Existence insurance coverage peak weight chart is a the most important side of figuring out insurance coverage premiums. It supplies a ancient assessment of ways insurers have used bodily attributes to evaluate menace. Alternatively, those charts have boundaries and biases, and fashionable menace review strategies are evolving.

This newsletter delves into the main points of existence insurance coverage peak weight charts, exploring the information at the back of them, their affect on premiums, selection review strategies, and the prospective function of generation in shaping the way forward for menace analysis. Figuring out those nuances is secret to meaking knowledgeable choices about existence insurance coverage insurance policies.

Creation to Existence Insurance coverage Peak Weight Charts

Existence insurance coverage, a the most important side of monetary making plans, frequently comes to assessing menace to resolve premiums. Traditionally, insurers trusted quite a lot of elements to gauge menace, and peak and weight charts had been a outstanding software. Whilst their use has developed, working out their function prior to now and provide is vital to greedy the intricacies of existence insurance coverage.Peak and weight charts had been in the beginning used to expect mortality menace.

The common sense at the back of this used to be easy: sure bodily attributes would possibly correlate with well being prerequisites that might result in untimely demise. Those correlations had been frequently in response to statistical research of huge populations, making an attempt to spot traits between bodily traits and longevity.

Ancient Context and Function

Early existence insurance coverage corporations used peak and weight charts to categorize folks into menace teams. This facilitated the advent of top rate buildings, with the ones deemed greater menace paying greater premiums. The aim used to be simple: to evaluate menace and worth insurance policies accordingly. Those charts had been supposed to streamline the underwriting procedure, enabling faster and extra environment friendly analysis of candidates.

Obstacles and Doable Biases

Peak and weight charts, whilst as soon as helpful, don’t seem to be a super predictor of well being. Vital boundaries come with the truth that they do not account for person way of life elements, reminiscent of nutrition, workout, and smoking conduct. An individual with the next BMI could be extremely energetic and wholesome, whilst any person with a decrease BMI would possibly have underlying well being problems. This loss of individualization may end up in vital inaccuracies.Moreover, those charts frequently show off inherent biases.

As an example, they won’t as it should be replicate the well being standing of people from various backgrounds or ethnicities. The ancient information used to create those charts may well be influenced through societal elements that disproportionately impact sure populations.

Whilst existence insurance coverage peak weight charts appear simplistic, their inherent biases frequently overshadow their purported accuracy. They ceaselessly fail to account for person well being elements, making them a questionable metric for assessing menace. That is strikingly very similar to the inherent assumptions baked into many recipes, like a recipe for apple pie the use of canned apple pie filling recipe for apple pie using canned apple pie filling , which will significantly adjust the general end result relying at the high quality of the components.

In the end, each require a extra nuanced strategy to in reality perceive the complexities concerned.

Utilization in Underwriting

Insurance coverage underwriters use peak and weight data as one part of a broader analysis. Whilst no longer the only determinant, it is a issue that is nonetheless thought to be along different standards like clinical historical past, circle of relatives historical past, and way of life alternatives. This complete means objectives to offer a extra nuanced review of menace.

Kinds of Existence Insurance coverage and Top rate Have an effect on

Several types of existence insurance coverage insurance policies react in a different way to peak and weight issues. Time period existence insurance coverage, designed for a particular length, would possibly have somewhat other top rate buildings in response to menace elements. Everlasting existence insurance coverage, reminiscent of complete existence or common existence, additionally elements in peak and weight, even though probably much less at once, as they’re designed for long-term protection.

- Time period Existence Insurance coverage: Premiums for time period existence insurance coverage are frequently at once correlated to perceived menace, influenced through elements like age, peak, weight, and well being. Upper menace candidates will in most cases pay greater premiums.

- Everlasting Existence Insurance coverage: For everlasting existence insurance coverage, peak and weight might play a smaller function in comparison to time period existence insurance coverage. Underwriting is extra complete, making an allowance for a spread of things past bodily attributes. Alternatively, the preliminary top rate quantity would possibly nonetheless be impacted through perceived menace.

Trendy Tendencies and Concerns, Existence insurance coverage peak weight chart

Trendy insurance coverage corporations more and more depend on subtle actuarial fashions that transcend easy peak and weight charts. Those fashions combine a broader vary of well being elements, together with genetic predispositions and blood markers, to offer a extra correct and personalised menace review. The objective is to offer a extra correct analysis of an applicant’s long-term well being dangers, relatively than depending on simplified metrics.

Figuring out the Information At the back of the Charts

Existence insurance coverage peak and weight charts are extra than simply arbitrary numbers. They constitute years of painstaking analysis and knowledge research, aiming to expect mortality menace. Figuring out the criteria that pass into those charts is vital to appreciating their boundaries and doable biases, in addition to spotting their function in pricing insurance policies.Those charts are constructed on a basis of statistical fashions, correlating bodily attributes like peak and weight with the possibility of demise at quite a lot of ages.

This isn’t a super science, and it is vital to concentrate on the methodologies and the criteria that impact the accuracy of those estimations.

Information Assortment and Compilation Strategies

Existence insurance coverage corporations depend on huge datasets to create those charts. Those datasets are frequently compiled from more than one assets, together with present insurance coverage data, epidemiological research, and govt well being surveys. This complete means objectives to seize a consultant pattern of the inhabitants. The sheer quantity of knowledge is important in smoothing out person anomalies and figuring out patterns that don’t seem to be instantly obvious in smaller datasets.

Elements Regarded as in Figuring out Mortality Charges

Mortality charges are not merely decided through peak and weight. A large number of things affect the chance of demise. Age is essentially the most the most important issue. Underlying well being prerequisites, smoking conduct, circle of relatives historical past of illnesses, and way of life alternatives additionally play an important function. Those are frequently included into extra subtle fashions past easy peak and weight correlations.

Have an effect on of Clinical Developments and Converting Demographics

Clinical developments considerably affect mortality charges. Enhancements in remedies and preventive measures have altered the connection between bodily attributes and lifespan. Converting demographics, reminiscent of expanding existence expectancy and shifts in inhabitants distribution, additionally affect the information used to create those charts. This necessitates steady updates to the charts, to replicate the evolving nature of well being and society.

For instance, the higher incidence of sure illnesses or the emerging charges of weight problems would want to be mirrored within the up to date charts.

Correlating Peak, Weight, and Mortality Chance

The correlation between peak, weight, and mortality menace is complicated. Other fashions are hired, some more practical than others, to determine relationships between those elements. The most simple manner would possibly use a statistical style that establishes a courting between frame mass index (BMI) and mortality menace. Alternatively, extra complicated tactics might account for quite a lot of elements and supply extra nuanced predictions.

Doable Inaccuracies and Biases in Information Assortment and Research

Information assortment and research are by no means absolute best. There may be at all times a possible for inaccuracies and biases. One doable supply of error is the accuracy of the information submitted through folks. There will also be variety bias, as people who make a choice to buy existence insurance coverage could have other traits when compared to people who do not. Moreover, there could be biases embedded inside the fashions used to research the information, resulting in skewed effects.

It can be crucial to concentrate on those boundaries and to interpret the consequences cautiously.

Have an effect on of Peak and Weight on Premiums

Existence insurance coverage premiums are not a one-size-fits-all determine. Elements like your peak and weight play an important function in figuring out the price. Insurance coverage corporations assess those elements to calculate the chance related to insuring your existence. Figuring out how those elements affect premiums permit you to make knowledgeable choices about your coverage.Insurance coverage corporations use actuarial information to estimate the possibility of demise at other ages.

This information, which considers quite a lot of elements together with peak, weight, and clinical historical past, lets them calculate the best top rate for every person. Peak and weight are simply two elements in a fancy calculation, however they’re vital ones, influencing the chance profile.

Top rate Diversifications In keeping with Peak and Weight

Insurance coverage corporations typically categorize folks into other peak and weight brackets to resolve premiums. Those classes are in most cases in response to Frame Mass Index (BMI) which is calculated through dividing weight in kilograms through the sq. of peak in meters. This means supplies a standardized solution to assess menace throughout a various inhabitants.

| Peak (inches) | Weight (lbs) | BMI Class | Estimated Top rate (pattern coverage – $100,000 protection) |

|---|---|---|---|

| 60-64 | 120-150 | Underweight/Wholesome Weight | $150/yr |

| 65-69 | 150-180 | Wholesome Weight | $175/yr |

| 70-74 | 180-210 | Wholesome Weight/Obese | $200/yr |

| 75-79 | 210-240 | Obese | $225/yr |

| 80+ | 240+ | Overweight | $250+/yr |

Those figures are illustrative and must no longer be taken as actual estimates. Exact premiums will range considerably relying at the insurance coverage corporate, coverage kind, and different elements like age and well being. This desk demonstrates how the next BMI, typically related to higher well being dangers, correlates with greater premiums.

Changes in Top rate Calculation

Insurance coverage corporations regulate premiums in response to quite a lot of elements, together with peak and weight. Elements reminiscent of age, gender, and way of life alternatives additionally play an important function in calculating premiums. Those calculations believe mortality tables, clinical historical past, and different elements to expect the possibility of demise throughout the coverage length.

The primary at the back of this means is to stability the monetary menace of the insurer with the price of the coverage for the insured.

For instance, a 30-year-old male who’s 6 ft tall and weighs 180 kilos will most probably have a decrease top rate than a 60-year-old feminine who’s 5 ft 4 inches tall and weighs 200 kilos. It is because the chance of demise is typically decrease for more youthful, fitter folks.

Coverage Sort and Top rate Have an effect on

Several types of existence insurance coverage insurance policies react in a different way to peak and weight diversifications.

| Coverage Sort | Peak/Weight Have an effect on |

|---|---|

| Time period Existence Insurance coverage | Premiums are typically extra delicate to peak/weight diversifications, particularly for greater menace classes. |

| Entire Existence Insurance coverage | Peak/weight has a smaller affect in comparison to time period existence insurance coverage. |

| Common Existence Insurance coverage | Premiums can vary relying at the coverage’s explicit provisions and the insured’s menace profile. |

Those diversifications in premiums replicate the various ranges of menace related to other coverage sorts. Premiums for time period existence insurance coverage, as an example, are extra aware of adjustments in well being dangers because of the restricted length of protection. Premiums for complete existence insurance coverage have a tendency to be much less delicate to those elements because of the longer length and funding elements.

Selection Strategies for Chance Evaluate

Existence insurance coverage used to depend closely on easy peak and weight charts, however fashionable menace review is way more subtle. Long past are the times of crude estimations; insurers now make use of a multifaceted means that considers a wealth of knowledge past simply your bodily dimensions. This extra nuanced technique permits for a extra correct analysis of your menace profile, resulting in fairer premiums and extra adapted insurance policies.Trendy existence insurance coverage corporations use a mixture of things to resolve the possibility of any person experiencing a well being tournament.

As a substitute of depending only on static measurements, they incorporate dynamic information reflecting an individual’s present well being state and way of life alternatives. This permits for a extra complete and personalised strategy to menace review.

Clinical Historical past

Clinical historical past is a cornerstone of contemporary menace review. Insurers meticulously read about previous diseases, surgical procedures, and any power prerequisites. This contains diagnoses, remedy plans, and restoration occasions. A historical past of prerequisites like diabetes, center illness, or most cancers considerably affects the chance review. An intensive clinical historical past permits insurers to raised perceive a person’s well being trajectory and expect long run well being wishes.

Way of life Elements

Past clinical historical past, insurers additionally believe way of life elements. Smoking conduct, alcohol intake, and nutrition are all evaluated. Workout routines and general task ranges also are thought to be, as those play a pivotal function in keeping up just right well being. Those elements are the most important as a result of they supply perception into a person’s dedication to their well-being and the proactive steps they take to mitigate well being dangers.

Well being Metrics and Questionnaires

Insurers make use of quite a lot of well being metrics to refine menace review. Blood force, levels of cholesterol, and blood glucose readings, if to be had, be offering treasured insights. Moreover, complete well being questionnaires are hired to assemble detailed data on way of life, well being conduct, and circle of relatives clinical historical past. Those questionnaires are designed to gauge menace elements in a scientific approach, offering a extra granular view of a person’s general well being.

Whilst existence insurance coverage peak weight charts frequently appear simplistic, their inherent boundaries are readily obvious. Those charts, ceaselessly used to determine initial menace exams, are frequently overly generalized, failing to account for person well being prerequisites. This may end up in misguided top rate calculations, particularly when making an allowance for houses like way of life alternatives and circle of relatives historical past. As an example, any person dwelling at 131 Lonsdale st Melbourne vic 3000, with a recognized predisposition to sure well being dangers, would possibly face considerably other premiums in comparison to a person with equivalent metrics however a more fit profile.

In the end, a nuanced strategy to assessing menace, incorporating a much wider vary of things, is the most important for truthful and correct existence insurance coverage pricing.

Examples of Well being Questionnaires

Well being questionnaires are the most important equipment in underwriting. Those detailed paperwork delve into quite a lot of sides of an applicant’s well being. They frequently inquire about previous diseases, surgical procedures, drugs, and circle of relatives historical past of sure illnesses. Examples of questions would possibly come with: “Have you ever ever been recognized with a prolonged sickness?” or “Do you incessantly have interaction in strenuous bodily task?”. Such questions permit a extra holistic view of the applicant’s menace profile, going past fundamental measurements to surround a much wider spectrum of things.

Comparability with Conventional Peak/Weight Charts

Conventional peak/weight charts are somewhat easy and reasonably priced. Alternatively, they provide a restricted view of a person’s general well being. Trendy strategies, encompassing clinical historical past, way of life elements, and well being metrics, supply a considerably extra complete and correct review of menace. This complicated means recognizes that an individual’s well being is way more complicated than just their peak and weight.

Significance of Entire Clinical Analysis

A whole clinical analysis is very important for correct insurability resolution. This comes to a radical assessment of clinical data, session with clinical execs, and in all probability bodily examinations. This multifaceted means guarantees that the insurance coverage corporate has a whole image of the applicant’s well being standing. With out a complete analysis, the insurer would possibly leave out the most important data, probably resulting in misguided menace review and irrelevant top rate pricing.

Illustrative Examples of Peak Weight Charts

Existence insurance coverage corporations use peak and weight information to evaluate menace and resolve premiums. This data is a part of a fancy style, making an allowance for quite a lot of elements. The charts are simplified representations of a wider menace review procedure.

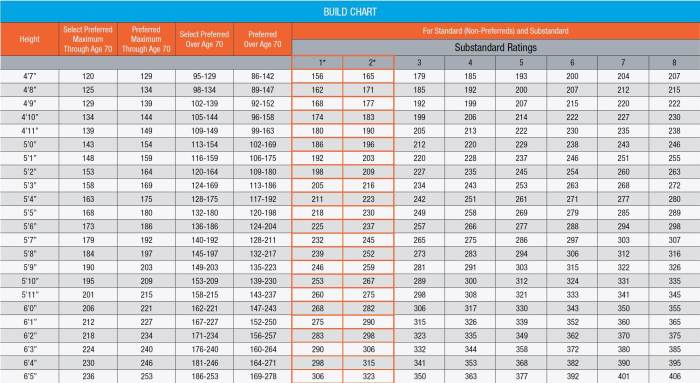

Pattern Existence Insurance coverage Peak Weight Chart (Age 30-35)

Insurance coverage corporations categorize folks in response to peak and weight to team equivalent menace profiles. This simplification is helping in pricing insurance policies. The chart underneath displays a hypothetical instance for people elderly 30-35. Be aware that exact charts utilized by insurers are considerably extra detailed and come with a variety of elements past peak and weight.

| Peak (inches) | Weight (lbs) | Top rate Class |

|---|---|---|

| 5’4″ – 5’6″ | 120-150 | Usual |

| 5’4″ – 5’6″ | 151-170 | Most popular |

| 5’4″ – 5’6″ | 171-190 | Most popular |

| 5’7″ – 5’9″ | 120-150 | Usual |

| 5’7″ – 5’9″ | 151-175 | Most popular |

| 5’7″ – 5’9″ | 176-195 | Most popular |

| 5’10” – 6’0″ | 130-160 | Usual |

Mortality Charges for Other Peak and Weight Classes

This desk illustrates hypothetical mortality charges for a similar age team. Exact charges are way more complicated and come with a lot of different elements like way of life alternatives, clinical historical past, and circle of relatives historical past. The aim is to reveal how those elements are thought to be in calculating premiums.

| Peak/Weight Class | Mortality Price (according to 10,000) |

|---|---|

| Usual | 10 |

| Most popular | 7 |

| Very good | 4 |

Top rate Resolution The usage of the Chart

The top rate class assigned within the first desk is a the most important think about figuring out the insurance coverage top rate. Insurance coverage corporations use complicated fashions to reach at premiums. Those fashions incorporate the mortality charges and different menace elements. A ‘Usual’ class would possibly lead to the next top rate in comparison to a ‘Most popular’ or ‘Very good’ class.

Hypothetical Case Find out about

A 32-year-old person, 5’8″ and weighing 165 kilos, falls into the ‘Most popular’ class. This implies their menace of demise is not up to any person within the ‘Usual’ class, resulting in a probably decrease top rate. Conversely, a 32-year-old, 5’8″ person weighing 210 kilos would most probably be positioned in the next menace class and pay the next top rate.

Obstacles and Biases of the Chart Examples

Peak and weight charts, as simplified representations, don’t account for person well being prerequisites, way of life alternatives, and circle of relatives historical past. An individual with a prime BMI however superb well being and a circle of relatives historical past of longevity would possibly have a decrease menace than any person with a decrease BMI however a circle of relatives historical past of untimely demise. This simplification inevitably introduces biases. Moreover, those charts do not believe elements like smoking, alcohol intake, and workout conduct.

The charts don’t seem to be a definitive measure of menace however a device to team folks into wide classes for pricing functions.

Doable Have an effect on of Era on Charts

Existence insurance coverage premiums are influenced through elements like age, well being, and way of life. Historically, peak and weight charts performed a task in menace review. Alternatively, technological developments are hastily reshaping this panorama, probably resulting in extra actual and environment friendly strategies for comparing menace.The evolving international of generation gifts thrilling probabilities for refining how existence insurance coverage corporations assess menace, shifting past static peak and weight charts.

New information assets and complex algorithms be offering the prospective to construct a extra correct image of a person’s well being and longevity, leading to extra personalised premiums.

Rising Applied sciences Bettering Chance Evaluate

Technological developments are introducing leading edge strategies for menace review. Wearable generation, like health trackers and smartwatches, gathers complete information on day by day task, sleep patterns, and center fee variability. Those information issues can also be built-in into menace fashions to offer a extra holistic view of a person’s well being standing. Moreover, genetic checking out and complicated clinical imaging applied sciences be offering insights into a person’s predisposition to sure illnesses, bearing in mind a extra adapted menace review.

Incorporating New Information Assets

The incorporation of recent information assets into existence insurance coverage menace review is a key development. Consider a state of affairs the place a person’s constant use of well being apps, meticulously monitoring their nutritional consumption, sleep patterns, and workout conduct, is built-in into the chance review procedure. This wealth of private well being information, blended with conventional elements like peak and weight, may probably supply a extra correct image in their well being profile and longevity.

The prospective exists for personalised menace review fashions to emerge, enabling a extra correct mirrored image of person well being dangers.

Making improvements to Potency and Accuracy

Era guarantees to seriously fortify the potency and accuracy of the existence insurance coverage procedure. AI-powered programs can analyze huge quantities of knowledge, figuring out patterns and correlations that could be overlooked through human analysts. This automatic procedure can boost up the underwriting procedure, lowering turnaround occasions for coverage packages. The accuracy of menace review can also be stepped forward through integrating those complicated equipment, probably resulting in extra actual top rate calculations and a fairer review of menace.

Long run Programs of AI in Predicting Mortality Chance

Synthetic intelligence (AI) is poised to play a the most important function in predicting mortality menace. AI algorithms can also be skilled on huge datasets of well being data, figuring out complicated relationships between quite a lot of elements and mortality charges. As an example, an AI style may analyze a person’s genetic make-up, way of life alternatives, and clinical historical past to estimate their long run mortality menace with better precision.

Such predictive fashions may result in extra correct top rate calculations, benefitting each the insurer and the policyholder.

Illustrative Instance

Imagine a state of affairs the place a person constantly logs their well being information by way of a wearable tool. The knowledge, encompassing task ranges, sleep high quality, and center fee, is built-in into an AI-powered menace review style. This information, blended with conventional elements like peak, weight, and age, permits the machine to generate a extra nuanced menace profile for the person. This would result in extra correct top rate calculations, reflecting the person’s exact well being standing extra exactly.

Ultimate Assessment: Existence Insurance coverage Peak Weight Chart

In conclusion, whilst existence insurance coverage peak weight charts had been a standard manner of menace review, fashionable approaches emphasize a holistic analysis of things past simply peak and weight. A whole clinical analysis, way of life elements, and different well being metrics play an important function in recent menace review. The way forward for those charts most probably comes to a extra nuanced and complete means, incorporating technological developments to create extra correct and environment friendly menace critiques.

Standard Questions

What are the constraints of the use of peak and weight to evaluate mortality menace?

Peak and weight charts can also be misguided as a result of they do not account for person diversifications in frame composition, muscle groups, or underlying well being prerequisites. In addition they probably perpetuate biases in response to elements like race or ethnicity.

How do insurance coverage corporations regulate premiums in response to peak and weight?

Insurance coverage corporations use peak and weight as one issue amongst many of their actuarial fashions. Other classes are frequently created for peak and weight levels, with premiums expanding for the ones in higher-risk classes. The precise top rate adjustment depends upon the insurance coverage corporate’s method.

Are there selection strategies for menace review in fashionable existence insurance coverage?

Sure, fashionable existence insurance coverage more and more makes use of complete clinical critiques, together with way of life elements, clinical historical past, and well being metrics like blood force and levels of cholesterol, to evaluate menace extra as it should be.

How does generation affect existence insurance coverage peak weight charts?

Era is remodeling menace review through bearing in mind the research of huge quantities of knowledge, together with genetic data and wearable tool information, to offer extra personalised and correct menace exams. This will result in extra actual top rate calculations sooner or later.