Moderate automotive insurance coverage charge Maine is a significant fear for drivers. This complete information breaks down the whole lot you want to find out about premiums, suppliers, and protection choices. Get able to navigate the maze of Maine automotive insurance coverage and in finding the most productive deal in your scenario!

From motive force profiles to automobile varieties, we will discover the important thing components that have an effect on your insurance coverage charges within the Pine Tree State. Be informed in regards to the other insurance coverage suppliers, protection choices, or even contemporary developments that would possibly have an effect on your pockets. It is time to get your automotive insurance coverage taken care of out!

Elements Affecting Moderate Automotive Insurance coverage Prices in Maine: Moderate Automotive Insurance coverage Value Maine

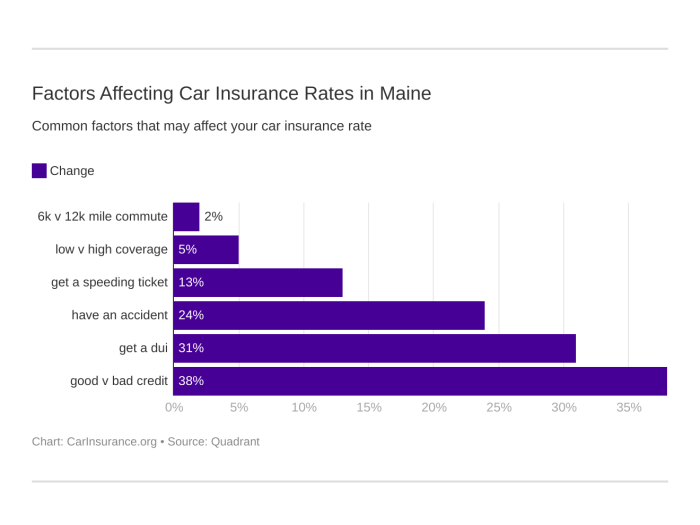

Automotive insurance coverage premiums in Maine, like in lots of different states, are influenced by means of a lot of components. Working out those components can lend a hand folks and households make knowledgeable selections about their protection and doubtlessly decrease their prices. Those components aren’t static; they may be able to vary according to quite a lot of marketplace prerequisites and regulatory adjustments.Quite a lot of parts, together with person using behavior, automobile traits, and geographic location, give a contribution to the whole charge of auto insurance coverage.

This newsletter supplies an in depth review of those influential components, enabling higher comprehension of ways they have interaction to form insurance coverage premiums in Maine.

Elements Influencing Automotive Insurance coverage Premiums, Moderate automotive insurance coverage charge maine

Working out the various components affecting automotive insurance coverage premiums is the most important for any person searching for to regulate their insurance coverage prices successfully. Various factors weigh another way, and the mix of those components considerably affects the whole top class.

| Issue Class | Particular Issue | Clarification |

|---|---|---|

| Motive force Profile | Age | More youthful drivers incessantly face upper premiums because of their perceived upper chance of injuries in comparison to extra skilled drivers. |

| Motive force Profile | Using Report | Injuries, site visitors violations, and transferring violations immediately have an effect on insurance coverage charges. A blank using document most often ends up in decrease premiums. |

| Motive force Profile | Gender | Traditionally, gender-based pricing disparities have existed, however that is turning into much less not unusual. Alternatively, insurance coverage firms nonetheless believe gender as a part of their chance review. |

| Motive force Profile | Location | Spaces with upper coincidence charges or site visitors congestion could have upper insurance coverage premiums. |

| Automobile Sort | Automobile Fashion | Sure automobile fashions are thought to be extra susceptible to robbery or harm than others, doubtlessly affecting premiums. |

| Automobile Sort | Automobile Protection Options | Cars with complicated security measures, equivalent to airbags or anti-lock brakes, would possibly obtain discounted charges. |

| Automobile Sort | Automobile Worth | Upper-value cars incessantly have upper premiums, particularly if they’re extra susceptible to robbery or harm. |

| Coverage Main points | Protection Choices | Particular protection possible choices, equivalent to complete or collision protection, will have an effect on premiums. |

| Coverage Main points | Deductibles | Upper deductibles incessantly result in decrease premiums. |

Demographic Affect on Insurance coverage Prices

Demographic components play a vital position in shaping insurance coverage premiums. Working out how those components give a contribution to price diversifications is very important for knowledgeable decision-making.

| Demographic | Doable Affect on Prices | Instance |

|---|---|---|

| Age | More youthful drivers most often face upper premiums because of their statistically upper coincidence charges. | A 16-year-old motive force would possibly pay considerably greater than a 30-year-old motive force with a equivalent using document. |

| Gender | Traditionally, there were gender-based pricing disparities. | In some circumstances, ladies would possibly pay moderately decrease premiums than males because of noticed using behaviors. |

| Location | Spaces with upper crime charges or coincidence charges would possibly enjoy upper premiums. | Insurance coverage charges in densely populated city spaces could be upper than in rural spaces. |

Affect of Using Behaviors on Insurance coverage Charges

Using behaviors are a essential think about figuring out automotive insurance coverage premiums. Constant protected using behavior result in decrease premiums.

| Violation Sort | Doable Affect on Premiums | Instance |

|---|---|---|

| Injuries | Injuries considerably build up premiums, with the severity of the coincidence influencing the magnitude of the rise. | A motive force inquisitive about a minor fender bender will most probably face a modest top class build up, while a motive force inquisitive about a major coincidence will most probably face a considerable build up. |

| Site visitors Violations | Site visitors violations, equivalent to dashing or operating crimson lighting, can lead to top class will increase. | A motive force cited for dashing would possibly enjoy a noticeable build up of their top class. |

| Transferring Violations | Transferring violations, equivalent to reckless using, have a substantial have an effect on on premiums, incessantly resulting in really extensive will increase. | A motive force convicted of reckless using will most probably face a considerable top class build up. |

Comparability of Insurance coverage Suppliers in Maine

Choosing the proper automotive insurance coverage supplier in Maine can considerably have an effect on your monetary well-being. Working out the choices and reputations of various firms is the most important for making an educated resolution. This segment supplies a comparability of a number of primary suppliers, highlighting their moderate prices, protection choices, and customer support reputations.

Moderate Automotive Insurance coverage Prices by means of Supplier

Pricing varies a great deal relying on components like using document, automobile kind, and placement. The next desk supplies an estimated moderate charge comparability for automotive insurance coverage in Maine, for illustrative functions handiest. Precise prices will fluctuate according to person instances.

| Supplier Identify | Moderate Value (Annual) | Description of Protection Choices |

|---|---|---|

| Innovative | $1,500 | Innovative gives a variety of protection choices, together with legal responsibility, collision, and complete. They incessantly supply reductions for just right drivers and protected using behavior. Their on-line platform is user-friendly, making coverage control handy. |

| State Farm | $1,700 | State Farm is a well-established insurer identified for its intensive protection choices and powerful customer support. They supply quite a lot of add-ons and choices, like roadside help, to toughen coverage options. |

| Liberty Mutual | $1,650 | Liberty Mutual emphasizes customer support and provides aggressive charges. Their protection choices most often come with legal responsibility, collision, and complete insurance coverage, in conjunction with different not obligatory add-ons. |

Reductions Presented by means of Insurance coverage Suppliers

Many insurers be offering reductions to inspire accountable using and extra incentivize coverage purchases. The next desk highlights some not unusual reductions to be had in Maine.

| Insurer | Cut price Sort | Eligibility Standards |

|---|---|---|

| Innovative | Excellent Scholar Cut price | Scholars with a just right instructional document. |

| State Farm | Multi-Coverage Cut price | Proudly owning more than one insurance policies with State Farm. |

| Liberty Mutual | Bundled House owners Insurance coverage | Having a house insurance coverage with Liberty Mutual. |

Supplier Popularity and Buyer Carrier Scores

Buyer critiques and rankings be offering treasured insights into the popularity and repair high quality of insurance coverage suppliers. Underneath is a desk exhibiting rankings from quite a lot of on-line evaluation platforms.

| Supplier | Evaluation Website | Score | Feedback |

|---|---|---|---|

| Innovative | Shopper Affairs | 4.2/5 | Many purchasers praised the convenience of on-line get admission to and declare procedure. |

| State Farm | Trustpilot | 4.0/5 | Prime quantity of certain comments referring to customer support. |

| Liberty Mutual | BBB | 4.5/5 | In most cases certain comments referring to responsiveness and declare dealing with. |

Kinds of Automotive Insurance coverage Protection in Maine

Working out the quite a lot of varieties of automotive insurance policy to be had in Maine is the most important for deciding on a coverage that meets your particular wishes and complies with state rules. This information empowers you to make knowledgeable selections in regards to the degree of coverage you require.Other protection choices cater to other dangers, starting from harm for your automobile to monetary duties against others inquisitive about an coincidence.

Working out the specifics of each and every kind is essential to selecting the best steadiness of coverage and cost-effectiveness.

Kinds of Protection Choices

Opting for the best protection is necessary for complete coverage. Other coverages deal with quite a lot of dangers related to automotive possession. A well-rounded coverage combines other coverages for a extra powerful protection web.

| Protection Sort | Description | What it Covers |

|---|---|---|

| Legal responsibility | Covers monetary duty for damages brought about to other folks or their belongings in an coincidence the place you might be at fault. | Covers physically damage and belongings harm to others. Does no longer quilt harm for your personal automobile. |

| Collision | Covers harm for your automobile without reference to who’s at fault in an coincidence. | Covers restore or substitute prices in your automobile if it is broken in a collision. |

| Complete | Covers harm for your automobile from incidents rather than collisions, equivalent to vandalism, robbery, or climate occasions. | Covers harm for your automobile from non-collision occasions like fireplace, hail, or vandalism. |

| Uninsured/Underinsured Motorist | Protects you if you’re inquisitive about an coincidence with a motive force who does no longer have insurance coverage or whose insurance policy is inadequate. | Will pay in your accidents or automobile damages if the at-fault motive force is uninsured or underinsured. |

Prison Necessities for Automotive Insurance coverage in Maine

Maine mandates particular minimal insurance policy to make sure drivers are financially accountable in case of injuries. Assembly those necessities is the most important for heading off consequences and felony headaches.

| Protection Sort | Minimal Prohibit |

|---|---|

| Legal responsibility Physically Damage | $25,000 consistent with particular person, $50,000 consistent with coincidence |

| Legal responsibility Belongings Injury | $20,000 consistent with coincidence |

Conventional Exclusions for Automotive Insurance coverage Coverages

Working out the exclusions related to other coverages is very important for figuring out the whole scope of your coverage. Understanding what isn’t coated can save you sudden problems.

| Protection Sort | Conventional Exclusions |

|---|---|

| Legal responsibility | Intentional acts, pre-existing prerequisites, accidents brought about by means of your individual intoxication, and harm for your personal automobile. |

| Collision | Put on and tear, pre-existing harm, harm brought about by means of neglecting automobile repairs, and harm because of mechanical failure unrelated to the coincidence. |

| Complete | Injury brought about by means of battle, nuclear incidents, environmental contamination, overlook of car repairs, and harm because of a intentionally set fireplace. |

Value Permutations by means of Automobile Sort and Use

Automotive insurance coverage premiums in Maine, like somewhere else, don’t seem to be a one-size-fits-all determine. A number of components, together with the kind of automobile and its supposed use, considerably have an effect on the fee. Working out those nuances can lend a hand drivers wait for and doubtlessly mitigate their insurance coverage bills.

Automobile Sort Affect on Insurance coverage Prices

Other automobile varieties provide various dangers to insurers, main to worth discrepancies. Elements such because the automobile’s length, horsepower, and doable for harm all give a contribution to the danger review. Decrease-value cars incessantly have decrease premiums, while high-performance sports activities vehicles or luxurious cars would possibly have upper charges because of greater doable for harm and robbery.

| Automobile Sort | Conventional Insurance coverage Value (Illustrative Instance) | Reasoning |

|---|---|---|

| Compact Vehicles | $1,000 – $1,500 once a year | In most cases decrease restore prices and not more more likely to be focused for robbery. |

| Mid-Dimension Sedans | $1,200 – $1,800 once a year | Balanced chance profile in comparison to compact and bigger cars. |

| SUVs and Vehicles | $1,500 – $2,500 once a year | Upper restore prices because of doable for harm and bigger length. Higher robbery chance for some fashions. |

| Luxurious Vehicles | $1,800 – $3,000+ once a year | Upper restore prices, doable for high-value robbery, and better call for for insurance policy. |

| Sports activities Vehicles | $1,800 – $3,500+ once a year | Upper chance of injuries and harm because of upper horsepower and doable for reckless using. |

Automobile Utilization Affect on Insurance coverage Charges

The way in which a automobile is used additionally influences its insurance coverage top class. Commuting, as an example, carries a special chance profile in comparison to common weekend journeys or use for business functions. Insurers believe the frequency and period of use when comparing chance.

| Automobile Utilization | Conventional Insurance coverage Value (Illustrative Instance) | Reasoning |

|---|---|---|

| Day by day Shuttle | $1,200 – $1,500 once a year | Decrease chance profile because the automobile is most often pushed in managed prerequisites (roads). |

| Weekend Journeys | $1,200 – $1,600 once a year | Quite upper chance profile, particularly if involving longer distances or extra drivers. |

| Widespread Lengthy-Distance Commute | $1,400 – $2,000 once a year | Upper chance profile because of greater publicity to injuries and doable harm. |

| Business Use | $1,800 – $4,000+ once a year | Considerably upper chance profile, relying at the nature of the industrial use. |

Affect of Protection Options on Insurance coverage Premiums

Automobile security measures can considerably scale back insurance coverage premiums. Anti-theft methods, airbags, and complicated driver-assistance methods (ADAS) are some examples. Insurers view those options as a discount in chance, resulting in decrease premiums.

| Protection Function | Conventional Top class Relief (Illustrative Instance) | Reasoning |

|---|---|---|

| Anti-theft Gadget | 5-10% | Reduces the danger of robbery, a significant factor in insurance coverage prices. |

| Airbags | 3-5% | Reduces the danger of significant damage in an coincidence. |

| Complicated Motive force-Help Programs (ADAS) | 5-15% | Reduces the danger of injuries by means of assisting the driving force with options like lane departure caution and automated emergency braking. |

| Digital Balance Regulate (ESC) | 3-7% | Reduces the danger of injuries and severity of wear by means of helping the driving force in keeping up keep watch over of the automobile. |

Contemporary Developments in Maine Automotive Insurance coverage Prices

Contemporary years have witnessed fluctuating automotive insurance coverage prices in Maine, influenced by means of quite a lot of components. Working out those developments is the most important for drivers to make knowledgeable selections about their insurance policy and price range. This segment explores the important thing tendencies and their have an effect on on Maine’s automotive insurance coverage panorama.

Contemporary Top class Adjustments

Maine automotive insurance coverage premiums have exhibited a trend of fluctuation. Whilst some sessions display balance, others display vital will increase or decreases. Elements equivalent to coincidence charges, claims frequency, and the price of hospital treatment are primary members to those diversifications.

| 12 months | Moderate Top class Trade (%) | Description |

|---|---|---|

| 2020 | +5% | Slight build up attributed to emerging scientific prices and slight build up in coincidence charges. |

| 2021 | +8% | A noticeable build up most probably related to emerging inflation and better restore prices. |

| 2022 | +3% | A extra reasonable build up, perhaps reflecting a stabilization of coincidence charges and a moderately cooling inflation fee. |

| 2023 | +2% | A modest build up, indicating a continuation of the former 12 months’s pattern and ongoing inflationary pressures. |

Affect of Regulation and Rules

Maine’s legislative and regulatory atmosphere performs a task in shaping insurance coverage prices. Adjustments in regulations referring to minimal protection necessities, coincidence reporting, or the supply of sure insurance coverage merchandise can have an effect on premiums.

| Regulation/Law | Impact on Charges | Instance |

|---|---|---|

| Higher Minimal Legal responsibility Protection | Doubtlessly greater premiums for drivers. | Elevating the minimal legal responsibility protection would possibly necessitate upper premiums to adequately compensate doable sufferers of injuries. |

| Necessary Protection Options in New Cars | Doable for lowered premiums for drivers of more moderen, more secure cars. | Maine requiring sure security measures in new cars would possibly correlate with a lower in coincidence claims, doubtlessly leading to decrease premiums for the ones with compliant cars. |

| Adjustments in No-Fault Insurance coverage Rules | Doubtlessly various results, relying at the particular exchange. | Adjustments to no-fault insurance coverage regulations would possibly affect premiums by means of adjusting the monetary burden on folks within the tournament of an coincidence. |

Financial Elements and Their Correlation

Financial components, equivalent to inflation and rates of interest, considerably have an effect on the price of insurance coverage. Emerging inflation will increase the price of items and products and services, together with restore prices for cars. Adjustments in rates of interest can have an effect on the price of borrowing for insurers.

| Financial Issue | Affect on Insurance coverage Prices | Instance |

|---|---|---|

| Inflation | Higher premiums to mirror emerging restore prices and different bills. | If the price of auto portions will increase by means of 10% because of inflation, insurers wish to regulate premiums to hide the greater charge of upkeep. |

| Passion Charges | Doable have an effect on on funding returns and borrowing prices for insurers. | Upper rates of interest can result in greater borrowing prices for insurers, that could be handed directly to policyholders within the type of upper premiums. |

| Unemployment Price | Imaginable correlation to coincidence charges. | Sessions of excessive unemployment could be correlated with an build up in injuries because of drivers being much less wary or because of greater using time in some circumstances. |

Finish of Dialogue

So, there you will have it – a deep dive into moderate automotive insurance coverage charge Maine. Working out the standards that affect your premiums empowers you to make knowledgeable selections and doubtlessly get monetary savings. Armed with this data, you’ll be able to store good, in finding the proper protection, and power with self assurance, understanding you have got your bases coated.

Solutions to Not unusual Questions

Q: What is the most cost-effective automotive insurance coverage corporate in Maine?

A: Sadly, there is not any unmarried “most cost-effective” corporate. Charges range considerably according to person components like using document, automobile kind, and placement. Comparability buying groceries with more than one suppliers is essential.

Q: How does my using document have an effect on my insurance coverage charges?

A: Injuries and violations, like dashing tickets, will considerably build up your premiums. A blank using document is the most important for decrease charges.

Q: Do I would like complete protection in Maine?

A: Whilst no longer obligatory, complete protection is very really helpful. It protects you from damages no longer brought about by means of some other motive force, equivalent to climate harm or vandalism.

Q: Are there reductions to be had for just right scholars?

A: Many insurers be offering reductions for college kids with just right grades. Take a look at along with your supplier for particular eligibility standards.