Automobile insurance coverage in citadel lauderdale fl – Automobile insurance coverage in Fortress Lauderdale, FL, is a the most important facet of accountable using. Navigating the native marketplace may also be difficult, however this information will allow you to perceive the panorama, to be had choices, and the right way to to find the most efficient deal. We will quilt the whole lot from not unusual varieties of protection to essentially the most aggressive suppliers, making sure you might be well-informed.

Figuring out the specifics of Fortress Lauderdale’s using atmosphere and the original insurance coverage panorama is secret to meaking the correct choices. This complete review will take you during the steps to safe the perfect automobile insurance plans.

Assessment of Automobile Insurance coverage in Fortress Lauderdale, FL

Fortress Lauderdale, FL, like different spaces in Florida, studies a dynamic automobile insurance coverage marketplace influenced by way of components like climate patterns, using behavior, and native demographics. This review explores the panorama of auto insurance coverage in Fortress Lauderdale, outlining not unusual varieties, standard prices, and key influencing components. Figuring out those components is the most important for citizens and guests looking for suitable protection.The auto insurance coverage marketplace in Fortress Lauderdale, Florida, is aggressive, with more than a few insurance coverage suppliers vying for patrons.

This festival continuously interprets into various choices and ranging value issues. Components past the elemental protection wishes of drivers play a task in shaping the marketplace. Figuring out the native nuances, together with coincidence charges and using prerequisites, can assist in settling on an appropriate insurance plans.

Commonplace Sorts of Automobile Insurance coverage

A large number of varieties of automobile insurance coverage insurance policies cater to various wishes. Those insurance policies come with legal responsibility protection, which protects in opposition to damages led to to others. Collision protection safeguards in opposition to injury for your personal car in injuries, whilst complete protection extends this coverage to different incidents like vandalism or robbery. Uninsured/underinsured motorist protection is the most important, offering monetary coverage if curious about an coincidence with a motive force missing enough insurance coverage.

Further non-compulsory coverages, comparable to condo repayment or roadside help, fortify the full coverage presented.

Standard Prices and Components Affecting Premiums

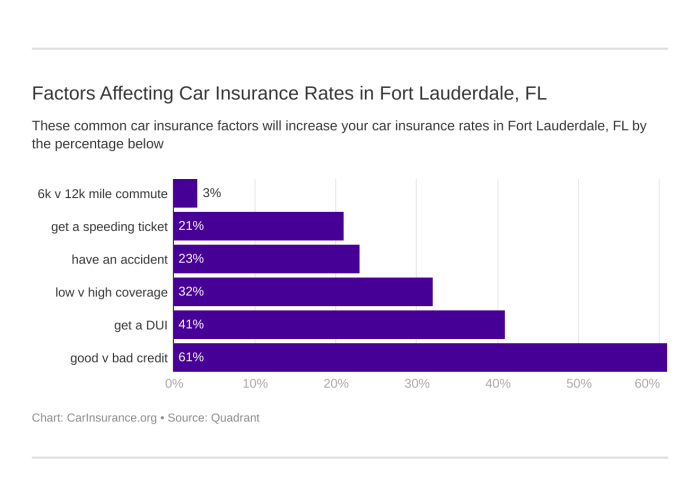

Automobile insurance coverage premiums in Fortress Lauderdale, like different spaces, are suffering from a number of components. Those components vary from the driving force’s age and using document to the kind of car and placement of the car. The price of automobile insurance coverage varies considerably, impacting folks and households otherwise.

Comparability of Reasonable Charges to Different Florida Towns

Evaluating Fortress Lauderdale’s reasonable automobile insurance coverage charges to different Florida towns unearths a relative place throughout the state’s marketplace. Components like the precise demographics, coincidence charges, and using prerequisites of every town affect the pricing. Whilst precise figures would possibly range relying at the explicit coverage and insurer, Fortress Lauderdale’s charges typically fall inside of a spread not unusual to different primary Florida towns.

Components Affecting Automobile Insurance coverage Charges

| Issue | Description | Have an effect on on Value | Examples |

|---|---|---|---|

| Motive force Age | Displays the driving force’s revel in and possibility profile. | More youthful drivers continuously have upper premiums because of upper coincidence possibility. | A 16-year-old motive force will most likely pay greater than a 35-year-old motive force. |

| Riding Document | Contains visitors violations and injuries. | Drivers with a blank document typically have decrease premiums. | A motive force with a couple of dashing tickets will most likely pay greater than a motive force and not using a violations. |

| Car Sort | Refers back to the make, fashion, and worth of the auto. | Upper-value cars would possibly lead to upper premiums because of greater possible loss. | A luxurious sports activities automobile will most likely value extra to insure than a compact sedan. |

| Location | Particular house of Fortress Lauderdale the place the car is garaged. | Spaces with upper coincidence charges in most cases have upper premiums. | Insurance coverage charges in high-traffic spaces of Fortress Lauderdale may well be upper than in quieter residential neighborhoods. |

Those components, interacting in advanced techniques, form the full value of auto insurance coverage in Fortress Lauderdale. Figuring out those components lets in for instructed choices when opting for a coverage.

Particular Protection Choices

Fortress Lauderdale’s colourful way of life and numerous using prerequisites necessitate a cautious attention of auto insurance policy. Figuring out the more than a few choices to be had and their implications is the most important for safeguarding your property and making sure peace of thoughts at the street. Choosing the proper protection steadiness guarantees you might be adequately ready for unexpected instances.

Legal responsibility Protection

Legal responsibility protection protects you should you motive an coincidence that ends up in injury to someone else’s car or accidents to them. It in most cases covers damages in line with the regulations of the state, and the volume of protection you choose at once affects the volume you might be liable for. That is continuously a compulsory minimal in Fortress Lauderdale and different states.

Collision Protection

Collision protection will pay for damages for your car without reference to who’s at fault. That is necessary in Fortress Lauderdale, the place the chance of injuries may also be upper because of the town’s visitors density and probably adversarial climate prerequisites. In case your car is curious about a collision, this protection will step in to fix or substitute your car, without reference to fault.

Complete Protection

Complete protection, every now and then known as “rather than collision,” protects your car in opposition to damages from occasions rather than collisions, comparable to robbery, vandalism, hearth, hail, or herbal failures. In Fortress Lauderdale, with its possible for critical climate occasions, complete protection supplies crucial coverage in opposition to unexpected instances.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection protects you and your passengers if you are curious about an coincidence with a motive force who lacks or has inadequate insurance coverage. That is specifically necessary in Fortress Lauderdale, given the potential for encountering drivers with out good enough protection. It is helping mitigate monetary duty for incidents involving uninsured or underinsured events.

Protection Comparability Desk

| Protection | Description | Reasonable Value (Fortress Lauderdale, FL) | Implications |

|---|---|---|---|

| Legal responsibility | Covers injury to others’ assets or accidents led to by way of you. | $200-$500 once a year | Required by way of legislation, however restricted protection. |

| Collision | Covers injury for your car in an coincidence, without reference to fault. | $200-$800 once a year | Protects your car funding, although you might be at fault. |

| Complete | Covers damages from occasions rather than collisions (robbery, vandalism, and so on.). | $100-$400 once a year | Protects in opposition to a much broader vary of possible damages. |

| Uninsured/Underinsured Motorist | Covers damages if you are curious about an coincidence with an uninsured or underinsured motive force. | $100-$300 once a year | Supplies monetary coverage in opposition to injuries involving irresponsible drivers. |

Deductibles and Coverage Limits

Deductibles and coverage limits considerably have an effect on automobile insurance coverage prices. A better deductible reduces premiums, however you’ll be able to be accountable for a bigger out-of-pocket cost within the match of a declare. Coverage limits outline the utmost quantity your insurance coverage corporate can pay out for damages or accidents. In Fortress Lauderdale, as in different spaces, working out those components is necessary for organising an appropriate protection plan.

Upload-ons

Upload-ons like roadside help and condo automobile protection can fortify your Fortress Lauderdale automobile insurance plans. Roadside help supplies assist in emergencies, whilst condo automobile protection compensates for transportation wishes right through maintenance. Those add-ons be offering precious further coverage, particularly in a town like Fortress Lauderdale with its continuously busy roads and possible for unexpected instances.

Insurance coverage Corporations and Suppliers

Choosing the proper automobile insurance coverage supplier in Fortress Lauderdale is the most important for safeguarding your car and monetary well-being. Figuring out the native marketplace, reputations, and to be had protection choices is very important to creating an educated resolution. Other firms cater to more than a few wishes and budgets, so comparing choices in line with your explicit necessities is vital.The Fortress Lauderdale automobile insurance coverage marketplace provides quite a lot of firms, every with its personal strengths and weaknesses.

Native suppliers continuously have a deeper working out of the precise using prerequisites and visitors patterns of the world. Nationwide firms, then again, would possibly be offering broader protection and probably decrease charges because of economies of scale. Examining the popularity, buyer evaluations, and claims processes of those suppliers is necessary for settling on the most efficient have compatibility to your wishes.

Common Insurance coverage Suppliers in Fortress Lauderdale

A number of firms are distinguished within the Fortress Lauderdale house, providing more than a few insurance coverage applications. Spotting those key gamers and working out their reputations inside of the local people is very important for evaluating choices. Comparing their customer support, claims processes, and total revel in is the most important within the decision-making procedure.

Most sensible 5 Insurance coverage Corporations in Fortress Lauderdale

This desk gifts a snapshot of 5 distinguished insurance coverage firms in Fortress Lauderdale, highlighting their native presence, buyer rankings, and further services and products. Observe that buyer rankings can range in line with person studies.

| Corporate Identify | Native Presence | Buyer Ranking (Reasonable) | Further Products and services |

|---|---|---|---|

| State Farm | Sturdy; intensive community of brokers | 4.2 out of five | Reductions, roadside help, cellular app |

| Geico | Extensively to be had; a couple of places | 4.0 out of five | On-line quote equipment, just right customer support |

| Modern | Found in Fortress Lauderdale; native places of work | 3.8 out of five | Reductions for just right drivers, virtual equipment |

| Allstate | Native presence with a number of brokers | 3.9 out of five | Claims dealing with, more than a few coverage choices |

| National | Just right native illustration; brokers | 4.1 out of five | Protection choices, coincidence give a boost to, on-line assets |

Native vs. Nationwide Suppliers

The selection between a neighborhood and nationwide supplier comes to cautious attention of explicit wishes. Native suppliers continuously have a deeper working out of the native house, probably resulting in adapted protection answers. Then again, nationwide firms would possibly be offering extra aggressive pricing and wider protection choices because of their broader succeed in and economies of scale. Weighing those components in opposition to your own instances is very important.

Claims Procedure and Buyer Provider

A the most important facet of opting for an insurance coverage supplier is working out their claims procedure and customer support protocols. A easy and environment friendly claims procedure is significant right through a time of want. Customer support high quality can affect the full revel in and supply steerage right through policy-related problems. Many firms have on-line portals, telephone give a boost to, and in-person help. Researching those avenues mean you can make a well-informed selection.

Discovering the Very best Deal on Automobile Insurance coverage

Securing essentially the most wonderful automobile insurance plans in Fortress Lauderdale, FL, calls for a strategic means. Evaluating quotes from more than a few suppliers is the most important to spot the most efficient have compatibility to your wishes and finances. This procedure comes to comparing protection choices, working out coverage phrases, and leveraging to be had assets.

Evaluating Automobile Insurance coverage Quotes

Discovering the most efficient deal on automobile insurance coverage comes to a scientific comparability of quotes. This procedure guarantees you safe a coverage that aligns together with your monetary state of affairs and desired degree of coverage. A complete comparability procedure contains comparing protection choices, working out coverage phrases, and leveraging to be had assets.

Acquiring Quotes: On-line and Offline Strategies

Acquiring automobile insurance coverage quotes may also be accomplished thru each on-line and offline channels. On-line strategies be offering comfort and velocity, whilst offline strategies permit for customized interplay.

- On-line Strategies: Web pages devoted to evaluating insurance coverage quotes are readily to be had. Those platforms supply a streamlined procedure for collecting a couple of quotes from more than a few suppliers in one location. This technique considerably reduces the effort and time curious about acquiring quotes from other insurers.

- Offline Strategies: Unbiased insurance coverage brokers stay a precious useful resource. They supply customized steerage and will help in navigating the complexities of auto insurance coverage insurance policies. This technique lets in for in-depth discussions about your wishes and tailoring the coverage for your explicit necessities.

On-line Quote Comparability Web pages

A large number of on-line platforms facilitate the comparability of auto insurance coverage quotes. Those platforms be offering more than a few options and ranging ranges of pricing transparency.

| Web page | Key Options | Person Critiques | Pricing Transparency |

|---|---|---|---|

| Insurify | Simple-to-use interface, a couple of quote comparisons, detailed coverage data. | Normally sure, customers respect the simplicity and complete knowledge. | Top; transparent show of pricing for various protection ranges. |

| QuoteWizard | Wide selection of insurers, comparability equipment, and coverage choices. | Blended evaluations; some customers to find the web page overwhelming whilst others respect the huge variety. | Average; calls for some navigation to grasp the pricing construction. |

| Policygenius | Person-friendly interface, easy quote request procedure, and buyer give a boost to. | Certain evaluations, highlighting the transparent explanations and useful customer support. | Top; clear breakdown of protection prices and premiums. |

| The Zebra | Specializes in offering customized insurance coverage suggestions in line with person knowledge. | Normally sure, emphasizing the adapted suggestions. | Top; transparent pricing construction, highlighting the adapted pricing for person wishes. |

Figuring out Coverage Wordings and Phrases

Thorough exam of coverage wording and phrases is significant to working out the protection presented and related prices. It is important to check coverage paperwork in moderation, paying shut consideration to main points comparable to exclusions, boundaries, and deductible quantities.

Unbiased Insurance coverage Brokers

Unbiased insurance coverage brokers play a vital position in aiding shoppers in securing essentially the most wonderful automobile insurance coverage insurance policies. They possess intensive wisdom of more than a few insurance coverage suppliers and will tailor protection to person wishes. This customized means lets in for a complete working out of coverage choices and guarantees shoppers obtain the most efficient imaginable price for his or her top class bills.

Reductions and Financial savings

Saving cash on automobile insurance coverage is a most sensible precedence for lots of Fortress Lauderdale citizens. Figuring out to be had reductions can considerably scale back your top class prices. This segment explores not unusual reductions and methods for securing the most efficient imaginable fee.Fortress Lauderdale drivers can continuously to find really extensive financial savings by way of profiting from more than a few reductions presented by way of insurance coverage firms. Those reductions are steadily in line with components like protected using behavior, car options, and way of life possible choices.

Leveraging those alternatives can lead to really extensive long-term monetary financial savings.

Commonplace Reductions

A large number of reductions are to be had to drivers in Fortress Lauderdale. Those incentives continuously praise accountable using, explicit way of life possible choices, and the adoption of protection measures.

- Secure Riding Information: Insurance coverage firms continuously supply reductions for drivers with a blank using document. This normally interprets to fewer injuries and violations over a specified duration. As an example, drivers with a really perfect using document for 5 years would possibly qualify for a considerable cut price, probably saving loads of greenbacks once a year.

- Just right Scholar Standing: Insurance coverage suppliers steadily be offering reductions for college students who handle a just right instructional document. This can be a popularity of accountable conduct and an indication of personality. A pupil with a excessive GPA, or who demonstrates instructional fulfillment, may obtain this kind of cut price.

- Anti-theft Units: Putting in anti-theft units like alarms or monitoring programs can qualify drivers for reductions. Insurance coverage firms acknowledge those measures as deterrents in opposition to robbery, leading to diminished possibility. For instance, cars provided with complex anti-theft era continuously obtain a substantial cut price.

- Bundling Insurance policies: Combining your automobile insurance coverage with different insurance policies, comparable to house insurance coverage, can continuously result in a blended cut price. This can be a not unusual technique, as insurance coverage firms acknowledge some great benefits of having a couple of insurance policies with the similar buyer. For instance, a circle of relatives that insures their house and a couple of vehicles with the similar corporate would possibly obtain a ten% or extra cut price on their total insurance coverage premiums.

- Defensive Riding Lessons: Finishing a defensive using route can result in a cut price. Through bettering their using abilities and information, drivers scale back the chance of injuries and qualify for those discounts. This demonstrates a dedication to protection and accountable using practices, which continuously ends up in a reduced top class.

Bargain Breakdown

A transparent working out of to be had reductions and their possible financial savings may also be recommended.

| Bargain Sort | Description | Eligibility Standards | Approximate Financial savings |

|---|---|---|---|

| Secure Riding Document | Reductions for drivers with a blank using document | No injuries or violations inside of a specified duration (e.g., 3 years) | $100-$500+ in keeping with 12 months |

| Just right Scholar Standing | Reductions for college students with a just right instructional document | Keeping up a definite GPA or attaining explicit instructional milestones | $50-$200+ in keeping with 12 months |

| Anti-theft Units | Reductions for cars with put in anti-theft units | Set up of alarms, monitoring programs, or different security features | $25-$150+ in keeping with 12 months |

| Bundling Insurance policies | Reductions for combining a couple of insurance policies (e.g., house and automobile) | Having a couple of insurance policies with the similar insurance coverage supplier | $50-$300+ in keeping with 12 months |

Bundling Insurance policies

Bundling your automobile insurance coverage with different insurance policies, like house insurance coverage, is continuously a precious technique.

Insurance coverage firms steadily be offering reductions for patrons who’ve a couple of insurance policies with them.

It will considerably have an effect on the full value of your insurance coverage premiums. Through having a complete insurance coverage bundle, it’s possible you’ll to find your self saving really extensive cash.

Negotiating Higher Charges

Negotiating together with your insurance coverage supplier can result in higher charges.

Researching other insurance coverage firms and evaluating quotes is a basic technique.

Through working out your choices, you’re higher provided to barter and safe a extra aggressive fee. Be ready to speak about your using historical past, car main points, and any reductions it’s possible you’ll qualify for.

Felony Necessities and Rules: Automobile Insurance coverage In Fortress Lauderdale Fl

Fortress Lauderdale, like the remainder of Florida, has strict rules referring to automobile insurance coverage. Compliance is the most important to steer clear of felony repercussions and make sure your protection at the street. Figuring out those necessities is necessary for accountable drivers.The state of Florida mandates minimal protection ranges for all drivers. Failure to handle good enough insurance coverage can lead to vital monetary consequences and possible felony motion.

Understanding the specifics of those necessities is very important to stop issues and make sure easy operation.

Necessary Automobile Insurance coverage Necessities

Florida legislation calls for all approved drivers to hold a minimal degree of auto insurance coverage. This can be a basic requirement to give protection to each the driving force and different street customers. The precise protection quantities range relying on the kind of coverage.

Penalties of Riding With out Ok Insurance coverage

Riding with out enough automobile insurance coverage can result in severe penalties. Those can vary from hefty fines to suspension of using privileges, probably impacting your skill to trip and have interaction in day by day actions. The effects may also be financially burdensome and time-consuming to unravel.

Minimal Required Protection Quantities and Felony Consequences

The next desk Artikels the minimal required protection quantities and related consequences for violations in Fortress Lauderdale, Florida.

| Protection Sort | Minimal Requirement | Penalty Main points | Supporting Felony References |

|---|---|---|---|

| Physically Damage Legal responsibility (BIL) | $10,000 in keeping with user, $20,000 in keeping with coincidence | Fines starting from a number of hundred to a number of thousand bucks, possible suspension of motive force’s license. Court docket prices would possibly follow. | Florida Statutes Bankruptcy 324 |

| Belongings Harm Legal responsibility (PDL) | $10,000 in keeping with coincidence | Fines starting from a number of hundred to a number of thousand bucks, possible suspension of motive force’s license. Court docket prices would possibly follow. | Florida Statutes Bankruptcy 324 |

| Uninsured/Underinsured Motorist (UM/UIM) | $10,000 in keeping with user, $20,000 in keeping with coincidence | Fines starting from a number of hundred to a number of thousand bucks, possible suspension of motive force’s license. Court docket prices would possibly follow. Possible declare boundaries relying at the explicit protection. | Florida Statutes Bankruptcy 324 |

Observe: Consequences can range in line with explicit instances and the severity of the violation. It is important to visit felony pros for correct and customized steerage.

Function of the Division of Monetary Products and services

The Florida Division of Monetary Products and services (DFS) performs a the most important position in regulating automobile insurance coverage firms and suppliers. This oversight guarantees that insurance coverage firms function relatively and transparently, keeping up public consider. The DFS enforces state rules to handle the integrity of the insurance coverage marketplace.

Have an effect on of Florida’s No-Fault Insurance coverage Device

Florida’s no-fault insurance coverage gadget has a vital have an effect on on claims and settlements. Within the match of a automobile coincidence, claims are in most cases treated between the concerned events’ insurance coverage firms, without reference to fault. The program streamlines the claims procedure, probably decreasing the time and complexity of felony lawsuits. Then again, it is very important perceive the precise main points and possible boundaries of the no-fault gadget, which would possibly range in line with the kind of declare.

Contemporary Developments and Long term Outlook

Automobile insurance coverage charges in Fortress Lauderdale, like around the country, are continuously evolving. Contemporary traits disclose a fancy interaction of things, from the frequency and severity of injuries to the have an effect on of recent applied sciences. Figuring out those traits is the most important for each customers and suppliers to look ahead to long term adjustments and adapt accordingly. Examining those traits and their possible have an effect on at the long term is necessary to navigating the complexities of the marketplace.

Contemporary Developments in Fortress Lauderdale Automobile Insurance coverage Charges

Contemporary knowledge signifies a slight upward development in automobile insurance coverage premiums in Fortress Lauderdale, Florida. That is partly as a result of the expanding value of repairing cars broken in injuries, an immediate results of inflation and emerging subject matter prices. Moreover, claims frequency has remained slightly solid, however the severity of a few claims has proven a discernible upward development. The emerging value of work curious about coincidence restore and claims dealing with additionally performs a vital position.

Components Influencing Long term Price Adjustments, Automobile insurance coverage in citadel lauderdale fl

A number of components are anticipated to persuade long term automobile insurance coverage fee adjustments in Fortress Lauderdale. Emerging inflation and its impact on restore prices and different bills are a vital worry. An build up within the choice of critical climate occasions within the area may additionally give a contribution to emerging claims and premiums. Additionally, if the frequency of injuries will increase because of adjustments in using behavior or street prerequisites, this might most likely result in upper insurance coverage charges.

The possible have an effect on of recent applied sciences at the insurance coverage business, like self-driving vehicles, is every other key part.

Possible Have an effect on of New Applied sciences

The emergence of self-driving cars is poised to turn out to be the auto insurance coverage panorama. As independent cars develop into extra prevalent, the position of human error in injuries is predicted to decrease. This may probably decrease insurance coverage charges for some drivers. Then again, the legal responsibility implications of injuries involving self-driving vehicles stay a vital house of uncertainty, and the possibility of popular adoption will decide the best have an effect on on charges.

Virtual Transformation within the Insurance coverage Trade

The virtual transformation of the insurance coverage business is already underway in Fortress Lauderdale. Insurance coverage firms are more and more leveraging era to streamline processes, fortify customer support, and reinforce possibility overview. This contains the usage of telematics to watch using behavior, imposing on-line platforms for coverage control, and using knowledge analytics to spot traits and patterns. This virtual evolution is predicted to proceed, impacting buyer revel in and pricing fashions.

Forecast of Long term Automobile Insurance coverage in Fortress Lauderdale

| Development | Description | Have an effect on on Prices | Long term Implications |

|---|---|---|---|

| Emerging Restore Prices | Inflation and subject matter value will increase are using up restore prices for cars curious about injuries. | Upper premiums | Shoppers would possibly want to think about upper premiums for his or her automobile insurance coverage insurance policies. |

| Expanding Severity of Claims | Critical climate occasions and possible will increase in coincidence severity are contributing to raised claims prices. | Upper premiums | Insurance coverage firms would possibly want to regulate charges to account for greater claims. |

| Adoption of Self-Riding Automobiles | Self sustaining cars are anticipated to scale back human error-related injuries. | Doubtlessly decrease premiums for some drivers | The legal responsibility implications of injuries involving self-driving vehicles stay to be decided. |

| Virtual Transformation | Higher use of era for possibility overview, customer support, and coverage control. | Possible for stepped forward potency and customized pricing. | Shoppers can be expecting a extra streamlined and customized revel in in managing their automobile insurance coverage insurance policies. |

Finish of Dialogue

In conclusion, securing the correct automobile insurance coverage in Fortress Lauderdale, FL, is a multifaceted procedure. Through working out the nuances of protection choices, evaluating suppliers, and exploring reductions, you’ll considerably scale back your insurance coverage prices. This information has equipped the information to empower you in making essentially the most instructed choices to your monetary well-being.

FAQ Information

What are the minimal insurance coverage necessities in Fortress Lauderdale, FL?

Florida legislation mandates explicit minimal protection quantities for legal responsibility insurance coverage. Failure to satisfy those necessities can result in vital consequences.

How do I evaluate automobile insurance coverage quotes on-line?

A number of on-line equipment assist you to evaluate quotes from more than a few suppliers. Inputting your car data, using historical past, and desired protection choices will allow you to to find aggressive quotes.

What reductions are to be had for automobile insurance coverage in Fortress Lauderdale?

Reductions for protected using data, anti-theft units, and bundling insurance policies are not unusual in Fortress Lauderdale. Many suppliers be offering a couple of reductions, so it is price exploring other choices.

What are the everyday prices of auto insurance coverage in Fortress Lauderdale in comparison to different Florida towns?

Fortress Lauderdale’s charges continuously fall throughout the vary of different Florida towns, despite the fact that native components can impact premiums. Comparability buying groceries throughout other suppliers is the most important to seek out essentially the most aggressive charges.