Motorbike insurance coverage vs automotive insurance coverage – a the most important resolution for any rider. Navigating the nuances of protection, prices, and claims processes is very important. This in-depth glance supplies a complete comparability, highlighting key variations and serving to you’re making the proper selection.

From legal responsibility protection to complete coverage, figuring out the precise wishes of bike insurance coverage is vital. Components like rider revel in, motorcycle sort, and placement considerably impression premiums. We will discover those sides intimately to offer a transparent image.

Advent to Motorbike Insurance coverage

Embarking at the exhilarating adventure of motorcycling calls for a profound figuring out of the protecting defend presented by means of insurance coverage. Motorbike insurance coverage, a essential element of accountable driving, safeguards your monetary well-being and the well-being of others. It is greater than only a file; it is a dedication to protection, a testomony on your consciousness of the street’s inherent demanding situations, and a beacon of peace of thoughts on two wheels.Motorbike insurance coverage differs considerably from same old auto insurance coverage.

The inherent nature of bikes, their decrease weight, and usally smaller dimension give a contribution to larger threat components. This necessitates a adapted solution to protection, addressing the precise vulnerabilities and doable liabilities distinctive to bikes.

Motorbike Insurance coverage Protection Choices

Motorbike insurance coverage insurance policies normally surround a variety of coverages designed to handle various doable dangers. Those choices aren’t simply contractual provisions; they constitute layers of coverage towards the uncertainties that existence at the avenue can provide.

Commonplace Motorbike Insurance coverage Coverages

The cornerstone of any complete motorbike insurance coverage lies in its protection choices. Those protections aren’t simply conditions; they constitute layers of safety, safeguarding your monetary long run and providing peace of thoughts.

| Protection | Description |

|---|---|

| Legal responsibility | This elementary protection can pay for damages to someone else or their belongings in an coincidence the place you’re at fault. It is corresponding to a security internet, offering monetary toughen to these harmed by means of your movements at the avenue. That is usally a compulsory element of any motorbike insurance coverage, making sure your duty to others is upheld. |

| Complete | This protection protects your motorbike towards incidents rather than collisions, corresponding to robbery, vandalism, or injury from herbal failures. It safeguards your funding and gives a way of safety, realizing your motorbike is secure towards a huge spectrum of doable perils. |

| Collision | This protection can pay for damages on your motorbike in an coincidence, irrespective of who’s at fault. It supplies monetary help within the tournament of a collision, making sure you’ll be able to restore or substitute your motorbike, irrespective of the cases. This protection is a the most important component in keeping up your skill to proceed your motorbike adventure. |

| Uninsured/Underinsured Motorist | This protection protects you in case you are excited by an coincidence with a motive force who does now not have ok insurance coverage or is uninsured. It’s an very important safeguard towards monetary loss when faced with irresponsible or negligent drivers. |

Components Affecting Motorbike Insurance coverage Premiums

The trail to accountable driving usally starts with figuring out the standards that form your motorbike insurance coverage premiums. Those components, just like the intricate dance of the weather, affect the price of your coverage, guiding you in opposition to knowledgeable selections. Simply as a talented navigator reads the celestial charts, you can also navigate the panorama of insurance coverage prices by means of spotting the variables at play.

Rider Enjoy and Age

Rider revel in and age considerably impression motorbike insurance coverage premiums. A seasoned rider, having amassed miles and mastered the nuances of dealing with, usally receives a decrease top rate. This displays the diminished threat related to revel in. Conversely, a more recent rider, nonetheless growing their abilities, carries a better threat profile, which interprets into a better top rate. Age additionally performs a job, as more youthful riders are most often regarded as higher-risk because of components like inexperience and not more advanced judgment.

For instance, a rider with 5 years of revel in and a blank using file might qualify for a decrease top rate than a rider with only one yr of revel in and minor site visitors violations.

Motorbike Kind and Changes

The kind of motorbike and any changes considerably impact insurance coverage premiums. Traveling bikes, with their added weight and complexity, usally incur increased premiums in comparison to smaller, lighter sportbikes. Changes, corresponding to aftermarket exhaust methods or high-performance elements, too can build up premiums. It is because such changes can adjust the motorbike’s dealing with traits and doubtlessly fortify its threat of involvement in injuries.

For example, a custom-built sportbike with upgraded elements may draw in a better top rate than a regular fashion.

Location and Claims Historical past

Location, just like the geographical terrain of the adventure, is a the most important issue influencing motorbike insurance coverage premiums. Spaces with a better focus of injuries or increased ranges of site visitors density usally lead to increased premiums. A complete claims historical past, just like an in depth account of previous trips, holds immense weight in figuring out premiums. A rider with a historical past of claims will most often pay greater than a rider with a blank file.

For instance, a rider in a metropolitan space with a contemporary coincidence declare may see a vital build up of their top rate. A rider in a rural space with a blank file, on the other hand, may see a decrease top rate.

Comparability of Motorbike and Automotive Insurance coverage Top class Components

| Issue | Motorbike Insurance coverage | Automotive Insurance coverage |

|---|---|---|

| Rider Enjoy | An important; increased revel in, decrease top rate | Essential; increased revel in, decrease top rate |

| Rider Age | More youthful riders, increased top rate | More youthful drivers, increased top rate |

| Motorbike Kind | Higher, extra tough bikes, increased top rate | Higher, extra tough cars, increased top rate |

| Changes | Aftermarket portions, increased top rate | Aftermarket portions, increased top rate |

| Location | Prime-accident spaces, increased top rate | Prime-accident spaces, increased top rate |

| Claims Historical past | Claims, increased top rate | Claims, increased top rate |

This desk summarizes the important thing components influencing each motorbike and automotive insurance coverage premiums. Figuring out those components permits for proactive steps to control insurance coverage prices and advertise secure driving practices.

Protection Comparisons

Embarking at the adventure of bike possession necessitates a profound figuring out of the intricate tapestry of protection choices. The airy dance between coverage and duty takes heart level in navigating the world of insurance coverage. This figuring out transcends mere monetary issues, encompassing the profound sense of safety that includes realizing your preferred car is shielded towards unexpected cases.The area of bike insurance coverage, whilst usally mirroring automotive insurance coverage, possesses distinctive nuances.

Legal responsibility necessities, complete protection, and the significance of roadside help all intertwine to form the contours of your protecting defend. This exploration delves into the sophisticated however vital disparities, making sure you navigate this realm with enlightened discernment.

Legal responsibility Protection Necessities

Legal responsibility protection safeguards you towards monetary repercussions stemming from incidents the place your movements reason hurt to others. Bikes and automobiles each necessitate legal responsibility protection, however the particular necessities and bounds range considerably. Motorbike legal responsibility protection usally comes to decrease minimums in comparison to automotive insurance coverage, highlighting the differing levels of threat related to each and every car sort. On the other hand, exceeding those minimums stays the most important for tough monetary coverage.

This disparity underscores the significance of tailoring protection to particular person cases and doable liabilities.

Complete and Collision Protection Variations

Complete protection safeguards towards perils past your keep an eye on, corresponding to vandalism, robbery, or weather-related incidents. Collision protection, conversely, addresses damages incurred in injuries involving your motorbike. Motorbike complete and collision protection usally possess decrease limits than related automotive protection, reflecting the inherent vulnerabilities of bikes in positive eventualities. This difference emphasizes the need for cautious analysis of your particular wishes and doable dangers.

Good enough protection guarantees you are provided to stand unexpected occasions.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection protects you if every other motive force, missing enough insurance coverage, reasons an coincidence. This protection is similarly important for bikes and automobiles, offering a security internet within the tournament of an incident involving a negligent or uninsured motive force. This facet underscores the profound want for accountable and moral using behavior from all events concerned.

Roadside Help and Emergency Products and services

Roadside help and emergency products and services protection be offering important toughen when your motorbike encounters mechanical problems or is excited by an coincidence. This protection, usally missing in same old automotive insurance coverage, proves specifically the most important for bikes, given their inherent vulnerability in positive cases. Its inclusion can considerably mitigate the tension and inconvenience related to unexpected mechanical breakdowns or injuries. This emphasizes the essential function of preemptive making plans in navigating the unpredictable nature of the street.

Standard Protection Limits

| Protection Kind | Motorbike Insurance coverage (Standard) | Automotive Insurance coverage (Standard) |

|---|---|---|

| Legal responsibility Physically Harm | $25,000-$100,000 in step with individual, $50,000-$300,000 in step with coincidence | $25,000-$100,000 in step with individual, $50,000-$300,000 in step with coincidence |

| Legal responsibility Belongings Injury | $25,000-$100,000 | $25,000-$100,000 |

| Complete | $1,000-$5,000 | $1,000-$10,000 |

| Collision | $1,000-$5,000 | $1,000-$10,000 |

| Uninsured/Underinsured Motorist | $25,000-$100,000 in step with individual, $50,000-$300,000 in step with coincidence | $25,000-$100,000 in step with individual, $50,000-$300,000 in step with coincidence |

This desk showcases conventional protection limits. Exact limits range a great deal in line with the insurer, your location, and your personal cases. All the time seek the advice of your insurance coverage supplier for actual main points. A radical figuring out of those figures is very important to verify ok coverage.

Claims Procedure and Settlements

The adventure during the aftermath of a bike coincidence will also be fraught with complexities. Navigating the claims procedure and securing an excellent agreement calls for figuring out the precise procedures and doable pitfalls distinctive to motorbike insurance coverage. This intricate dance comes to meticulous documentation, verbal exchange, and a nuanced appreciation for the inherent variations between motorbike and car claims. The trail to solution calls for a transparent figuring out of the jobs performed by means of all events concerned, from the injured rider to the insurance coverage adjusters.The claims procedure for motorbike injuries usally differs considerably from that of auto injuries because of the inherent vulnerability of bikes and the usally extra complicated nature of accidents sustained.

Motorbike injuries often contain increased ranges of threat and doable for extra serious penalties, necessitating a specialised solution to dealing with claims. The purpose of each processes, on the other hand, is to quite compensate the injured events whilst making sure a simply and environment friendly solution.

Motorbike Twist of fate Claims Procedure

The method normally starts with reporting the coincidence to the related government and your insurance coverage corporate. Thorough documentation is the most important. This comprises amassing witness statements, images of the coincidence scene, and scientific data. The severity of the coincidence considerably affects the period of the method. Minor incidents is also resolved hastily, while critical injuries can take a number of months and even years to conclude.

Adjusters play a essential function in assessing the wear and tear, figuring out legal responsibility, and negotiating an excellent agreement.

Variations in Claims Dealing with

Motorbike insurance coverage claims usally contain a extra detailed evaluate of the wear and tear to the motorbike and the rider’s accidents, as in comparison to automotive insurance coverage claims. This stems from the motorbike’s inherent vulnerability and the opportunity of extra critical accidents. Motorbike insurance coverage adjusters are usally extra aware of the precise components affecting motorbike injuries and the original demanding situations in calculating damages.

This specialization permits for a extra adapted solution to resolving the declare.

Agreement Approaches

Agreement approaches in each sorts of claims usally contain negotiation between the events. This negotiation goals to succeed in a mutually appropriate solution. The severity of the coincidence, the level of accidents, and the perceived legal responsibility of the events affect the agreement. In some instances, mediation or arbitration is also important to facilitate a solution. Examples of such instances are the ones involving disputed legal responsibility or intensive accidents requiring vital repayment.

Position of Adjusters

Motorbike insurance coverage adjusters are usally extremely specialised pros. They possess a deep figuring out of bike coincidence dynamics, restore prices, and damage critiques. Their function extends past merely comparing damages; they play a key function in investigating the coincidence, accumulating proof, and negotiating settlements. Adjusters ensure that an excellent and environment friendly solution by means of adhering to established insurance coverage insurance policies and procedures.

Standard Steps in a Motorbike Declare

- Reporting: Straight away file the coincidence to the government and your insurance coverage corporate. Correct and advised reporting is the most important for starting up the declare procedure and protecting proof.

- Documentation: Acquire all related paperwork, together with scientific data, witness statements, and images of the coincidence scene. Thorough documentation considerably strengthens your declare and is helping within the evaluate of damages.

- Investigation: The insurance coverage corporate will habits an investigation to decide the reason for the coincidence and the level of damages. This comes to reviewing proof and contacting witnesses to reconstruct the development.

- Evaluate: Adjusters evaluation the damages to the motorbike, belongings, and the wounds sustained by means of the rider. This evaluate paperwork the foundation for figuring out the volume of repayment.

- Negotiation: The insurance coverage corporate and the claimant negotiate a agreement that adequately compensates for the damages and accidents. Negotiations intention for an excellent solution that respects the rights and tasks of all events concerned.

- Agreement: As soon as an settlement is reached, the agreement is finalized, and the repayment is paid. This procedure comes to moving price range and finishing all important forms.

Agreement Timelines

| Facet | Motorbike Insurance coverage | Automotive Insurance coverage |

|---|---|---|

| Minor Injuries | In most cases resolved inside 2-4 weeks | In most cases resolved inside 1-3 weeks |

| Average Injuries | In most cases resolved inside 4-8 weeks | In most cases resolved inside 2-6 weeks |

| Critical Injuries | Might take a number of months to a yr or extra | Might take a number of weeks to a couple of months |

Word: Those are common estimations. Exact timelines might range considerably relying at the specifics of the case, the complexity of the investigation, and the negotiation procedure.

Motorbike vs. Automotive Insurance coverage

Embarking at the open avenue, the wind whispering thru your hair, a bike gives an exciting freedom. On the other hand, this exhilarating revel in carries distinctive dangers that should be said and understood. A profound figuring out of those dangers is very important for navigating the complexities of bike insurance coverage, permitting riders to make knowledgeable selections that safeguard their monetary well-being and their adventure.

Explicit Dangers Related to Motorbike Using, Motorbike insurance coverage vs automotive insurance coverage

Motorbike driving inherently items distinct dangers in comparison to using a automotive. The diminished coverage afforded by means of a bike body, coupled with the rider’s bigger publicity to the weather, considerably affects insurance coverage premiums. Bikes are extra liable to collisions, with the rider usally bearing a better portion of the impression. The smaller dimension and decrease profile of bikes additionally build up the possibility of being lost sight of by means of drivers of different cars, thereby expanding the chance of injuries.

Figuring out those distinctive dangers is the most important for securing suitable insurance policy.

Have an effect on of Using Kind on Premiums

The frequency and severity of doable injuries range considerably relying on the kind of motorbike driving. Commuting riders, for example, usally face predictable and not more hazardous routes, while racers or fanatics engaged in high-speed actions on twisting roads face bigger dangers. This distinction at once interprets into various premiums, with racing or stunt-style driving usally commanding considerably increased charges.

Dangers of Injuries Involving Bikes

Injuries involving bikes often contain high-impact collisions. The vulnerability of the rider and the inherent instability of the motorbike can result in extra serious accidents in comparison to automotive injuries. The rider’s loss of coverage, coupled with the often-greater drive of impression, considerably will increase the opportunity of critical damage and consequential monetary burden. This issue is a essential component in assessing motorbike insurance coverage wishes.

Specialised Protection for Explicit Bikes

Positive sorts of bikes, corresponding to custom-built or off-road fashions, usally require specialised insurance policy. The original options and doable for injury related to most of these bikes may necessitate further protections now not normally incorporated in same old insurance policies. For instance, custom-built bikes can have changes that void same old protection or necessitate specialised tests.

Possible for Upper Declare Payouts in Motorbike Injuries

The opportunity of increased declare payouts in motorbike injuries is a vital fear. The rider’s loss of considerable coverage, blended with the larger probability of significant accidents, usally ends up in considerable scientific bills and long-term rehabilitation prices. Claims involving serious accidents can considerably exceed the ones from related automotive injuries, underscoring the significance of complete motorbike insurance policy.

Significance of Riders’ Consciousness of Non-public Dangers

A rider’s non-public threat evaluate is the most important in figuring out the best insurance policy. Components like driving revel in, driving behavior, and the kind of motorbike ridden considerably affect the opportunity of injuries. Skilled riders with a confirmed monitor file of secure driving may qualify for decrease premiums, while the ones with a historical past of violations or reckless habits might face increased charges.

Forms of Motorbike Injuries

| Twist of fate Kind | Description |

|---|---|

| Collision with every other car | It is a not unusual form of motorbike coincidence, the place a bike collides with a automotive, truck, or different motorbike. Continuously, the motorbike is lost sight of, resulting in a extra serious impression. |

| Fall or lack of keep an eye on | Injuries can stand up from more than a few reasons, together with slippery roads, mechanical screw ups, or rider error. The loss of protecting boundaries can result in critical accidents. |

| Object or impediment impression | Sudden items or hindrances within the avenue may cause riders to lose keep an eye on, leading to falls or collisions. |

| Environmental hazards | Climate stipulations, like rain or ice, could make the street floor hazardous, expanding the possibility of falls and injuries. |

Riders must be conscious about their particular person threat components and modify their driving behavior accordingly.

Value-Receive advantages Research and Suggestions: Motorbike Insurance coverage Vs Automotive Insurance coverage

Embarking at the trail of bike possession is a adventure of freedom, a dance with the wind, a communion with the open avenue. On the other hand, this exhilarating revel in comes with the duty of figuring out the monetary implications, particularly in terms of insurance coverage. This research delves into the cost-benefit equation, illuminating the prospective financial savings and profound advantages of securing suitable motorbike insurance coverage.A profound figuring out of the pricetag construction of bike insurance coverage is very important for navigating this adventure correctly.

This research will unveil the nuances of the monetary panorama, offering a transparent roadmap to make knowledgeable selections. The comparability between motorbike and automotive insurance coverage, coupled with insightful suggestions, will empower you to select a trail aligned together with your monetary objectives and private philosophy.

Moderate Prices of Motorbike and Automotive Insurance coverage

The monetary panorama of bike insurance coverage usally items a stark distinction to that of auto insurance coverage. Motorbike insurance coverage premiums normally fall under the ones for automotive insurance coverage, reflecting the decrease threat profile related to bikes. This distinction in prices arises from more than a few components, together with the decrease price of a bike in comparison to a automotive, the opportunity of much less injury in an coincidence, and the often-lower probability of accidents in a bike coincidence.

Components just like the rider’s revel in, location, and the kind of motorbike additional affect the pricetag.

Possible Financial savings Related to Motorbike Insurance coverage

Important financial savings are usally doable during the even handed collection of motorbike insurance coverage. The decrease reasonable premiums for motorbike insurance coverage can translate into considerable annual financial savings in comparison to automotive insurance coverage. For example, a rider with a blank using file and a low-risk motorbike fashion may doubtlessly save masses of bucks yearly by means of choosing a bike insurance coverage as an alternative of a complete automotive insurance coverage.

Those financial savings will also be channeled into stories at the open avenue, upgrades to the motorbike, or different non-public interests.

Advantages of Having Motorbike Insurance coverage

Past the monetary benefits, motorbike insurance coverage supplies essential coverage in unexpected cases. The monetary coverage afforded by means of insurance coverage is important for dealing with the prices related to maintenance, scientific expenses, and prison charges within the tournament of an coincidence. This coverage isn’t just about monetary safety, but in addition about peace of thoughts, permitting riders to benefit from the adventure with out the load of economic anxieties.

It fosters a way of safety, enabling a extra carefree solution to the street.

Necessity of Sparsely Comparing Motorbike Insurance coverage Choices

The area of bike insurance coverage gives a various spectrum of choices, each and every catering to various wishes and personal tastes. A radical analysis of various coverage provisions is very important to verify the selected coverage successfully safeguards your pursuits. Cautious attention of things corresponding to protection limits, deductibles, and add-on choices is the most important for maximizing coverage with out needless bills.

Complete Evaluate of Value Issues for Other Insurance coverage Choices

Navigating the panorama of bike insurance coverage calls for a willing eye for element. Other choices, corresponding to liability-only insurance policies, complete protection, and add-ons for roadside help or uninsured/underinsured motorist coverage, include various value tags. Figuring out the specifics of each and every choice is secret to meaking knowledgeable selections. The prices related to other choices usally mirror the extent of coverage and the precise dangers concerned.

This necessitates a cautious exam of 1’s particular person wishes and cases.

Value-Receive advantages Research Desk

| Insurance coverage Kind | Moderate Top class (USD) | Possible Financial savings (USD) | Key Advantages |

|---|---|---|---|

| Motorbike Legal responsibility Handiest | $200-$500 | $300-$800+ | Elementary prison coverage; lowest charge. |

| Motorbike Complete | $300-$800 | $200-$700+ | Covers damages to the motorbike and different events excited by an coincidence. |

| Automotive Insurance coverage | $800-$2000+ | $500-$1500+ | Broader protection; protects towards car injury and doable accidents. |

Motorbike insurance coverage, usally a considerably extra inexpensive choice than automotive insurance coverage, permits riders to allocate extra assets in opposition to the revel in and delight in the adventure.

Motorbike Insurance coverage Sources

Navigating the labyrinth of bike insurance coverage choices can really feel overwhelming. But, figuring out the to be had assets empowers you to make knowledgeable selections, making sure your preferred coverage aligns harmoniously together with your wishes and non secular aspirations. A well-researched coverage, corresponding to a well-maintained gadget, can give you the safety and freedom important for the soul’s adventure.

Respected Motorbike Insurance coverage Suppliers

A plethora of insurance coverage suppliers cater to the motorbike group. Opting for a credible supplier is paramount, because it indicates a dedication to truthful practices and accountable provider. Search suppliers with a powerful monitor file, certain buyer evaluations, and a transparent figuring out of the nuances of bike insurance coverage. Transparency and moral practices are hallmarks of a credible supplier.

Their willpower to buyer pride is corresponding to a guiding mild within the huge expanse of insurance coverage alternatives.

Helpful Sources for Evaluating Motorbike Insurance coverage Quotes

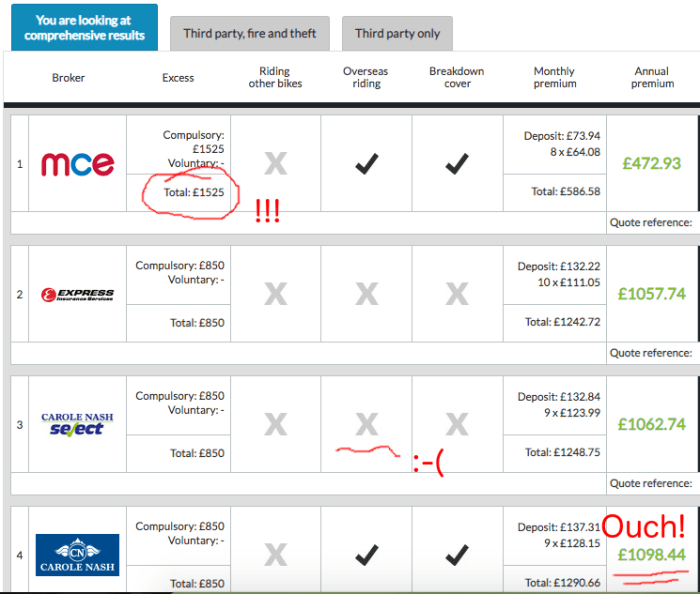

Comparability web sites supply a handy platform to guage more than a few motorbike insurance coverage insurance policies. Those platforms combination quotes from a couple of suppliers, simplifying the method of discovering the most productive have compatibility to your particular person wishes. Make the most of those equipment to discover quite a lot of choices, making sure you discover the optimum steadiness between protection and value. Those equipment are like celestial maps, guiding you during the complicated panorama of insurance coverage choices.

Significance of Researching and Evaluating Insurance policies

Thorough analysis and coverage comparisons are the most important for acquiring essentially the most favorable phrases. Do not accept the primary quote; as an alternative, examine insurance policies from other suppliers. This guarantees you are now not lacking out on doubtlessly decrease premiums or enhanced protection. This diligence is sort of a pilgrimage, a adventure of discovery, that in the long run ends up in a extra protected and spiritually pleasant trail.

Position of On-line Comparability Equipment in Discovering the Easiest Motorbike Insurance coverage

On-line comparability equipment are beneficial property within the quest for the optimum motorbike insurance coverage. Those equipment usally supply personalised suggestions in line with your particular necessities, corresponding to location, driving revel in, and motorbike sort. They streamline the method, permitting you to concentrate on the core components of your non secular adventure. Those equipment are corresponding to sensible mentors, guiding you in opposition to the most productive imaginable trail.

On-line Sources for Motorbike Insurance coverage

| Useful resource | Description |

|---|---|

| Insure.com | A complete on-line platform for evaluating more than a few insurance coverage insurance policies, together with motorbike insurance coverage. |

| Policygenius | A user-friendly site offering a big selection of insurance coverage choices, together with motorbike insurance coverage. |

| NerdWallet | Provides detailed comparisons of bike insurance coverage insurance policies, enabling knowledgeable decision-making. |

| QuoteWizard | Supplies an intensive collection of motorbike insurance coverage quotes, facilitating an easy comparability procedure. |

Those assets are very important equipment for navigating the complicated global of bike insurance coverage.

Closure

In the long run, opting for between motorbike and automotive insurance coverage depends upon particular person wishes and cases. Believe your driving genre, doable dangers, and price range. Thorough analysis and comparisons are important ahead of creating a dedication. This information gives the insights you wish to have to make an educated resolution.

Commonplace Queries

What are the everyday protection choices in a bike insurance coverage?

Standard choices come with legal responsibility, complete, collision, and uninsured/underinsured motorist protection. Explicit main points range by means of insurer and coverage.

How does rider revel in impact motorbike insurance coverage premiums?

Extra revel in usally interprets to decrease premiums, as insurers understand much less threat. Conversely, more recent riders face increased premiums.

What are some not unusual sorts of motorbike injuries?

Commonplace varieties come with collisions with different cars, rollovers, and single-vehicle crashes. The particular form of coincidence usally influences declare settlements.

What on-line assets can I take advantage of to match motorbike insurance coverage quotes?

A lot of on-line comparability equipment exist that will help you examine insurance policies from other suppliers.