy Abound pet food?

Abound pet food is available to buy on-line during the authentic Abound web site and at make a choice puppy provide shops and veterinary clinics.