California non proprietor automobile insurance coverage – California non-owner automobile insurance coverage supplies protection for many who don’t personal a automobile however wish to power one. This kind of insurance coverage is the most important for scenarios like the usage of a pal’s automobile or riding a condominium automobile. Figuring out the more than a few varieties, protection, and rules surrounding this specialised insurance coverage is important for making knowledgeable selections. This information provides a complete evaluation, overlaying the whole lot from the fundamental necessities to the claims procedure, that will help you navigate this often-complex house.

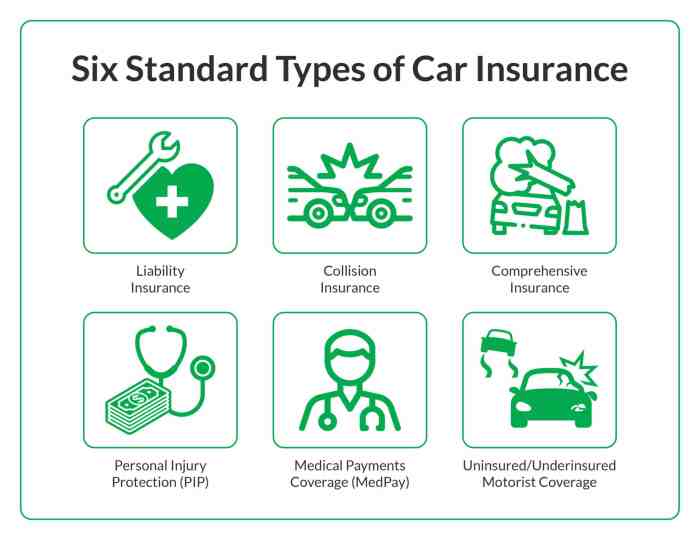

California non-owner automobile insurance coverage insurance policies generally duvet legal responsibility, which protects you from monetary duty in case of an coincidence. The particular protection limits, and different kinds of protection (akin to collision or complete), range between suppliers and insurance policies. This detailed overview explores the intricacies of California non-owner automobile insurance coverage, equipping you with the information had to make the proper selection.

Evaluation of California Non-Proprietor Automotive Insurance coverage

California non-owner automobile insurance coverage is sort of a brief customer’s visa on your wheels. It is designed for many who do not personal a automobile however want protection when borrowing or riding any individual else’s automobile. Bring to mind it as a security internet for the ones occasional rides, making sure everybody’s secure in case of an coincidence.This kind of insurance coverage protects each the driving force and the automobile proprietor, safeguarding their property and fending off hefty monetary burdens in unlucky occasions.

It is a the most important instrument for individuals who may no longer personal a automobile however often use one, akin to a pupil riding a pal’s automobile, or a circle of relatives member the usage of a relative’s automobile.

Sorts of Non-Proprietor Insurance policies

California provides more than a few non-owner automobile insurance coverage choices, each and every adapted to other wishes. Bring to mind them as other flavors of coverage – some are candy and easy, whilst others are a little extra complicated. The secret is discovering the coverage that most closely fits your riding behavior and finances.

- Transient Protection: That is the most simple possibility, appropriate for occasional riding. It is like a condominium automobile insurance plans, just for automobiles you do not personal. It kicks in whilst you use any individual else’s automobile for a restricted time, for instance, a weekend go back and forth.

- Common Protection: That is extra like a long-term cross for individuals who often power a automobile they do not personal. Take into consideration the frequency of use and the length of the riding. This coverage is perfect for individuals who use a non-owned automobile steadily for commuting, errands, or different actions.

Instances Requiring Non-Proprietor Insurance coverage, California non proprietor automobile insurance coverage

Non-owner insurance coverage is usally required via the automobile proprietor as a situation for the usage of their automobile. It is a the most important facet for making sure each events are secure in case of an coincidence. That is in particular necessary in scenarios the place the driving force may no longer have their very own legal responsibility protection. It is necessarily a security precaution for everybody concerned.

- Using a borrowed automobile: That is the commonest state of affairs. In case you are borrowing a automobile, the landlord may require you to have non-owner protection to offer protection to their pursuits. It is like a excellent neighbor coverage, making sure everybody’s secure.

- Using a automobile with out insurance coverage: Some states require non-owner insurance coverage if you are riding a automobile that does not have its personal insurance plans. This safeguards the driving force and different events in case of an coincidence.

- Using a automobile registered to any individual else: In case you often power a automobile registered to any individual else, it is a good suggestion to have non-owner insurance coverage. This guarantees you are coated and protects the automobile proprietor’s pursuits.

Protection Barriers and Exclusions

Non-owner insurance policies, whilst useful, are not a loose cross. They generally include positive obstacles. Bring to mind them because the positive print of your coverage.

- Restricted Protection: Those insurance policies usally have decrease limits on legal responsibility protection in comparison to complete proprietor insurance policies. Which means in case of a major coincidence, the protection will not be sufficient to hide all damages.

- Exclusions: Non-owner insurance policies in most cases exclude positive actions, akin to riding beneath the affect or for business functions. That is to forestall misuse and make certain that the protection is used responsibly.

Key Variations Between Non-Proprietor Insurance coverage Choices

| Characteristic | Transient Protection | Common Protection |

|---|---|---|

| Frequency of Use | Rare | Common |

| Length of Use | Brief-term | Lengthy-term |

| Protection Limits | Decrease | Probably upper |

| Price | Usually decrease | Probably upper |

Non-owner insurance coverage is a vital part of defending your self and others when riding a automobile you do not personal. It provides a layer of economic safety within the match of an coincidence, minimizing doable monetary burdens.

Protection and Advantages: California Non Proprietor Automotive Insurance coverage

So, you are fascinated by California non-owner automobile insurance coverage? Sensible choice! It is like a security internet, particularly if you are borrowing a automobile or the usage of any individual else’s automobile. Consider a pal’s candy journey getting totaled when you are at the back of the wheel – you’ll be able to be glad about that protection.This coverage necessarily protects you from monetary damage if you are in a fender-bender or worse whilst riding a automobile you do not personal.

Bring to mind it as a peace of thoughts parachute for unintended mishaps at the highway. Now, let’s dive into the juicy main points.

Sorts of Protection

California non-owner insurance policies in most cases be offering legal responsibility protection. That is the bread and butter, overlaying damages you reason to people’s belongings or accidents to them in an coincidence. Bring to mind it because the “I am sorry, I brought about the coincidence” protection. It is the usual solution to make issues proper with the ones you could have ran into.

Eventualities The place Protection is Useful

This protection kicks in if you are riding a automobile you do not personal and are interested by an coincidence. Say you are visiting a pal and their automobile has a flat tire, and also you borrow their automobile to get to the store. A surprising bathe makes the street slippery and also you crash right into a parked automobile. Legal responsibility protection would duvet the damages to the opposite automobile.

Any other instance? You might be operating errands on your pal’s automobile, and any individual runs a crimson mild and crashes into you. Legal responsibility protection would assist duvet the wounds and belongings injury in your pal’s automobile. It is a lifesaver whilst you least be expecting it.

Monetary Implications

The monetary implications rely at the coverage limits you select. Decrease limits will imply decrease premiums, however you’ll be able to be coated for much less if a major coincidence happens. Upper limits, then again, imply costlier premiums, however they supply better coverage in case of a big mishap. It is a balancing act between your pockets and your peace of thoughts.

Bear in mind, it is all the time higher to err at the facet of warning and make a choice upper limits in case your finances lets in.

Price Comparability

Non-owner insurance coverage premiums usually value not up to complete protection for a automobile you personal. It is like renting a automobile – you pay for the security, no longer all of the automobile. This makes it a extra reasonably priced possibility if you are borrowing a automobile every so often.

Protection Limits Comparability

| Coverage Kind | Physically Damage Legal responsibility (in keeping with individual) | Physically Damage Legal responsibility (in keeping with coincidence) | Assets Injury Legal responsibility |

|---|---|---|---|

| Fundamental | $15,000 | $30,000 | $5,000 |

| Medium | $25,000 | $50,000 | $10,000 |

| Top | $50,000 | $100,000 | $25,000 |

This desk offers a common thought of the conceivable protection limits for various non-owner insurance policies. You’ll be able to modify those limits consistent with your wishes and finances. Bear in mind, those are simply examples, and precise limits would possibly range.

Necessities and Rules

So, you are making plans to borrow your pal’s candy journey for a weekend jaunt? California’s no longer precisely recognized for its laissez-faire angle against riding with out insurance coverage, so let’s dive into the nitty-gritty of non-owner automobile insurance coverage. It isn’t rocket science, however you have to get it proper. It is like understanding the principles of a recreation earlier than you step onto the sector.California’s were given a couple of regulations about who is chargeable for overlaying your at the back of when you are at the back of the wheel of a borrowed automobile.

Those regulations are there for a reason why, to not be imply, however to offer protection to everybody at the highway. Bring to mind it as the security internet that forestalls a fender bender from changing into a monetary disaster.

Felony Necessities for Non-Proprietor Automotive Insurance coverage

California regulation mandates that anybody running a automobile should have evidence of economic duty. This is not only a recommendation; it is the regulation. In case you are riding a automobile you do not personal, you want to remember to have insurance policy. In a different way, you are risking a hefty positive. It is your duty to make certain that the auto you’re riding is insured.

Consequences for Loss of Required Protection

California does not mess around on the subject of riding with out insurance coverage. Failure to have the correct protection may end up in hefty fines and consequences, most likely even suspension of your riding privileges. Bring to mind it as a major parking price tag – simplest a lot, a lot worse. Consider the headache of getting your license quickly revoked since you did not get the proper insurance coverage.

Procedures for Acquiring a Non-Proprietor Coverage

Getting a non-owner coverage is in most cases a simple procedure. You’ll be able to wish to supply some details about the automobile you are riding, the dates you’ll be able to be the usage of it, and your own main points. Maximum insurance coverage suppliers be offering this sort of protection, so it is in most cases no longer a large deal to get it. It is like getting a short lived cross to power a pal’s automobile.

Position of the Division of Insurance coverage

The California Division of Insurance coverage performs a the most important position in regulating non-owner automobile insurance coverage. They make certain that insurance coverage corporations are following the principles and providing truthful protection. They are the watchdogs, ensuring the whole lot’s above board. Consider them because the referee, making sure the sport is performed via the principles.

Insurance coverage Necessities Desk

| State of affairs | Insurance coverage Requirement |

|---|---|

| Borrowing a pal’s automobile for a weekend go back and forth | Non-owner protection is wanted. |

| The usage of a condominium automobile | The condominium corporate in most cases handles the insurance coverage. |

| Using a circle of relatives member’s automobile with out their permission | The circle of relatives member’s insurance coverage may no longer duvet you. It is best to get your individual insurance coverage or ask the circle of relatives member. |

| The usage of a automobile for a industry go back and forth | Non-owner protection is in most cases required, however it is all the time perfect to test with the industry or the landlord of the auto. |

Comparability with Different Insurance coverage Choices

So, you are looking at non-owner automobile insurance coverage? Nice! However is it the

- proper* selection for

- you*? Let’s evaluate it to different choices, like brief protection or the usage of your number one coverage, to look which is essentially the most appropriate. We will discover the scenarios the place each and every shines, highlighting the professionals and cons of each and every manner. This manner, you’ll be able to make the neatest resolution on your pockets and your wheels.

Selecting the proper automobile insurance coverage is like selecting the easiest outfit for a celebration – you need one thing that matches your wishes and elegance. Non-owner insurance coverage could be an excellent selection for a non permanent condominium or borrowing a automobile, but it surely is probably not the most productive resolution for long-term use. Let’s have a look at the way it stacks up towards different choices.

Evaluating Non-Proprietor Insurance coverage with Different Choices

Non-owner insurance coverage is designed for individuals who do not personal the auto however want protection. It is like renting a automobile, however as an alternative of paying for the automobile, you pay for cover. Transient insurance coverage covers a selected period of time, like a condominium or borrowing duration, while a number one policyholder’s protection usally comes with a bunch of alternative advantages and tasks.

Eventualities The place Non-Proprietor Insurance coverage Would possibly Be Most well-liked

Non-owner insurance coverage usally shines when you are borrowing a automobile for a little while, akin to for a weekend getaway, a highway go back and forth, or the usage of a pal’s automobile. Consider you are renting a antique sports activities automobile – you’ll need insurance coverage adapted to that distinctive circumstance, and non-owner protection can give simply that. It is also a excellent possibility if you are the usage of a automobile for a restricted time or want protection with out the headaches of a person coverage.

Take into consideration riding a pal’s automobile for a couple of weeks whilst their automobile is being repaired; non-owner insurance coverage would are compatible the invoice.

Comparability Desk

| Insurance coverage Kind | Execs | Cons | When it is a excellent are compatible |

|---|---|---|---|

| Non-Proprietor Insurance coverage | Explicit protection for brief use, probably less expensive than a complete coverage. | Restricted protection, may have upper deductibles. | Borrowing a automobile for a brief duration, the usage of a condominium, or in case your number one coverage does not duvet brief use. |

| Transient Insurance coverage | Easy and fast protection for a selected duration, usally for condominium automobiles. | Won’t be offering the similar complete protection as a complete coverage, and every now and then has prime premiums. | Renting a automobile for a weekend go back and forth or a brief industry go back and forth. |

| Number one Policyholder’s Protection | Most often extra complete protection, usally a part of a package deal of advantages. | Is probably not appropriate for non permanent use, may contain complicated processes for approval. | Proudly owning the auto and desiring protection for day-to-day use. |

Components Influencing the Choice

The collection of insurance coverage is dependent upon a number of elements. Imagine the length of use, the kind of automobile, the protection wanted, and your finances. As an example, if you want protection for a vintage automobile, you’ll be able to most likely need complete protection. The price of the automobile, the quantity of protection you want, and your own riding historical past additionally play a job.

Opting for the Best possible Possibility

Settling on the most productive insurance coverage possibility comes to weighing the professionals and cons of each and every. Non-owner insurance coverage is a brilliant possibility for non permanent wishes, whilst brief insurance coverage could be higher for particular condominium classes. Your number one coverage may duvet extra scenarios, but it surely could be overkill for a fast go back and forth. In the end, the most suitable option is the person who aligns along with your distinctive cases.

Claims Procedure and Procedures

Navigating the declare procedure can really feel like looking for a out of place parking price tag in a crowded mall parking space. However concern no longer, fellow drivers! We are right here to wreck down the stairs interested by submitting a California non-owner automobile insurance coverage declare in some way that may not make your head spin. It isn’t rocket science, only a collection of steps you want to take to get again at the highway.The declare procedure, whilst probably irritating, is designed to be as clean as conceivable.

Figuring out the necessities and procedures previously will considerably cut back the effort and make sure a sooner solution. So, let’s dive in and overcome the ones declare bureaucracy with a grin!

Steps Excited about Submitting a Declare

Submitting a declare comes to a simple procedure. Acquire the entire important paperwork and practice the stairs meticulously. The quicker you do that, the earlier you’ll be able to be again at the highway!

- Record the coincidence: In an instant notify your insurance coverage corporate in regards to the coincidence. They’re going to want the main points, and bear in mind, honesty is the most productive coverage. Mendacity may just complicate issues additional down the road. A easy telephone name or on-line document will do the trick.

- Acquire documentation: That is the most important. Acquire all proof, together with police experiences (if any), witness statements, footage of the wear, and clinical information if acceptable. Bring to mind it as growing a visible timeline of the coincidence. Do not fail to remember the receipts for any upkeep you could have already had executed.

- Whole the declare shape: Your insurance coverage corporate will supply a declare shape. Fill it out appropriately and entirely. Double-check the entire knowledge, and if one thing’s unclear, ask for explanation.

- Publish supporting paperwork: That is the place you publish the accumulated proof. Be sure to prepare the paperwork well for environment friendly processing.

- Watch for the analysis: Your insurance coverage corporate will overview the declare and the supporting paperwork. This may take a little time. Keep up a correspondence with them often.

- Negotiate a agreement (if wanted): If the declare is sophisticated, your insurance coverage corporate may wish to negotiate with the opposite celebration concerned. They’re going to do their perfect to protected the fairest agreement conceivable.

- Obtain cost: As soon as the declare is settled, the cost shall be processed. Your insurance coverage corporate will notify you in regards to the cost and any comparable procedures.

Documentation Required for Claims

The documentation wanted for a declare varies according to the specifics of the coincidence. On the other hand, here is a common evaluation of what is repeatedly required.

- Police document: If the coincidence concerned an coincidence document, get a replica of it. It main points the cases of the incident.

- Witness statements: If there have been witnesses, get their statements in writing. They supply treasured context and fortify your model of occasions.

- Pictures: Record the wear in your automobile, the opposite automobile, and another related parts on the scene. Footage are worthwhile proof.

- Clinical information: In case you or any person concerned within the coincidence sustained accidents, accumulate your clinical information.

- Evidence of car possession: Supply documentation appearing you are the licensed motive force of the auto.

- Insurance coverage knowledge: Supply all main points of your insurance plans and any comparable paperwork.

Conventional Time-frame for Processing Claims

The time it takes to procedure a declare is dependent upon the complexity of the case and the insurance coverage corporate’s procedures. It may well vary from a couple of weeks to a number of months. Bring to mind it because the insurance coverage corporate’s model of a big, thorough puzzle.

Roles of Other Events Concerned

Other events play a job within the claims procedure. All of them paintings in combination to get issues resolved as easily as conceivable.

- Policyholder: You, the policyholder, are chargeable for reporting the declare and offering the entire important documentation.

- Insurance coverage adjuster: They examine the declare, evaluation the wear, and negotiate settlements.

- Different events concerned: If there are different events concerned, akin to the opposite motive force or witnesses, their roles are the most important to the claims procedure.

Claims Procedure Timeline

This desk Artikels the stairs concerned within the claims procedure, from reporting to agreement.

| Step | Description |

|---|---|

| Reporting | Notify the insurance coverage corporate of the coincidence. |

| Documentation Accumulating | Acquire all important paperwork, together with police experiences, witness statements, and footage. |

| Declare Shape Submission | Publish the finished declare shape and supporting paperwork. |

| Analysis | Insurance coverage corporate evaluates the declare. |

| Agreement Negotiation (if wanted) | Negotiation with the opposite celebration concerned, if important. |

| Fee Processing | Fee is processed and dispensed to the policyholder. |

Attainable Problems and Concerns

So, you are fascinated by non-owner automobile insurance coverage? Nice! However earlier than you signal at the dotted line (or, you realize, click on the “purchase now” button), let’s speak about doable potholes within the highway. It’s a must to perceive the prospective pitfalls to steer clear of getting caught with a coverage that is extra hassle than it is value. Bring to mind it as your pre-insurance fact examine!

Studying the Wonderful Print (Critically!)

Figuring out the phrases and prerequisites of your coverage is the most important. Do not simply skim it; dive deep. This is not a singular; it is a legally binding contract! In case you are undecided about the rest, ask questions. You would not signal a loan with no attorney, would you? Insurance coverage insurance policies deserve the similar degree of scrutiny.

The positive print is not just there to make your eyes glaze over; it is there to offer protection to

each* you and the insurance coverage corporate.

Protection Limits and Exclusions: Know Your Obstacles

Understanding your coverage’s protection limits and exclusions is very important. Consider a fender bender that finally ends up costing greater than your coverage covers – ouch! It is like purchasing a lottery price tag and simplest profitable a greenback. It is higher to grasp your obstacles and feature life like expectancies. Protection limits outline the utmost quantity the insurance coverage corporate pays in case of a declare.

Exclusions element scenarios the place the coverage does not follow, like if you are riding recklessly or if the auto is used for business functions. It is like a buffet with some dishes you’ll be able to’t order.

When Felony Suggest Would possibly Be Wanted

Now and again, even with cautious studying, problems can stand up. If in case you have a declare that the insurance coverage corporate is disputing, or if you are undecided in regards to the phrases of your coverage, looking for felony recommend is a smart transfer. It is like having a professional to your facet to make certain that you get an even shake. Felony illustration is very important if the insurance coverage corporate is being unreasonable or in the event you suspect fraud.

Bear in mind, you are no longer simply coping with a industry; you are coping with a felony contract.

Commonplace Problems and Attainable Answers

| Factor | Attainable Answer |

|---|---|

| Coverage exclusions no longer obviously understood. | Touch the insurance coverage supplier or a felony skilled for explanation. |

| Declare denied with out correct rationalization. | Request an in depth rationalization of the denial. Imagine consulting an lawyer if the reason is unsatisfactory. |

| Protection limits are inadequate for damages. | Evaluate your coverage and imagine rising your protection limits if wanted. This may require a brand new coverage. |

| Issues of the claims procedure. | Stay detailed information of all communique and practice up diligently. If important, touch a felony skilled. |

Fresh Tendencies and Tendencies

California’s non-owner automobile insurance coverage marketplace is a wild west, continuously evolving like a young person’s social lifestyles. From the upward thrust of ride-sharing apps to the ever-increasing value of the whole lot, maintaining with the newest developments is like seeking to catch a greased piglet. This phase will dive into the hot shifts, from tech-driven adjustments to coverage changes and the have an effect on to your pockets.

Technological Developments

The virtual age has infiltrated each nook of the insurance coverage business, and non-owner automobile insurance coverage is not any exception. On-line quoting gear and cellular apps are making it more straightforward than ever to match charges and get protection, probably saving you some critical dough. Consider immediately evaluating insurance policies from other suppliers to your telephone whilst ready in line at Starbucks – that is the long term.

Moreover, telematics-based insurance coverage is on the upward thrust. Through monitoring your riding behavior with a tool on your automobile, you could be rewarded with decrease premiums if you are a protected motive force. However be warned, the information accumulated can be utilized for the whole lot from personalised riding recommendation to probably affecting your insurance coverage charges in case your riding conduct deviates from the norm.

New Rules and Coverage Adjustments

California regulators are continuously tweaking the principles to make sure equity and offer protection to shoppers. New rules may have an effect on the kinds of protection to be had, the specified minimal quantities, and even how claims are processed. Those adjustments can considerably have an effect on the costs and phrases of your insurance coverage. As an example, some new rules may incentivize drivers to make use of extra eco-friendly automobiles.

Affect of Emerging Premiums

Unfortunately, emerging premiums are a common fact within the insurance coverage international, and non-owner insurance policies aren’t immune. Inflation, higher claims frequency, or even converting demographics are all elements that push up prices. The have an effect on is usally felt via the ones with restricted monetary assets. A slight build up on your top class may just probably put a dent on your finances.

The excellent news is that there are tactics to offset the have an effect on, akin to buying groceries round for higher charges and probably rising your deductibles.

Timeline of Non-Proprietor Insurance coverage Choices

The evolution of non-owner automobile insurance coverage is an engaging adventure. The next desk displays a glimpse into its transformation over the years, highlighting key adjustments and trends.

| Yr | Building |

|---|---|

| Nineteen Eighties | Fundamental non-owner insurance policies emerge, essentially thinking about legal responsibility protection. |

| Nineties | Growth of protection choices with the advent of extra coverage like uninsured/underinsured motorist protection. |

| 2000s | Greater use of on-line gear and comparability web sites. |

| 2010s | Upward thrust of telematics and data-driven insurance coverage fashions. |

| 2020s | Endured construction of virtual platforms and the combination of AI in underwriting. |

Pointers for Opting for a Supplier

Selecting the correct non-owner automobile insurance coverage supplier can really feel like navigating a maze of complicated insurance policies and hidden charges. However concern no longer, intrepid motive force! This information will equip you with the gear to make an educated resolution, so you’ll be able to steer clear of the scary “oops, I am uninsured” second. We will destroy down the important thing elements, evaluate suppliers like professionals, and provide you with some dependable names to imagine.

Components to Imagine When Deciding on a Supplier

Opting for a non-owner automobile insurance coverage supplier comes to extra than simply the fee tag. You wish to have to appear past the glossy brochures and delve into the nitty-gritty. Imagine those key elements to make the most productive conceivable selection:

- Price: Whilst value is the most important, do not sacrifice protection for a couple of dollars. A less expensive coverage may have obstacles on what is coated in case of an coincidence. Examine apples to apples – equivalent protection ranges, an identical deductibles, and an identical coverage phrases.

- Protection Choices: Your wishes will dictate the protection you require. In case you steadily power borrowed automobiles, complete protection could be a should. Do not accept the naked minimal; offer protection to your self and your pockets.

- Buyer Carrier: Consider being caught with a declare and dealing with a wall of paperwork. Search for suppliers with a name for speedy, responsive, and useful customer support. A excellent corporate will make resolving any problems a breeze.

- Coverage Flexibility: Existence occurs! Search for suppliers that provide coverage adjustments and changes in case your riding behavior trade. Flexibility is your pal on the subject of navigating the sudden.

Evaluating Other Supplier Insurance policies

Evaluating other insurance coverage insurance policies is a little like evaluating apples and oranges – other suppliers have other pricing buildings, protection choices, and customer support. You wish to have to match like with like to make sure an even analysis.

- Protection Comparability: In moderation scrutinize each and every supplier’s protection main points. Do they duvet the entire important bases on your riding scenarios? Make sure to perceive the specifics of each and every coverage’s exclusions and obstacles.

- Price Breakdown: Do not simply focal point at the per 30 days top class. Dig deeper to know any hidden charges, further fees, and coverage changes. A apparently low top class may just cover further prices down the street.

- Coverage Phrases and Prerequisites: Learn the positive print! Figuring out the phrases and prerequisites of each and every coverage will let you make an educated resolution. That is the place you find the main points about claims procedures, protection limits, and any further exclusions or restrictions.

Significance of Checking Buyer Critiques and Rankings

Do not simply depend on shiny advertising and marketing fabrics. Actual-world reviews are gold when opting for an insurance coverage supplier. Test on-line critiques and scores to get an impartial viewpoint on buyer pride.

- On-line Critiques: See what different drivers have to mention about their reviews with the insurance coverage supplier. Search for commonplace issues – are there habitual problems with claims processing or customer support? Actual buyer comments is your perfect pal.

- Ranking Businesses: Impartial ranking businesses can be offering treasured insights right into a supplier’s monetary balance and claim-paying historical past. A financially sturdy corporate is much more likely to care for claims rather and promptly.

Examples of Dependable Suppliers

A lot of insurance coverage suppliers be offering non-owner automobile insurance coverage. Some well-regarded names within the business come with [insert 3-4 reliable providers]. Researching those suppliers will provide you with a forged place to begin on your comparability.

Supplier Comparability Desk

| Supplier | Price (Instance: $50/month) | Protection (Instance: Complete, Legal responsibility) | Buyer Critiques (Instance: 4.5 out of five stars) |

|---|---|---|---|

| Supplier A | $45 | Legal responsibility, Collision, Complete | 4.7 |

| Supplier B | $55 | Legal responsibility, Collision, Complete, Uninsured/Underinsured | 4.3 |

| Supplier C | $60 | Legal responsibility, Collision, Complete | 4.2 |

Finishing Remarks

In conclusion, California non-owner automobile insurance coverage is an important attention for any person running a automobile they don’t personal. This information has explored the nuances of this sort of insurance coverage, overlaying the whole lot from protection and necessities to claims procedures and doable problems. Through working out the specifics of California non-owner insurance coverage, you’ll be able to make knowledgeable selections, making sure you are adequately secure whilst riding.

Selecting the proper coverage and supplier is the most important, and cautious attention of things like protection limits and supplier recognition will in the long run give a contribution to a clean and relaxing riding revel in.

FAQ Abstract

What are the average causes any individual may want California non-owner automobile insurance coverage?

People who borrow, hire, or power a automobile owned via any individual else usally want non-owner insurance coverage. This contains scenarios like the usage of a pal’s automobile, riding a condominium automobile, or riding a automobile belonging to a circle of relatives member. This protection protects the driving force and probably the automobile proprietor in case of an coincidence.

How do I make a choice the proper protection limits for my non-owner coverage?

Protection limits rely on person wishes and the kind of automobile being pushed. Components akin to the price of the automobile, the driving force’s riding historical past, and the danger concerned within the state of affairs will have to all be taken under consideration when opting for protection limits. Visit an insurance coverage skilled for personalised suggestions.

What are the consequences for riding with out California non-owner automobile insurance coverage?

Using with out the specified insurance coverage may end up in fines, suspension of riding privileges, or even felony motion. California has strict rules relating to automobile insurance coverage, and failure to conform may end up in critical penalties.

Are there any particular scenarios the place non-owner insurance coverage is legally required in California?

California regulation mandates that anybody running a automobile should have good enough insurance policy. Non-owner insurance coverage is usally required when a motive force isn’t the registered proprietor of the automobile they’re running. Seek the advice of California’s Division of Insurance coverage for essentially the most up-to-date necessities.