Lack of use protection automobile insurance coverage supplies monetary reinforce when your automobile is unusable because of harm or twist of fate. This essential part of your coverage incessantly covers bills like condominium vehicles, misplaced wages, and different related prices, making sure a clean transition when your automobile is out of fee. Figuring out the nuances of this protection is very important for navigating unexpected instances, making sure monetary safety and minimizing disruptions.

The interaction of quite a lot of elements, from the kind of harm to the specifics of your coverage, determines the level of your protection. Figuring out those intricacies lets in for knowledgeable choices and proactive making plans, mitigating attainable monetary burdens.

This information delves into the intricacies of lack of use protection, exploring its quite a lot of sides, from its definition and kinds to say procedures and exclusions. By means of inspecting the interaction between protection choices, exclusions, and the declare procedure, you acquire a deeper figuring out of ways this protection purposes inside the broader context of vehicle insurance coverage.

Defining Lack of Use Protection: Loss Of Use Protection Automotive Insurance coverage

Lack of use protection in automobile insurance coverage is sort of a protection internet, offering monetary help when your automobile is out of fee because of an twist of fate or coated tournament. It is a an important part of complete insurance coverage, serving to you navigate the sudden prices whilst your automobile is being repaired or changed. Believe a unexpected breakdown, combating you from commuting to paintings.

This protection allow you to quilt the prices of other transportation, conserving your existence on course.This protection is helping you set up bills whilst your automobile is out of motion. It is designed to ease the monetary burden of being not able to make use of your automobile, providing quite a lot of advantages adapted for your particular wishes. Several types of lack of use protection supply various levels of monetary help.

Lack of Use Protection Sorts

Lack of use protection incessantly comprises a number of choices to assist with transportation bills all through a coated incident. Those choices cater to other wishes and instances.

- Condominium Repayment: This kind of protection compensates for the price of renting a short lived automobile whilst your automobile is being repaired. This may also be extraordinarily useful for keeping up your day-to-day regimen, whether or not for paintings, errands, or non-public commitments. It is an instantaneous and tangible good thing about lack of use protection. This receive advantages can assist ease the monetary pressure related to changing your transportation wishes.

- Different Choices: But even so condominium compensation, some insurance policies would possibly come with protection for extra bills like brief transportation prices, comparable to the usage of a ride-sharing carrier or a public shipping machine. This might be particularly treasured if you need to shipping items or other people. This may give further reinforce, making the placement extra manageable all through the restore or substitute duration.

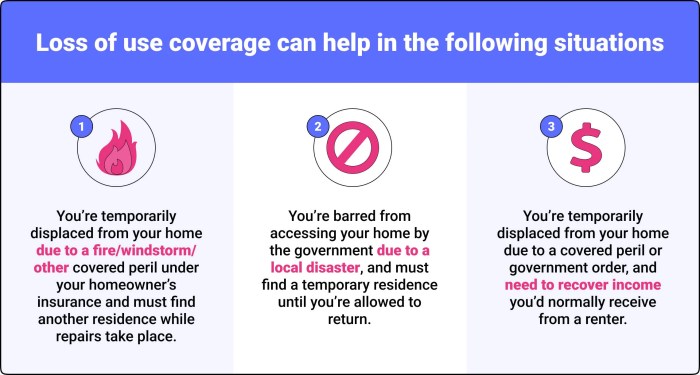

Cases for Lack of Use Protection

Lack of use protection generally applies when your automobile is deemed unusable because of a coated tournament. Those occasions are incessantly injuries, however too can come with such things as vandalism and even herbal screw ups. As an example, in case your automobile is broken past restore in a fireplace, lack of use protection would most likely observe. It’s at all times absolute best to test your coverage main points for particular exclusions and barriers.

Comparability of Lack of Use Protection Choices

| Protection Kind | Description | Advantages | Barriers |

|---|---|---|---|

| Condominium Repayment | Covers the price of renting a change automobile whilst your automobile is being repaired or changed. | Supplies a handy and dependable selection transportation all through the restore duration. | Could have day-to-day or weekly limits on condominium compensation quantities. Insurance policies would possibly specify the varieties of cars that qualify for compensation. |

| Different | Covers further transportation bills like ride-sharing or public shipping. | Gives flexibility in opting for transportation choices, particularly if a condominium is unavailable or incorrect. | The compensation quantity is generally in accordance with the real bills incurred, however insurance policies might set limits on overall compensation. The precise approach of compensation would possibly range. |

Protection Exclusions and Barriers

Lack of use protection, whilst a useful perk, ain’t a magic bullet. It has got some barriers, similar to the entirety else on this global. Figuring out those exclusions and barriers is secret to meaking positive you might be now not stuck off guard when a mishap moves. Like a sensible palemban service provider, you wish to have to grasp the deal sooner than you signal the contract!

Commonplace Exclusions

Lack of use protection incessantly comes with an inventory of exclusions. Those are scenarios the place the protection may not kick in, so it’s critical to grasp what they’re. It is like realizing the “no-go” zones on your insurance coverage.

- Pre-existing harm: In case your automobile already had a pre-existing factor that is now making it unusable, the lack of use protection would possibly now not quilt it. Believe you had a leaky radiator for some time and it in any case brought about your automobile to wreck down. The protection would possibly now not quilt the time you could not use the auto if it was once a pre-existing drawback.

- Harm brought about through your movements: If the wear and tear for your automobile is a results of your individual negligence or recklessness, lack of use protection would possibly now not observe. Like in the event you parked your automobile in a flood zone and it were given flooded, the insurance coverage corporate would possibly now not quilt the time you could not use it.

- Harm brought about through battle or terrorism: Protection most often excludes occasions like battle or terrorism. It is a beautiful not unusual exclusion in maximum insurance coverage insurance policies, as the dangers are large and unpredictable.

- Harm brought about through put on and tear: Common put on and tear for your automobile, like standard use and getting old, is not generally coated through lack of use protection. Bring to mind it like standard automobile repairs, like converting your oil.

- Harm brought about through forget or loss of repairs: In case your automobile is not maintained correctly and that ends up in harm, lack of use protection more than likely may not quilt the time you’ll’t use it.

Barriers in Particular Eventualities

The period of time lack of use protection applies can range relying at the instances. It isn’t at all times a straight-forward “this many days” form of deal.

- Restore time: The protection incessantly simplest applies for the time it takes to fix your automobile, now not for any time beyond regulation you could want to prepare transportation. It is like in case your automobile wishes a brand new engine, the protection would possibly simplest pay for the time it takes to put in the brand new engine, now not the time beyond regulation you wish to have to search out selection transportation.

- Selection transportation: You probably have different transportation choices (like a spare automobile or public shipping), the period of time coated for lack of use may well be diminished. It’s because you’ve a solution to get round whilst your automobile is being fastened.

- Overall loss: In case your automobile is deemed a complete loss, the lack of use protection would possibly simplest quilt a particular duration, or it could now not quilt it in any respect. It’s because the insurance coverage corporate is largely changing the auto, and the price of the usage of the outdated one is not as top as though it is simply being repaired.

Eventualities The place Protection May No longer Observe

There are scenarios the place lack of use protection merely may not quilt your bills.

- Delays in restore: If there are sudden delays in getting your automobile repaired, the lack of use protection would possibly now not lengthen past a undeniable duration. This might be because of portions shortages or unexpected headaches all through the restore procedure.

- Unexpected instances: For those who revel in problems that were not expected (like a significant climate tournament that is affecting the restore procedure), the protection would possibly now not observe to the time beyond regulation it takes to get your automobile again at the street. It’s because the insurance coverage corporate is not answerable for problems past their keep an eye on.

Abstract Desk

| Exclusion Class | Instance | Clarification |

|---|---|---|

| Pre-existing Harm | Leaking radiator inflicting breakdown | Harm provide sooner than the coated tournament. |

| Negligence | Parking in a flood zone | Harm brought about through your movements. |

| Acts of Conflict/Terrorism | Harm all through a battle | Protection most often excludes those occasions. |

| Put on and Tear | Standard automobile deterioration | Common use and getting old are not coated. |

| Loss of Upkeep | Ignoring essential repairs | Harm brought about through neglecting automobile care. |

Declare Procedure and Procedures

Submitting a lack of use declare generally is a bit like navigating a Palembang river, every so often winding and every so often easy. However do not be disturbed, we will information you throughout the procedure step by step, making it as clean as a standard Palembang boat journey. Figuring out the declare procedure guarantees a hassle-free revel in and a swift answer.This phase main points the method of submitting a lack of use declare, from the preliminary steps to the predicted time frame.

We’re going to Artikel the specified documentation and explain the timeline, making sure a clear and environment friendly declare answer. This will likely make the entire procedure much less daunting and extra comprehensible.

Declare Submitting Steps

The declare procedure is structured in some way that is simple to observe. Every step is designed to streamline the method and make sure a well timed answer. We have laid out the stairs for readability.

- Document the Loss: Straight away document the incident for your insurance coverage supplier. That is an important for starting up the declare procedure. Touch the insurance coverage corporate the usage of the quantity for your coverage file or the designated channels. A well timed document guarantees a clean procedure. As an example, in case your automobile is broken in a visitors twist of fate, document it right away for your insurer.

- Accumulate Required Paperwork: That is like assembling the substances for a scrumptious Palembang dish. The essential forms makes the declare procedure run easily. You can want your coverage main points, evidence of possession, and an in depth document of the incident. If there are witnesses, their statements are useful too.

- Put up the Declare Shape: Fill out the lack of use declare shape appropriately and entirely. This type is your legit request to the insurance coverage corporate. Make sure you supply all of the required main points to steer clear of any delays in processing.

- Supply Supporting Paperwork: Connect any supporting paperwork, comparable to police experiences, restore estimates, or scientific expenses if appropriate. Those paperwork reinforce your declare and supply a transparent image of the placement.

- Anticipate Analysis: The insurance coverage corporate will evaluation your declare in accordance with the equipped knowledge and paperwork. This analysis procedure can take time. Be affected person and observe up along with your insurer if essential. Like a patiently crafted Palembang batik, the analysis procedure takes time to finish.

- Agreement: As soon as the declare is authorized, the insurance coverage corporate will prepare the agreement. This is able to contain offering repayment for lack of use, or arranging brief transportation. The agreement quantity depends upon the main points of your declare.

Documentation Required

To expedite the declare procedure, be sure you have the essential paperwork readily to be had. The next paperwork are an important for a lack of use declare:

- Coverage Main points: Your insurance coverage file, together with coverage quantity, protection main points, and speak to knowledge.

- Evidence of Possession: Automobile registration, possession certificates, or every other related file proving your possession of the automobile.

- Incident Document: An in depth document of the incident, together with date, time, location, and outline of the development. This would possibly come with a police document if one was once filed.

- Restore Estimates: If appropriate, restore estimates for the broken automobile, or a letter from the mechanic describing the wear and tear. This is helping in assessing the whole restore price and the lack of use.

- Clinical Expenses (if appropriate): In circumstances the place the twist of fate comes to accidents, scientific expenses are crucial to reinforce the declare.

Timeline for Processing

The timeline for processing a lack of use declare can range relying on a number of elements. Those elements come with the complexity of the declare, the supply of supporting paperwork, and the insurer’s inside procedures.

| Step | Description | Required Paperwork | Timeline |

|---|---|---|---|

| Document the Loss | Preliminary touch with the insurance coverage corporate | Coverage main points | Inside of 24 hours |

| Declare Submission | Submission of the declare shape and supporting paperwork | Declare shape, supporting paperwork | Inside of 5 trade days |

| Analysis | Overview and review of the declare through the insurer | All supporting paperwork | 7-14 trade days |

| Agreement | Agreement of the declare | Licensed declare paperwork | 7-21 trade days |

Evaluating with Different Coverages

Hai, kawan-kawan! Kita mau bahas lebih dalam nih, tentang perbandingan antara asuransi kehilangan penggunaan (lack of use) dengan jenis asuransi mobil lainnya, seperti complete dan collision. Penting banget nih buat kita semua, supaya kita paham mana yang paling cocok buat mobil kesayangan kita.Figuring out the nuances of various automobile insurance coverage coverages is an important for making knowledgeable choices. Realizing which protection most nearly fits your wishes is helping you steer clear of monetary burdens and care for peace of thoughts.

Lack of Use Protection In comparison to Complete

Lack of use protection and complete protection deal with other facets of vehicle possession. Complete protection, then again, basically specializes in damages brought about through perils like storms, vandalism, or injuries involving animals. Lack of use protection, against this, steps in when your automobile is broken and unavailable to be used, without reference to the purpose.

- Lack of use protection kicks in when your automobile is broken and unusable, without reference to who brought about the wear and tear. This might be because of a complete declare tournament, or a myriad of different scenarios.

- Complete protection, then again, at once addresses the restore or substitute of the broken automobile. It is like an instantaneous repair for the wear and tear.

Lack of Use Protection In comparison to Collision

Collision protection and lack of use protection are each prompted through injuries, however they have got distinct roles. Collision protection basically offers with the bodily harm brought about through a collision, whilst lack of use protection addresses the consequential monetary losses from now not having the ability to use your automobile.

- Collision protection particularly specializes in the maintenance or substitute prices in case your automobile is broken in a collision, regardless of whose fault it’s.

- Lack of use protection, then again, steps in to catch up on the monetary hardship you face because of now not gaining access to your automobile. This is able to come with such things as transportation prices or misplaced wages.

Comparative Desk

| Protection Kind | Key Options | Benefits | Disadvantages |

|---|---|---|---|

| Lack of Use | Covers misplaced source of revenue, transportation bills, and different prices when your automobile is unusable because of harm. | Supplies monetary coverage all through a duration of auto unavailability. Very helpful in the event you rely on your automobile for paintings or different crucial actions. | Does not at once quilt the price of maintenance or substitute. It is a supplementary protection. |

| Complete | Covers damages from quite a lot of perils, comparable to climate occasions, vandalism, or injuries with animals. | Supplies wide coverage in opposition to sudden damages. | Does not quilt the prices related to the time your automobile is unusable. |

| Collision | Covers damages attributable to collisions with different cars or gadgets. | Supplies coverage for damages from injuries. | Does not quilt the prices related to the time your automobile is unusable. |

Illustrative Eventualities

Lack of use protection, an important a part of your automobile insurance coverage, steps in when your automobile is unavailable to be used because of unexpected instances. Figuring out those situations will allow you to admire the assurance this protection provides. Believe having the ability to proceed your day-to-day existence with out the monetary pressure of a automobile mishap, due to the reinforce of your coverage!Lack of use protection kicks in when your automobile is out of fee because of occasions like injuries, robbery, or harm requiring restore.

It is helping catch up on the bills you incur whilst your automobile is unusable. Figuring out the way it works in numerous scenarios will supply treasured insights into the advantages and barriers of this protection.

Automobile Totaled in an Twist of fate

Lack of use protection is especially helpful when your automobile is deemed a complete loss in an twist of fate. This implies the restore price exceeds the automobile’s price, making maintenance impractical.

-

Your automobile is totally totaled in a fender bender. You want to get round, and the restore prices are astronomical. Lack of use protection will allow you to quilt the price of selection transportation, like taxis or ride-sharing products and services, whilst your automobile is being changed. This protection too can allow you to quilt the price of any essential bills.

The precise quantity of repayment depends upon your coverage phrases and the bills incurred.

- The insurance coverage corporate deems the automobile past restore after an important twist of fate. This protection is helping you quilt the price of a condominium automobile, public shipping, or ride-sharing products and services whilst the insurance coverage corporate processes the declare and arranges for a brand new automobile. The possible prices come with condominium charges, fuel bills, and attainable inconvenience.

- The twist of fate comes to considerable harm. In case your automobile is totaled, your lack of use protection offers you a financial repayment to hide the brief inconvenience brought about through the shortcoming to make use of your automobile. The ease lies in keeping off the disruption on your day-to-day existence whilst the declare is being processed and a brand new automobile is being bought.

Robbery of Your Automobile

Although your automobile is stolen, lack of use protection is there that will help you. This protection will lend a hand you with the monetary implications whilst your automobile is recovered or changed.

- Your automobile is stolen, leaving you stranded. Lack of use protection will supply repayment for selection transportation bills, together with ride-sharing products and services, taxis, or public transportation. This protection will allow you to care for your day-to-day regimen whilst looking forward to the government to recuperate your automobile or the insurance coverage corporate to settle the declare.

- Your automobile is stolen and broken. The protection supplies help with brief transportation prices whilst the police examine and your automobile is recovered or repaired. It may additionally assist with any further prices related to the robbery, comparable to brief lodging or different bills.

- The automobile is stolen and unrecoverable. Lack of use protection allow you to with the brief transportation prices when you download a brand new automobile or till the police to find the stolen automobile. This protection will lend a hand you in keeping up your day-to-day existence and regimen.

Automobile Harm Requiring Prolonged Restore

Every so often, a automobile twist of fate or incident necessitates intensive maintenance.

- Your automobile wishes intensive maintenance. Lack of use protection will assist quilt the price of brief transportation whilst your automobile is within the store. This allow you to steer clear of monetary burdens and make sure you’ll proceed your day-to-day routines.

- The auto is broken past restore, or a brand new section is unavailable. Lack of use protection supplies brief transportation answers whilst the automobile is underneath restore. The possible prices come with transportation bills and different incidental prices.

- The maintenance take longer than anticipated. Lack of use protection can quilt brief transportation bills all through the prolonged restore duration. This protection can save you monetary hardship all through a long restore procedure.

Significance of Figuring out Phrases and Prerequisites

Figuring out the particular phrases and stipulations of your lack of use protection is an important.

Overview your coverage sparsely to grasp the protection limits, exclusions, and procedures. This will likely allow you to make knowledgeable choices and be sure you get probably the most from your protection.

Shopper Recommendation and Pointers

Hai semuanya! Selecting the proper automobile insurance coverage lack of use protection generally is a bit tough, however do not be disturbed, we are right here that will help you navigate the method comfortably, like a seasoned Palembang motive force! Figuring out your choices and realizing your rights is essential to getting the most efficient conceivable coverage.This phase will supply sensible recommendation, making sure you might be well-equipped to make knowledgeable choices about lack of use protection and navigate claims processes like a professional.

Opting for the Proper Lack of Use Protection

Selecting the best lack of use protection is an important for shielding your monetary well-being in case of an twist of fate. Imagine the price of your automobile, the level of the maintenance, and your attainable source of revenue loss all through the restore duration. A complete protection may give a security internet if your automobile is unusable for a longer duration because of an twist of fate or different coated tournament.

Do not simply snatch the most cost effective choice; evaluation the protection limits to make sure it aligns along with your wishes and expectancies.

Studying Your Coverage Paperwork Sparsely

Totally reviewing your coverage paperwork is very important to figuring out your rights and obligations. Pay shut consideration to the specifics of lack of use protection, together with the stipulations underneath which it applies, the utmost payout quantity, and any exclusions. Figuring out those main points will save you any unsightly surprises all through a declare procedure. Search for readability and specifics, now not simply wide statements.

Ask questions if one thing is not transparent.

Negotiating with Insurance coverage Firms All over a Declare

When submitting a declare, a well mannered and assertive method can considerably strengthen your possibilities of a beneficial consequence. Obviously and concisely provide your case, documenting all related knowledge, comparable to restore estimates and source of revenue loss. Be ready to supply supporting proof. If you are feeling the insurance coverage corporate is not being honest, search skilled steering. Take note, you’ve rights, and you need to to give protection to them.

Be skilled and protracted, but in addition affected person and figuring out.

Searching for Criminal Recommendation, Lack of use protection automobile insurance coverage

There are cases the place in search of felony recommend is beneficial. For those who come across vital stumbling blocks all through the declare procedure, or if you are feeling the insurance coverage corporate is not pleasant their contractual tasks, in search of felony recommendation may also be really useful. As an example, if the insurance coverage corporate delays or denies your declare with out legitimate justification, consulting a felony skilled is a brilliant step.

Do not hesitate to hunt assist when essential. Your rights are essential, and felony illustration can give protection to them.

Illustrative Examples of Eventualities Requiring Criminal Recommendation

Listed below are some examples the place in search of felony recommendation is sensible:

- The insurance coverage corporate denies your declare with out a transparent clarification or justification, resulting in vital monetary hardship.

- The insurance coverage corporate provides a agreement quantity that falls considerably quick of the particular damages incurred, together with the lack of use.

- The insurance coverage corporate refuses to catch up on misplaced source of revenue all through the duration of vehicle restore, regardless of the protection explicitly together with such losses.

- The insurance coverage corporate misrepresents or ignores related coverage clauses or provisions similar for your lack of use declare.

Finish of Dialogue

In conclusion, lack of use protection automobile insurance coverage is an important part of any complete automobile insurance coverage. Figuring out the scope of this protection, its attainable advantages, and the accompanying barriers empowers you to make knowledgeable choices about your insurance coverage wishes. Thorough analysis and cautious attention of your particular instances are key to maximizing the security this protection provides.

Take note, each and every coverage is exclusive, and consulting your insurance coverage supplier is an important for customized steering.

Questions Incessantly Requested

What are not unusual exclusions for lack of use protection?

Commonplace exclusions incessantly come with pre-existing stipulations, intentional harm, or use of the automobile for unlawful actions. Coverage specifics range, so at all times seek the advice of your coverage paperwork for whole main points.

How lengthy does the declare procedure generally take?

Declare processing timelines rely at the insurance coverage corporate and the complexity of the declare. Most often, it will possibly vary from a couple of weeks to a number of months. Components just like the completeness of documentation and the desire for value determinations can have an effect on the time frame.

What paperwork are wanted for a lack of use declare?

Crucial paperwork most often come with police experiences (if appropriate), restore estimates, and evidence of condominium automobile bills. Particular necessities range through insurance coverage corporate; refer for your coverage for exact main points.

How does lack of use protection examine to complete protection?

Lack of use protection addresses the monetary have an effect on of a automobile being unusable, whilst complete protection generally can pay for harm for your automobile, without reference to fault. Lack of use is an ancillary receive advantages that enhances complete protection. They serve as independently, with lack of use overlaying consequential prices associated with the automobile’s unavailability and complete protection addressing the bodily harm to the automobile itself.