Affordable automobile insurance coverage Gainesville FL is a crucial attention for drivers on this colourful town. Navigating the native marketplace can really feel daunting, however working out the criteria influencing premiums and the methods for securing reasonably priced charges is empowering. This complete information unveils the secrets and techniques to discovering the most efficient offers on automobile insurance coverage, offering insights into supplier comparisons, protection choices, and the most important pointers for accountable using.

Acquire precious wisdom concerning the nuances of auto insurance coverage in Gainesville, FL, enabling you to make knowledgeable selections and protected essentially the most appropriate protection to your wishes. Uncover how using report, car kind, and site immediately affect your insurance coverage prices, along the importance of credit score historical past and the position of age and gender in charge calculations.

Evaluate of Affordable Automotive Insurance coverage in Gainesville, FL

Unlocking the secrets and techniques to reasonably priced automobile insurance coverage in Gainesville, FL, is more straightforward than you suppose! This colourful town, like many others, has a aggressive insurance coverage marketplace. Working out the criteria using prices and commonplace misconceptions can empower you in finding the most efficient deal.The automobile insurance coverage marketplace in Gainesville, FL, is a dynamic enviornment the place quite a lot of elements interaction to decide premiums.

From town’s demographic profile to its using prerequisites, those components jointly form the panorama of insurance coverage prices. Navigating this complicated interaction is the most important for securing reasonably priced protection.

Value Components Influencing Insurance coverage Premiums

Working out the weather that give a contribution in your automobile insurance coverage premiums is paramount. Components like your using report, car kind, and site all play a task. Your historical past of injuries or site visitors violations considerably affects your charge. A blank using report in most cases interprets to decrease premiums. The worth and make of your automobile also are important issues.

Luxurious automobiles frequently include larger premiums because of their perceived larger menace of wear or robbery. Your Gainesville deal with additionally issues, as sure neighborhoods will have the next prevalence of injuries or robbery.

Commonplace Misconceptions about Affordable Automotive Insurance coverage

Many myths encompass the pursuit of inexpensive automobile insurance coverage. One prevalent false impression is {that a} unmarried quote is the definitive solution. Evaluating quotes from a couple of suppliers is the most important for figuring out essentially the most aggressive charges. Every other false impression is that larger deductibles all the time result in decrease premiums. Whilst true in some instances, a excessive deductible frequently approach you are accountable for a bigger out-of-pocket expense within the tournament of an coincidence.

In spite of everything, there may be the realization that reductions are inappropriate; on the other hand, reductions for excellent pupil standing, defensive using lessons, or a couple of automobiles can considerably decrease your premiums.

Historical past of Automotive Insurance coverage Pricing Developments in Gainesville

Gainesville, like different spaces, has observed fluctuations in automobile insurance coverage pricing. The advent of recent protection rules and the evolution of generation have infrequently resulted in a downward pattern in general prices. Conversely, will increase in claims frequency or severity can power up premiums. Total, the fad demonstrates a dynamic marketplace the place working out present charges is significant for attaining the most efficient conceivable price.

Moderate Insurance coverage Charges for Other Automobile Varieties

This desk presentations estimated reasonable insurance coverage charges for quite a lot of car varieties in Gainesville, FL. Those figures are approximate and will range in keeping with particular person instances.

| Automobile Sort | Estimated Moderate Top class (USD/12 months) |

|---|---|

| Compact Automotive | 1,200 – 1,500 |

| Mid-size Sedan | 1,500 – 1,800 |

| SUV | 1,600 – 2,000 |

| Sports activities Automotive | 1,800 – 2,500 |

| Luxurious Automotive | 2,000 – 3,000 |

Figuring out Insurance coverage Suppliers Providing Reasonably priced Charges

Unlocking the name of the game to saving giant on automobile insurance coverage in Gainesville, FL begins with savvy analysis. This the most important step comes to figuring out respected suppliers who persistently be offering aggressive charges, adapted reductions, and a easy claims procedure. By means of working out those components, you’ll be able to expectantly make a selection the precise insurance coverage plan that balances affordability and peace of thoughts.Discovering the precise insurance coverage supplier is similar to discovering the easiest are compatible to your automobile.

Similar to a meticulously selected car fits your wishes, the most efficient insurance coverage supplier enhances your monetary scenario and using profile. This comes to now not solely the associated fee but additionally the extent of shopper toughen and the benefit of submitting a declare.

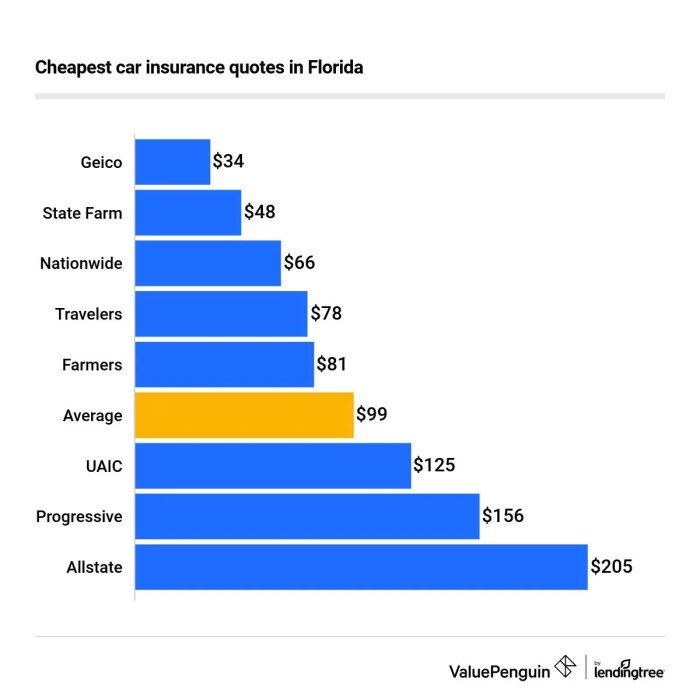

Insurance coverage Suppliers Recognized for Aggressive Charges

A number of insurance coverage suppliers stand out for his or her aggressive charges in Gainesville, FL. They have established a name for offering reasonably priced premiums whilst keeping up a powerful toughen device.

- State Farm: Recognized for its in depth community and wide variety of reductions, State Farm continuously provides aggressive charges. Their customer support is in most cases regarded as dependable, and so they supply a complete vary of insurance coverage merchandise, together with auto insurance coverage.

- Geico: Geico is well-regarded for its cutting edge solution to insurance coverage, frequently resulting in sexy pricing. Their virtual platform and quite a lot of reductions, together with multi-policy reductions, give a contribution to their affordability.

- Revolutionary: Revolutionary frequently sticks out with aggressive charges, specifically thru its usage-based insurance coverage systems and reductions for secure using behavior. Their on-line gear and cell apps make declare submitting and coverage control simple.

- Allstate: Allstate supplies a big selection of insurance coverage merchandise, together with auto insurance coverage, and frequently provides aggressive charges, particularly when blended with different insurance policies. Their claims dealing with procedure is in most cases environment friendly and well-structured, making an allowance for a smoother enjoy.

- National: National is known for its aggressive charges, specifically for drivers with a powerful using report. They frequently supply sexy reductions for secure drivers, excellent scholars, and people who take part in defensive using lessons.

Reductions Introduced by way of Suppliers, Affordable automobile insurance coverage gainesville fl

Insurance coverage suppliers continuously be offering reductions to incentivize policyholders to choose their products and services. Those reductions can considerably scale back your general top rate prices.

- Multi-Coverage Reductions: Many suppliers be offering reductions whilst you package deal a couple of insurance policies (house, auto, and so on.) with them.

- Excellent Pupil Reductions: Scholars with excellent grades or enrollment in a credible establishment can frequently protected reductions.

- Protected Driving force Reductions: Insurance coverage suppliers frequently praise drivers with a blank using report and a low coincidence historical past with discounted premiums.

- Defensive Using Lessons: Finishing defensive using lessons can frequently result in decrease premiums, as those lessons exhibit dedication to secure using practices.

- Reductions for Bundled Insurance policies: Some suppliers be offering diminished premiums if you happen to mix a couple of insurance policies below one supplier.

Claims Dealing with Procedures

Claims dealing with is a crucial facet of the insurance coverage enjoy. A easy and environment friendly claims procedure can prevent time and pressure all through a difficult duration.

- State Farm: State Farm frequently receives excessive scores for the velocity and potency in their claims dealing with processes. They normally have a well-established procedure for submitting and resolving claims.

- Geico: Geico has streamlined its claims procedure thru its virtual platform. This frequently ends up in a sooner solution time.

- Revolutionary: Revolutionary is understood for its complete on-line sources and gear to facilitate the claims procedure, frequently offering a very easy and obtainable method to record and monitor claims.

- Allstate: Allstate in most cases has a well-structured claims dealing with process, making sure an affordable solution time and constant conversation.

- National: National frequently employs a well-organized solution to claims processing, with a focal point on recommended conversation and backbone.

Comparability Desk

The next desk supplies a concise comparability of the suppliers, their reasonable charges, and to be had reductions. Remember that reasonable charges can range in keeping with particular person elements.

| Supplier | Moderate Price (Estimated) | Reductions To be had | Buyer Provider Score (Moderate) |

|---|---|---|---|

| State Farm | $1,500-$2,000 in line with 12 months | Excellent Pupil, Protected Driving force, Multi-Coverage | 4.5 out of five |

| Geico | $1,300-$1,800 in line with 12 months | Excellent Pupil, Protected Driving force, Multi-Coverage, Bundled Insurance policies | 4.3 out of five |

| Revolutionary | $1,400-$1,900 in line with 12 months | Excellent Pupil, Protected Driving force, Utilization-Primarily based | 4.4 out of five |

| Allstate | $1,550-$2,100 in line with 12 months | Excellent Pupil, Protected Driving force, Multi-Coverage | 4.2 out of five |

| National | $1,450-$1,950 in line with 12 months | Excellent Pupil, Protected Driving force, Defensive Using | 4.3 out of five |

Customer support scores are in keeping with aggregated buyer comments. Particular person reports would possibly range.

Components Influencing Affordable Automotive Insurance coverage Charges in Gainesville

Unlocking the secrets and techniques to reasonably priced automobile insurance coverage in Gainesville, FL begins with working out the important thing elements that form your premiums. Understanding those components empowers you to make knowledgeable possible choices and probably protected considerable financial savings. Components like your using report, the kind of car you personal, or even your location all play a the most important position in figuring out your insurance coverage prices.

Working out those influences is step one against discovering essentially the most appropriate and budget-friendly automobile insurance coverage.Gaining a complete clutch of those influencing elements lets you successfully navigate the complexities of the insurance coverage marketplace. By means of working out the criteria that power up or down your premiums, you’ll be able to take proactive steps to probably decrease your insurance coverage prices and protected a extra favorable charge.

Using Document

Using historical past is a vital determinant for your insurance coverage premiums. A blank using report, freed from injuries and site visitors violations, normally interprets to decrease insurance coverage prices. Insurance coverage firms assess your using historical past to judge your menace profile. Injuries, dashing tickets, and different violations sign the next menace, main to raised premiums. A historical past of accountable using, alternatively, demonstrates a decrease menace, leading to decrease premiums.

Insurance coverage firms use this information to are expecting long run menace.

Automobile Sort

The kind of car you power considerably affects your insurance coverage prices. Sports activities vehicles, high-performance automobiles, and comfort vehicles frequently have larger premiums than same old sedans or compact vehicles. That is in large part because of elements comparable to the upper chance of injuries and service prices related to those automobiles. The worth and age of the car also are vital elements.

The upper the worth and the more recent the car, the upper the price of changing or repairing it within the tournament of an coincidence, which frequently interprets into larger premiums.

Location

Your location in Gainesville, FL, additionally performs a task for your insurance coverage premiums. Spaces with larger coincidence charges or larger publicity to critical climate occasions will have larger insurance coverage prices. That is because of the larger menace of injuries or damages in those spaces. Insurance coverage firms modify their charges to mirror those native elements. As an example, spaces with larger charges of robbery or vandalism would possibly have larger premiums in comparison to more secure neighborhoods.

Credit score Historical past

Strangely, your credit score historical past can have an effect on your automobile insurance coverage premiums in Gainesville, FL. Insurance coverage firms frequently use credit score rankings as a hallmark of your general duty and monetary steadiness. A decrease credit score rating frequently correlates with the next menace profile, probably main to raised insurance coverage premiums. This issue is vital to believe when comparing your insurance coverage choices.

Folks with superb credit score rankings frequently qualify for decrease charges.

Age and Gender

Age and gender also are elements regarded as in figuring out automobile insurance coverage charges. More youthful drivers and men are frequently considered as higher-risk drivers, leading to larger premiums in comparison to older drivers and women folk. That is attributed to elements like enjoy degree and using conduct. Insurance coverage firms have in depth knowledge on coincidence patterns throughout other demographics. This information is helping them correctly assess menace.

Native Regulations and Rules

Native regulations and rules in Gainesville, FL, can affect insurance coverage premiums. As an example, explicit site visitors regulations, parking rules, or different regulations can have an effect on insurance coverage prices. Insurance coverage firms consider those native nuances to verify correct menace overview. The presence of explicit ordinances or restrictions can affect charges.

Using Behavior and Insurance coverage Premiums

Using behavior considerably affect insurance coverage premiums. Protected using practices like keeping up a secure following distance, keeping off competitive using, and adhering to hurry limits in most cases result in decrease premiums. Insurance coverage firms praise accountable using behaviors with decrease charges. The other could also be true, as irresponsible using behaviors building up the top rate.

| Using Addiction | Have an effect on on Insurance coverage Top class |

|---|---|

| Protected Following Distance | Decrease Top class |

| Competitive Using | Upper Top class |

| Dashing | Upper Top class |

| Defensive Using | Decrease Top class |

| Fending off Distracted Using | Decrease Top class |

Methods for Acquiring Reasonably priced Automotive Insurance coverage

Unlocking the most efficient automobile insurance coverage offers in Gainesville, FL calls for a strategic means. Savvy consumers can considerably scale back their premiums by way of using good tactics and leveraging to be had sources. This phase Artikels confirmed strategies for locating the most efficient conceivable charges, empowering you to make knowledgeable selections and lower your expenses.

Discovering the Very best Automotive Insurance coverage Offers

Discovering essentially the most aggressive automobile insurance coverage charges comes to a multi-faceted means. Get started by way of researching respected insurance coverage suppliers in Gainesville, FL, evaluating their insurance policies and protection choices. On-line comparability gear are beneficial sources for this job, offering a handy platform to temporarily collect quotes from a couple of firms.

Evaluating Quotes Successfully

Evaluating quotes from a couple of suppliers is the most important for securing essentially the most reasonably priced insurance coverage. Use on-line comparability gear to enter your car main points, using historical past, and desired protection. Remember to in moderation overview the fantastic print of each and every coverage to grasp the precise protection and exclusions. Consider to consider any reductions chances are you’ll qualify for.

The Energy of Bundling

Bundling your insurance coverage insurance policies, comparable to combining your automobile insurance coverage with your house or renters insurance coverage, is a formidable manner to reach considerable financial savings. Insurance coverage firms frequently be offering bundled reductions to incentivize consumers to mix their insurance policies below one supplier. As an example, a buyer who bundles their automobile insurance coverage with their householders insurance coverage may just probably see a discount of their general premiums.

Working out Insurance coverage Coverage Terminology

Insurance coverage insurance policies can comprise complicated terminology. Familiarizing your self with commonplace phrases like “deductible,” “top rate,” “legal responsibility protection,” and “complete protection” is very important for making knowledgeable selections. Working out those phrases lets you tailor your protection in your explicit wishes and funds. By means of working out coverage phrases, you might be empowered to steer clear of misunderstandings and profit from your insurance coverage.

A Information to Commonplace Insurance coverage Reductions

Insurance coverage firms be offering a variety of reductions to incentivize coverage purchases. Those reductions can range in keeping with elements comparable to excellent using data, anti-theft gadgets, and security features. Working out those reductions assist you to considerably scale back your premiums.

| Bargain Sort | Description | Instance |

|---|---|---|

| Excellent Driving force Bargain | For drivers with blank using data. | A driving force and not using a injuries or violations would possibly qualify for a cut price. |

| Protection Function Bargain | For automobiles supplied with security features. | Automobiles with anti-theft gadgets or complicated protection techniques, like airbags, frequently qualify for reductions. |

| Bundled Insurance policies Bargain | For combining a couple of insurance policies with one supplier. | Combining automobile insurance coverage with householders insurance coverage frequently qualifies for a bundled cut price. |

| More than one Automobiles Bargain | For insuring a couple of automobiles with the similar supplier. | A buyer with two vehicles insured below the similar coverage frequently qualifies for this cut price. |

| Pupil Bargain | For college kids with a blank using report. | Scholars enrolled at school would possibly qualify for this cut price. |

Working out Insurance coverage Coverage Protection

Unlocking the secrets and techniques to reasonably priced automobile insurance coverage in Gainesville, FL, hinges on a deep working out of your coverage’s protection. Navigating the sector of insurance coverage can really feel daunting, however worry now not! This phase will demystify the several types of protection to be had, serving to you are making knowledgeable selections to safeguard your car and your monetary well-being.

Varieties of Automotive Insurance coverage Protection in Florida

Florida mandates explicit minimal protection ranges, however choosing further coverage is very really helpful. Working out the quite a lot of choices empowers you to tailor your coverage in your distinctive wishes and funds.

Legal responsibility Insurance coverage: Protective Others

Legal responsibility insurance coverage is the bedrock of any automobile insurance coverage in Florida. It covers damages you purpose to folks or their assets in an coincidence. Whilst the most important, it has barriers. As an example, in case your damages exceed your coverage limits, you can be individually answerable for the remainder prices. A coverage of $100,000 in physically harm legal responsibility in line with particular person and $300,000 in overall physically harm legal responsibility is the really helpful minimal, however believe expanding this protection to raised give protection to your self and others.

Upper limits supply a security internet, making sure you are financially ready for severe injuries.

Complete and Collision Insurance coverage: Protective Your Automobile

Complete and collision insurance coverage supply further layers of coverage to your automobile. Complete insurance coverage covers injury from occasions now not involving a collision, comparable to robbery, vandalism, hearth, hail, or falling gadgets. Collision insurance coverage covers injury in your car led to by way of a collision with any other car or an object, without reference to who is at fault. Those coverages are very important if you wish to restore or change your car with out incurring important out-of-pocket bills.

Uninsured/Underinsured Motorist Protection: A Essential Protection Web

Uninsured/underinsured motorist protection is paramount in Florida. This protection steps in in case you are inquisitive about an coincidence with a driving force who lacks insurance coverage or whose insurance coverage limits are inadequate to hide the damages. With out this protection, it’s worthwhile to be left to undergo the monetary burden of considerable damages, probably jeopardizing your monetary steadiness.

Abstract Desk of Automotive Insurance coverage Coverages

| Protection Sort | Description | Advantages |

|---|---|---|

| Legal responsibility Insurance coverage | Covers injury you purpose to others in an coincidence. | Protects you from monetary duty for damages led to to others, as much as coverage limits. |

| Complete Insurance coverage | Covers injury in your car from non-collision occasions (robbery, vandalism, hearth, and so on.). | Protects your car from injury led to by way of occasions past your keep watch over. |

| Collision Insurance coverage | Covers injury in your car in a collision, without reference to fault. | Protects your car from injury in collisions, without reference to who’s at fault. |

| Uninsured/Underinsured Motorist Protection | Covers damages in case you are inquisitive about an coincidence with an uninsured or underinsured driving force. | Protects you financially in case you are in an coincidence with a driving force missing ok insurance coverage. |

Guidelines for Opting for the Proper Coverage: Affordable Automotive Insurance coverage Gainesville Fl

Navigating the sector of auto insurance coverage can really feel like decoding a fancy code. Selecting the proper coverage is not just about discovering the most cost effective charge; it is about making sure you are adequately safe and ready for unexpected instances. Working out the nuances of your coverage is the most important to creating an educated determination.Selecting the proper automobile insurance coverage comes to cautious attention of a number of elements, from protection choices to coverage exclusions and deductibles.

This complete information supplies precious insights that will help you make your best choice to your explicit wishes and monetary scenario.

Components to Believe When Opting for a Coverage

Working out your wishes and the to be had choices is essential. Believe your using behavior, car kind, and monetary scenario. Components like your using report, location, and the worth of your car will all affect the fee and protection you can want. A radical overview of those elements will allow you to determine the precise coverage are compatible.

- Using Document: A blank using report frequently interprets to decrease premiums. Injuries and violations will most likely building up your insurance coverage prices. Evaluate your using historical past and perceive the prospective affect to your charges.

- Automobile Sort: The make, style, and 12 months of your car play a task. Prime-value automobiles would possibly command larger insurance coverage premiums, whilst older automobiles would possibly have other protection necessities.

- Location: Your location inside Gainesville, Florida, and the encircling house can have an effect on your insurance coverage charges. Spaces with larger coincidence charges in most cases have larger premiums.

- Protection Wishes: Assess your monetary scenario and make a decision at the extent of protection you wish to have. Believe legal responsibility protection, complete protection, and collision protection. Assessment the prospective dangers you face and decide the safety degree essential.

Working out Insurance coverage Coverage Paperwork

Insurance coverage insurance policies are frequently dense and complicated. Taking the time to entirely overview your coverage file is very important. Search for transparent explanations of protection, exclusions, and boundaries.

- Learn In moderation: Do not simply skim the file. Pay shut consideration to the phrases and prerequisites. Working out the language used for your coverage is essential to steer clear of any misunderstandings.

- Search Explanation: If you do not perceive one thing, do not hesitate to touch your insurance coverage supplier for explanation. Asking questions is the most important to totally greedy the consequences of your coverage.

- Evaluate Exclusions: In moderation read about the exclusions indexed for your coverage. Working out what is not coated is as vital as working out what’s.

Implications of Coverage Exclusions

Coverage exclusions Artikel eventualities the place your insurance coverage would possibly not quilt damages or losses. Those exclusions give protection to the insurance coverage corporate from over the top claims. Working out them is significant to keeping off sudden prices.

- Pre-existing Stipulations: Some insurance policies exclude protection for pre-existing injury in your car, comparable to rust or body injury. Evaluate your coverage to verify it covers this sort of injury.

- Particular Cases: Exclusions too can observe to precise instances, comparable to injury led to by way of intentional acts, or use of the car for unlawful actions. Make yourself familiar with the specifics to steer clear of surprises.

- Exclusions of Legal responsibility: Legal responsibility protection would possibly exclude sure forms of claims, comparable to the ones coming up from intentional acts or use of the car in unlawful actions. Working out those exclusions is the most important to combating surprises in case of an coincidence.

The Importance of Coverage Deductibles

Deductibles are the quantity you pay out-of-pocket prior to your insurance coverage corporate covers the remainder price. Decrease deductibles in most cases imply decrease premiums, however you can pay extra when creating a declare.

- Have an effect on on Premiums: Upper deductibles frequently lead to decrease premiums. It is because the insurance coverage corporate bears much less monetary duty. Perceive the connection between your deductible and top rate prices.

- Declare Prices: When submitting a declare, you can want to pay the deductible quantity first. This can be a the most important facet to believe when assessing your monetary duty.

- Balancing Act: Opting for a deductible comes to balancing the prospective prices of a declare with the affect to your top rate bills. A cautious analysis of your wishes is vital to steer clear of overpaying or under-protecting your self.

Submitting a Declare with an Insurance coverage Corporate

Submitting a declare is a procedure that calls for cautious consideration to element and adherence to the insurance coverage corporate’s pointers.

- Record Instantly: Record any injuries or damages in your insurance coverage corporate promptly. That is the most important for keeping up a easy declare procedure.

- Collect Documentation: Accumulate all related paperwork, together with police stories, witness statements, and service estimates. This documentation will toughen your declare.

- Apply Directions: Apply the insurance coverage corporate’s directions in moderation. This contains offering essential knowledge and finishing required paperwork.

Illustrative Examples of Insurance coverage Insurance policies

Unveiling the sector of auto insurance coverage insurance policies can really feel daunting, however working out the differing types and their protection is the most important for making knowledgeable selections. Those examples will illustrate the various ranges of coverage to be had, empowering you to select the coverage that most closely fits your wishes and funds in Gainesville, FL.Selecting the proper automobile insurance coverage is a the most important step in keeping your monetary well-being and property.

Other coverage varieties be offering various levels of protection, and working out those nuances is vital to discovering the most efficient price to your cash.

Legal responsibility-Best Coverage Instance

A liability-only coverage is essentially the most fundamental form of protection. It protects you financially in case you are at fault for an coincidence and purpose hurt to someone else or their assets. This coverage normally covers the price of damages to different automobiles and accidents to others, however

does now not* quilt damages in your personal car or your accidents.

This coverage is frequently essentially the most reasonably priced choice, however it supplies minimum coverage in case of an coincidence.

As an example, consider you are inquisitive about a fender bender the place you are deemed at fault. A liability-only coverage would quilt the opposite driving force’s restore prices and scientific bills, however your personal car maintenance and scientific expenses can be your duty.

Complete Coverage Instance

A complete coverage supplies broader coverage than a liability-only coverage. It covers damages in your car from perils past injuries, comparable to robbery, vandalism, hearth, hail, and climate occasions.

Complete protection considerably complements your monetary coverage by way of protecting a much broader vary of doable damages.

As an example, in case your automobile is stolen, broken by way of a falling tree all through a hurricane, or vandalized, a complete coverage would assist quilt the maintenance. This kind of coverage frequently features a deductible, which is the quantity you pay out-of-pocket prior to the insurance coverage corporate steps in.

Collision and Complete Coverage Instance

A collision and complete coverage provides the absolute best degree of coverage. It covers injury in your car in an coincidence (collision) and in addition injury from quite a lot of perils (complete), as mentioned above.

This coverage supplies essentially the most in depth protection and monetary coverage, safeguarding you towards a big selection of doable damages.

As an example, in case your automobile is broken in an coincidence or by way of a tree department falling on it all through a hurricane, a collision and complete coverage would quilt the restore prices.

Coverage with Upload-ons (e.g., Roadside Help)

Many insurance coverage insurance policies may also be enhanced with add-ons. Roadside help is a well-liked instance. This selection supplies assist in eventualities comparable to a flat tire, a lifeless battery, or a car lockout.

Including roadside help in your coverage supplies handy toughen in emergency eventualities.

As an example, in case your automobile breaks down on a far flung freeway, roadside help would supply towing, jump-starting, or different essential products and services to get you again at the highway.

Key Variations Abstract Desk

| Coverage Sort | Protection | Value | Coverage Degree |

|---|---|---|---|

| Legal responsibility-Best | Covers damages to others | Lowest | Minimum |

| Complete | Covers injury from non-collision occasions | Reasonable | Medium |

| Collision and Complete | Covers each collision and non-collision injury | Absolute best | Most |

| Coverage with Upload-ons (e.g., Roadside Help) | Provides further options like roadside help | Variable | Enhanced |

Keeping up a Sure Using Document in Gainesville

A pristine using report is paramount to securing reasonably priced automobile insurance coverage in Gainesville, FL. Protected using behavior now not solely give protection to you and others at the highway but additionally immediately affect your insurance coverage premiums. By means of adhering to site visitors regulations and working towards defensive using tactics, you’ll be able to considerably scale back your menace of injuries and experience decrease insurance coverage charges.Protected using practices are the most important for accountable drivers and feature an instantaneous affect on insurance coverage premiums.

A blank using report demonstrates your dedication to secure using, which insurers price extremely. This dedication can translate to considerable financial savings to your automobile insurance coverage.

Significance of Protected Using Practices

Protected using practices are very important for decreasing injuries and selling highway protection. Those practices come with keeping up a secure following distance, obeying site visitors regulations, and keeping off distractions. By means of being aware of different drivers and highway prerequisites, you considerably lower your menace of inflicting an coincidence. This proactive means demonstrates accountable using and will prevent cash on insurance coverage premiums.

Steps to Keep away from Visitors Violations

Fending off site visitors violations is essential to keeping up a favorable using report. This comes to adhering to hurry limits, the usage of flip indicators, and watching site visitors regulations. Understanding and respecting the principles of the street can save you expensive violations and take care of a blank using report.

- Obey Velocity Limits: Strict adherence to posted pace limits is significant. Exceeding the prohibit considerably will increase the danger of injuries. Using at suitable speeds lets in for higher response time and decreases the severity of collisions.

- Use Flip Indicators Accurately: Correct use of flip indicators obviously communicates your intentions to different drivers, decreasing the chance of misunderstanding and doable injuries.

- Keep away from Distractions: Using whilst the usage of a mobile phone, consuming, or enticing in different distracting actions is terribly unhealthy. Focusing only on using maximizes protection and forestalls violations.

- Handle Correct Following Distance: Keeping up a secure following distance supplies the most important response time in case of unexpected stops or emergencies. This reduces the danger of rear-end collisions.

Importance of Keeping up a Blank Using Document

A blank using report displays your dedication to secure using practices. Insurance coverage firms view drivers with a historical past of accountable using as decrease menace. This belief immediately interprets to decrease insurance coverage premiums. Keeping up a blank using report is an funding for your monetary well-being.

Examples of How Protected Using Practices Can Definitely Have an effect on Insurance coverage Premiums

Insurance coverage firms use using data to evaluate menace. Drivers with fewer violations and injuries are labeled as decrease menace, resulting in decrease premiums. This immediately demonstrates the worth of secure using practices.

- Decreased Injuries: By means of adhering to secure using practices, drivers considerably scale back the chance of injuries. Decreased injuries immediately affect insurance coverage premiums.

- Fewer Violations: Fending off site visitors violations like dashing or working purple lighting fixtures demonstrates a dedication to accountable using. Fewer violations translate to decrease premiums.

- Stepped forward Insurance coverage Charges: Insurance coverage firms praise drivers who prioritize protection. A blank using report may end up in considerable financial savings on insurance coverage premiums.

Illustrative Situation of Driving force Making improvements to Their Document and Seeing a Decrease Insurance coverage Price

Believe a driving force in Gainesville, FL, named Sarah, who persistently made errors that affected her insurance coverage premiums. She known the significance of secure using practices and actively labored on bettering her report. Sarah actively thinking about following pace limits, the usage of flip indicators, and keeping off distractions. After six months of constant secure using, Sarah noticed a noticeable lower in her automobile insurance coverage top rate.

This illustrates the direct correlation between secure using practices and decrease insurance coverage charges. By means of prioritizing secure using, Sarah used to be ready to economize on her insurance coverage, showcasing the worth of accountable using behavior.

Closing Phrase

In conclusion, securing reasonable automobile insurance coverage in Gainesville, FL, calls for a strategic means encompassing analysis, comparability buying groceries, and working out your explicit wishes. By means of in moderation taking into consideration the quite a lot of elements influencing premiums and adopting good methods, you’ll be able to navigate the complexities of the native marketplace and procure essentially the most high quality insurance coverage insurance policies. This information serves as your compass, empowering you to make knowledgeable selections and to find the best protection to your monetary well-being.

FAQ

What are the most typical reductions introduced by way of insurance coverage suppliers in Gainesville, FL?

Many suppliers be offering reductions for secure using data, pupil standing, and bundling a couple of insurance policies. Some insurers additionally be offering reductions in keeping with car kind or anti-theft gadgets.

How does my credit score historical past have an effect on my automobile insurance coverage charges in Gainesville?

A adverse credit historical past can negatively affect your automobile insurance coverage charges, because it signifies the next menace of monetary irresponsibility. Conversely, a excellent credit score rating would possibly result in decrease premiums.

What forms of automobile insurance policy are to be had in Florida?

Florida mandates legal responsibility insurance coverage, however complete and collision protection, at the side of uninsured/underinsured motorist coverage, are further choices.

What’s the significance of bundling insurance coverage insurance policies?

Bundling insurance coverage insurance policies, comparable to automobile and residential insurance coverage, can frequently result in discounted charges because of a perceived decrease menace.