Automotive insurance coverage via VIN quantity is an excellent essential factor, you understand? It is like giving your automobile a distinct ID that is helping insurance coverage firms know precisely which car you might be speaking about. This is helping them briefly and correctly procedure claims, or even is helping save you fraud. It is a great way to verify the entirety is obvious and truthful for everybody concerned.

Figuring out your VIN is like having an excellent secret code to liberate your automobile’s insurance coverage main points. This implies you’ll simply to find out your coverage main points, protection, or even declare standing, all because of that particular VIN quantity. It is great handy, proper?

Figuring out Car Identity Quantity (VIN)

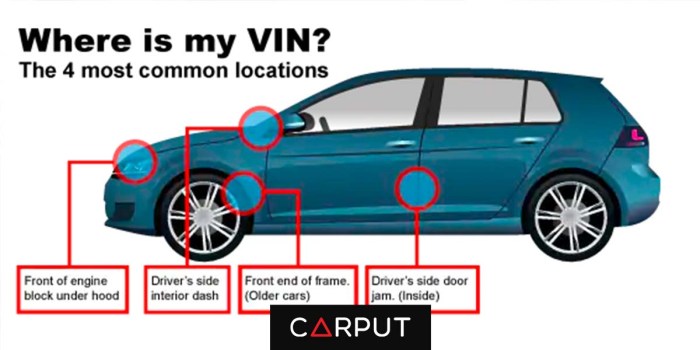

The Car Identity Quantity (VIN) is a singular alphanumeric code that serves as a car’s virtual fingerprint. It is a the most important piece of data, permitting government and insurance coverage suppliers to briefly and correctly establish a particular car, the most important for the entirety from verifying possession to assessing doable dangers. This complete information will discover the construction and importance of a VIN, equipping you with a deeper working out of this very important code.A VIN, continuously discovered at the motive force’s facet dashboard, and every now and then at the car’s body or different visual portions, is greater than only a string of characters.

It is a meticulously designed checklist containing information about the car’s make, fashion, yr, and different vital specs. Figuring out this code may give precious perception right into a car’s historical past and traits.

Construction and Parts of a VIN

A VIN is a 17-character alphanumeric collection, continuously organized in a particular development. This standardized structure permits seamless identity and information retrieval throughout quite a lot of producers. Every persona performs a very important function in conveying particular details about the car.

Other VIN Codecs for More than a few Car Sorts

Other car varieties may have diversifications of their VIN structure. Whilst the core construction stays constant, minor changes is also carried out to house specific fashions or configurations. The diversities generally contain the location or inclusion of particular characters or digits, designed to take care of the original identity whilst adapting to design issues. Examples come with diversifications within the structure for bikes, vans, or custom designed automobiles.

Importance of Every Digit Inside of a VIN

Every persona in a VIN holds a particular that means. The positions and varieties of characters used are standardized, offering a constant method for quite a lot of entities to interpret the information. This meticulous design permits for environment friendly processing and correct identity of any car. The primary 3 characters generally denote the producer, whilst the rest characters steadily establish the car’s fashion, yr, engine, and different main points.

How VINs are Used to Uniquely Establish a Explicit Car

The original nature of a VIN lies in its talent to unequivocally establish a selected car. No two automobiles percentage the similar VIN, making it a competent identifier for insurance coverage firms, regulation enforcement, and car registries. This unyielding distinctiveness is the most important in keeping up correct information and tracing automobiles in case of robbery or harm. Moreover, it permits for simple verification of possession and guarantees that insurance coverage claims are correctly related to the particular car.

VIN Breakdown Desk

This desk illustrates the other sections and data discovered inside of a VIN. Figuring out this structure permits for a extra detailed comprehension of the ideas encoded inside the car’s identity code.

| Segment | Knowledge |

|---|---|

| International Producer Identifier (WMI) | Signifies the producer (e.g., GM, Ford, Toyota). |

| Car Descriptor Series | Specifies the car’s sort, fashion, and frame taste. |

| Car Identity Quantity (VIN) | Uniquely identifies the car. |

| Take a look at Digit | A calculated digit used to validate the accuracy of the VIN. |

Automotive Insurance coverage and VIN Quantity Dating

A car identity quantity (VIN) is greater than only a string of numbers and letters; it is the distinctive fingerprint of your car. Insurance coverage firms leverage this distinctive identifier to meticulously arrange their insurance policies and claims. This vital connection guarantees correct protection and protects each the policyholder and the insurer from fraudulent actions. Figuring out this dating is essential to navigating the arena of vehicle insurance coverage.Insurance coverage firms use VIN numbers to make sure the car’s identification.

This verification is the most important for a number of causes. At the start, it guarantees the policyholder is insured for the right kind car. Secondly, it is helping save you fraudulent claims. Thirdly, it permits insurers to briefly establish and observe automobiles in case of robbery or harm. This procedure streamlines claims and is helping decide the validity of any given declare.

VIN Verification in Insurance coverage Claims

VIN verification is a cornerstone of insurance coverage declare processing. It guarantees that the reported harm corresponds to the car insured. This procedure is very important in minimizing fraudulent claims and keeping up accuracy in coverage control. With out a actual VIN fit, claims may also be rejected or not on time, doubtlessly resulting in monetary hardship for the policyholder.

VIN Verification in Coverage Control

Insurance coverage firms use VINs to take care of correct information of insured automobiles. This comprises updating main points comparable to adjustments, injuries, and maintenance. A complete database of VIN data permits insurers to trace automobiles all over their lifespan, offering an in depth historical past for every car. This detailed checklist is necessary for comparing possibility and adjusting premiums accordingly.

Comparability of VIN Utilization in Other Declare Situations

The significance of VINs varies throughout other declare situations. As an example, in a collision declare, an exact VIN fit is very important to make certain that the wear and tear corresponds to the insured car. If a car is stolen, the VIN is important for reporting the robbery and starting up the restoration procedure. In a case of a complete loss, the VIN is wanted to make sure the car’s identification and start up the payout procedure.

Examples of Vital VIN Utilization

Believe a scenario the place a car has been concerned with an coincidence. With out the VIN, the insurance coverage corporate can not ascertain that the car in query is the only insured. This results in an important prolong in processing the declare and doubtlessly denies the declare solely. Every other instance comes to a stolen car. The VIN is the most important for reporting the robbery to the government and for the insurance coverage corporate to start up the declare procedure.

With out the VIN, the insurance coverage corporate can not decide if the declare is reliable.

Desk Evaluating Declare Sorts

| Usual Declare | VIN-Primarily based Declare |

|---|---|

| Policyholder’s title, cope with, and make contact with data | Policyholder’s title, cope with, touch data, and the VIN of the insured car |

| Description of the wear and tear or loss | Description of the wear and tear or loss, and the suitable VIN of the broken/stolen car |

| Supporting documentation (e.g., police document, pictures) | Supporting documentation (e.g., police document, pictures, and any further paperwork that can come with the VIN) |

Getting access to Insurance coverage Knowledge via VIN

Unraveling the mysteries of your car’s insurance plans can really feel like interpreting historical hieroglyphics. Thankfully, the Car Identity Quantity (VIN) acts as a key to liberate this data, offering a simple pathway in your coverage main points. This phase will discover the quite a lot of strategies for acquiring this necessary records, making sure you might be armed with the data to navigate the insurance coverage labyrinth with self belief.

Strategies for Acquiring Insurance coverage Knowledge

Figuring out download your automobile insurance coverage data via VIN is the most important for quite a lot of causes, together with coverage verification, claims control, or even easy record-keeping. The strategies to be had vary from easy on-line portals to doubtlessly extra concerned interactions together with your insurer.

- On-line Portals: Many insurance coverage firms be offering safe on-line portals the place policyholders can get right of entry to their coverage main points. Those portals generally require login credentials for verification. As an example, some firms use a singular login ID and password for safe get right of entry to, enabling policyholders to view protection main points, cost historical past, and declare data. Getting access to your coverage main points on-line continuously permits for swift and handy retrieval of the ideas you wish to have, getting rid of the desire for telephone calls or in-person visits.

- Buyer Provider Representatives: Direct interplay with insurance coverage corporate representatives stays a viable possibility. By way of contacting customer support and offering the VIN, you’ll acquire get right of entry to in your coverage main points. Insurance coverage brokers may give details about your coverage phrases, protection quantities, and cost schedules. This manner may also be specifically really useful for advanced scenarios or when in the hunt for rationalization on particular sides of your coverage.

- Insurance coverage Paperwork: In some circumstances, the insurance plans itself or supporting paperwork might include the essential details about your coverage. As an example, the insurance coverage paperwork may come with main points on protection quantities, coverage phrases, or cost time table, and the VIN quantity may well be incorporated in those paperwork.

Procedures for Discovering Insurance coverage Coverage Main points

Finding your coverage main points the use of the VIN comes to a scientific manner. It continuously comes to verifying the VIN’s accuracy, offering the right kind data to the insurance coverage corporate, and working out the corporate’s procedure.

- Verification of VIN: Be sure that the VIN you supply is correct. Double-check the VIN in opposition to your car registration paperwork for affirmation. A easy error can derail your efforts and reason delays.

- Contacting Insurance coverage Corporate: Succeed in out in your insurance coverage supplier. Use the precise channels, comparable to on-line portals, telephone beef up, or the insurance coverage corporate’s web page. Give you the VIN to the consultant or input it into the gadget.

- Acquiring Coverage Main points: As soon as your identification and the VIN are verified, the insurance coverage corporate will have to give you the asked data. Be expecting information about your protection, coverage phrases, and any related updates.

Felony Sides of Getting access to Insurance coverage Knowledge

Getting access to insurance coverage data by way of a VIN is ruled via particular prison rules. Those rules continuously focal point on protective the privateness and safety of private records. Moreover, insurance coverage firms are legally obligated to verify correct records dealing with.

How Insurance coverage Firms Examine VIN Knowledge

Making sure the accuracy of VIN data is a the most important side of the insurance coverage procedure. Insurance coverage firms use quite a lot of strategies to make sure the ideas, keeping up records integrity and combating fraudulent actions. They generally cross-reference the VIN with car registration databases and different authoritative resources.

| Way | Process | Benefits | Disadvantages |

|---|---|---|---|

| On-line Portal | Get right of entry to the insurer’s on-line portal, log in, and input the VIN. | Comfort, potency, self-service. | Calls for account get right of entry to and might not be to be had for all insurance policies. |

| Buyer Provider | Name the insurer’s customer support line and give you the VIN. | Help for advanced problems or clarifications. | Possible wait instances, much less handy for easy inquiries. |

| Insurance coverage Paperwork | Assessment your insurance plans paperwork for VIN data. | Easy and direct get right of entry to if the paperwork are readily to be had. | Calls for having the paperwork readily available. |

Insurance coverage Coverage Main points via VIN

Unveiling the secrets and techniques of your automobile’s insurance plans, one VIN at a time! Figuring out your coverage main points is the most important, particularly when surprising mishaps happen. This phase delves into the specifics, revealing how your VIN unlocks a treasure trove of details about your protection.The Car Identity Quantity (VIN) acts as a singular identifier on your automobile, intrinsically connected to its insurance plans.

This connection permits approved events to get right of entry to vital coverage data, making sure fast and environment friendly claims processing and offering transparency all over the insurance coverage procedure.

Explicit Coverage Main points Available via VIN

Insurance coverage insurance policies include a wealth of data. Throughout the VIN, you’ll get right of entry to very important main points just like the policyholder’s title, the coverage’s efficient dates, and the varieties of protection incorporated. This detailed data is necessary for working out your coverage.

Forms of Protection Related to a Explicit VIN

The VIN at once correlates with the particular coverages related together with your automobile. This comprises legal responsibility protection, collision protection, complete protection, and doubtlessly extra specialised choices, relying at the insurer. Figuring out those protection varieties is helping you recognize the breadth of your coverage.

Discovering Protection Limits, Deductibles, and Premiums Associated with a Explicit VIN

Coverage main points come with protection limits, deductibles, and premiums, all uniquely tied in your VIN. The protection prohibit specifies the utmost quantity the insurer can pay for a selected declare. Deductibles are the quantities you will have to pay out-of-pocket sooner than the insurer begins overlaying your bills. Premiums are the periodic bills you are making on your insurance plans. Most of these figures may also be accessed throughout the VIN.

For example, a coverage with a excessive protection prohibit for collision may have a better top rate.

Obstacles of Getting access to Explicit Coverage Knowledge by way of VIN

Whilst the VIN supplies vital get right of entry to to coverage main points, obstacles exist. No longer all coverage data is instantly to be had throughout the VIN on my own. Some records, comparable to claims historical past, may well be limited for privateness causes or as a result of it is only available via a devoted buyer portal. This can be a the most important level to bear in mind.

Desk of Available Coverage Main points via VIN

| Coverage Element | Instance |

|---|---|

| Policyholder’s Title | John Smith |

| Coverage Efficient Dates | 01/01/2024 – 12/31/2024 |

| Forms of Protection | Legal responsibility, Collision, Complete |

| Protection Limits | $100,000 for physically damage legal responsibility |

| Deductibles | $500 for collision |

| Premiums | $150 per 30 days |

Word: The particular main points available might range relying at the insurance coverage supplier and the extent of get right of entry to granted.

VIN-Primarily based Insurance coverage Declare Procedure

Submitting an insurance coverage declare, particularly after a fender-bender or a extra severe incident, can really feel like navigating a bureaucratic maze. Thankfully, the VIN, that distinctive identifier on your car, can streamline the method, making it much less of a headache and extra of a manageable process. Bring to mind the VIN as your car’s passport, straight away verifying its identification and historical past to the insurance coverage corporate.The VIN performs a the most important function in validating the car’s main points and making sure correct declare processing.

It serves as a key component in confirming the car’s possession, fashion, and any pre-existing harm, serving to insurance coverage adjusters to evaluate the declare promptly and slightly. This streamlined manner continuously results in sooner declare answer.

Steps Excited about Submitting a Declare

The declare procedure, although continuously a annoying revel in, is unusually easy when the VIN is used as a information. First, promptly notify your insurance coverage corporate concerning the coincidence or harm. A transparent description of the incident, together with the date, time, location, and any witnesses, is important. Subsequent, acquire all related documentation, together with police experiences (if appropriate), restore estimates, and pictures of the wear and tear.

Be mindful, the extra detailed the ideas, the smoother the method.

Reporting an Twist of fate or Injury The usage of a VIN

To expedite the method, give you the VIN together with the entire main points. This permits the insurance coverage corporate to straight away get right of entry to your coverage data and start the analysis. This verification step guarantees that the declare is processed successfully and that every one essential data is instantly to be had. Your VIN is your car’s distinctive identifier, appearing as a key to liberate your coverage data and expedite the declare procedure.

Affect of VIN Verification on Declare Processing Time

The VIN verification procedure, like a well-oiled system, can dramatically cut back declare processing time. By way of straight away confirming the car’s main points and coverage protection, the insurance coverage corporate can start up the declare agreement a lot sooner. This potency interprets to a faster answer for you, permitting you to get again at the highway (or a minimum of get the maintenance completed) faster.

In lots of instances, this procedure can save days or weeks in comparison to conventional declare processing strategies.

Declare Situations and Resolutions

Believe those situations:* Situation 1: A motive force experiences a minor scratch on their automobile. Offering the VIN together with the pictures and a short lived description permits the insurance coverage corporate to make sure the car’s main points and approve the declare briefly. A easy, easy procedure with a favorable result.* Situation 2: A extra advanced coincidence involving more than one automobiles.

The VIN is helping in figuring out the concerned automobiles, confirming their possession, and verifying protection main points, taking into account a sooner and extra correct agreement for all events.

VIN-Primarily based Insurance coverage Declare Procedure Phases, Automotive insurance coverage via vin quantity

| Level | Motion |

|---|---|

| Reporting | Notify insurance coverage corporate of incident, supply VIN. |

| Verification | Insurance coverage corporate verifies VIN, coverage main points. |

| Evaluate | Insurance coverage adjuster assesses harm, gathers proof. |

| Approval/Denial | Insurance coverage corporate approves or denies the declare. |

| Agreement | Cost for maintenance, or different repayment. |

VIN and Insurance coverage Fraud

The Car Identity Quantity (VIN) is a the most important instrument for insurers, appearing as a singular fingerprint for every car. Sadly, unscrupulous folks every now and then try to exploit the gadget, resulting in fraudulent insurance coverage claims. Figuring out how VINs are utilized in those schemes is very important for each policyholders and insurance coverage firms to give protection to in opposition to those fraudulent actions.VINs are meticulously built-in into insurance coverage databases, making a complete checklist of auto possession and historical past.

This permits insurers to straight away test a car’s identification and historical past, which is the most important in combating fraudulent claims. Using VIN verification programs considerably reduces the probabilities of claims being made on stolen or broken automobiles.

The Function of VINs in Combating Insurance coverage Fraud

VINs function a vital part in preventing insurance coverage fraud. Their distinctive nature and traceable historical past are key to verifying a car’s identification, historical past, and present standing. This is helping to spot fraudulent claims making an attempt to misuse or manipulate VINs for insurance coverage fraud. Insurers leverage VIN data to make sure the legitimacy of claims, mitigating the danger of payouts on fictitious occasions.

Strategies Used to Stumble on Fraudulent Claims Involving VIN Manipulation

Insurers make use of subtle find out how to locate fraudulent claims involving VIN manipulation. Those strategies continuously mix records research, ancient information tests, and direct investigation. A mix of those tactics considerably reduces the risk of fraud being a success.

- Knowledge Research: Insurance coverage firms analyze claims records, searching for patterns or anomalies that might point out fraudulent process. As an example, a surprising surge in claims for a particular fashion yr of a car may cause an investigation. Odd declare frequency, coupled with an identical descriptions, can be a pink flag.

- Historic Data Assessments: Insurers completely examine the car’s historical past the use of databases that checklist car titles, registrations, and prior harm claims. Discrepancies on this records can divulge inconsistencies and alert investigators to doable fraud.

- Direct Investigation: Insurance coverage firms might at once touch car homeowners, dealerships, and service retail outlets to make sure the main points of a declare. This procedure guarantees that the declare main points align with the car’s documented historical past.

Consequences for Insurance coverage Fraud Involving VINs

Insurance coverage fraud, particularly that involving VIN manipulation, is a significant offense with serious penalties. Those consequences range via jurisdiction however in most cases contain hefty fines and doable imprisonment. Those sanctions deter folks from enticing in such fraudulent actions.

Consequences for insurance coverage fraud involving VIN manipulation are vital and range in response to the particular rules in every jurisdiction.

Examples of Actual-International Circumstances The place VINs Had been Utilized in Insurance coverage Fraud Schemes

A number of real-world instances show how VINs may also be manipulated in insurance coverage fraud schemes. Those examples spotlight the significance of strong verification processes to forestall fraudulent actions.

- Car Cloning: In a single example, a legal gang cloned a VIN, creating a stolen car seem as though it belonged to an blameless celebration. This allowed them to record fraudulent claims for harm to the car, benefiting from the insurance coverage gadget.

- Fictitious Injury Claims: Every other case concerned submitting false claims for harm to a car the use of a manipulated VIN. By way of changing the VIN to compare a unique car, they effectively accrued insurance coverage payouts.

Desk of Insurance coverage Fraud Schemes and VIN Involvement

The desk under illustrates how VINs are concerned with quite a lot of insurance coverage fraud schemes.

| Scheme | Function of VIN |

|---|---|

| Car Cloning | The VIN is altered to make a stolen car seem reliable, permitting fraudulent claims. |

| Fictitious Injury Claims | The VIN is used to create false information of wear, permitting claims for maintenance that didn’t happen. |

| Stolen Car Claims | A stolen car’s VIN is used to record a declare for harm or robbery, whilst the real car stays stolen. |

Long run Developments in VIN and Insurance coverage

The way forward for automobile insurance coverage is having a look extra like a high-tech, data-driven detective company than a easy bureaucracy workout. VIN numbers, the ones apparently risk free alphanumeric strings, are poised to play a pivotal function on this transformation, providing a glimpse into an international the place insurance coverage is as customized as your favorite pair of shoes.The intricate dance between VINs and insurance coverage is ready to grow to be much more intricate.

Insurance coverage firms will likely be leveraging the huge trove of information related to every VIN not to most effective assess possibility extra exactly but additionally to tailor insurance policies to the particular wishes and traits of particular person automobiles. This will likely be a game-changer for each insurers and policyholders.

Predicting Long run Use of VIN Numbers

The usage of VIN numbers in insurance coverage is not only a pattern; it is a structural shift. Insurers will most likely combine VIN records into their predictive modeling, examining components like car make, fashion, yr, or even particular options to evaluate the possibility of injuries and different claims. This proactive manner will permit insurers to correctly are expecting possibility and alter premiums accordingly.

Believe a state of affairs the place a particular fashion of a sports activities automobile demonstrates a better fee of injuries because of competitive using kinds; this information, coupled with the VIN, will allow extra centered pricing.

Affect of Generation on VIN-Primarily based Insurance coverage Processes

Technological developments will considerably streamline VIN-based insurance coverage processes. Believe a long term the place a car’s VIN mechanically triggers a customized coverage upon registration. Using blockchain era will allow the safe and clear change of VIN-related records between quite a lot of stakeholders, fostering consider and potency. Additionally, AI-powered programs will have the ability to analyze huge quantities of information related to VINs, facilitating fast declare tests and lowering the effort and time concerned with all the procedure.

Rising Developments in Insurance coverage Insurance policies Tied to VINs

Insurance coverage insurance policies tied to VINs will likely be transferring towards higher customization. This implies insurance policies will adapt to express options of a car, just like the presence of complicated driver-assistance programs or specialised protection apparatus. The coverage will mechanically alter in response to the VIN, doubtlessly decreasing premiums for automobiles provided with awesome security features. This dynamic adaptation is a key component within the evolution of insurance coverage.

Improving Coverage Customization with VINs

VINs be offering an impressive instrument for customizing insurance coverage insurance policies. A coverage for a antique sports activities automobile may have a unique top rate construction than a contemporary circle of relatives sedan. The VIN will permit for adapted protection, top rate changes, or even particular add-ons, comparable to enhanced roadside help, adapted to the specific car. This customized manner displays a shift against extra granular possibility evaluation.

Bettering Possibility Evaluate Accuracy with VIN Knowledge

The usage of VIN records to give a boost to possibility evaluation accuracy is a the most important step. Inspecting records from quite a lot of resources, together with VIN-related coincidence experiences and upkeep information, will supply a extra complete view of a car’s historical past. This will likely lend a hand insurers make extra correct possibility tests, resulting in fairer and extra clear pricing. A car with a historical past of repairs problems, for instance, may cause a better top rate than a meticulously maintained car.

Closing Level

In brief, the use of VIN numbers for automobile insurance coverage makes issues a lot smoother and more secure. It is helping steer clear of confusion, accelerate declare processes, and protects everybody concerned. So, understanding your VIN is a the most important step for buying the most productive automobile insurance coverage revel in imaginable. It is like having a super-powered buddy for your facet, ensuring the entirety is treated completely!

Solutions to Not unusual Questions: Automotive Insurance coverage By way of Vin Quantity

What if I do not need my VIN quantity?

No downside! You’ll typically to find it for your automobile’s identify, registration, and even at the automobile itself. Simply examine round and you are able to find it!

How lengthy does it take to get insurance coverage data by way of VIN?

Typically, it is lovely speedy. Insurance coverage firms have programs in position to get this data briefly. You’ll typically get your main points inside of a couple of mins or hours.

Can I exploit my VIN to test if my insurance plans is legitimate?

Sure! Your VIN is helping test your coverage’s main points and make sure it is up-to-date. It is a dependable strategy to ascertain your protection remains to be energetic.

What if I am concerned with an coincidence, and want to record a declare? How can VIN be helpful?

Offering your VIN is the most important for correct declare processing. It is helping insurance coverage firms establish the car and the coverage main points connected to it, making the entire declare procedure a lot sooner.