Does long-term care insurance coverage duvet impartial dwelling? This query probes a the most important side of senior care making plans. Figuring out the nuances of protection is essential for people in quest of to protected their long run and make sure suitable enhance of their selected dwelling preparations.

This complete research delves into the intricacies of long-term care insurance coverage insurance policies, analyzing their provisions for impartial dwelling bills. We’re going to discover the quite a lot of forms of insurance policies, their doable protection, and the standards influencing protection choices. This will likely permit a clearer figuring out of the position long-term care insurance coverage performs in facilitating impartial dwelling preparations for seniors.

Figuring out Impartial Dwelling: Does Lengthy-term Care Insurance coverage Quilt Impartial Dwelling

Impartial dwelling amenities be offering a supportive and relaxed atmosphere for seniors who need a top level of autonomy whilst playing group engagement. Those amenities are designed to cater to the precise wishes of seniors who can take care of their independence and self-sufficiency however recognize the added comfort and social interplay of a communal surroundings. They supply a spread of services and products and facilities adapted to strengthen their high quality of existence.

Impartial Dwelling Amenities: A Detailed Description

Impartial dwelling amenities are designed for seniors who’re rather wholesome and cell, in quest of a maintenance-free way of life with alternatives for social interplay and group involvement. Those communities in most cases be offering a number of facilities, similar to well-maintained residences, commonplace spaces, eating halls, and get admission to to leisure amenities. Many come with transportation services and products, housework, and scheduled actions. The extent of enhance supplied varies, however it’s in most cases much less extensive than in assisted dwelling or nursing houses.

The focal point is on fostering independence and a way of group, whilst making sure security and safety.

Impartial Dwelling vs. Different Senior Housing Choices

Impartial dwelling differs considerably from different senior housing choices. Assisted dwelling amenities supply a better degree of enhance, together with help with day by day duties similar to bathing, dressing, and drugs control, adapted to citizens with expanding care wishes. Nursing houses be offering probably the most extensive degree of care, offering 24-hour clinical supervision and deal with citizens requiring in depth clinical help.

Impartial dwelling amenities, by contrast, are essentially designed for many who can set up their day by day wishes independently. They are perfect for seniors who wish to take care of their autonomy and way of life whilst playing the advantages of a group. A key distinction lies within the level of help and enhance presented.

Conventional Day-to-day Routines and Actions

Day-to-day routines in impartial dwelling communities are versatile and range in keeping with resident personal tastes. Citizens in most cases set up their very own schedules, take part in actions, or have interaction in spare time activities. Many amenities be offering a number of scheduled actions, similar to workout categories, social gatherings, tutorial techniques, and outings. Eating amenities are steadily communal, providing alternatives for social interplay right through foods.

Citizens are inspired to take care of their independence and take part locally’s actions at their very own tempo and pastime.

Ranges of Reinforce and Help

The degrees of enhance and help in impartial dwelling are considerably much less extensive than in assisted dwelling or nursing houses. Citizens take care of their independence in day by day actions, even though some amenities would possibly be offering not obligatory help with duties like transportation or gentle housework. The principle center of attention is on offering a protected and supportive atmosphere, with readily to be had body of workers to deal with any emergencies or issues.

The extent of enhance presented is the most important in selecting the best group for person wishes.

Comparability of Senior Housing Choices

| Function | Impartial Dwelling | Assisted Dwelling | Nursing House |

|---|---|---|---|

| Facilities | Residences, commonplace spaces, eating, game, transportation | Residences, commonplace spaces, eating, game, help with ADLs, drugs control | Non-public or shared rooms, eating, game, 24-hour hospital treatment |

| Stage of Care | Minimum; essentially fascinated with security and safety | Average; help with day by day dwelling actions (ADLs) | Top; 24-hour clinical supervision and care |

| Value | Most often not up to assisted dwelling or nursing houses | Upper than impartial dwelling, not up to nursing houses | Best some of the 3 choices |

Impartial dwelling amenities be offering a balanced option to senior housing, hanging a stability between autonomy and group.

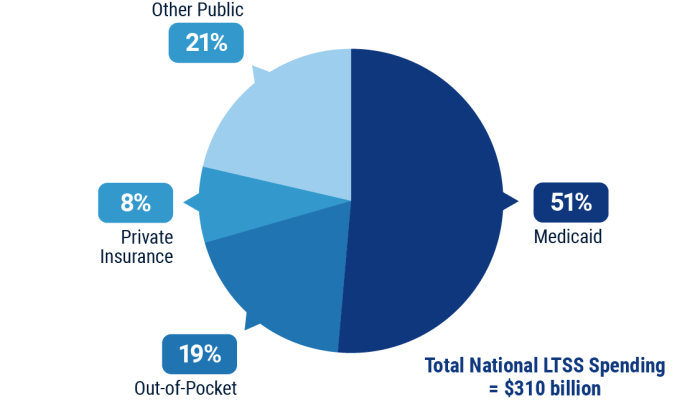

Lengthy-Time period Care Insurance coverage Protection

Lengthy-term care insurance coverage is a specialised form of insurance coverage designed to hide the prices of long-term care services and products. It is the most important to take into account that this protection is distinct from conventional medical insurance, which in most cases specializes in temporary diseases and accidents. Lengthy-term care insurance coverage objectives to supply monetary help for prolonged care wishes, similar to the ones coming up from continual prerequisites, disabilities, or the growing older procedure.Lengthy-term care insurance coverage insurance policies can considerably scale back the monetary burden on folks and households going through extended care wishes.

The particular protection and advantages range extensively relying at the coverage, so cautious attention and comparability are very important.

Coverage Sorts and Protection Choices

Lengthy-term care insurance coverage insurance policies are available in quite a lot of bureaucracy, each and every providing other protection choices. Those choices are adapted to express wishes and budgets. Figuring out the to be had coverage sorts is the most important for deciding on probably the most suitable protection. Not unusual sorts come with those who supply advantages in keeping with a day by day or per thirty days fee for knowledgeable care services and products.

Protection Choices

Insurance policies steadily be offering a spread of protection choices. Some insurance policies center of attention on offering advantages for knowledgeable nursing amenities, whilst others additionally come with protection for domestic well being care services and products. There may well be choices to hide assisted dwelling amenities, and a few insurance policies even be offering a mixture of those services and products.

Exclusions and Boundaries

Now not all bills are coated below long-term care insurance coverage. Insurance policies in most cases exclude positive forms of care or prerequisites. For instance, some insurance policies would possibly not duvet pre-existing prerequisites, or the care required would possibly want to be explicitly indexed within the coverage paperwork. Deductibles, ready classes, and receive advantages boundaries also are commonplace exclusions.

Coverage Construction and Pricing

Lengthy-term care insurance coverage insurance policies are structured to supply protection for a particular duration or lifetime, relying at the coverage. Top class prices are influenced through components such because the insured’s age, well being standing, and the specified degree of protection. Premiums are steadily calculated the use of actuarial fashions and would possibly range considerably between insurers and coverage sorts.

Not unusual Coverage Sorts, Advantages, and Prices

| Coverage Kind | Advantages | Related Prices |

|---|---|---|

| Conventional Lengthy-Time period Care Insurance coverage | Supplies advantages for a spread of care settings, together with professional nursing amenities, assisted dwelling, and residential well being care. Might be offering lifetime advantages or a particular duration. | Premiums are in most cases upper than different choices because of broader protection. The price is influenced through age, well being, and protection degree. |

| Hybrid Insurance policies (Combining Lengthy-Time period Care and Existence Insurance coverage) | Combines long-term care advantages with existence insurance plans. Some insurance policies would possibly come with a loss of life receive advantages or different benefits. | Prices are in most cases upper than a standalone existence insurance coverage because of the added long-term care element. The suitable price is dependent upon the precise coverage’s options. |

| Sped up Get advantages Insurance policies | Be offering the power to get admission to advantages previous within the tournament of a qualifying situation. The phrases and stipulations range extensively. | Those insurance policies steadily have upper premiums because of the speeded up receive advantages function. The suitable price is dependent upon the coverage’s specs. |

Protection for Impartial Dwelling

Lengthy-term care insurance coverage, whilst essentially designed to hide assisted dwelling and nursing domestic bills, would possibly once in a while prolong protection to impartial dwelling scenarios. This protection, on the other hand, isn’t same old and relies closely at the particular coverage phrases. Figuring out the nuances of those provisions is the most important for shoppers to as it should be assess the advantages presented.

Scenarios The place Impartial Dwelling Bills May Be Lined

Lengthy-term care insurance coverage insurance policies would possibly duvet impartial dwelling bills in scenarios the place a person calls for help to take care of their independence however does now not but want the extent of care supplied in assisted dwelling or nursing houses. This steadily comes to scenarios the place the person has purposeful boundaries however can nonetheless live of their domestic. Examples come with:

- House changes: If important domestic changes are vital to deal with declining bodily talents, those bills may probably be coated. For instance, ramps, seize bars, or specialised rest room fixtures may well be eligible.

- House healthcare services and products: Some insurance policies would possibly duvet the prices of in-home care, similar to help with private care, meal preparation, or drugs control, to lend a hand take care of impartial dwelling.

- Transportation help: If transportation turns into an important barrier to day by day actions, the prices of transportation services and products might be coated.

- Respite care: This kind of care, permitting number one caregivers a short lived wreck, might be coated if the insured person wishes help to stay of their impartial dwelling surroundings right through the respite duration.

Coverage Provisions for Impartial Dwelling Protection

A number of coverage provisions may probably duvet impartial dwelling prices. Those steadily come with:

- Definitions of “long-term care”: Some insurance policies can have broader definitions of long-term care that come with help with day by day dwelling actions in an impartial dwelling surroundings.

- House care advantages: Particular provisions that duvet domestic care services and products might be interpreted as appropriate to impartial dwelling scenarios.

- House amendment advantages: Insurance policies would possibly come with particular provisions masking cheap and vital domestic changes required for the person to stay of their impartial dwelling domestic.

Standards for Figuring out Protection

Insurers in most cases assess the person’s wishes and the desired degree of help. Elements regarded as steadily come with:

- Purposeful boundaries: The level to which the person wishes lend a hand with actions of day by day dwelling (ADLs) and instrumental actions of day by day dwelling (IADLs) is a key criterion.

- Clinical necessity: The insurer will most probably review whether or not the help required is medically vital to take care of impartial dwelling.

- Affordable and vital bills: Simplest bills deemed cheap and vital to take care of impartial dwelling can be coated.

Boundaries and Exclusions, Does long-term care insurance coverage duvet impartial dwelling

Now not all impartial dwelling bills are coated. Insurance policies in most cases have boundaries and exclusions, similar to:

- Protection caps: There is also limits at the overall quantity coated for impartial dwelling bills.

- Exclusions for regimen help: Regimen help that’s not medically vital may not be coated.

- Ready classes: Some insurance policies can have ready classes sooner than protection for impartial dwelling bills starts.

Protection Eventualities and Doable Coverage Sorts

| State of affairs | Coverage Kind | Protection Main points |

|---|---|---|

| Person calls for help with day by day duties, however can nonetheless are living independently. | Complete Lengthy-Time period Care Coverage | Doable protection for domestic healthcare, domestic changes, and respite care. |

| Person wishes help with mobility and calls for a wheelchair ramp for domestic get admission to. | Lengthy-Time period Care Coverage with House Amendment Advantages | Protection for ramp set up and different domestic changes, however most probably with boundaries on overall prices. |

| Person wishes lend a hand with meal preparation and drugs control. | Coverage with House Care Advantages | Imaginable protection for in-home help, relying at the coverage’s definition of long-term care and clinical necessity. |

Elements Influencing Protection Choices

Lengthy-term care insurance coverage insurance policies, whilst designed to help folks going through long run care wishes, don’t seem to be a common resolution. Protection for impartial dwelling, a the most important side of such insurance policies, is steadily influenced through a large number of things. Figuring out those components is very important for potential policyholders to make knowledgeable choices.

Pre-Current Stipulations

Pre-existing prerequisites considerably have an effect on long-term care insurance plans choices. Insurance policies steadily have exclusions or boundaries for prerequisites that manifest sooner than the coverage’s efficient date. Those exclusions can range considerably between insurers and insurance policies, now and again except protection for any care associated with the situation, despite the fact that it arises in impartial dwelling scenarios. As an example, a pre-existing center situation may restrict or deny protection for assisted dwelling preparations, despite the fact that the person wishes handiest minimum enhance of their impartial dwelling state of affairs.

Stage of Care Wanted

The level of care required in an impartial dwelling surroundings influences protection choices. Insurance policies in most cases differentiate between quite a lot of ranges of care, from minimum help to extra extensive enhance. Insurance policies would possibly now not duvet the prices related to day by day duties like bathing or dressing, which don’t seem to be regarded as “long-term care” throughout the coverage’s definition. Conversely, if a situation necessitates extra considerable lend a hand, similar to help with drugs control or mobility, the coverage would possibly supply protection.

A coverage would possibly duvet a person wanting lend a hand with drugs reminders, however now not with dressing, relying at the specifics of the coverage.

Coverage Specifics

Coverage specifics, similar to receive advantages quantities and ready classes, at once have an effect on protection for impartial dwelling. Decrease receive advantages quantities would possibly not adequately duvet the prices related to impartial dwelling enhance. Ready classes, steadily mandated sooner than protection starts, can create important monetary hardship for the ones requiring quick care. A person requiring lend a hand with foods and transportation would possibly face a long ready duration sooner than protection starts, making a monetary burden right through this time.

Age and Well being Standing

The insured’s age and well being standing are the most important components in figuring out impartial dwelling protection. Insurers in most cases assess the danger related to other age teams, and better premiums or restricted protection choices may well be presented to older folks with pre-existing prerequisites. Insurers steadily believe the projected longevity and well being wishes of the person, adjusting protection in keeping with those components.

An older person with a historical past of mobility problems would most probably face extra stringent prerequisites for protection than a more youthful person without a pre-existing prerequisites.

Elements Affecting Protection Choices for Impartial Dwelling

| Issue | Doable Affect | Examples |

|---|---|---|

| Pre-existing prerequisites | Might result in exclusions or boundaries in protection, and even denial of protection for care associated with the situation. | A pre-existing respiration situation would possibly exclude protection for assisted respiring gadgets, despite the fact that wanted for impartial dwelling. |

| Stage of care wanted | Protection steadily is dependent upon the depth of required care. Minimum help may not be coated, whilst extra extensive wishes may well be. | Help with meal preparation may not be coated, however help with mobility or drugs control may well be. |

| Coverage specifics (receive advantages quantities, ready classes) | Low receive advantages quantities would possibly not sufficiently duvet prices, and ready classes can create monetary pressure. | A coverage with a low receive advantages quantity would possibly now not duvet the prices of specialised domestic care services and products, whilst a protracted ready duration would possibly extend vital enhance. |

| Age and well being standing | Age and well being historical past considerably affect top rate charges and protection choices. | A more youthful, more fit person would possibly have extra favorable protection choices and decrease premiums than an older person with pre-existing prerequisites. |

Illustrative Eventualities

Lengthy-term care insurance coverage insurance policies are advanced, and protection for impartial dwelling help varies considerably. Figuring out the precise instances below which bills are or don’t seem to be coated is the most important for making knowledgeable choices. The next situations illustrate commonplace scenarios and the standards influencing protection choices.

Lined Impartial Dwelling Bills

A 75-year-old policyholder, Ms. Smith, has a long-term care insurance coverage that covers “custodial care” within the tournament of a debilitating situation. Her coverage defines custodial care as help with actions of day by day dwelling (ADLs), similar to bathing, dressing, and consuming. Ms. Smith reports a stroke that leaves her wanting lend a hand with those duties.

She continues to are living in her own residence however calls for day by day the help of a house healthcare aide. Her insurance coverage particularly covers those bills, together with the aide’s wages, as a part of her custodial care receive advantages.

Exposed Impartial Dwelling Bills

Mr. Jones, a 68-year-old, has a long-term care insurance coverage that explicitly excludes bills for assisted dwelling or impartial dwelling services and products. He reports a decline in cognitive serve as and calls for lend a hand with meal preparation and drugs control. Whilst those services and products might be regarded as impartial dwelling help, his coverage does now not duvet those prices. It is because the coverage’s definition of coated bills is restricted to express, medically vital services and products associated with the policyholder’s incapacity to accomplish actions of day by day dwelling, now not simply help with impartial dwelling duties.

Hypothetical Case Learn about: Mrs. Garcia’s Scenario

“Coverage Phrases and Stipulations: Lengthy-Time period Care Insurance coverage Coverage – XYZ Insurance coverage Corporate. Protection for ‘custodial care’ comprises help with actions of day by day dwelling (ADLs) and professional nursing care, however excludes bills associated with impartial dwelling lodging, until particularly Artikeld as a coated receive advantages.”

Mrs. Garcia, age 72, holds a long-term care insurance coverage with XYZ Insurance coverage Corporate. She develops dementia and desires lend a hand with family chores and errands. Whilst her coverage covers help with ADLs like bathing and dressing, it does now not duvet the price of hiring anyone to lend a hand her with family duties. Her coverage explicitly excludes these kinds of bills until a separate add-on for “homemaker services and products” is bought.

Mrs. Garcia’s state of affairs demonstrates how the most important it’s to rigorously evaluate coverage main points to know the precise scope of protection.

Figuring out Eligibility for Protection: Mr. Chen’s Case

Mr. Chen, age 80, has a long-term care insurance coverage. He reports a fall and calls for help with mobility and shifting. To decide eligibility for protection, the insurance coverage supplier will assess the severity of Mr. Chen’s situation, the desire for help, and whether or not the desired services and products fall below the coverage’s definition of coated bills.

This overview in most cases comes to a evaluate of clinical information, doctor statements, and a complete analysis of his wishes. The insurance coverage corporate will decide if the services and products fall throughout the coverage’s protection scope, bearing in mind components such because the frequency and length of required help.

Insurance coverage Supplier’s Protection Choice Procedure

Insurance coverage suppliers use a standardized procedure to decide protection for impartial dwelling enhance. This procedure comes to a multi-step analysis:

- Coverage Overview: The insurance coverage supplier critiques the coverage’s phrases and stipulations, particularly figuring out the definition of “custodial care” and any exclusions.

- Clinical Evaluation: Clinical information, doctor statements, and different related documentation are reviewed to decide the severity of the policyholder’s situation and the desired degree of help.

- Wishes Evaluation: A complete overview of the policyholder’s wishes, together with actions of day by day dwelling, mobility, and cognitive serve as, is performed.

- Eligibility Choice: In accordance with the coverage’s phrases and the overview, the insurance coverage supplier determines whether or not the desired services and products fall throughout the coverage’s protection scope.

The insurance coverage supplier would possibly require additional info or reviews to achieve a conclusive choice. This guarantees that protection choices are made as it should be and moderately, aligning with the coverage’s Artikeld advantages.

Ultimate Conclusion

In conclusion, long-term care insurance coverage’s position in supporting impartial dwelling is advanced and is dependent upon a number of components. Pre-existing prerequisites, the extent of care required, and coverage specifics all play an important section in figuring out eligibility and protection quantities. An intensive figuring out of those components is very important for making knowledgeable choices about long-term care insurance coverage and securing a relaxed and impartial long run.

FAQ

Can long-term care insurance coverage duvet the price of domestic changes for impartial dwelling?

House changes for impartial dwelling, similar to ramps or seize bars, may well be coated relying at the particular coverage and the insurer’s interpretation of the desire for such changes. A complete overview of the desire and the coverage’s wording is the most important.

What if my impartial dwelling wishes exceed the coverage’s receive advantages quantity?

If the bills for impartial dwelling exceed the convenience quantity specified within the coverage, the protection can be restricted to the utmost payout. Supplementing protection with further sources is also vital.

Does the kind of impartial dwelling facility have an effect on protection?

The kind of impartial dwelling facility (e.g., a privately owned place of dwelling as opposed to a senior group) is in most cases now not a figuring out think about protection. The will for care and the coverage’s phrases would be the deciding components.

How does a pre-existing situation have an effect on protection for impartial dwelling?

Pre-existing prerequisites can affect protection for impartial dwelling, as some insurance policies would possibly exclude or restrict protection for prerequisites that existed previous to the coverage’s efficient date. Seek advice from a monetary marketing consultant to know the have an effect on of pre-existing prerequisites on protection choices.