Does medical insurance quilt automotive twist of fate accidents? This can be a the most important query for any individual enthusiastic about a automotive twist of fate. Working out the specifics of your coverage is essential, as protection can range considerably. We will delve into the main points, analyzing what is most often coated, what is excluded, and the function of different insurance coverage sorts.

This exploration will explain how medical insurance operates within the tournament of a automotive twist of fate. We will take a look at examples of coated clinical remedies, speak about attainable obstacles, and supply a transparent comparability of various medical insurance plans.

Insurance coverage Protection Review

Yo, peeps! Medical insurance, it is like a security internet on your well being woes. It is a contract between you and the insurance coverage corporate, the place they comply with pay for positive clinical bills in trade on your premiums. Working out the way it works is essential, particularly when coping with stuff like automotive injuries.Medical insurance works through overlaying a portion of your clinical expenses.

It isn’t a free-for-all, despite the fact that. There are regulations and laws, and other plans have other ranges of protection. Principally, the insurance coverage corporate steps in to lend a hand with the prices of remedy, fighting you from having to foot all of the invoice.

Common Rules of Well being Insurance coverage Protection

Medical insurance protection is most often in response to the primary of chance sharing. Insurance coverage corporations pool premiums from many people to hide the prospective clinical bills of a couple of who would possibly want important care. The extra folks concerned, the extra tough the pool, and the easier the protection for everybody. This manner, it is a collective effort to take care of unexpected well being crises.

How Well being Insurance coverage Covers Clinical Bills

Most often, medical insurance covers a variety of clinical bills, from physician visits to sanatorium remains. The level of protection varies relying at the plan. The method in most cases comes to you getting remedy, filing receipts, and the insurance coverage corporate verifying and paying their portion. Bring to mind it as a gadget of reimbursements in response to the specifics of your plan.

Examples of Lined Clinical Remedies

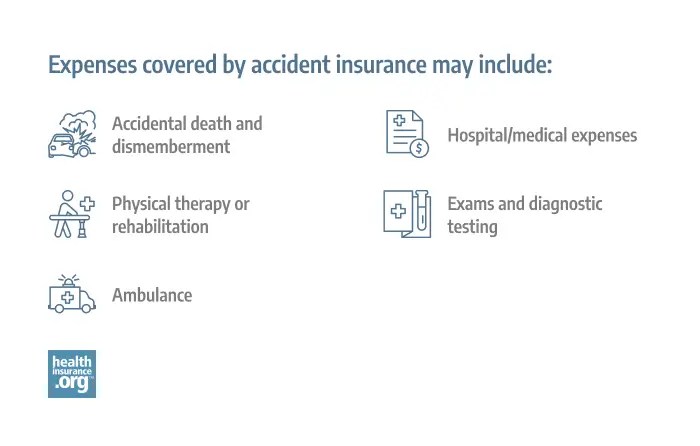

A big selection of remedies are most often coated, equivalent to physician visits, lab checks, surgical procedures, sanatorium remains, bodily treatment, or even psychological well being products and services. Explicit remedies could have obstacles in response to the plan, despite the fact that. Such things as prescribed drugs, dental care, and imaginative and prescient care frequently have separate protection or obstacles.

Exclusions from Well being Insurance coverage Protection

It is the most important to know what is no longer coated. Exclusions can range extensively between plans, however they frequently come with pre-existing prerequisites (relying at the explicit plan), beauty procedures, experimental remedies, and a few choice remedies. At all times verify your coverage paperwork for a transparent image of what is excluded.

Comparability of Well being Insurance coverage Plans, Does medical insurance quilt automotive twist of fate

| Plan Sort | Twist of fate-Similar Clinical Expense Protection | Premiums | Deductibles |

|---|---|---|---|

| Fundamental Plan | Covers very important clinical products and services, however with attainable prime out-of-pocket bills. | Decrease | Upper |

| Bronze Plan | Average protection, frequently with the next deductible and co-pays. | Average | Average |

| Silver Plan | Just right steadiness of protection and value. | Upper | Average |

| Gold Plan | Complete protection with decrease out-of-pocket bills. | Very best | Lowest |

| Platinum Plan | Very best protection, very low out-of-pocket bills. | Very best | Lowest |

Other plans have other approaches to protection, affecting the quantity you pay and the quantity the insurance coverage corporate covers. The desk above supplies a fundamental evaluation, however all the time seek the advice of your explicit coverage main points.

Automobile Twist of fate-Explicit Protection

Yo, peeps! Navigating automotive twist of fate insurance coverage could be a actual headache. This phase breaks down the several types of protection, serving to you recognize what is coated and what is no longer when issues cross sideways at the street. Let’s get into it!

Clinical Protection vs. Private Harm Coverage (PIP)

Clinical protection and PIP are each the most important for automotive twist of fate sufferers, however they have got key variations. Clinical protection most often can pay on your personal clinical expenses at once as a result of the twist of fate, while PIP covers your clinical bills irrespective of who used to be at fault. Necessarily, PIP is sort of a protection internet, overlaying your individual accidents with out the want to turn out fault.

Bring to mind it like this: Clinical protection is for the

- prices* of your accidents, and PIP is for the

- coverage* of your well-being.

Evaluating Insurance coverage Coverage Dealing with of Twist of fate Accidents

Other insurance coverage insurance policies take care of twist of fate accidents another way. Some insurance policies would possibly prioritize clinical protection over PIP, whilst others would possibly have extra complete PIP plans. It is like evaluating other eating places – some have a greater diversity of choices on their menu, whilst others would possibly have explicit dishes you could desire. Working out the specifics of your coverage is essential to figuring out what you might be entitled to.

Lined Injuries underneath Well being Insurance coverage

Standard medical insurance insurance policies in most cases quilt clinical bills as a result of a automotive twist of fate, however there are essential caveats. Typically, they quilt accidents which might be at once associated with the twist of fate, equivalent to damaged bones, comfortable tissue harm, or head accidents. The the most important phase is that the harm will have to be a right away end result of the twist of fate. Bring to mind it like a sequence response: the twist of fate is the preliminary tournament, and the wounds are the following results.

The Position of Legal responsibility Insurance coverage

Legal responsibility insurance coverage comes into play when any person else is at fault for the twist of fate. It covers the clinical bills of the injured birthday celebration in such eventualities, performing as a safeguard for the opposite motive force’s legal responsibility. Consider a situation the place you might be hit through a motive force who wasn’t paying consideration; legal responsibility insurance coverage is there to make sure the injured birthday celebration will get compensated.

Pre-Current Stipulations and Twist of fate Protection

Pre-existing prerequisites can have an effect on protection for accident-related accidents. Now and again, the insurance coverage would possibly no longer quilt pre-existing prerequisites which might be annoyed through the twist of fate. It is like a pre-existing downside getting worse because of a particular tournament. It is the most important to know your coverage’s specifics in this topic.

Obstacles of Well being Insurance coverage in Automobile Injuries

Medical insurance protection for automotive injuries is not all the time countless. There are frequently deductibles, co-pays, and out-of-pocket maximums that may have an effect on the quantity your insurance coverage will quilt. Additionally, some accidents would possibly fall outdoor the scope of what your coverage considers coated. This is sort of a finances; you may have a undeniable amount of cash to be had, however there are limits to how a lot you’ll spend.

Standard Situations and Well being Insurance coverage Protection

| Situation | Most likely Well being Insurance coverage Protection? |

|---|---|

| Damaged arm in a automotive twist of fate | Most likely sure, if the ruin is at once associated with the twist of fate. |

| Pre-existing again ache annoyed through a automotive twist of fate | Most likely sure, however protection may well be restricted relying at the coverage and severity of aggravation. |

| Whiplash as a result of a rear-end collision | Most likely sure, if the whiplash is at once related to the collision. |

| Psychological well being problems bobbing up from a anxious twist of fate | Doubtlessly sure, relying at the coverage and severity. |

| Accidents from an twist of fate the place the motive force used to be intoxicated | Most likely sure, however coverage phrases and stipulations will practice. |

Protection Issues and Obstacles

Whats up Pontianak peeps! Navigating medical insurance after a automotive crash could be a actual headache. Working out the nitty-gritty main points is essential to figuring out what you might be actually coated for. This phase dives deep into the criteria that affect your protection, the function of the ones pesky deductibles and co-pays, and the entire claims procedure. We will additionally ruin down how other accidents are handled, the function of different insurance coverage, and the wild diversifications between states and insurance coverage corporations.

Get able to point up your wisdom!This phase highlights the the most important elements influencing medical insurance protection for automotive twist of fate accidents. Those elements don’t seem to be all the time evident, so let’s unpack them!

Components Influencing Protection Extent

Components like your pre-existing prerequisites, the severity of your accidents, and the precise remedy plan can considerably have an effect on the quantity of protection you obtain. Your insurance coverage corporate will most probably overview your clinical information to evaluate the need and appropriateness of the remedy you won. Insurance coverage suppliers frequently have explicit pointers relating to remedies deemed medically essential or experimental, which might have an effect on the protection quantity.

As an example, a easy sprain would possibly have a decrease protection restrict than a serious spinal twine harm.

Deductibles and Co-pays in Automobile Twist of fate Claims

Deductibles and co-pays are like the ones pesky hidden charges for your insurance coverage plan. They are the prematurely prices it’s a must to pay earlier than your insurance coverage kicks in. In a automotive twist of fate, those can upload up rapid. A deductible is a hard and fast quantity you pay out-of-pocket earlier than insurance coverage begins overlaying prices. A co-pay is a collection quantity you pay each and every time you notice a health care provider or get a process.

You need to know those quantities earlier than the twist of fate, as they will have an effect on your out-of-pocket bills. As an example, a $500 deductible would possibly appear small, however it might briefly climb if you want in depth bodily treatment periods or a couple of physician visits.

Claims Procedure for Well being Insurance coverage

The claims procedure for medical insurance associated with automotive injuries most often comes to reporting the twist of fate for your insurance coverage supplier, collecting essential clinical documentation (like physician’s notes and expenses), and filling out declare bureaucracy. Be ready for attainable delays and bureaucracy. Your insurance coverage corporate will most probably wish to check the reason for the twist of fate and the level of your accidents, which would possibly contain contacting the opposite birthday celebration’s insurance coverage corporate.

Protection for Other Varieties of Accidents

Several types of accidents from a automotive twist of fate have other protection implications. Damaged bones, as an example, most often have easier protection than comfortable tissue harm or head accidents. Cushy tissue accidents, like sprains and traces, could have extra variable protection, because the analysis and remedy can also be advanced. Head accidents, because of their attainable long-term implications, might require in depth and specialised care, doubtlessly leading to upper claims quantities.

The precise remedy and rehabilitation prices will considerably affect the full quantity coated.

Position of Different Insurance coverage Insurance policies

Different insurance coverage insurance policies, equivalent to auto insurance coverage, may additionally play a job in overlaying bills associated with a automotive twist of fate. That is frequently decided through the specifics of the coverage and the cases of the twist of fate. If the opposite motive force used to be at fault, their insurance coverage would possibly quilt a few of your clinical bills. Working out the intricacies of car insurance coverage insurance policies and their applicability relating to a automotive twist of fate is the most important.

Diversifications in Protection Between States and Suppliers

Medical insurance protection for automotive twist of fate accidents can vary considerably between states and insurance coverage suppliers. Some states could have stricter laws relating to protection, whilst others might be offering extra complete plans. Insurance coverage suppliers could have various insurance policies relating to pre-existing prerequisites, remedy sorts, or the time period for protection. Researching your explicit coverage main points and figuring out state-level laws is the most important.

Attainable Out-of-Pocket Prices

| Situation | Attainable Out-of-Pocket Prices |

|---|---|

| Minor comfortable tissue harm (sprain): | $200-$500 (deductible and co-pays) |

| Damaged arm requiring surgical treatment: | $1,000-$3,000 (deductible, co-pays, and attainable sanatorium fees) |

| Average head harm with ongoing treatment: | $5,000-$15,000+ (deductibles, co-pays, treatment periods, and attainable long-term care) |

This desk illustrates attainable eventualities and corresponding prices. Keep in mind, those are estimates and exact prices might range considerably in response to person cases. At all times seek the advice of your insurance plans and clinical suppliers for explicit main points.

Further Knowledge and Sources

Whats up Pontianak peeps! Navigating medical insurance after a automotive crash can really feel like a jungle. However concern no longer, we are breaking down the assets and eventualities that can assist you perceive your rights and choices. Understanding your rights is essential, particularly when coping with insurance coverage corporations.Working out your medical insurance protection after a automotive twist of fate is the most important. This comes to no longer simply the fundamentals, but additionally figuring out the prospective pitfalls and the way to give protection to your self.

From understanding what is coated to dealing with claims, this phase will give you the lowdown to be sure you’re no longer left striking.

Discovering Extra About Protection

A lot of assets are to be had to delve deeper into your medical insurance protection. Your insurance coverage supplier’s web page is an implausible start line, full of coverage main points and FAQs. On-line boards devoted to medical insurance too can supply insights from other folks in an identical eventualities. Checking along with your native shopper coverage company or a criminal support society may well be advisable, too.

Those assets be offering a broader point of view for your choices and criminal rights.

Explicit Situations

Working out when medical insurance

- would possibly* or

- would possibly no longer* quilt accident-related bills is important. As an example, in case your harm calls for surgical treatment, it is most probably your insurance coverage will quilt the process. Alternatively, if the harm is deemed to be self-inflicted (and no longer confirmed differently) protection might be denied. Likewise, beauty procedures for accident-related accidents are frequently no longer coated. At all times double-check your coverage for explicit exclusions.

A shuttle to the emergency room for a whiplash harm most probably can be coated, whilst a beauty remedy for a minor scar will most probably no longer be. This underscores the significance of figuring out your coverage’s explicit phrases.

Reviewing Your Coverage

Totally reviewing your medical insurance coverage main points is paramount. That is your own information to figuring out what is coated and what is not. Search for specifics on automotive twist of fate protection, together with exclusions, limits, and pre-authorization necessities. Being attentive to those main points prevents unsightly surprises down the road. Failing to learn your coverage may imply you might be caught with sudden prices.

Working out your rights and obligations will permit you to really feel extra in keep an eye on of the location.

Commonplace Questions and Solutions

| Query | Resolution |

|---|---|

| Does medical insurance quilt all automotive accident-related clinical bills? | No, insurance coverage insurance policies frequently have exclusions and obstacles. Take a look at your coverage main points for explicit protection. |

| What if my declare is denied? | In case your declare is denied, in moderation overview the denial letter. It’ll give an explanation for the explanation. If you happen to disagree, you could want to attraction or search criminal recommend. |

| How do I stay information of clinical bills? | Care for detailed information of all clinical expenses, receipts, and remedy notes. This documentation is the most important for supporting your declare. |

| What function does an legal professional play in those circumstances? | An legal professional can constitute you in coping with insurance coverage corporations and navigating the criminal procedure in case your declare is denied or advanced. |

Prison Implications of Denied Claims

Denial of a declare could have criminal implications. Overview the denial letter in moderation to know the grounds for denial. If you happen to disagree, you could want to believe criminal choices.

In case your declare is denied, a radical overview of the denial letter is the most important. Working out the explanations for denial will lend a hand resolve the following steps. Attainable criminal motion may well be essential in some circumstances, relying at the cases. Prison implications rely closely at the explicit scenario and main points of your coverage.

Significance of Retaining Data

Keeping up detailed information of clinical bills and coverings is the most important. This contains receipts, physician’s notes, and some other supporting documentation. Correct information lend a hand substantiate your declare and expedite the method. Complete information exhibit the level of your accidents and coverings, strengthening your case. Do not underestimate the facility of right kind record-keeping.

Position of an Legal professional

In advanced automotive twist of fate circumstances involving medical insurance claims, an legal professional can give precious help. An legal professional can negotiate with insurance coverage corporations, constitute your pursuits, and make sure your rights are secure all the way through the method. Legal professionals are skilled in navigating insurance coverage declare procedures and assist you to perceive your choices and rights. They are able to information you in the course of the procedure, making sure your declare is treated relatively and successfully.

Ultimate Notes

In conclusion, figuring out in case your medical insurance covers automotive twist of fate bills depends upon more than a few elements, together with your explicit coverage, the character of the wounds, and pre-existing prerequisites. Reviewing your coverage totally is very important, and consulting with a healthcare skilled or insurance coverage consultant can give further steering. Working out the restrictions and looking for skilled recommendation can lend a hand navigate the complexities of those claims.

FAQ Useful resource: Does Well being Insurance coverage Quilt Automobile Twist of fate

Does medical insurance quilt ambulance charges after a automotive twist of fate?

Incessantly, ambulance charges are coated, however verify your coverage specifics. Emergency clinical products and services are regularly incorporated, however there may well be exceptions.

What if my accidents are from a fender bender?

Even minor injuries may end up in considerable clinical expenses. Your medical insurance protection relies on the severity of your accidents and your coverage’s specifics.

How do pre-existing prerequisites have an effect on my declare?

Pre-existing prerequisites would possibly affect your declare, impacting the level of protection for accident-related accidents.

What’s the function of legal responsibility insurance coverage on this?

Legal responsibility insurance coverage covers accidents to others within the twist of fate. Your medical insurance would possibly quilt your individual accidents irrespective of fault.