Loose automobile insurance coverage template obtain is your key to navigating the arena of vehicle insurance coverage. It simplifies the method of evaluating quotes, figuring out protection, and documenting your coverage main points. This information dives deep into the sensible makes use of and attainable pitfalls of those templates, making sure you are making knowledgeable choices about your automobile insurance coverage.

Whether or not you are a seasoned driving force or simply beginning out, this template supplies a structured strategy to figuring out your insurance coverage. We will discover the various kinds of protection, crucial parts, and criminal concerns, equipping you with the data to make use of those templates successfully and responsibly.

Working out Loose Automobile Insurance coverage Templates

Loose automobile insurance coverage templates be offering a place to begin for figuring out and doubtlessly structuring a fundamental automobile insurance coverage. They’re in particular helpful for people unfamiliar with the complexities of insurance coverage or for the ones searching for a handy guide a rough evaluate of protection choices. Then again, customers must pay attention to the constraints inherent in loose templates and workout warning when the use of them for authentic documentation.Those templates function a foundational framework, outlining the fundamental parts of a automobile insurance coverage.

Their number one use circumstances come with training, comparability buying groceries, and initial making plans for a brand new coverage. They don’t seem to be supposed for legally binding contracts or for the finalization of insurance coverage preparations.

Function and Use Instances of Loose Templates

Loose automobile insurance coverage templates supply a simplified construction for figuring out the various kinds of protection and the guidelines normally required. They are able to be helpful equipment for evaluating insurance policies from other suppliers, teaching oneself concerning the components of vehicle insurance coverage, and making a initial figuring out of 1’s wishes.

Forms of Automobile Insurance coverage Protection in Loose Templates

Loose templates ceaselessly come with the usual varieties of automobile insurance plans. Those come with legal responsibility protection, which protects in opposition to monetary accountability for damages brought about to others. Collision protection addresses damages to 1’s personal automobile from injuries. Complete protection, often referred to as “as opposed to collision” protection, covers damages to the automobile from occasions as opposed to injuries, similar to robbery, vandalism, or weather-related incidents.

Working out the specifics of every protection sort is a very powerful for fine possibility control.

Advantages and Drawbacks of The usage of Loose Templates

Loose templates be offering the benefit of accessibility and a handy guide a rough evaluate of vehicle insurance coverage. They are able to assist folks familiarize themselves with the crucial parts of a coverage. Then again, they will lack the excellent main points and customization choices to be had in skilled templates. For example, loose templates would possibly not account for particular state necessities or distinctive protection wishes. Moreover, their loss of criminal status way they don’t seem to be appropriate for formal insurance coverage agreements.

A a very powerful attention is the possibility of mistakes or omissions in loose templates, resulting in erroneous representations of protection.

Key Parts of a Complete Automobile Insurance coverage Template

A complete automobile insurance coverage template must come with coverage limits, deductibles, named insureds, protection main points, and any exclusions. Moreover, it must specify the varieties of cars coated and the geographical spaces the place the coverage is appropriate. It must obviously delineate the tasks of the insured birthday party. Seriously, the template must be adapted to the precise state and native laws relating to automobile insurance coverage.

Not unusual Automobile Insurance coverage Protection and Knowledge in Loose Templates

| Protection Kind | Knowledge Integrated |

|---|---|

| Legal responsibility | Coverage limits, named insureds, varieties of protection (physically damage, assets injury), and attainable exclusions. |

| Collision | Coverage limits, deductibles, and protection quantities for maintenance or substitute of the automobile. |

| Complete | Coverage limits, deductibles, and protection for damages now not associated with collisions (e.g., robbery, vandalism, climate). |

Template Construction and Parts: Loose Automobile Insurance coverage Template Obtain

A well-structured automobile insurance coverage template is a very powerful for readability, accuracy, and environment friendly processing of coverage data. Correct group guarantees all essential main points are readily out there, minimizing mistakes and facilitating fine verbal exchange between the insurer and the insured. This construction additionally aids within the identity and control of various kinds of coverages.Templates must be adaptable to quite a lot of insurance coverage sorts, similar to liability-only insurance policies, complete protection, or particular add-on choices.

This adaptability permits customers to tailor the template to their particular person wishes and the precise insurance coverage merchandise they require.

Coverage Main points Phase

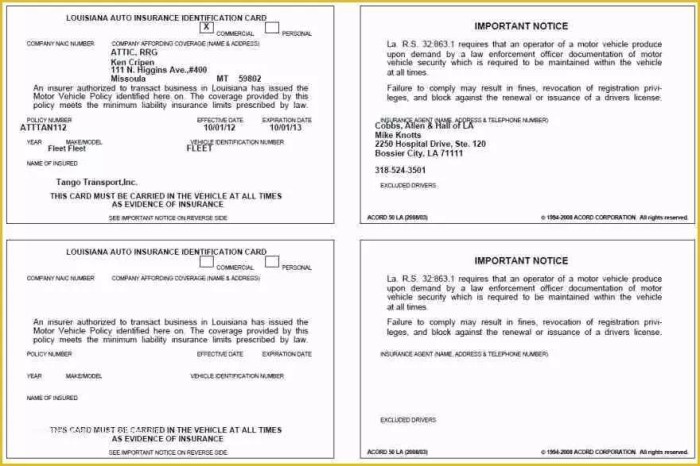

This phase bureaucracy the basis of the template, offering a concise evaluate of the coverage’s key options. It must come with the coverage fine and expiration dates, coverage quantity, the automobile identity main points (VIN, make, fashion, 12 months), and the top class quantity. Correct record-keeping of those main points is important for managing coverage renewals and making sure compliance with laws. Actual and verifiable main points give a contribution to environment friendly coverage management.

Protection Knowledge Phase

This phase Artikels the precise coverages incorporated within the coverage. For instance, it must element legal responsibility protection (physically damage and assets injury), collision, complete, uninsured/underinsured motorist protection, and any further choices like roadside help. Obviously defining every protection, together with its limits and exclusions, is very important to stop misunderstandings and make sure transparency. This phase guarantees the insured totally comprehends the scope in their coverage.

Non-public Knowledge Phase

The template should come with fields for the insured’s non-public data, together with identify, cope with, telephone quantity, e-mail cope with, and driving force’s license main points. Those main points are crucial for contacting the insured and processing claims. This phase additionally necessitates inclusion of the automobile proprietor’s data for correct record-keeping.

Touch Knowledge for All Events, Loose automobile insurance coverage template obtain

This phase is significant for environment friendly verbal exchange and declare processing. It must come with the insurer’s touch data (cope with, telephone quantity, e-mail), the insured’s touch main points, and emergency touch data (identify, dating, telephone quantity). Having readily to be had touch main points minimizes delays and facilitates fine verbal exchange in case of injuries or claims.

Pattern Fundamental Automobile Insurance coverage Template Construction

- Coverage Main points: Coverage Quantity, Efficient Date, Expiration Date, Top rate Quantity, Car Id Quantity (VIN), Make, Style, Yr.

- Protection Knowledge: Legal responsibility Protection (Physically Harm and Belongings Injury Limits), Collision Protection Limits, Complete Protection Limits, Uninsured/Underinsured Motorist Protection Limits, Further Coverages (e.g., Roadside Help).

- Insured Knowledge: Complete Identify, Deal with, Telephone Quantity, E-mail, Driving force’s License Quantity.

- Car Knowledge: VIN, Make, Style, Yr, Car Id Quantity (VIN), License Plate Quantity.

- Touch Knowledge: Insurer Touch Knowledge (Deal with, Telephone, E-mail), Insured Touch Knowledge (Deal with, Telephone, E-mail), Emergency Touch Knowledge (Identify, Courting, Telephone Quantity).

Desk of Sections and Functions

| Phase | Function |

|---|---|

| Coverage Main points | Summarizes the coverage phrases, protection quantities, and different key coverage main points. |

| Protection Knowledge | Explains the specifics of various coverages, together with limits and exclusions. |

| Touch Knowledge | Comprises main points of all events concerned, facilitating verbal exchange and declare processing. |

Criminal Concerns and Barriers

Loose automobile insurance coverage templates, whilst providing comfort, provide attainable criminal pitfalls. Customers should perceive the constraints and implications prior to depending on those templates for his or her insurance coverage wishes. Mistaken use may end up in invalid insurance policies and even criminal repercussions.The usage of a loose template with out figuring out its obstacles may end up in important criminal issues. Templates are ceaselessly now not adapted to particular person instances or particular state rules, and mistakes in final touch can lead to a freelance that does not meet criminal necessities.

Additionally, some templates may now not as it should be replicate the newest criminal interpretations, leaving the consumer uncovered to attainable demanding situations in a courtroom of legislation.

Criminal Implications of The usage of Loose Templates

Loose automobile insurance coverage templates ceaselessly lack the detailed provisions and criminal precision of professionally drafted paperwork. This can lead to ambiguity, misunderstandings, and in the long run, disputes. For instance, a template omitting a very powerful clauses referring to legal responsibility or protection limits may go away the policyholder prone in case of an twist of fate. The loss of particular language adapted to the state’s insurance coverage rules too can create headaches.

Doable Criminal Problems and Vulnerabilities

The usage of an inadequately reviewed template may result in a number of criminal problems. One not unusual worry is the possibility of incomplete or erroneous data. If the template does not seize all essential main points, it could now not as it should be replicate the settlement between the events concerned, making a foundation for disputes. Every other vulnerability arises from the loss of criminal recommend within the template’s construction.

Skilled criminal recommendation is a very powerful in making sure compliance with related state rules and laws.

Barriers of Loose Templates in Assembly Criminal Necessities

Loose templates ceaselessly fall quick in assembly the correct criminal necessities of a specific jurisdiction. State rules governing insurance coverage insurance policies can range significantly. A template designed for one state may not be compliant with the rules of every other. Moreover, the template may now not come with particular clauses mandated through state laws, similar to the ones linked to express varieties of protection or reporting procedures.

For instance, a template omitting a required “cancellation clause” may render the coverage invalid.

Comparability of Loose and Professionally Drafted Templates

Professionally drafted automobile insurance coverage templates, created through criminal execs, are meticulously crafted to conform to particular state rules. They’re adapted to particular person instances, making sure the record is correct, complete, and legally sound. Against this, loose templates ceaselessly lack this personalised consideration, doubtlessly compromising their criminal efficacy. Loose templates could be appropriate for a fundamental figuring out, however now not for developing legally binding contracts.

Crucially, a professionally drafted template can have clauses to handle ambiguities and attainable problems now not foreseen through the consumer.

Essential Criminal Phrases for Insurance coverage Templates

- Coverage Length: Specifies the period of the insurance plans. That is crucial to make sure the coverage is lively when wanted.

- Protection Limits: Artikels the utmost quantity the insurer pays for damages or accidents. It is a important clause for monetary coverage.

- Exclusions: Main points scenarios the place the insurance coverage does now not practice. Working out those is significant to keep away from surprises.

- Legal responsibility Protection: Describes the insurer’s accountability for damages brought about to others.

- Belongings Injury Protection: Artikels the insurer’s accountability for damages to the insured’s automobile.

- Uninsured/Underinsured Motorist Protection: Addresses legal responsibility if an twist of fate comes to a driving force with out ok insurance coverage.

Templates must explicitly come with those and different related phrases to keep away from long run disputes. A well-defined template will cope with those phrases as it should be and punctiliously, protective the events concerned.

The usage of the Template for Other Functions

A loose automobile insurance coverage template gives a structured strategy to managing and evaluating insurance coverage insurance policies. This standardized layout permits customers to collect, prepare, and analyze a very powerful data, resulting in extra knowledgeable choices about their automobile insurance coverage. This adaptability empowers folks to navigate the complexities of the insurance coverage marketplace successfully.This template’s versatility extends past fundamental record-keeping. It may be adapted to satisfy quite a lot of wishes, from evaluating quotes to meticulously documenting protection specifics.

Correct usage of the template streamlines the method of figuring out and settling on essentially the most appropriate automobile insurance coverage.

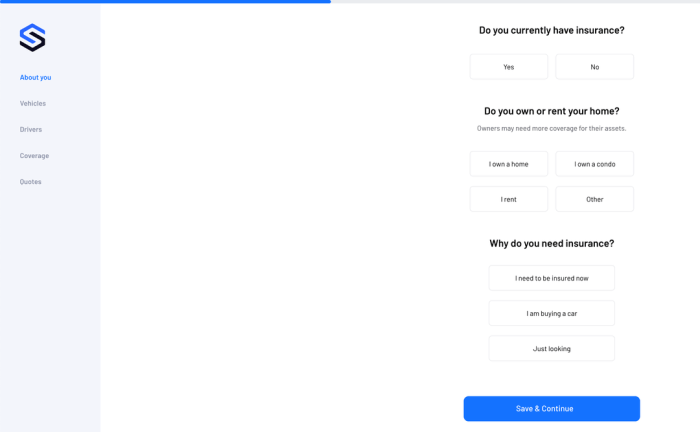

Evaluating Quotes from Other Insurers

A a very powerful side of securing the most efficient automobile insurance coverage is evaluating quotes from more than one insurers. The usage of the template to listing quotes guarantees a complete and arranged comparability. Each and every insurer’s quote will also be documented, together with premiums, protection main points, and any further charges. This structured way facilitates a transparent evaluate of pricing and choices, making the choice procedure more uncomplicated.

For instance, a driving force may listing quotes from 3 other firms, noting the deductibles, protection limits, and any reductions introduced.

Working out and Documenting Insurance coverage Protection

The template can function an in depth listing of insurance plans. Customers can meticulously record the precise main points in their coverage, together with the varieties of protection, limits, deductibles, and exclusions. This complete documentation is important for figuring out the scope of coverage and making sure that the coverage aligns with particular person wishes. For example, a consumer can record complete protection limits, collision protection specifics, and legal responsibility protection main points.

This documentation turns into particularly treasured in case of a declare, offering a readily to be had reference.

Making Knowledgeable Insurance coverage Selections

A well-structured automobile insurance coverage template fosters knowledgeable choices. By means of meticulously recording main points of quite a lot of insurance policies, customers acquire a clearer figuring out of the choices to be had. This detailed evaluate is helping in figuring out the most efficient worth for the protection required. For instance, a consumer may examine other legal responsibility limits and deductibles to resolve essentially the most cost-effective choice whilst keeping up ok coverage.

This complete figuring out permits folks to make knowledgeable alternatives, resulting in extra suitable and adapted insurance policy.

Use Instances for a Loose Automobile Insurance coverage Template

| Use Case | Description |

|---|---|

| Evaluating Quotes | Report quotes from other insurers, noting premiums, protection main points, and further charges. |

| Working out Protection | Report particular coverage main points, together with protection sorts, limits, deductibles, and exclusions. |

| Documentation | Deal with a complete listing of insurance coverage insurance policies and main points, together with coverage numbers, fine dates, and make contact with data. |

Guidelines for Opting for and The usage of a Template

Opting for an acceptable loose automobile insurance coverage template is a very powerful for making sure accuracy and criminal compliance. A poorly decided on or incompletely understood template may end up in important problems, together with rejected claims or criminal disputes. Correct use of the template is very important to keep away from those pitfalls and make sure the record’s integrity.

Assessing Explicit Wishes

Cautious attention of particular person instances is important when settling on a automobile insurance coverage template. Several types of protection, similar to legal responsibility, collision, or complete, necessitate other templates. The precise wishes of the insured particular person, together with automobile main points, using historical past, and protection necessities, should be taken into consideration. Templates designed for particular insurance coverage insurance policies, like the ones for business cars or newly received cars, might vary considerably from usual templates.

Working out Template Phrases

Thorough overview of the template’s phrases and stipulations is paramount prior to its use. Templates ceaselessly include complicated criminal language that is probably not simply understood with out skilled steerage. Pay shut consideration to clauses bearing on exclusions, obstacles, and attainable liabilities. Consulting with an insurance coverage skilled can explain any ambiguities. Working out the precise phrases is a very powerful for heading off misunderstandings and making sure that the template as it should be displays the specified protection.

Making sure Accuracy in Filling Out the Template

Accuracy in finishing the template is paramount. Faulty or incomplete data can negatively have an effect on the declare procedure. In moderation verifying all main points, together with automobile identity numbers, dates, and coverage data, is significant. Pass-referencing data from quite a lot of resources, like automobile registration paperwork or insurance coverage insurance policies, can toughen accuracy. Use transparent, legible handwriting or a computer-generated font to keep away from misinterpretations.

In search of explanation from an insurance coverage skilled if any side is unclear is very important.

Keeping up Integrity and Safety

Correctly storing and safeguarding the finished template is a very powerful for keeping up its integrity and safety. The template must be saved in a protected location, clear of unauthorized get right of entry to. Virtual copies must be sponsored up incessantly. Templates must be safe from injury, alteration, or loss. Following usual information safety protocols, particularly for digitally saved templates, is very important.

Essential Concerns in Template Variety

- Coverage Kind: Other insurance policies require particular templates. Non-public auto insurance coverage templates will vary from business auto insurance coverage templates.

- Protection Wishes: Believe the varieties of protection required (legal responsibility, collision, complete) and make a selection a template that adequately addresses those wishes.

- State Laws: Be sure the template complies with state-specific laws governing insurance coverage insurance policies. State rules might dictate particular data required throughout the template.

- Template Supplier Recognition: Analysis the supplier’s recognition and revel in in offering correct and dependable insurance coverage paperwork. Search for templates from respected insurance coverage firms or criminal execs.

- Completeness and Readability: Evaluation the template for readability and comprehensiveness. Examine that every one essential fields are incorporated and the directions are simple.

Finish of Dialogue

In conclusion, a loose automobile insurance coverage template obtain could be a robust software for managing your protection. By means of figuring out its parts, criminal obstacles, and quite a lot of programs, you’ll use it to match quotes, perceive your coverage, and make knowledgeable choices. Then again, consider to continue with warning, and all the time test data along with your insurance coverage supplier.

Query Financial institution

What varieties of automobile insurance plans are most often incorporated in a loose template?

Maximum loose templates duvet legal responsibility, collision, and complete insurance coverage. Then again, the extent of element can range considerably.

Are there any criminal problems I must pay attention to when the use of a loose template?

Loose templates would possibly not totally conform to all criminal necessities. All the time test along with your state’s insurance coverage laws and your insurance coverage supplier.

How can I exploit this template to match quotes from other insurers?

Use the template to listing the coverage main points, protection quantities, and premiums from every insurer. This may let you examine side-by-side.

What are some absolute best practices for opting for a template?

Completely overview the template’s phrases and stipulations prior to use. Be sure it meets your particular wishes and as it should be displays the kind of protection you need.