Automobile insurance coverage in lafayette los angeles – Automobile insurance coverage in Lafayette, LA, is a a very powerful facet of accountable possession. This information supplies a radical evaluate of the native marketplace, exploring the particular wishes of Lafayette citizens, the quite a lot of protection choices, and price components. We will delve into standard insurers, inexpensive choices, coverage main points, and techniques to offer protection to your coverage.

Figuring out the nuances of vehicle insurance coverage in Lafayette, LA is important for making knowledgeable selections. This complete useful resource will equip you with the information to navigate the complexities of the native insurance coverage panorama and safe the most efficient imaginable protection on the best worth.

Review of Lafayette LA Automobile Insurance coverage: Automobile Insurance coverage In Lafayette L. a.

Lafayette, Louisiana, like different spaces, faces a posh automotive insurance coverage marketplace influenced by means of components equivalent to regional demographics, twist of fate charges, and to be had insurance coverage suppliers. Figuring out those components is a very powerful for citizens searching for inexpensive and complete protection. This evaluate explores the nuances of vehicle insurance coverage in Lafayette, highlighting standard wishes, to be had varieties, and related prices.The automobile insurance coverage panorama in Lafayette, LA, is formed by means of a mixture of components.

Those come with the superiority of explicit automobile varieties, the frequency of visitors injuries, and the contest among insurance coverage suppliers. Those components in the long run resolve the associated fee and availability of protection for drivers.

Standard Insurance coverage Wishes and Considerations of Lafayette Citizens

Lafayette citizens, like many within the area, often face considerations associated with the price of protection and the extent of coverage presented. The will for complete protection that addresses possible injury to their automobiles, accidents to themselves and others, and legal responsibility for injuries is paramount. Many citizens also are involved in regards to the explicit protection required by means of Louisiana legislation, equivalent to uninsured/underinsured motorist protection.

Other Varieties of Automobile Insurance coverage To be had in Lafayette, LA

Different types of automotive insurance coverage insurance policies are to be had in Lafayette, every providing various ranges of coverage and protection. Those insurance policies are adapted to handle other dangers and desires. Legal responsibility protection protects towards monetary duty for damages to others in an twist of fate. Collision protection will pay for damages to the insured automobile irrespective of fault. Complete protection will pay for injury to the insured automobile from reasons as opposed to collision, equivalent to vandalism or climate occasions.

Uninsured/underinsured motorist protection protects the insured within the tournament of an twist of fate with a driving force who’s uninsured or underinsured.

Commonplace Reductions Presented by means of Insurance coverage Suppliers

Insurance coverage suppliers in Lafayette, LA, incessantly be offering reductions to inspire accountable riding behavior and fiscal duty. Examples of commonplace reductions come with the ones for secure riding, multi-vehicle insurance policies, and just right scholar standing. Insurance coverage firms additionally often be offering reductions to drivers who care for a just right riding document and use security features like anti-theft units.

Comparability of Automobile Insurance coverage Prices in Lafayette, LA to Different Louisiana Towns

A comparability of vehicle insurance coverage prices in Lafayette, LA, with different Louisiana towns will also be complicated. Diversifications exist in response to particular person riding profiles, the particular protection applications selected, and the insurer decided on. Then again, information from quite a lot of resources means that insurance coverage charges in Lafayette would possibly align with the ones of alternative in a similar fashion sized towns within the state. Components influencing pricing come with regional twist of fate statistics, and the native insurance coverage marketplace dynamics.

Components Affecting Automobile Insurance coverage Prices in Lafayette LA

Automobile insurance coverage premiums in Lafayette, LA, like in different places, are influenced by means of a posh interaction of things past merely the automobile’s make and style. Figuring out those parts is a very powerful for citizens to make knowledgeable selections about their protection and budgeting. Those components are incessantly interconnected, and a deficient riding document, for example, can considerably building up insurance coverage prices, although the automobile is new and well-maintained.Insurance coverage suppliers in Lafayette, LA, meticulously assess quite a lot of parts to resolve the proper top class for every policyholder.

This multifaceted analysis considers now not most effective the person’s riding historical past but additionally the kind of automobile, the site of place of abode, and claims historical past. Those exams, whilst incessantly opaque, assist insurance coverage firms organize threat and make sure sustainable operations.

Using Report Have an effect on on Insurance coverage Charges

Using information are a number one determinant of vehicle insurance coverage premiums in Lafayette, LA. A blank riding document, devoid of injuries or visitors violations, normally ends up in decrease premiums. Conversely, drivers with a historical past of injuries or shifting violations face considerably upper premiums. Insurance coverage firms view a historical past of violations as indicative of a better threat of long run claims.

As an example, a driving force with a couple of rushing tickets would possibly see a 20-30% building up of their top class. In a similar fashion, an at-fault twist of fate may building up premiums by means of a substantial margin, relying at the severity of the incident and the related damages.

Automobile Kind Have an effect on on Automobile Insurance coverage Prices

The kind of automobile considerably affects insurance coverage premiums. Prime-performance automobiles, sports activities automobiles, or automobiles with upper robbery threat have a tendency to have upper insurance coverage premiums. Conversely, smaller, economical automobiles incessantly include decrease premiums. Components such because the automobile’s make, style, and yr of manufacture all give a contribution to the general top class quantity. As an example, a luxurious sports activities automotive will in most cases have a better top class than a compact sedan, because of the upper chance of wear or robbery.

Moreover, automobiles with complicated security features would possibly obtain a slight cut price, reflecting the diminished threat to the insurance coverage corporate.

Location and Demographics Have an effect on on Insurance coverage Charges

Location performs a a very powerful function in Lafayette, LA automotive insurance coverage charges. Spaces with upper crime charges or twist of fate concentrations in most cases have upper premiums. Demographic components, equivalent to age and gender, additionally affect insurance coverage prices. More youthful drivers incessantly face upper premiums in comparison to older drivers, as they’re statistically extra vulnerable to injuries. Geographic permutations inside of Lafayette, LA, would possibly result in slight charge variations in positive neighborhoods, reflecting the original threat profiles of the ones spaces.

The proximity to high-traffic intersections or recognized twist of fate hotspots may give a contribution to better premiums for the ones living within the neighborhood.

Claims Historical past Affect on Lafayette, LA Insurance coverage Premiums

A driving force’s claims historical past considerably impacts insurance coverage premiums in Lafayette, LA. Drivers with a historical past of submitting claims for injuries or injury to their automobiles incessantly face considerably upper premiums. This displays the higher threat related to those that have had prior claims. Repeated claims reveal a better chance of long run claims, prompting insurance coverage firms to regulate premiums accordingly.

As an example, a driving force who has filed two claims throughout the remaining 3 years may see a 30-50% building up of their top class.

Correlation Between Components and Price Will increase

| Issue | Description | Have an effect on on Price |

|---|---|---|

| Using Report | Injuries, violations, riding historical past | Upper premiums for drivers with injuries or violations; decrease premiums for the ones with blank information |

| Automobile Kind | Prime-performance, luxurious, or older automobiles | Upper premiums for high-performance or luxurious automobiles, doubtlessly decrease for more recent automobiles with complicated security features |

| Location | Prime-crime spaces, twist of fate hotspots, proximity to intersections | Upper premiums in spaces with upper twist of fate concentrations or crime charges |

| Claims Historical past | Earlier claims for injuries or damages | Upper premiums for drivers with a historical past of claims, doubtlessly reflecting a better threat of long run claims |

Standard Insurance coverage Suppliers in Lafayette LA

Lafayette, LA, drivers have a number of automotive insurance coverage choices to be had, however choosing the proper supplier can considerably affect prices and protection. Figuring out the strengths and weaknesses of various firms is a very powerful for making an educated determination. Components like monetary balance, customer support, and explicit protection choices presented range between insurers, impacting the entire cost proposition for native drivers.An intensive exam of standard insurance coverage suppliers in Lafayette, LA, taking into account their popularity, monetary balance, and the particular wishes of native drivers, permits for a more practical comparability.

Key Insurance coverage Firms Serving Lafayette, LA

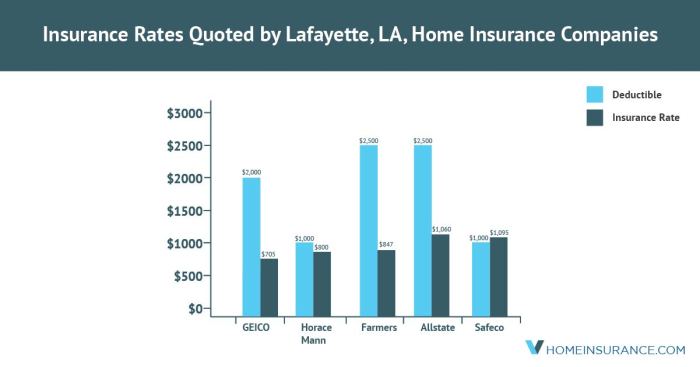

A number of insurance coverage firms are outstanding within the Lafayette, LA marketplace, every with its personal strategy to pricing, protection, and customer support. Figuring out those firms’ distinctive traits can support drivers in deciding on probably the most appropriate coverage.

- State Farm: A national massive, State Farm is a well-established identify in Lafayette, recognized for its intensive community of native brokers. Drivers incessantly recognize the personalised carrier and readily to be had fortify presented by means of those brokers. Then again, State Farm’s pricing would possibly now not at all times be probably the most aggressive, and the breadth of specialised protection choices would possibly now not at all times fit the desires of all drivers.

- Revolutionary: Revolutionary incessantly objectives more youthful drivers and the ones searching for decrease premiums. Their on-line platform gives a user-friendly revel in for coverage control. Then again, drivers will have to in moderation believe their protection choices and the specifics in their coverage, as Revolutionary’s protection applications won’t at all times be offering the similar stage of customization as different suppliers.

- Geico: Geico is every other well known national insurer with a considerable presence in Lafayette. Their promoting incessantly emphasizes low premiums, making them horny to budget-conscious drivers. Then again, drivers will have to take note of any possible obstacles in protection or customer support fortify in comparison to firms with extra intensive native networks.

- Allstate: Allstate supplies a balanced means, providing protection choices for quite a lot of drivers. They incessantly have a forged popularity for customer support, with a big presence within the house. Then again, their pricing won’t at all times align with probably the most aggressive charges to be had out there.

- Farmers Insurance coverage: Farmers Insurance coverage is a regional insurer with a powerful presence in Lafayette, incessantly related to dependable carrier. Drivers would possibly recognize the localized fortify and adapted strategy to coverage choices. Then again, they won’t at all times be offering probably the most aggressive charges out there in comparison to nationwide suppliers.

Buyer Carrier Recognition

Customer support varies significantly amongst insurers. The extent of fortify, responsiveness, and total revel in drivers have with every corporate can affect their selection. Drivers incessantly prioritize a clean claims procedure and simple get right of entry to to fortify representatives when assessing customer support.

- State Farm incessantly receives certain comments in regards to the availability and responsiveness in their native brokers. They often excel in offering instructed and environment friendly help with coverage changes and declare dealing with.

- Revolutionary makes use of on-line platforms, which will also be handy for some drivers. Then again, some customers have reported difficulties with navigating their virtual programs and attaining customer support representatives.

- Geico in most cases maintains a powerful on-line presence, however direct conversation with brokers could be restricted. Their on-line assets will also be useful for fast coverage knowledge, however navigating extra complicated problems would possibly require further effort.

- Allstate incessantly receives comments that their customer support representatives are useful and succesful. Then again, their availability for fast help would possibly range.

- Farmers Insurance coverage, incessantly famous for its regional focal point, normally garners favorable evaluations in regards to the personalised strategy to customer support and coverage changes.

Monetary Balance and Scores

Insurers’ monetary energy is a a very powerful issue for drivers. A financially solid corporate is much more likely to satisfy its responsibilities in case of a big declare. A powerful monetary profile is very important for long-term coverage.

| Corporate | Protection Choices | Price | Buyer Ranking ||—|—|—|—|| State Farm | Complete protection choices, together with automobile alternative | Reasonable | 4.2/5 || Revolutionary | Reasonably priced premiums, explicit reductions to be had | Aggressive | 3.9/5 || Geico | In depth protection, excessive buyer base | Low | 4.0/5 || Allstate | Huge number of choices, together with personalised protection | Reasonable | 4.1/5 || Farmers Insurance coverage | Sturdy regional presence, just right cost for cash | Reasonable | 4.3/5 |Discovering Reasonably priced Automobile Insurance coverage in Lafayette LA

Navigating the automobile insurance coverage marketplace in Lafayette, LA, can really feel daunting. With quite a lot of suppliers and components influencing premiums, discovering probably the most inexpensive choice calls for strategic making plans and analysis. Figuring out the method for evaluating quotes and using to be had assets is essential to securing the most efficient imaginable charges.Efficient comparability buying groceries is very important for securing probably the most aggressive charges. By way of taking into account a couple of suppliers and in moderation comparing their choices, Lafayette citizens can considerably scale back their insurance coverage prices.

Leveraging on-line gear and assets simplifies this procedure, offering a streamlined strategy to discovering inexpensive automotive insurance coverage.

Methods for Discovering the Maximum Reasonably priced Automobile Insurance coverage

A proactive strategy to securing inexpensive automotive insurance coverage comes to a number of key methods. Comparability buying groceries, bundling insurance coverage insurance policies, and working out reductions are all efficient the right way to decrease premiums. Using on-line comparability gear can considerably expedite this procedure, providing a wealth of choices to choose between.

Evaluating Quotes from Other Suppliers

Evaluating quotes from a couple of insurance coverage suppliers is a very powerful for figuring out probably the most inexpensive choices. This procedure calls for accumulating knowledge from quite a lot of firms, comparing protection choices, and working out the criteria influencing top class prices. Figuring out every supplier’s explicit insurance policies and protection main points is paramount in making an educated determination. As an example, one supplier would possibly be offering decrease charges for drivers with a blank riding document, whilst every other would possibly emphasize reductions for bundling insurance policies.

Assets for Discovering and Evaluating Automobile Insurance coverage Charges

A large number of assets are to be had to Lafayette citizens searching for inexpensive automotive insurance coverage. On-line comparability internet sites are a precious instrument, permitting customers to enter their knowledge and obtain quotes from a couple of suppliers. Native insurance coverage brokers too can supply personalised recommendation and steerage, tailoring protection choices to particular person wishes. Moreover, client coverage companies and fiscal advisors can give independent knowledge on insurance coverage insurance policies and charges.

The usage of On-line Comparability Equipment for Lafayette Automobile Insurance coverage

On-line comparability gear have revolutionized the automobile insurance coverage marketplace, making it more straightforward for Lafayette citizens to search out inexpensive charges. Those gear acquire knowledge from quite a lot of suppliers and provide it in a user-friendly layout, enabling swift comparisons. Inputting private main points and automobile knowledge permits the gear to generate custom designed quotes, offering a complete evaluate of to be had choices. A person can briefly see the fee variations between quite a lot of insurance policies and protection ranges, enabling knowledgeable selections.

Step-by-Step Information to Acquiring Automobile Insurance coverage Quotes

This step by step information supplies a structured strategy to acquiring automotive insurance coverage quotes in Lafayette, LA:

- Acquire Data: Accumulate important main points, together with automobile knowledge, riding historical past, and desired protection ranges.

- Make the most of Comparability Equipment: Enter information into on-line comparability internet sites to obtain quotes from a couple of suppliers.

- Assessment Quotes: Sparsely examine quotes in response to protection, premiums, and further advantages.

- Touch Suppliers: Inquire about any further reductions or choices from the suppliers that appear favorable.

- Make a Choice: Make a choice the coverage that most closely fits your wishes and price range.

The Significance of Bundling Insurance coverage Insurance policies

Bundling insurance coverage insurance policies, equivalent to combining automotive insurance coverage with house owners or renters insurance coverage, can incessantly result in important price financial savings for Lafayette citizens. This technique leverages the economies of scale, enabling insurance coverage firms to provide discounted charges for a couple of insurance policies below one account. As an example, a house owner who bundles their automotive and residential insurance coverage would possibly see a 5-10% relief of their total premiums.

Bundling insurance coverage insurance policies is a cheap option to organize insurance coverage wishes, in particular in Lafayette, LA, the place the prices of insurance coverage will also be considerable.

Figuring out Automobile Insurance coverage Insurance policies in Lafayette LA

Navigating the complexities of vehicle insurance coverage can really feel daunting, particularly in a particular location like Lafayette, LA. Figuring out the quite a lot of coverages, phrases, and possible exclusions is a very powerful for securing good enough coverage and heading off pricey surprises. This complete information clarifies the very important parts of vehicle insurance coverage insurance policies in Lafayette, outlining various kinds of protection, highlighting the significance of coverage evaluation, and offering insights into commonplace claims.

Varieties of Protection To be had in Lafayette LA Automobile Insurance coverage Insurance policies, Automobile insurance coverage in lafayette los angeles

Automobile insurance coverage insurance policies in Lafayette, LA, in most cases be offering a mix of coverages. Figuring out those differing kinds is essential to tailoring a coverage to particular person wishes. Other insurance policies may have other obstacles and exclusions, so it is a very powerful to scrupulously evaluation the particular phrases and prerequisites.

- Legal responsibility protection protects you in case you are at fault for an twist of fate, overlaying damages to the opposite driving force and their automobile.

- Collision protection will pay for damages for your automobile irrespective of who’s at fault in an twist of fate.

- Complete protection covers damages for your automobile from occasions as opposed to injuries, equivalent to robbery, vandalism, or weather-related incidents.

- Uninsured/Underinsured Motorist Protection protects you in case you are excited about an twist of fate with a driving force who does not have insurance coverage or does not have sufficient insurance coverage to hide the damages.

- Private Harm Coverage (PIP) supplies protection for clinical bills and misplaced wages for you and your passengers in an twist of fate, irrespective of who’s at fault.

Significance of Studying and Figuring out Coverage Phrases in Lafayette, LA

Sparsely reviewing and working out the phrases and prerequisites of your automotive insurance coverage is very important. Insurance policies incessantly comprise tremendous print that can exclude positive scenarios or prohibit the scope of protection. Failure to know those main points can result in surprising prices and diminished coverage.

Commonplace Exclusions and Barriers in Lafayette LA Automobile Insurance coverage Insurance policies

Insurance policies in most cases come with exclusions and obstacles to outline the scope of protection. Figuring out those is important to steer clear of surprises.

- Pre-existing prerequisites, equivalent to a previous twist of fate, would possibly impact protection.

- Sure actions, equivalent to racing or riding inebriated or medicine, would possibly void protection.

- Use of the automobile for unlawful actions can result in coverage cancellations or claims denials.

- Explicit geographic places or riding patterns would possibly affect premiums and protection availability.

- Protection could also be diminished for automobiles that experience a historical past of robbery or injuries.

Examples of Commonplace Automobile Insurance coverage Claims in Lafayette, LA

Claims in Lafayette, LA, can range, however some commonplace varieties come with:

- Belongings injury claims bobbing up from injuries involving different automobiles or gadgets.

- Robbery claims involving automobiles parked in public or personal places.

- Claims because of vandalism, equivalent to injury to the automobile’s external or inside.

- Harm claims involving private damage coverage (PIP) for accidents to the driving force or passengers.

Legal responsibility, Collision, and Complete Protection Defined

Those coverages are elementary to a complete automotive insurance coverage.

- Legal responsibility protection protects towards monetary duty for damages to someone else’s belongings or accidents to someone else that happen on account of your movements. It does now not duvet damages for your automobile.

- Collision protection will pay for damages for your automobile in an twist of fate, irrespective of who’s at fault. That is essential for maintenance or alternative of your automobile.

- Complete protection supplies coverage for damages for your automobile from non-collision occasions. Examples come with robbery, vandalism, hail injury, or hearth injury.

Reviewing Protection Choices In line with Person Wishes

Assessing particular person riding behavior, automobile sort, and fiscal state of affairs are a very powerful in deciding on suitable protection. Tailoring protection to those components guarantees the coverage aligns together with your explicit wishes and avoids needless prices.

Guidelines for Protective Your Automobile Insurance coverage in Lafayette LA

Keeping up a powerful automotive insurance coverage in Lafayette, LA, calls for proactive measures to safeguard protection and steer clear of pricey problems. This comes to working out the prospective pitfalls of fraud, combating coverage cancellations, and upholding a riding document that displays accountable behavior. Correct automobile upkeep and using respected insurance coverage brokers additionally play a very powerful roles in protective your coverage’s integrity.Protective your automotive insurance coverage in Lafayette, LA, comes to a multifaceted means that is going past merely paying premiums.

It encompasses working out the quite a lot of components that may affect your protection, from heading off fraudulent actions to keeping up a blank riding document. By way of following those a very powerful steps, citizens can make sure that their insurance coverage stays legitimate and inexpensive.

Methods for Fighting Insurance coverage Fraud

Fraudulent actions can considerably affect your automotive insurance coverage, resulting in pricey repercussions. Figuring out the caution indicators of fraud is very important for shielding your protection. Be cautious of people making an attempt to make false claims or impersonate you to make fraudulent claims. Examine any requests for info or paperwork together with your insurance coverage corporate immediately to steer clear of falling sufferer to fraudulent schemes.

Measures to Steer clear of Coverage Cancellations or Charge Will increase

Keeping up a blank riding document and adhering to coverage phrases are a very powerful for combating coverage cancellations or charge will increase. Steer clear of visitors violations and care for accountable riding behavior to stay your premiums inexpensive and your protection intact. Promptly reporting injuries and following thru with all required documentation can assist mitigate possible problems.

Significance of Keeping up a Excellent Using Report

A favorable riding document immediately affects your automotive insurance coverage premiums. A blank riding document demonstrates accountable conduct at the street, which incessantly interprets to decrease premiums. Fending off visitors violations, keeping up secure riding practices, and making sure your automobile registration is up-to-date are all a very powerful facets of holding a positive riding document. As an example, a rushing price tag or an twist of fate can result in an important building up in insurance coverage charges.

Guidelines for Keeping up Correct Automobile Repairs

Correct automobile upkeep can assist save you injuries and claims, in the long run reaping benefits your automotive insurance coverage. Common upkeep, equivalent to oil adjustments and tire rotations, can prolong the lifetime of your automobile and scale back the chance of mechanical disasters. Adhering to manufacturer-recommended upkeep schedules can assist save you surprising breakdowns and injuries that would cause claims. Making sure your automobile is frequently inspected and serviced can assist steer clear of possible injuries and needless maintenance, which will affect your insurance coverage premiums.

Advantages of The usage of a Respected Insurance coverage Agent

Using a credible insurance coverage agent can give precious help in navigating the complexities of vehicle insurance coverage insurance policies. A an expert agent help you perceive your coverage main points, give an explanation for possible dangers, and supply steerage on keeping up protection. An agent can assist examine other coverage choices, making sure you’ve got probably the most suitable protection in your wishes and price range. They are able to additionally supply help in dealing with claims and addressing any considerations you will have.

Staying Knowledgeable About Insurance coverage Coverage Updates and Adjustments

Staying up to date on insurance coverage updates and adjustments is very important for keeping up correct protection. Coverage phrases and prerequisites can alternate through the years, so it’s a must to stay knowledgeable about any updates or revisions for your explicit coverage. Reviewing your coverage frequently help you determine any adjustments and make sure your protection aligns together with your wishes. Checking for updates thru your insurance coverage supplier’s web page or contacting your agent is a great apply.

Ultimate Conclusion

In conclusion, acquiring the fitting automotive insurance coverage in Lafayette, LA, comes to cautious attention of things like riding document, automobile sort, and site. By way of evaluating quotes, working out coverage specifics, and protective your coverage, you’ll make sure that monetary safety and peace of thoughts. This information supplies a powerful basis for making knowledgeable alternatives and navigating the native insurance coverage marketplace.

Query Financial institution

What are the standard insurance coverage wishes and considerations for Lafayette, LA citizens?

Lafayette citizens, like many drivers, incessantly prioritize legal responsibility protection, because it protects them from monetary duty within the tournament of an twist of fate. Considerations incessantly come with discovering inexpensive charges, working out coverage specifics, and securing protection for his or her specific riding wishes, equivalent to a high-value automobile or common out-of-state trip.

What reductions are in most cases to be had for Lafayette, LA automotive insurance coverage?

Reductions can range by means of insurer, however commonplace reductions incessantly come with the ones for secure riding information, a couple of automobiles insured with the similar corporate, and automobile anti-theft units.

How does location impact automotive insurance coverage charges in Lafayette, LA?

Location performs a job in Lafayette, LA, automotive insurance coverage charges. Components equivalent to visitors quantity, twist of fate frequency, and proximity to different high-risk spaces can affect premiums.

What are the stairs to check quotes from other insurance coverage suppliers in Lafayette, LA?

Evaluating quotes comes to the usage of on-line comparability gear, contacting a couple of suppliers immediately, and reviewing protection choices for the most efficient cost. Do not hesitate to invite questions and explain any uncertainties.