Automotive insurance coverage Missouri Town TX, a beacon illuminating the trail against protected mobility. Navigating the complexities of insurance coverage on this colourful neighborhood, we unveil the important thing elements impacting your monetary well-being at the street. Figuring out the intricacies of insurance policies, premiums, and protection choices empowers you to make knowledgeable alternatives that harmonize together with your adventure.

Missouri Town, TX, items a singular tapestry of insurance coverage concerns, from numerous coverage sorts to the delicate influences of location and demographics. We delve into the main points, analyzing how elements like age, using historical past, and automobile sort give a contribution on your total insurance coverage charge. Moreover, we provide a complete evaluate of native insurance coverage suppliers, comparing their strengths, weaknesses, and buyer comments to assist your decision-making procedure.

Uncover the avenues for charge aid, discover very important protection sorts, and achieve a deeper figuring out of your rights and duties at the street.

Assessment of Automotive Insurance coverage in Missouri Town, TX

Automotive insurance coverage in Missouri Town, Texas, like in other places, is a an important facet of accountable automobile possession. Figuring out the marketplace dynamics and the criteria affecting premiums lets in folks to make knowledgeable choices about their protection wishes. The provision of quite a lot of coverage sorts and the significance of a excellent using file additional underscore the importance of this matter.

Components Influencing Automotive Insurance coverage Charges

A number of key elements affect automotive insurance coverage charges in Missouri Town, TX. Those come with the motive force’s age and revel in, the kind of automobile, the positioning of the automobile, and the motive force’s using file. A historical past of injuries or visitors violations ceaselessly results in upper premiums. Geographic location too can have an effect on charges, as some spaces could have the next occurrence of injuries or upper robbery charges.

The price and make of the automobile, reflecting its doable charge to fix or substitute, also are key concerns.

Commonplace Kinds of Automotive Insurance coverage Insurance policies

The most typical varieties of automotive insurance coverage insurance policies come with legal responsibility, complete, and collision. Legal responsibility insurance coverage covers damages you purpose to other folks’s belongings or accidents to others. Complete insurance coverage protects in opposition to damages now not brought about by way of injuries, similar to robbery, vandalism, or herbal failures. Collision insurance coverage covers damages on your automobile, without reference to who’s at fault.

Moderate Prices of Quite a lot of Protection Ranges

Moderate automotive insurance coverage prices in Missouri Town, TX range significantly according to the protection ranges decided on. Legal responsibility-only insurance policies normally have the bottom premiums, adopted by way of the ones providing complete and collision protection. The precise charge is determined by person cases and the precise coverage selected.

Function of Riding Information and Demographics in Charge Calculation, Automotive insurance coverage missouri town tx

Riding data play a vital function in figuring out automotive insurance coverage premiums. Drivers with a historical past of injuries or violations face upper charges in comparison to the ones with blank data. Demographics similar to age and placement additionally affect charges. More youthful drivers, for instance, have a tendency to have upper premiums because of their statistically upper twist of fate chance.

Automotive Insurance coverage Firms in Missouri Town, TX

| Corporate Identify | Protection Choices | Moderate Top rate | Buyer Critiques |

|---|---|---|---|

| Instance Corporate 1 | Complete, Legal responsibility | $1500 | Very good |

| Instance Corporate 2 | Complete Protection | $1200 | Just right |

| Instance Corporate 3 | Legal responsibility Simplest | $900 | Moderate |

Be aware: This desk supplies instance information. Precise premiums and critiques would possibly range according to person cases and the precise insurance policies selected.

Components Affecting Automotive Insurance coverage Premiums: Automotive Insurance coverage Missouri Town Tx

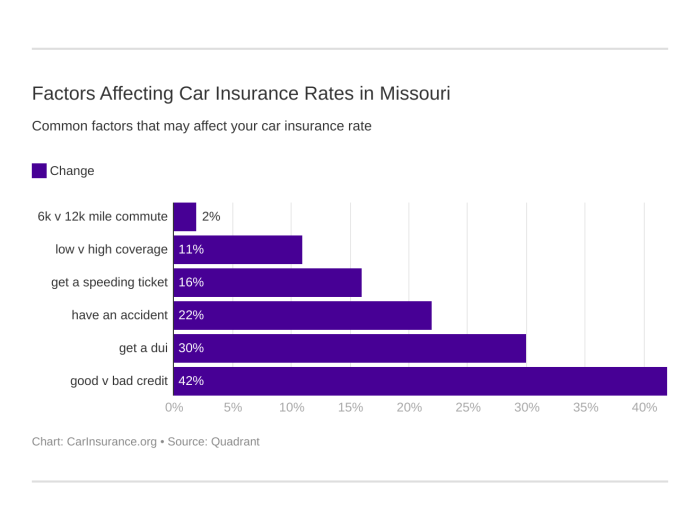

Figuring out the criteria that affect automotive insurance coverage premiums in Missouri Town, TX, is an important for making knowledgeable choices. Those elements aren’t arbitrary; they’re according to statistical research of chance profiles. Insurers use this information to resolve the suitable stage of protection and pricing.Components similar to age, gender, and using historical past are vital signs of chance, affecting the price of insurance coverage.

Automobile sort and utilization additionally play a job, reflecting the possibility of injury or injuries. Location inside the town can have an effect on charges because of elements like visitors density and twist of fate frequency. A motive force’s claims historical past is a crucial determinant of long term top rate prices. A historical past of injuries or claims demonstrates the next chance profile, thus justifying upper premiums.

Age and Gender

Age and gender are vital elements in figuring out insurance coverage premiums. More youthful drivers, normally elderly 16-25, are ceaselessly assigned upper premiums because of a statistically upper twist of fate price in comparison to older drivers. This displays the relative inexperience and better chance related to this demographic. In a similar fashion, gender-based variations in using conduct and twist of fate charges can affect premiums.

Riding Historical past

A blank using file, unfastened from injuries or violations, in most cases ends up in decrease insurance coverage premiums. This displays a decrease chance profile. Conversely, drivers with a historical past of injuries or visitors violations face upper premiums. It is because such data point out the next probability of long term claims, necessitating the next top rate to offset doable losses.

Automobile Kind and Use

The kind of automobile considerably impacts insurance coverage premiums. Sports activities automobiles, for example, ceaselessly have upper premiums because of their upper restore prices and perceived chance of wear and tear. In a similar fashion, automobiles used for business functions or common long-distance trip ceaselessly command upper premiums than non-public automobiles used essentially for commuting.

Location Inside of Missouri Town, TX

Location inside of Missouri Town, TX, can have an effect on insurance coverage charges because of various ranges of visitors congestion, twist of fate charges, and legislation enforcement presence. Spaces with upper visitors quantity and twist of fate frequency have a tendency to have upper insurance coverage premiums. Insurers believe elements such because the proximity to main intersections and high-accident spaces when surroundings premiums.

Claims Historical past

A motive force’s claims historical past has a vital have an effect on on long term insurance coverage premiums. A historical past of injuries or claims signifies the next chance profile, main to raised premiums. Insurers use this data to evaluate the possibility of long term claims and regulate premiums accordingly.

Have an effect on of Age on Premiums

| Age Workforce | Moderate Top rate | Share Distinction |

|---|---|---|

| 16-25 | $2000 | 50% upper |

| 26-35 | $1500 | 30% upper |

| 36-55 | $1200 | 20% upper |

| 56+ | $1000 | 10% upper |

This desk illustrates the typical top rate variations according to age teams in Missouri Town, TX. You need to notice that those are averages and person premiums can range according to different elements.

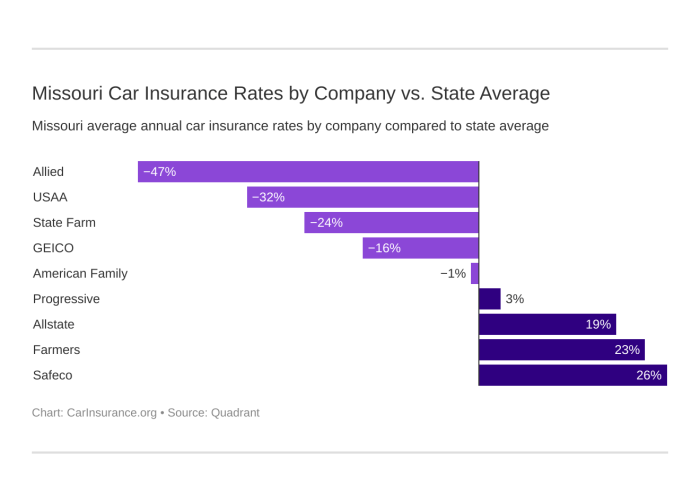

Evaluating Insurance coverage Firms in Missouri Town, TX

Choosing the proper automotive insurance coverage supplier in Missouri Town, TX is an important for monetary safety. Figuring out the strengths and weaknesses of various firms lets in drivers to make knowledgeable choices and protected the most efficient protection on the best worth. Components similar to protection choices, customer support, monetary balance, and reductions considerably affect the decision-making procedure.

Insurance coverage Supplier Services and products in Missouri Town, TX

Other insurance coverage suppliers be offering quite a lot of services and products adapted to satisfy numerous wishes. Those services and products prolong past fundamental protection, ceaselessly together with roadside help, claims control, and 24/7 buyer toughen. Figuring out those services and products is necessary for assessing the worth proposition of every supplier. The provision of customized customer support and effective claims processing can considerably have an effect on the total buyer revel in.

Protection Choices and Buyer Carrier Scores

Evaluating protection choices is very important. Other firms be offering various ranges of protection, from complete to liability-only. Customer support rankings supply insights into the standard of toughen equipped by way of every corporate. Prime buyer pride ratings ceaselessly correlate with an organization’s responsiveness and helpfulness in dealing with claims and inquiries. Components similar to the velocity of claims processing, the supply of on-line assets, and the accessibility of purchaser toughen channels play a an important function in figuring out total customer support.

Monetary Balance and Popularity

The monetary balance and recognition of an insurance coverage corporate are paramount. A financially strong corporate is much less more likely to revel in problems with pleasing claims tasks. A powerful recognition ceaselessly displays sure buyer stories and a historical past of accountable industry practices. Examining the corporate’s monetary rankings and trade recognition supplies precious perception into its skill to satisfy long term tasks.

Insurance coverage firms with a confirmed monitor file of reliability are much more likely to deal with their commitments.

Reductions Presented by way of Quite a lot of Firms

Insurance coverage firms often be offering quite a lot of reductions to incentivize consumers. Those reductions can considerably scale back premiums, making insurance coverage extra reasonably priced. Reductions are ceaselessly according to elements similar to protected using data, anti-theft units, or particular insurance coverage bundles. Figuring out the to be had reductions and the way they follow to person cases may end up in considerable financial savings. Examples of reductions come with the ones for excellent scholar standing, anti-theft units, and multiple-policy holders.

Abstract Desk of Most sensible Insurance coverage Suppliers

| Corporate | Strengths | Weaknesses |

|---|---|---|

| Instance Corporate A | Aggressive charges, very good customer support, wide selection of protection choices, readily to be had on-line assets. | Restricted revel in in dealing with complicated claims, occasional delays in processing. |

| Instance Corporate B | Wide variety of protection choices, complete customer support, a number of declare dealing with choices. | Upper premiums, probably longer processing occasions. |

| Instance Corporate C | Sturdy monetary status, very good recognition, intensive community of brokers. | Much less aggressive charges, restricted on-line assets. |

Guidelines for Saving on Automotive Insurance coverage in Missouri Town, TX

Reducing automotive insurance coverage premiums is a an important facet of managing non-public price range. Figuring out the criteria that affect those premiums, and using methods to mitigate them, can considerably scale back the monetary burden of auto insurance coverage. In Missouri Town, TX, as in different spaces, a proactive technique to protected using and monetary duty can yield considerable financial savings.Efficient methods for lowering automotive insurance coverage premiums are necessary for monetary prudence.

Via in moderation taking into consideration using behavior, keeping up a blank using file, and optimizing elements like automobile sort and credit score ranking, folks can considerably decrease their insurance coverage prices.

Keeping up a Just right Riding File

A spotless using file is paramount in attaining favorable automotive insurance coverage charges. Injuries and violations immediately have an effect on premiums. Constant adherence to visitors regulations and protected using practices demonstrates accountable conduct, leading to decrease insurance coverage prices. Insurance coverage firms ceaselessly supply reductions for drivers with blank data, reflecting their dedication to accountable using.

Advantages of Reductions for Protected Riding and Just right Credit score Rankings

Insurance coverage firms ceaselessly be offering reductions for protected using and excellent credit score ratings. Protected drivers, displaying accountable conduct at the street, qualify for decrease premiums. Just right credit score ratings show monetary duty, which insurers ceaselessly view as a discounted chance issue, resulting in discounted premiums. Those reductions can translate into considerable financial savings through the years.

Examples of Tactics to Toughen Your Credit score Rating

Bettering credit score ratings can definitely have an effect on automotive insurance coverage premiums. Frequently making on-time bills on all accounts, together with bank cards and loans, is an important. Decreasing remarkable balances on credit score accounts and keeping up a horrible credit usage ratio are very important steps in development a excellent credit score ranking. Tracking credit score experiences for mistakes and disputing inaccuracies can additional reinforce credit score ratings.

Those enhancements can immediately give a contribution to decrease automotive insurance coverage premiums.

Kinds of Cars Related to Decrease Premiums

Sure automobile sorts are related to decrease premiums because of their inherent security measures and cost-effectiveness. Smaller, fuel-efficient automobiles, identified for his or her decrease restore prices and gas potency, ceaselessly draw in decrease insurance coverage premiums. Cars with complicated security measures, similar to airbags and anti-lock brakes, also are often related to diminished insurance coverage prices. Those elements mirror the decrease chance of wear and tear or damage related to those automobiles.

Particular Tactics to Scale back the Chance of Injuries

Proactive measures to attenuate the danger of injuries can considerably decrease insurance coverage premiums. Adhering to hurry limits, warding off distractions like cellphones whilst using, and keeping up enough following distances are an important protection measures. Common automobile upkeep, making sure right kind tire power and brake serve as, reduces the possibility of mechanical screw ups that might result in injuries. Taking defensive using classes can reinforce using talents and consciousness, additional lowering the danger of injuries and thus, decreasing insurance coverage premiums.

Figuring out Protection Choices

Automotive insurance coverage in Missouri Town, TX, gives quite a lot of protection choices to give protection to your automobile and its occupants. Figuring out those choices is an important for making knowledgeable choices about your insurance coverage wishes. This information is helping be sure to’re adequately secure in quite a lot of scenarios.Other protection ranges supply various levels of coverage. The precise choices to be had and their pricing can range according to the insurance coverage corporate.

Choosing the proper protection is vital for balancing coverage and price.

Legal responsibility Protection

Legal responsibility protection protects you from monetary duty in the event you purpose injury to someone else’s belongings or injure somebody in an twist of fate. It’s ceaselessly required by way of legislation. This protection will pay for damages to the opposite birthday party’s automobile or clinical bills for accidents they maintain.As an example, if you’re eager about a automotive twist of fate and are at fault, legal responsibility protection will assist pay for the damages to the opposite motive force’s automobile.

Collision Protection

Collision protection protects your automobile from injury on account of an twist of fate, without reference to who’s at fault. This protection will pay for upkeep or alternative of your automobile if it is broken in a collision.Consider a situation the place you might be eager about a fender bender with any other automotive. Even though the opposite motive force is at fault, collision protection will assist pay for upkeep on your automobile.

Complete Protection

Complete protection protects your automobile from injury brought about by way of occasions rather than collisions, similar to hail, hearth, vandalism, or robbery. This protection will pay for upkeep or alternative of your automobile in those scenarios.A hail typhoon harmful your automotive’s roof is a superb instance the place complete protection would come into play.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage is an important for shielding your pursuits if you’re eager about an twist of fate with an at-fault motive force who lacks good enough insurance coverage. This protection compensates you for accidents or damages in such situations.Imagine a situation the place you might be hit by way of a motive force with inadequate insurance coverage. With out this protection, you may well be left to endure the monetary burden of clinical expenses and upkeep.

Comparability of Protection Choices

| Protection Kind | Description | Instance ||—|—|—|| Legal responsibility | Protects you from injury to others’ belongings | You hit any other automotive and injury it. || Collision | Covers your automobile if it is broken in an twist of fate | Your automotive will get broken in a collision. || Complete | Covers your automobile for damages from occasions rather than injuries | Your automotive is broken by way of a hail typhoon.

|| Uninsured/Underinsured Motorist | Covers you in case you are in an twist of fate with an uninsured or underinsured motive force | You might be hit by way of a motive force with out sufficient insurance coverage. |Figuring out those other protection sorts is helping you are making knowledgeable alternatives to your insurance coverage wishes, making sure monetary coverage and peace of thoughts.

Ultimate Abstract

In conclusion, securing automotive insurance coverage in Missouri Town, TX, is a multifaceted procedure not easy cautious attention. This exploration has illuminated the intricate panorama of protection choices, top rate elements, and insurance coverage supplier comparisons. In the end, your selection will have to align with your own wishes and monetary cases. Embody the insights shared to make knowledgeable choices, fostering a way of peace and preparedness at the street forward.

Very important Questionnaire

What are the most typical reductions presented for automotive insurance coverage in Missouri Town, TX?

Reductions for protected using, excellent scholar standing, and bundled insurance coverage insurance policies are not unusual. Particular reductions range between suppliers.

How does my credit score ranking have an effect on my automotive insurance coverage premiums in Missouri Town, TX?

A better credit score ranking in most cases correlates with decrease insurance coverage premiums, because it suggests accountable monetary control, ceaselessly reflecting a decrease chance profile for insurance coverage firms.

What are the standard prices of liability-only automotive insurance coverage in Missouri Town, TX?

Legal responsibility-only insurance policies normally charge lower than complete protection insurance policies, however be offering minimum coverage within the match of an twist of fate.

What’s the function of car sort in figuring out automotive insurance coverage premiums?

Prime-performance or luxurious automobiles ceaselessly include upper premiums because of their perceived chance and service prices.