Affordable automobile insurance coverage Waco TX is a the most important attention for drivers within the house. Figuring out the marketplace, price components, and to be had methods is vital to discovering the most efficient charges. This complete information explores the panorama of vehicle insurance coverage in Waco, TX, providing insights into discovering reasonably priced choices.

The Waco automobile insurance coverage marketplace gifts a mixture of aggressive suppliers and components influencing premiums. This information will analyze the specifics, from motive force profiles to automobile sorts, that can assist you navigate the method of securing reasonably priced protection.

Assessment of Affordable Automobile Insurance coverage in Waco, TX

Hey, other people! Searching for a just right deal on automobile insurance coverage in Waco? Smartly, buckle up, since the Waco automobile insurance coverage marketplace is a wild journey, with some strangely reasonably priced choices nestled among the standard suspects. Let’s dive in and notice what makes it tick.The Waco automobile insurance coverage scene is beautiful standard for Texas – a mixture of high-and-low price choices, relying for your state of affairs.

Elements like your riding file, the kind of automobile you power, or even the place you are living in Waco can considerably have an effect on your top class. So, let’s ruin it down and notice what influences the ones charges.

Price Elements Influencing Automobile Insurance coverage Premiums in Waco

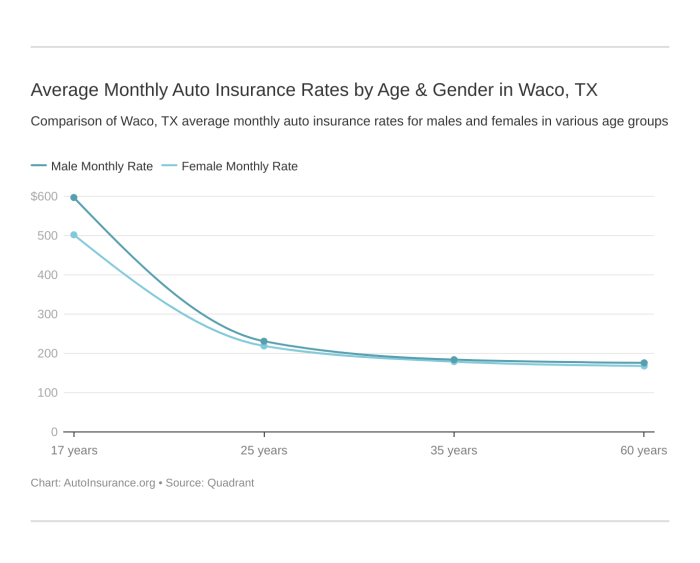

Elements influencing insurance coverage premiums in Waco, TX are multifaceted and don’t seem to be restricted to only the kind of automobile. Your riding file, age, and placement all play a the most important position within the ultimate price. A blank riding file, a tender age, and a secure group can considerably scale back your top class, whilst the other can build up it.

Not unusual Insurance coverage Suppliers within the Waco Space

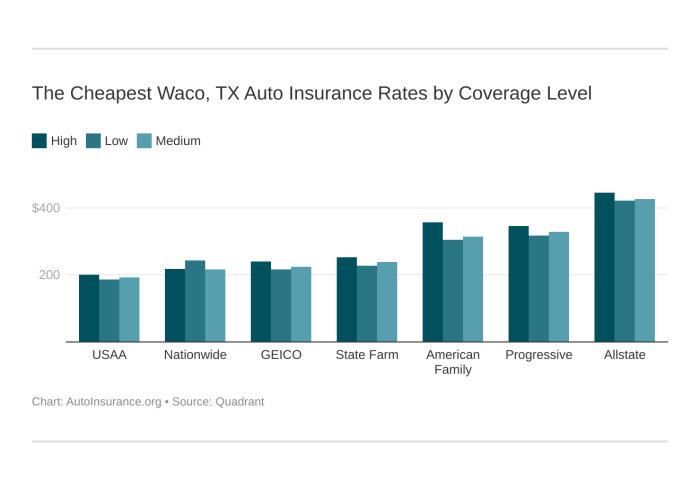

A number of primary gamers dominate the Waco insurance coverage marketplace. Those firms regularly be offering aggressive charges, however the most efficient deal will regularly rely on your particular wishes and instances. Corporations like State Farm, Allstate, Geico, and Innovative are incessantly noticed in Waco, however there also are a lot of native and regional firms.

Reasonable Insurance coverage Charges In comparison to Different Texas Towns

Waco’s insurance coverage charges generally tend to fall in the course of the pack in comparison to different Texas towns. There isn’t any massive disparity in charges throughout Texas towns. Elements like town’s crime charge, visitors density, and reasonable motive force age can all impact the common price of vehicle insurance coverage.

Conventional Insurance coverage Prices In response to Automobile Sort

| Automobile Sort | Estimated Per month Top rate (Instance) |

|---|---|

| Sedan | $100-$150 |

| SUV | $120-$180 |

| Pickup Truck | $150-$220 |

Observe: Those are simply examples. Precise premiums can range considerably in accordance with person components.

Elements Affecting Affordable Automobile Insurance coverage Charges in Waco

Discovering the most cost effective automobile insurance coverage in Waco can really feel like navigating a maze, however concern no longer, intrepid motive force! Figuring out the standards that affect charges is vital to getting the most efficient deal. It is all about understanding what makes your pockets sing – or no less than, no longer scream in agony on the insurance coverage invoice.Insurance coverage firms are not simply guessing; they use a fancy method to calculate your top class.

They take a look at a lot of components, out of your riding file in your location, to assist decide your threat degree. The extra predictable you might be, the decrease your top class may be. Recall to mind it as a praise for being a accountable motive force!

Using Historical past

A blank riding file is a motive force’s absolute best pal in terms of insurance coverage. Injuries and violations considerably have an effect on premiums. A string of dashing tickets or perhaps a unmarried twist of fate can result in considerably upper charges. It’s because insurance coverage firms see the next chance of long term claims for drivers with a less-than-stellar riding historical past. Recall to mind it as a credit score rating for riding – an ideal rating method decrease premiums!

Automobile Sort and Make/Style

The kind of automobile you power performs a task to your insurance coverage prices. Sure automobiles, regularly sporty or high-performance fashions, are costlier to fix or change, making them a better threat to insurers. The make and fashion additionally subject. Some manufacturers have a name for upper restore prices, and insurance coverage firms issue this into their pricing.

This can be a bit like purchasing for a automobile; some are costlier to handle.

Location Inside of Waco

Waco, like all town, has spaces with other crime charges and twist of fate frequencies. Your location inside of Waco can affect your insurance coverage prices. In case you are living in a space identified for extra injuries, your top class could also be upper. Insurance coverage firms be mindful components like visitors density, twist of fate charges, or even proximity to emergency products and services when surroundings charges.

It is not near to your riding; it is about the place you power.

Protection Possible choices

The kind of protection you select considerably impacts your premiums. Legal responsibility protection, protective you towards damages you motive to others, is the naked minimal, however the least dear. Complete and collision protection, protective your automobile from harm irrespective of who’s at fault, are costlier however be offering larger coverage. Recall to mind it as opting for your degree of armor – the extra armor, the upper the fee.

Driving force Profile Have an effect on on Charges

| Driving force Profile | Doable Have an effect on on Charges |

|---|---|

| Younger Drivers (16-25) | Usually upper charges because of the next twist of fate threat. |

| Older Drivers (65+) | Probably decrease charges if riding historical past is just right. |

| Male Drivers | Probably upper charges than feminine drivers in some instances, however this isn’t all the time the case. |

| Feminine Drivers | Probably decrease charges than male drivers in some instances, however this isn’t all the time the case. |

| Married Drivers | Will have relatively decrease charges than single drivers in some instances. |

A motive force’s age, gender, and marital standing are all thought to be by way of insurers when surroundings charges. Every issue contributes to the entire threat evaluation. This desk supplies a basic assessment, however the precise have an effect on can range very much relying on person instances and riding historical past. The information isn’t set in stone.

Methods for Discovering Affordable Automobile Insurance coverage in Waco

Discovering the fitting automobile insurance coverage in Waco can really feel like navigating a maze, however concern no longer, intrepid drivers! We have were given the lowdown on scoring the most efficient charges with out sacrificing your sanity. It is all about savvy methods and a bit little bit of detective paintings.Saving cash on automobile insurance coverage in Waco is surely achievable. It is not about success, however moderately figuring out the standards that affect premiums and using efficient comparability tactics.

Recall to mind it as a treasure hunt, however as an alternative of buried gold, you are after the bottom imaginable insurance coverage charges.

Evaluating Quotes from A couple of Suppliers

Buying groceries round for automobile insurance coverage is like sampling other flavors of ice cream—you want to take a look at a couple of to search out your favourite! Evaluating quotes from a couple of suppliers is the most important. Other firms have other pricing constructions, so a unmarried quote would possibly no longer mirror the most efficient deal. Via evaluating quotes, you acquire a transparent image of the to be had choices and establish essentially the most aggressive charges.

It is like having a style check on your pockets.

Studying Coverage Paperwork Moderately

Do not simply skim the coverage paperwork; learn them meticulously! Insurance coverage insurance policies can also be dense, however figuring out the phrases and prerequisites is essential. This fashion, you are no longer stuck off guard by way of hidden charges or exclusions. Thorough studying guarantees you are totally conscious about what you are paying for and steer clear of unsightly surprises down the street. It is like studying the tremendous print of a discount—figuring out each phrase guarantees you are getting the worth you are expecting.

Bundling Insurance coverage Insurance policies

Combining your own home and auto insurance coverage insurance policies with the similar supplier can regularly result in important financial savings. Insurance coverage firms regularly be offering reductions for bundling, spotting the shared threat and comfort of getting a couple of insurance policies with them. Recall to mind it as a double-dip bargain—you are getting a greater charge on two insurance policies as an alternative of only one. It is like getting a combo meal with additional financial savings!

Sources for Evaluating Automobile Insurance coverage Quotes

Discovering dependable sources for evaluating automobile insurance coverage quotes is very important. On-line comparability web pages, impartial insurance coverage brokers, or even your financial institution’s monetary advisors are all nice beginning issues. They may be able to supply a centralized platform for buying quotes from more than a few firms and streamline the method. It is like having a super-powered seek engine adapted particularly for insurance coverage quotes.

Steps to Examine Quotes

| Step | Motion |

|---|---|

| 1 | Accumulate your data (motive force’s license, automobile main points, riding historical past). |

| 2 | Use on-line comparability gear or talk over with insurance coverage brokers. |

| 3 | Request quotes from a couple of insurance coverage suppliers. |

| 4 | Moderately overview coverage paperwork and examine protection choices. |

| 5 | Make a selection the coverage with essentially the most aggressive charge and desired protection. |

Reductions and Financial savings for Waco Citizens

Hey, other people! Saving cash on automobile insurance coverage in Waco is like discovering a buried treasure. Understanding the to be had reductions permit you to snag a deal that’ll make your pockets sing. Let’s dive into the treasure map of reductions!

Reductions for Protected Using and Just right Using Information

A blank riding file is sort of a gold big name on your insurance coverage premiums. Insurance coverage firms love drivers and not using a injuries or violations. This interprets to important financial savings, like discovering a super-duper sale on the native retailer! A super riding file regularly comes with a hefty bargain.

Reductions for Scholars, Seniors, or Army Team of workers

Insurance coverage firms regularly praise particular demographics with reductions. Scholars, seniors, and armed forces staff are incessantly known for his or her distinctive instances, regularly getting particular charges. It is like getting a pupil or senior citizen’s bargain on the films, however on your automobile insurance coverage!

Reductions for Keeping up a Just right Credit score Ranking

A just right credit score rating is like having a powerful monetary basis. Insurance coverage firms imagine a powerful credit score historical past signifies accountable monetary conduct, which might translate into decrease premiums. Recall to mind it as a “just right credit score rating” bargain, an advantage for being financially savvy.

Reductions for Particular Automobile Protection Options

Some insurance coverage firms be offering reductions for vehicles with additional security features, like anti-theft gadgets, airbags, and complicated braking techniques. Those options point out a extra protected automobile, and the insurance coverage firms praise that protection. It is like getting an advantage for riding a tank—a secure tank, in fact!

Reductions for Bundling Insurance coverage Insurance policies

Bundling a couple of insurance coverage insurance policies, like house and auto insurance coverage, with the similar corporate, regularly ends up in financial savings. It is like a circle of relatives package deal deal, the place you get monetary savings for having the whole lot coated underneath one roof.

Desk of More than a few Reductions and Doable Financial savings

| Bargain Class | Description | Doable Financial savings (Instance) |

|---|---|---|

| Protected Using | No injuries or violations prior to now yr | 10-20% |

| Pupil Bargain | Energetic pupil enrolled in a highschool or faculty | 5-15% |

| Senior Bargain | Age-related bargain for seniors | 5-10% |

| Army Bargain | Energetic responsibility army staff or veterans | 5-15% |

| Just right Credit score Ranking | Keeping up a just right credit score rating | 5-10% |

| Automobile Protection Options | Anti-theft gadgets, complicated security features | 5-10% |

| Bundling | Bundling auto and residential insurance coverage | 5-15% |

Guidelines for Managing Insurance coverage Prices in Waco

Hey, Waco drivers! Understanding affordable automobile insurance coverage can really feel like looking to herd cats, however it does not should be a wild goose chase. We have were given some sensible guidelines that can assist you tame the ones insurance coverage premiums and stay your pockets satisfied.Managing your insurance coverage prices is a savvy transfer, like discovering a hidden parking spot in Waco’s downtown.

It is all about good possible choices and proactive measures. You can be shocked how a lot you’ll be able to save by way of making some easy changes in your riding conduct and protection.

Making improvements to Using Conduct to Decrease Insurance coverage Prices

Using safely is not just about keeping off injuries; it is an immediate trail to decrease insurance coverage premiums. A blank riding file is like gold within the insurance coverage recreation. Protected riding conduct regularly result in decrease premiums. Recall to mind it as a praise for accountable riding!

- Defensive Using: Staying alert, expecting possible hazards, and keeping up a secure following distance are key to keeping off injuries. This no longer handiest protects you but additionally your insurance coverage charges.

- Keep away from Distracted Using: Texting, speaking at the telephone, or twiddling with the radio whilst in the back of the wheel is a recipe for crisis. Insurance coverage firms see this as the next threat issue, main to better premiums.

- Velocity Limits: Exceeding velocity limits is a vital threat issue. Staying throughout the velocity prohibit can prevent cash and stay you secure at the highway.

- Accountable Alcohol and Drug Use: Using inebriated or medication is unlawful and very dangerous. Insurance coverage firms regularly fee considerably upper premiums for drivers with a historical past of DUI/DWI convictions.

Making Knowledgeable Protection Possible choices

Choosing the proper protection is like selecting the very best outfit for a Waco rodeo – it wishes to suit your wishes and price range. Do not overpay for protection you do not want.

- Legal responsibility Protection: This covers damages you motive to other folks or their belongings. Believe the quantity of protection that aligns along with your monetary state of affairs and threat tolerance.

- Collision Protection: This can pay for damages in your automobile in an twist of fate, irrespective of who is at fault. If you are in a low-risk state of affairs and feature sufficient financial savings, this can be a price you’ll be able to most probably skip.

- Complete Protection: This covers harm in your automobile from incidents like vandalism, robbery, or climate occasions. In case you are living in a high-theft house, this protection may well be value taking into consideration.

- Uninsured/Underinsured Motorist Protection: That is the most important if you are occupied with an twist of fate with a motive force who does not have insurance coverage or does not have sufficient to hide the damages.

Keeping up a Blank Using Document

A blank riding file is your absolute best pal in terms of getting affordable automobile insurance coverage. It is like having a golden price tag to decrease premiums. It displays insurance coverage firms that you are a accountable motive force.

- Keeping off Injuries: Following visitors regulations and working towards defensive riding is the most important for keeping up a spotless riding file.

- Paying Your Tickets on Time: Paying visitors tickets promptly is very important for keeping off issues for your riding file. Issues can result in upper premiums.

- Responding to Insurance coverage Corporate Requests: Promptly reply to any requests out of your insurance coverage corporate to steer clear of any problems along with your file.

Lowering Dangers Related to Your Automobile

Taking good care of your automobile too can scale back your insurance coverage prices. A well-maintained automobile is a more secure and extra dependable automobile.

- Common Repairs: Common upkeep, like oil adjustments and tire rotations, guarantees your automobile is in just right running order. This reduces the chance of mechanical problems that might result in injuries.

- Safety Measures: Believe putting in anti-theft gadgets to give protection to your automobile from robbery. It is a important price saver.

- Parking Properly: Parking in well-lit and protected spaces can deter vandalism and robbery.

Asking for a Coverage Overview

Do not be afraid to invite for a coverage overview. Insurance coverage charges can trade in accordance with more than a few components.

- Touch Your Insurance coverage Agent: Touch your insurance coverage agent to talk about any adjustments to your riding conduct, monetary state of affairs, or automobile data.

- Overview Your Protection Wishes: Evaluation your wishes steadily to be sure you have the fitting protection on the proper worth.

- Examine Charges from Different Suppliers: Store round with other insurance coverage suppliers to match charges and in finding the most efficient deal for you.

Figuring out Insurance coverage Insurance policies in Waco

So, you are looking to navigate the wild global of Waco automobile insurance coverage? It is like looking for a parking spot on a Saturday evening – tough, however attainable. Figuring out your coverage is vital to keeping off the ones sudden restore expenses and complications. Let’s ruin down the necessities.Insurance coverage insurance policies are necessarily contracts, promising repayment for particular losses. They are written in legalese, however they boil right down to protective you from monetary destroy if the worst occurs.

Recall to mind it as a security web – you pay a small quantity every month, and they are going to pay a large quantity in case your automobile will get totaled.

Conventional Protection Choices

Automobile insurance coverage insurance policies most often be offering a lot of coverages. The most typical are legal responsibility protection (to pay for harm to others’ vehicles or accidents), collision protection (to hide your automobile if it crashes), complete protection (for harm from such things as hail, robbery, or vandalism), and uninsured/underinsured motorist protection (if any individual with out insurance coverage hits you). Necessarily, you select the security degree that matches your wishes and price range.

Not unusual Automobile Insurance coverage Claims in Waco

Waco, like all town, has its proportion of fender benders. Not unusual claims come with injuries (rear-enders are great commonplace!), hail harm (particularly throughout spring storms), and vandalism (consider the ones late-night automobile parking space shenanigans). Robbery may be an element, particularly for older vehicles. From time to time, a declare is solely a minor twist of fate, however infrequently it is a primary incident.

Steps for Submitting a Automobile Insurance coverage Declare in Waco

Submitting a declare is somewhat like navigating a bureaucratic maze, however it isn’t that dangerous if you are arranged. First, touch your insurance coverage corporate straight away. Then, accumulate all related data (police file, footage of wear, witness statements). Be fair and thorough to your declare, and you can be at the highway to restoration sooner.

Examples of Conventional Automobile Insurance coverage Claims in Waco, Affordable automobile insurance coverage waco tx

Consider Sarah’s automobile used to be totaled in a hit-and-run twist of fate. Or imagine Mark, whose automobile used to be broken by way of a falling tree throughout a serious typhoon. Those are only a few examples. Incessantly, claims contain harm in your automobile, harm to you or others, and even the robbery of your automobile.

Not unusual Questions Referring to Insurance coverage Insurance policies

Listed below are some incessantly requested questions on insurance coverage insurance policies, and their solutions:

- What occurs if I am in an twist of fate with any individual who does not have insurance coverage?

- How a lot protection do I want?

- What if I’ve an twist of fate with any individual who’s at fault?

- What are the several types of automobile insurance coverage insurance policies?

Your uninsured/underinsured motorist protection kicks in to assist pay for damages.

The volume of protection relies on your property and your threat tolerance.

Your insurance coverage corporate must take care of the declare for damages in your automobile, and if there are accidents to you or others.

Legal responsibility, collision, complete, and uninsured/underinsured motorist protection are the most typical sorts.

Abstract of Not unusual Automobile Insurance coverage Insurance policies and Protection

| Coverage Sort | Description | Conventional Protection |

|---|---|---|

| Legal responsibility | Covers harm to others’ belongings or accidents to others. | Physically harm legal responsibility, belongings harm legal responsibility |

| Collision | Covers harm in your automobile in an twist of fate, irrespective of who is at fault. | Upkeep or substitute of your automobile. |

| Complete | Covers harm in your automobile from occasions rather then injuries, equivalent to vandalism, robbery, or climate harm. | Upkeep or substitute of your automobile. |

| Uninsured/Underinsured Motorist | Protects you if you are in an twist of fate with any individual who does not have insurance coverage or does not have sufficient insurance coverage. | Upkeep or substitute of your automobile and fee for clinical expenses. |

Evaluating Insurance coverage Suppliers in Waco

Discovering the fitting automobile insurance coverage in Waco can really feel like navigating a maze of complicated choices. However do not fret, we are right here that can assist you kind throughout the jargon and in finding the most efficient deal. Recall to mind it like evaluating other ice cream flavors – you need one that is creamy, scrumptious, and reasonably priced, proper? Insurance coverage is simply as necessary, and discovering the fitting have compatibility on your wishes is vital.Insurance coverage firms in Waco, like all over else, have their very own distinctive strengths and weaknesses.

Some may well be identified for his or her super-fast claims processing, whilst others excel at providing aggressive charges. We’re going to ruin down the distinguished gamers within the Waco marketplace and will let you perceive what every one brings to the desk. So, seize your metaphorical ice cream scoop and let’s dive into the main points!

Outstanding Insurance coverage Corporations in Waco

Waco boasts a variety of insurance coverage suppliers, every vying for what you are promoting. Some well known names come with State Farm, Geico, Allstate, and Innovative, amongst others. Every corporate has a special option to offering insurance coverage, so it’s a must to examine them in accordance with your particular wishes.

Services and products Introduced by way of Other Suppliers

Other firms be offering more than a few products and services past elementary automobile insurance coverage. Some would possibly come with roadside help, condo automobile protection, and even reductions for bundling your insurance policies. Believe what extras are necessary to you. For instance, when you incessantly go back and forth, roadside help can be a lifesaver. Take into accounts your way of life and select the corporate that most closely fits your wishes.

Aggressive Charges in Waco

A large number of components affect insurance coverage charges, equivalent to your riding file, the kind of automobile you personal, and your location. Researching other suppliers is very important to spot the ones persistently providing aggressive charges in Waco. You may in finding that an organization that specialize in more youthful drivers or the ones with just right riding data provides decrease premiums.

Supplier Reputations In response to Buyer Opinions

Buyer opinions be offering a treasured glimpse into an organization’s popularity. On-line platforms like Yelp and Google Opinions regularly supply perception into buyer stories. Studying opinions can come up with a way of ways an organization handles claims, their customer support, and their general responsiveness. Search for patterns within the opinions. If many of us point out gradual claims processing, that may well be a crimson flag.

Buyer Provider Ranges of Insurance coverage Corporations

Customer support is a important facet of the insurance coverage enjoy. Corporations with a name for very good customer support could make a vital distinction within the tournament of a declare. Search for firms that experience a devoted buyer enhance workforce and readily to be had telephone numbers. The benefit of conversation and responsiveness in your wishes are the most important.

Abstract Desk of Insurance coverage Suppliers

| Insurance coverage Supplier | Options | Execs | Cons |

|---|---|---|---|

| State Farm | In depth community, robust logo popularity, more than a few reductions | Dependable carrier, identified for claims dealing with, wide variety of goods | Probably upper premiums when compared to a couple competition |

| Geico | On-line gear, handy products and services, aggressive charges for some profiles | Simple on-line get admission to, reasonably priced for some, just right customer support in some spaces | Restricted native enhance, won’t have the entire products and services you want |

| Allstate | A couple of protection choices, complete insurance policies | Number of merchandise, regularly just right for particular wishes, respectable customer support in some spaces | Customer support can range by way of location, probably upper premiums |

| Innovative | Virtual platforms, reductions for just right drivers, cellular app | Very good on-line presence, user-friendly gear, obtainable on-line and by the use of app | Customer support may well be much less private, much less native enhance |

Ultimate Level: Affordable Automobile Insurance coverage Waco Tx

In conclusion, securing affordable automobile insurance coverage in Waco, TX, calls for cautious attention of more than a few components. Evaluating quotes, figuring out reductions, and managing prices are very important steps. This information has supplied a roadmap for locating the most efficient insurance coverage choices on your wishes. Take into accout, accountable riding and a proactive option to insurance coverage control are key to long-term price financial savings.

Continuously Requested Questions

What are the most typical reductions to be had for automobile insurance coverage in Waco, TX?

Reductions regularly come with secure riding, just right riding data, pupil standing, senior standing, army carrier, just right credit score ratings, and particular automobile security features.

How does my riding historical past impact my automobile insurance coverage premiums in Waco?

A blank riding file most often ends up in decrease premiums. Injuries and violations can considerably build up your charges.

What are the standard insurance coverage prices for various automobile sorts in Waco?

Prices range in accordance with the automobile’s make, fashion, and sort (e.g., sedans most often price not up to SUVs or vans). A desk within the complete article supplies extra element.

Which insurance coverage suppliers are most well liked in Waco, TX?

Common suppliers in Waco come with [Insert Names of Popular Providers], however evaluating quotes from a couple of firms is all the time really useful.