American trendy vintage automotive insurance coverage is a specialised house requiring cautious attention. Working out the nuances of protection, top rate elements, and declare processes is the most important for safeguarding your treasured funding. This information delves into the complexities of insuring those distinctive cars, providing sensible recommendation for navigating the insurance coverage panorama.

From complete and collision protection to legal responsibility and uninsured/underinsured motorist coverage, this information will stroll you throughout the other insurance coverage choices adapted for traditional vehicles. We will discover how elements just like the car’s age, situation, and historic importance affect premiums, offering treasured insights for knowledgeable decision-making.

Protection Choices for Vintage Vehicles

Cruising throughout the open street on your prized American trendy vintage automotive is a thrilling revel in. However protective this beloved piece of car historical past calls for a specialised solution to insurance coverage. Working out the nuances of vintage automotive insurance coverage, in particular the protection choices, is essential to making sure your funding is safeguarded towards unexpected cases.Vintage automotive insurance coverage ceaselessly differs considerably from protection for contemporary cars.

It is because vintage vehicles, with their distinctive historic and ceaselessly collector worth, require explicit concerns. Those elements come with the automobile’s age, rarity, attainable recovery prices, and the marketplace worth fluctuations. This specialised method guarantees that you’re adequately secure on your explicit vintage automotive.

Complete Protection

Complete protection is the most important for traditional vehicles, because it protects towards perils that don’t seem to be lined by means of collision insurance coverage. This contains harm from fireplace, robbery, vandalism, hail, flood, or even falling items. Complete protection, when adapted for traditional vehicles, ceaselessly accounts for the original recovery and service demanding situations that may be encountered. For instance, in case your vintage automotive is broken in a flood, specialised cleansing and recovery services and products could also be wanted, considerably expanding restore prices.

Collision Protection

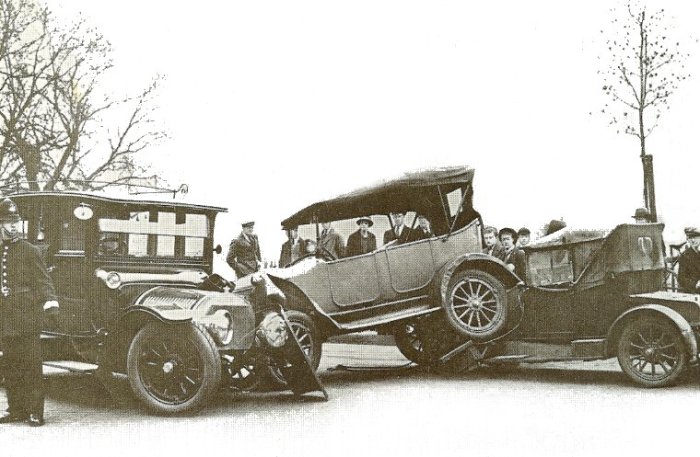

Collision protection steps in when your vintage automotive is broken in an coincidence. This protection will pay for upkeep or alternative, irrespective of who’s at fault. This is very important for traditional vehicles, as injuries may end up in in depth harm requiring specialised recovery. The provision and scope of collision protection for traditional vehicles can range relying at the insurance coverage supplier and the automobile’s situation.

Legal responsibility Protection

Legal responsibility protection protects you financially for those who reason an coincidence and injure someone else or harm their belongings. It is a basic element of any automotive insurance plans, making sure you’re legally secure within the tournament of an coincidence. Whilst legal responsibility protection is obligatory in maximum jurisdictions, its significance is similarly related for traditional vehicles.

Uninsured/Underinsured Motorist Protection, American trendy vintage automotive insurance coverage

Uninsured/underinsured motorist protection is very important coverage towards drivers who’re both uninsured or underinsured. In case you are keen on an coincidence with a motive force missing ok insurance coverage, this protection steps in to lend a hand compensate you on your damages. The significance of this protection is magnified when coping with vintage vehicles, as a major coincidence with an uninsured motive force may result in in depth and expensive upkeep.

Comparability of Protection Choices for Vintage vs. Fashionable Vehicles

| Protection Sort | Description | Standard Limits | Vital Concerns |

|---|---|---|---|

| Complete | Covers harm from perils rather then collisions. | Can range considerably in accordance with automotive worth and insurance plans. | Recovery prices may also be upper for traditional vehicles, affecting complete protection quantities. |

| Collision | Covers harm in your automotive in an coincidence, irrespective of fault. | Very similar to complete, can range in accordance with automotive worth. | Specialised recovery for traditional vehicles can building up collision restore prices. |

| Legal responsibility | Protects you financially for those who reason an coincidence. | Typically standardized by means of state regulations, with minimal necessities. | Vintage automotive legal responsibility protection must adequately deal with attainable harm. |

| Uninsured/Underinsured Motorist | Covers damages if keen on an coincidence with an uninsured or underinsured motive force. | Typically tied to legal responsibility limits, with changes in accordance with automotive worth. | Guarantees enough protection for attainable damages to a vintage automotive. |

Working out the particular phrases and prerequisites of every protection is important. Assessment your coverage sparsely to verify ok coverage on your vintage automotive. Particular deductibles and exclusions can affect your out-of-pocket prices in case of a declare.

Components Influencing Insurance coverage Premiums

Protective your prized American trendy vintage automotive calls for a willing figuring out of the criteria that affect its insurance coverage top rate. This data empowers you to make knowledgeable selections about protection and doubtlessly lower your expenses. Figuring out those elements will mean you can examine quotes and to find the most productive conceivable price.

Automobile Age and Fashion Yr

Age and fashion 12 months are important determinants of insurance coverage premiums. Older cars, particularly the ones outdoor of not unusual manufacturing years, ceaselessly lift upper premiums because of their decreased availability of portions and doubtlessly upper restore prices. The fashion 12 months, whilst associated with age, additionally displays developments in security features and engineering. Vehicles with fewer security features, or with older designs, could also be assigned upper chance profiles by means of insurance coverage firms.

Automobile Situation and Mileage

The situation of your vintage automotive immediately affects its insurance coverage top rate. A meticulously maintained automotive with minimum put on and tear will most often qualify for a decrease top rate than a automotive with important rust, harm, or overlooked upkeep. Top mileage too can point out greater put on and tear, doubtlessly main to raised restore prices and the next top rate.

Ancient Importance and Rarity

Vehicles with historic importance or rarity ceaselessly command upper premiums, now not best because of their inherent worth but in addition because of the greater chance of robbery or harm. Insurers assess the possibility of upper declare payouts because of the original nature and rarity of the automobile. For instance, a meticulously preserved and uncommon fashion from a particular generation or producer might command a top rate that displays the greater worth and attainable loss.

Recovery Standing

The recovery standing of your vintage automotive considerably influences the insurance coverage top rate. A completely restored automotive, with documented paintings and verifiable high quality, might qualify for a decrease top rate. Then again, a automotive within the technique of recovery, or one with incomplete or questionable recovery paintings, might face the next top rate because of the greater chance of headaches throughout restore or the opportunity of hidden problems.

Insurance coverage firms will ceaselessly require explicit documentation or inspection of restored cars to resolve the top rate.

Abstract of Components Impacting Insurance coverage Premiums

| Issue | Description | Affect on Top class | Instance |

|---|---|---|---|

| Automobile Age | The auto’s age, in most cases in years. | Older cars ceaselessly have upper premiums because of attainable for upper restore prices and less readily to be had portions. | A 1955 Chevy Bel Air will most likely have the next top rate than a 2000 fashion. |

| Automobile Situation | The auto’s general bodily state. | A meticulously maintained automotive with minimum put on and tear will most often have a decrease top rate than one with important harm or forget. | A restored 1969 Mustang with very best paint and fabric could have a decrease top rate than one with rust and broken inside. |

| Mileage | The full collection of miles pushed. | Top mileage ceaselessly signifies greater put on and tear, main to raised restore prices and a doubtlessly upper top rate. | A 1970 Dodge Challenger with 100,000 miles will most likely have a decrease top rate than one with 200,000 miles. |

| Ancient Importance/Rarity | The auto’s historic significance or rarity out there. | Vehicles with historic importance or rarity ceaselessly command upper premiums because of their greater worth and attainable for robbery or harm. | An overly uncommon, unique fashion of a Thirties Duesenberg could have a considerably upper top rate than a not unusual fashion. |

| Recovery Standing | The level of recovery paintings carried out at the car. | Totally restored vehicles with documented paintings and verifiable high quality might qualify for decrease premiums. Vehicles present process recovery or with questionable recovery might face upper premiums. | A completely restored 1967 Shelby GT500 could have a doubtlessly decrease top rate than one this is within the technique of recovery. |

Discovering the Proper Insurance coverage Supplier

Unlocking the very best insurance plans on your prized American trendy vintage automotive comes to extra than simply evaluating costs. It is about discovering a supplier who understands the original worth and nuances of those cars. A devoted vintage automotive insurer is not going to best be offering aggressive charges but in addition possess the experience to take care of attainable claims with sensitivity and care. Discovering the appropriate have compatibility approach you’ll relaxation confident your funding is secure, permitting you to experience your vintage automotive to the fullest.

Methods for Evaluating Insurance coverage Suppliers

Discovering the appropriate insurance coverage supplier on your vintage automotive is a the most important step. Evaluating insurance policies immediately comes to scrutinizing quite a lot of elements. Thorough analysis and cautious attention are secret to meaking an educated resolution. Start by means of figuring out suppliers that specialize in vintage cars. This specialised wisdom is important, as insurance policies for antique vehicles ceaselessly range considerably from the ones for contemporary cars.

Researching and Comparing Insurance coverage Quotes

More than a few strategies exist for researching and comparing insurance coverage quotes. On-line comparability equipment may give a complete evaluation of to be had insurance policies from a couple of suppliers. Make the most of those equipment to collect preliminary quotes from other insurers. Do not forestall at on-line comparisons. Touch insurers immediately to discover custom designed choices and doubtlessly negotiate phrases.

Believe inquiring for detailed explanations of protection specifics and exclusions, particularly referring to distinctive sides of your vintage automotive.

Evaluating Coverage Options and Advantages

Evaluating coverage options and advantages amongst other insurers is very important. Analyze protection limits for damages, together with complete and collision. Perceive the particular phrases and prerequisites of every coverage. Pay shut consideration to elements like deductible quantities, the claims procedure, and the insurer’s recognition for dealing with vintage automotive claims. Learn critiques and testimonials to gauge the insurer’s responsiveness and customer support.

Additionally, believe the insurer’s monetary steadiness; a financially sound corporate is much less more likely to revel in issues one day.

Standards for Settling on an Insurance coverage Supplier

Thorough research of insurance coverage suppliers calls for attention of quite a lot of elements. This desk summarizes the most important standards for deciding on an insurer that specialize in vintage vehicles.

| Criterion | Description | Significance | Instance |

|---|---|---|---|

| Protection Limits | The utmost quantity the insurer can pay for damages to the car. | Top | $50,000 for complete protection |

| Deductible Quantity | The volume you pay out-of-pocket earlier than the insurance coverage corporate will pay. | Medium | $500 deductible |

| Claims Procedure | The stairs keen on submitting and settling a declare. | Top | A streamlined on-line portal for reporting claims |

| Popularity and Opinions | Public belief and comments at the insurer’s provider high quality. | Medium-Top | Sure buyer critiques and testimonials |

| Monetary Steadiness | The insurer’s monetary power and talent to pay claims. | Top | A robust A.M. Very best ranking |

| Specialised Vintage Automotive Experience | Insurer’s revel in and information in dealing with vintage automotive claims. | Top | A devoted staff dealing with vintage automotive insurance policies |

Claims Procedure and Documentation

Protective your prized American trendy vintage automotive calls for a clean and environment friendly claims procedure. A well-documented historical past and a transparent figuring out of the procedures are the most important for a swift and a success declare answer. Figuring out precisely what to anticipate and learn how to continue will mean you can navigate the method with self assurance.A meticulous claims procedure guarantees that your vintage automotive’s distinctive worth is as it should be assessed and your insurance plans is correctly implemented.

The particular steps concerned might range relying at the insurance coverage supplier, however most often contain offering detailed knowledge, documenting the wear, and dealing collaboratively with the insurer to reach a good end result.

Declare Submitting Steps

Working out the stairs in submitting a declare is very important for a clean procedure. Each and every step is the most important for making sure your declare is processed successfully and as it should be.

Submitting a declare comes to a chain of steps, beginning with instant notification.

- Rapid Notification: Instantly touch your insurance coverage supplier to document the wear. Supply them with the main points of the incident, together with the date, time, location, and any witnesses. This recommended notification is helping start up the declare procedure and maintain attainable proof.

- Accumulating Documentation: Collect all related paperwork, together with your insurance plans, evidence of possession, and any pre-accident pictures of your automotive. Detailed pictures of the wear are crucial for correct review. Believe taking photos from a couple of angles, appearing the level of the wear. Documentation of the car’s historical past, reminiscent of upkeep information and former restore invoices, considerably aids within the review of the automobile’s situation and worth.

- Offering Knowledge to the Insurer: Obviously and entirely give you the important knowledge asked by means of your insurance coverage supplier. This may occasionally come with information about the incident, harm description, and the car’s historical past. Be exact and correct with all knowledge to steer clear of delays within the declare processing.

- Evaluate of Harm: The insurer will most likely ship a consultant to check out the wear in your vintage automotive. This inspection is helping them assess the price of upkeep or alternative. Vintage vehicles ceaselessly require specialised experience for correct exams, and the insurer might interact consultants conversant in vintage automotive restore.

- Negotiation and Agreement: As soon as the wear is classed, the insurer will supply a agreement proposal. For those who disagree with the agreement quantity, you’ll negotiate with the insurer to achieve a mutually applicable settlement. Open conversation and offering supporting proof, like quotes from respected vintage automotive restore stores, are key throughout negotiations.

- Restore or Alternative: Relying at the phrases of your coverage and the level of the wear, the insurer might duvet the price of upkeep or, in some circumstances, be offering a payout for the car’s worth. Be sure that upkeep are performed by means of certified and skilled vintage automotive mechanics to maintain the car’s unique situation.

Significance of Correct Data

Keeping up meticulous information of your vintage automotive’s historical past is important for a a success declare. Those information display the car’s situation and worth, helping within the declare review procedure. Correct information, reminiscent of upkeep logs, restore invoices, and historic documentation, considerably support the declare’s validity and boost up the agreement procedure.

- Upkeep Data: Detailed upkeep information, together with dates, descriptions of labor carried out, and the names of the mechanics concerned, supply treasured perception into the car’s historical past and present situation.

- Restore Invoices: Invoices for previous upkeep are crucial in organising the car’s historical past and the price of earlier upkeep. This permits the insurance coverage corporate to evaluate the car’s situation as it should be.

- Images: Pre-accident pictures of the car are the most important for demonstrating the car’s situation earlier than the incident. Those footage, at the side of post-accident photographs, supply a whole image of the wear.

Demanding situations in Comparing Vintage Automotive Harm

Comparing harm to a vintage automotive items distinctive demanding situations in comparison to trendy cars. The particular ways and experience had to assess the wear might range considerably. The insurer might wish to visit professionals conversant in vintage automotive restore practices and values.

- Authenticity and Price: Figuring out the authenticity and exact worth of a vintage automotive is complicated. The insurer may wish to visit professionals to evaluate the worth of the car, particularly if the automobile is a unprecedented or extremely collectible fashion.

- Specialised Maintenance: Discovering certified mechanics and portions for traditional automotive upkeep may also be difficult. The insurer might wish to paintings with specialised stores or people skilled in repairing vintage vehicles.

Preventive Measures for Vintage Automotive Insurance coverage

Protective your prized American trendy vintage automotive calls for proactive measures past merely buying insurance coverage. A proactive solution to car care and safety considerably reduces the danger of robbery or harm, in the long run resulting in decrease insurance coverage premiums and peace of thoughts. Through figuring out and enforcing those preventive methods, you’ll safeguard your funding and make sure your vintage automotive stays a beloved ownership for future years.

Protective In opposition to Robbery and Harm

Imposing powerful safety features is paramount to safeguarding your vintage automotive. Those measures now not best cut back the danger of robbery but in addition reduce the possibility of harm. Preventive measures are crucial in keeping up the automobile’s worth and lowering insurance coverage prices.

- Protected Parking and Garage: Park your vintage automotive in a well-lit, safe house on every occasion conceivable. Believe the use of a devoted storage or a lined car parking zone to offer protection to the car from the weather and attainable thieves. Spend money on high quality locks and alarms to discourage unauthorized get right of entry to. When storing the automobile for prolonged sessions, believe a safe garage facility or a climate-controlled surroundings.

- Automobile Monitoring Units: Set up a GPS monitoring tool or a identical machine to observe the car’s location in actual time. This may considerably building up the probabilities of restoration within the tournament of robbery. Fashionable monitoring techniques too can supply indicators for odd motion or tampering.

- Top-Safety Locks and Alarms: Improve your automotive’s locks and safety machine to discourage attainable thieves. Fashionable high-security locks and alarms are designed to be extra immune to compelled access. Believe putting in a steerage wheel lock and different supplementary safety gadgets.

- Automobile Detailing and Marking: Believe the use of car marking techniques, like paint markers or etching the VIN quantity onto visual chassis parts. This may make restoration more uncomplicated if the car is stolen. Common detailing and waxing can lend a hand handle the automobile’s pristine situation, additional deterring robbery.

Keeping up Optimum Situation

Correct upkeep immediately affects your insurance coverage premiums. A well-maintained vintage automotive is much less vulnerable to harm and extra interesting to attainable patrons. Those practices lend a hand be sure that the car’s situation and cut back attainable insurance coverage claims.

- Common Upkeep Agenda: Expand and cling to a complete upkeep agenda that aligns with the producer’s suggestions. Common servicing and inspections can save you main problems from growing and impacting your insurance coverage eligibility.

- High quality Portions and Fabrics: Use best high quality portions and fabrics throughout upkeep to maintain the car’s unique situation and worth. Steer clear of the use of substandard portions that would compromise the automobile’s structural integrity or capability.

- Documentation of Upkeep: Deal with detailed information of all upkeep carried out to your vintage automotive, together with dates, portions changed, and the mechanic’s touch knowledge. This complete documentation is useful in case of long run claims or inspections.

- Environmental Coverage: Give protection to your vintage automotive from excessive climate prerequisites. Correct garage and overlaying throughout sessions of inclement climate can save you important harm. Additionally, give protection to towards excessive temperatures.

Secure Garage and Protected Practices

Protected garage is the most important for safeguarding your vintage automotive from robbery and harm. The proper garage practices considerably cut back the danger of injuries and robbery.

- Protected Garage Facility: If storing the car for prolonged sessions, believe a safe garage facility, particularly for long-term parking. Such amenities are designed to offer protection to towards robbery and harm. Examine the safety options of quite a lot of garage choices.

- Local weather Keep watch over for Garage: Storing a vintage automotive in a climate-controlled surroundings is helping to offer protection to the paint, inside, and mechanical parts from harm led to by means of temperature fluctuations and humidity.

- Automobile Safety Methods: Spend money on a complicated safety machine that incorporates movement sensors, alarms, and far off tracking. A complicated safety machine can deter robbery makes an attempt and provide you with a warning to any suspicious task.

Preventive Upkeep and Insurance coverage Eligibility

Preventive upkeep immediately influences your insurance coverage eligibility. A well-maintained car demonstrates your dedication to protecting its worth and lowering attainable dangers.

- Keeping up a Detailed Historical past Record: An in depth and up-to-date car historical past document is the most important for insurance coverage functions. This document is helping insurers assess the car’s situation and expect long run dangers. Keeping up correct information of upkeep and upkeep is very important for acquiring an exact historical past document.

- Keeping up Documentation of Upgrades and Changes: Report any upgrades or changes made to the car. This documentation is helping insurers perceive the car’s present situation and worth, which immediately influences the top rate. Word any adjustments made, reminiscent of engine upgrades or aesthetic changes.

Automobile Historical past Record

A correct and up to date car historical past document is important for insurance coverage functions. It supplies a complete evaluation of the car’s previous, together with any injuries, upkeep, or changes. This data is very important for insurers to evaluate the car’s chance profile and set suitable premiums.

- Accuracy and Completeness: Be certain that the accuracy and completeness of your car historical past document. Any discrepancies can affect your insurance coverage eligibility and top rate. Correct information are crucial for a competent car historical past document.

- Common Updates: Stay your car historical past document up-to-date by means of recording all upkeep and upkeep. This proactive method will will let you supply a present and complete car historical past document.

Working out Coverage Exclusions

Navigating the arena of vintage automotive insurance coverage comes to extra than simply opting for a coverage; it is the most important to know the wonderful print. Coverage exclusions can considerably affect your protection, doubtlessly leaving you with out coverage when an unexpected tournament happens. This segment delves into not unusual exclusions, highlighting attainable protection gaps and emphasizing the significance of meticulous coverage assessment.

Commonplace Exclusions in Vintage Automotive Insurance coverage Insurance policies

American trendy vintage automotive insurance coverage insurance policies, like another, comprise exclusions. Those clauses Artikel explicit scenarios the place the coverage is not going to supply protection. Working out those exclusions is paramount to creating knowledgeable selections and warding off unwelcome surprises.

Attainable Protection Gaps

Positive insurance policies may now not duvet harm due to explicit occasions. This loss of protection can go away automotive house owners financially prone if a declare arises. For instance, a coverage may exclude harm led to by means of negligence, vandalism, or injuries involving a motive force now not indexed at the coverage.

Significance of Reviewing the Coverage Report

Thorough assessment of the coverage record is very important. It isn’t sufficient to easily learn the coverage abstract; delve into the detailed coverage wording to know the whole scope of protection and the proper wording of exclusions. This meticulous exam is helping in figuring out attainable gaps in protection.

Examples of Protection Denial Because of Exclusions

A policyholder who drives their vintage automotive on public roads with out the specified documentation (like right kind registration) may see a declare denied because of a coverage exclusion associated with unlawful operation. In a similar fashion, if a vintage automotive is used for racing or aggressive occasions past the coverage’s specified use, protection may well be denied. Even reputedly minor main points, reminiscent of changes now not disclosed to the insurer, may end up in declare rejection.

Commonplace Exclusions in Vintage Automotive Insurance coverage Insurance policies

| Exclusion Class | Description |

|---|---|

| Pre-existing Harm | Protection would possibly not practice to break that existed earlier than the coverage was once issued. This ceaselessly contains harm from earlier injuries or deterioration. |

| Negligence | Insurance policies in most cases exclude harm led to by means of the policyholder’s reckless or intentional acts. |

| Changes | Undisclosed or unauthorized changes to the car may lead to protection denial. |

| Unlawful Actions | Actions reminiscent of racing or the use of the car in violation of the regulation is probably not lined. |

| Put on and Tear | Standard put on and tear at the car, like sluggish deterioration of portions, is ceaselessly now not lined. |

| Harm from Particular Occasions | Insurance policies would possibly not duvet harm led to by means of sure occasions like battle, acts of terrorism, or earthquakes, relying at the coverage’s wording. |

Epilogue

Protective your American trendy vintage automotive comes to cautious attention of protection choices, top rate elements, and the declare procedure. Through figuring out the particular wishes of your car and the nuances of insurance coverage insurance policies, you’ll safeguard your funding and make sure peace of thoughts. This information has supplied a complete evaluation of the crucial sides of insuring vintage vehicles, empowering you to make knowledgeable selections about your protection.

Q&A: American Fashionable Vintage Automotive Insurance coverage

What sorts of harm are in most cases excluded from vintage automotive insurance coverage insurance policies?

Many insurance policies exclude harm led to by means of put on and tear, forget, or changes now not up to now disclosed. You’ll want to assessment the particular exclusions Artikeld on your coverage.

How does the recovery standing of a vintage automotive have an effect on insurance coverage premiums?

A completely restored vintage automotive, ceaselessly regarded as in higher situation, may have decrease premiums in comparison to a automotive desiring in depth recovery. The level of recovery paintings and the standard of the recovery will affect the top rate.

What are the stairs for submitting a declare for harm to a vintage automotive?

1. Touch your insurance coverage supplier straight away.

2. Collect all related documentation, together with car registration, insurance plans, and any pre-existing harm reviews.

3. Supply an in depth description of the wear, together with pictures and/or movies.

4. Cooperate absolutely with the insurance coverage adjuster within the review procedure.

What preventive measures can lend a hand cut back the danger of wear and tear or robbery for my vintage automotive?

• Protected parking in a storage or well-lit, monitored house.

• Spend money on a competent alarm machine and/or monitoring tool.

• Ceaselessly handle the car to forestall mechanical disasters.

• Stay correct information of the car’s historical past, upkeep, and any changes.