Automotive insurance coverage that again dates opens up a global of chances, but in addition gifts complexities. Figuring out the intricacies of backdating is an important for somebody desiring retroactive protection. This exploration dives deep into the nuances of this procedure, analyzing its prison implications, doable prices, and commonplace customer support problems. We’re going to additionally discover selection answers to backdating.

From working out the definition of “backdating” to navigating the procedures for soliciting for a backdated coverage, this information supplies a complete assessment. We’re going to additionally duvet the average pitfalls to keep away from and spotlight selection answers when suitable.

Figuring out Backdating in Automotive Insurance coverage

Navigating the complexities of vehicle insurance coverage may also be difficult, specifically when coping with requests for backdated insurance policies. Backdating, on this context, comes to adjusting the coverage’s efficient get started date to a previous date. This tradition, whilst infrequently essential, too can provide prison and sensible hurdles. Figuring out the nuances of backdating is an important for each policyholders and insurers.Backdating in automotive insurance coverage comes to changing the coverage’s graduation date to a prior one.

This variation can surround retroactive protection, impacting the coverage’s validity and related responsibilities from a selected time limit. This ceaselessly necessitates a evaluate of premiums, protection main points, and doable implications for each the insurer and the insured.

Definition of Backdating

Backdating in automotive insurance coverage is the act of adjusting the efficient get started date of a coverage to an previous date than the date the coverage used to be issued. This implies protection is regarded as to had been in impact previous to the real issuance of the record. This tradition can affect quite a lot of facets of the coverage, from top rate calculations to the length of protection.

Causes for Backdating, Automotive insurance coverage that again dates

A number of causes would possibly steered a request for backdated automotive insurance coverage. Those come with:

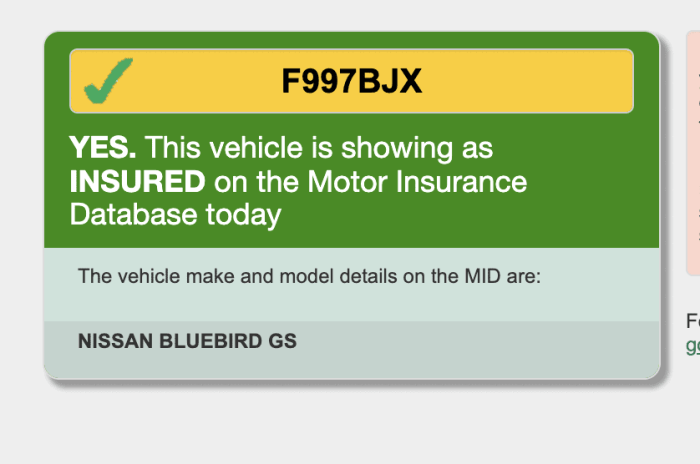

- Evidence of Insurance coverage Requirement: In some cases, policyholders would possibly want evidence of insurance policy for a length previous the coverage’s precise issuance, akin to for a selected prison or regulatory requirement.

- Retroactive Protection: If an twist of fate or different match came about previous to the coverage’s efficient date, backdating is also essential to make sure that the declare is roofed. That is commonplace for eventualities the place the policyholder’s want for protection arose previous than the coverage used to be got.

- Declare Solution: Every now and then, backdating is a part of a agreement or dispute solution procedure to verify claims are addressed quite and as it should be.

Felony Implications of Backdating

Backdating automotive insurance coverage insurance policies could have important prison ramifications. Falsely or fraudulently backdating a coverage to achieve an unfair merit or hide a previous match may just lead to prison motion, together with doable fines and legal fees. Moreover, insurance coverage insurance policies ceaselessly include provisions associated with backdating, and violating those phrases may just result in coverage cancellation.

Examples of Backdating Situations

Backdating automotive insurance coverage insurance policies may also be each essential and problematic, relying at the state of affairs.

- State of affairs 1: A driving force purchases a automotive and desires to supply evidence of insurance coverage for the DMV. They are able to backdate the coverage to the date of acquire, making sure compliance with the legislation. The price of insurance coverage will replicate the protection length.

- State of affairs 2: A policyholder claims injury to their car previous to the efficient date in their insurance coverage. The insurer would possibly conform to backdate the coverage to incorporate this incident. Alternatively, this may also be problematic if the policyholder intentionally hid the development or the coverage’s backdating is completed to keep away from previous legal responsibility.

Varieties of Backdating Situations

| State of affairs Sort | Description |

|---|---|

| Coverage Get started Date Adjustments | Adjusting the coverage’s efficient get started date to a previous date. |

| Retroactive Protection | Making sure protection for occasions that came about earlier than the coverage’s efficient date. |

| Top rate Changes | Calculating premiums according to the prolonged protection length. |

Legality and Insurance coverage Practices

Navigating the sector of vehicle insurance coverage may also be tough, particularly when taking into account backdating insurance policies. Figuring out the prison panorama and insurance coverage corporate procedures surrounding this custom is an important for each customers and suppliers. Whilst backdating would possibly look like a simple answer, its legality and execution range considerably by way of jurisdiction and insurance coverage supplier.The prison ramifications of backdating automotive insurance coverage insurance policies are complicated and rely closely on native rules and rules.

Insurance coverage corporations, in flip, have interior insurance policies and procedures that dictate their method to backdating requests, ceaselessly reflecting the prison necessities in their running area. A essential side to keep in mind is that fraudulent backdating carries severe penalties.

Legality of Backdating Insurance policies

Other jurisdictions have various views at the legality of backdating automotive insurance coverage insurance policies. Some states would possibly allow backdating beneath particular cases, whilst others would possibly limit it outright. The important thing issue ceaselessly lies in whether or not the backdating is meant to create a false checklist or to replicate a real settlement that used to be entered into after the truth. Figuring out the specifics of your jurisdiction’s rules is important.

Insurance coverage Corporate Practices

Insurance coverage corporations make use of other approaches when comparing backdating requests. Some would possibly allow backdating if it aligns with their interior procedures and native rules. Others can have strict insurance policies towards it, particularly in circumstances the place it’s perceived as probably fraudulent. Every insurance coverage supplier establishes its personal interior protocols, making sure adherence to prison necessities.

Procedures for Asking for Backdated Insurance policies

Insurance coverage corporations have particular procedures for dealing with backdating requests. Those ceaselessly contain offering documentation to make stronger the will for the coverage to be backdated. The documentation required can range broadly between suppliers and jurisdictions. As an example, some corporations would possibly require a signed settlement outlining the settlement for the backdated protection, together with supporting forms for the coverage efficient date.

The appropriate process is Artikeld by way of each and every insurance coverage supplier and must be explicitly mentioned of their phrases and prerequisites.

Penalties of False Knowledge or Fraudulent Backdating

Making an attempt to backdate a coverage fraudulently carries important penalties. Those can vary from denial of protection to hefty fines, and even legal prosecution. Offering misguided or deceptive data to protected a backdated coverage is regarded as a contravention of the insurance coverage contract and can lead to the invalidation of the coverage, and will also be against the law. It is very important to know the intense implications of offering false data or making an attempt to backdate a coverage fraudulently.

Not unusual Felony Restrictions on Backdating

| Area | Not unusual Felony Restrictions |

|---|---|

| United States (e.g., California) | Most often, backdating is authorized if it displays a previous settlement, however fraud or intent to lie to is against the law. Strict adherence to state rules is paramount. |

| United Kingdom | Very similar to the USA, backdating is normally allowed if it displays a previous settlement, however fraudulent intent is precisely forbidden. Strict tips exist for documentation necessities. |

| Eu Union | Person member states can have other rules. Most often, backdating is permissible beneath particular cases. Transparency and documentation are an important. |

| Canada | Provincial rules range, with some allowing backdating beneath sure prerequisites. Making sure the backdating displays a real prior settlement is significant. |

Be aware: This desk supplies a basic assessment and isn’t exhaustive. Particular rules and restrictions would possibly range by way of area and person insurance coverage supplier.

Have an effect on on Protection and Prices

Backdating a automotive insurance coverage, whilst apparently simple, could have important implications for each the policyholder and the insurance coverage supplier. Figuring out those results is an important to verify the coverage aligns together with your wishes and expectancies, and to keep away from doable disputes. This phase delves into the intricacies of ways backdating impacts protection, premiums, claims processing, and possibility review.

Protection Length Adjustment

Backdating modifies the efficient get started date of the coverage. This at once affects the length lined by way of the insurance coverage. If a coverage is backdated, the protection starts at the specified previous date, successfully extending the length of coverage. Alternatively, protection does now not lengthen past the coverage’s expiration date. This modification within the protection length is very important to imagine when calculating the length of coverage and doable declare eventualities.

Top rate Changes

Backdating a coverage can dramatically have an effect on the top rate price. The top rate isn’t merely a static quantity; it displays the chance related to the insured car and driving force right through the coverage length. The longer the backdated length, the upper the top rate might be. It’s because the insurer assumes a better possibility for an extended length of doable claims.

Claims Processing Issues

Backdating a coverage influences the processing of claims. If a declare arises right through the backdated length, the insurer will have to decide whether or not the declare falls inside the coverage’s efficient protection dates. Documentation and data as it should be reflecting the backdated coverage are an important for a clean and well timed declare agreement. Insurance coverage corporations depend on meticulous data for those processes, as unsuitable or incomplete data can obstruct declare approval.

Chance Evaluation Amendment

Insurance coverage corporations assess possibility components to decide suitable top rate charges. Backdating affects the chance review length, which impacts the corporate’s working out of the insured’s using historical past and car utilization right through the prolonged length. This information influences the calculated top rate, making backdating a essential consider figuring out the coverage’s monetary implications. An instance is a driving force with a blank checklist who backdates a coverage from a length with a minor twist of fate.

The insurance coverage corporate would possibly regulate the top rate upwards, taking into account the chance of doable long run claims right through the prolonged protection length.

Top rate Price Permutations

The top rate price is delicate to the backdating length. The longer the length, the upper the top rate. That is because of the higher possibility publicity for the insurance coverage corporate. An extended backdating length implies an extended length of doable claims. The desk underneath illustrates how the top rate price adjustments according to the backdating length.

This desk supplies a basic representation; the fitting figures range according to person cases and insurer insurance policies.

| Backdating Length (in days) | Estimated Top rate Build up (%) |

|---|---|

| 30 | 5-10% |

| 60 | 10-15% |

| 90 | 15-20% |

| 120 | 20-25% |

| 180 | 25-30% |

Buyer Carrier and Procedures

Navigating the intricacies of backdating automotive insurance coverage insurance policies generally is a irritating revel in for lots of. Figuring out the fitting procedures, doable pitfalls, and commonplace problems related to this procedure is an important for each customers and insurance coverage suppliers. This phase delves into the buyer provider side of backdating, outlining the stairs concerned and commonplace demanding situations encountered.Insurance coverage corporations will have to take care of meticulous data and processes when dealing with backdating requests to verify equity and accuracy.

A transparent working out of those procedures lets in consumers to look ahead to the timeline and doable hurdles, and assists insurance coverage corporations in managing those requests successfully.

Backdating Request Process

The method for soliciting for a backdated coverage usually comes to a number of steps. Shoppers must be expecting a proper utility procedure to verify accuracy and transparency. This ceaselessly starts with an in depth rationalization of the cause of the backdating, which can be regarded as by way of the insurer. The request will have to be obviously articulated, outlining the required coverage efficient date and together with all supporting documentation, like evidence of auto possession or registration main points.

Not unusual Buyer Carrier Problems

A number of problems continuously get up right through backdating requests. A loss of transparent communique from the insurer in regards to the standing of the request is a commonplace worry. Moreover, insufficient rationalization of the necessities or standards for approval could cause delays or rejection of the request. Mistaken or incomplete documentation submitted by way of the buyer additionally contributes to delays and doable rejection.

Discrepancies in coverage phrases, specifically within the context of the coverage’s inception date, are any other supply of issue.

Insurance coverage Corporate Dealing with of Backdating Requests

Insurance coverage corporations normally make use of a structured method to dealing with backdating requests. They usually require particular documentation and a transparent cause of the backdating. Those requests are ceaselessly reviewed by way of specialised groups, and a proper approval procedure is applied to verify compliance with regulatory necessities. The corporate may additionally habits thorough assessments to ensure the accuracy of the ideas supplied by way of the buyer.

Timeline for Processing Backdating Requests

The timeline for processing a backdating request varies considerably relying at the complexity of the case and the quantity of requests. Components such because the completeness of the appliance, the thoroughness of the documentation, and the insurer’s interior evaluate procedure all affect the length. A simple request with complete documentation might be processed extra briefly. A extra intricate case involving a number of components may just lengthen the timeline considerably.

The client must all the time ask about anticipated processing time.

Steps Eager about a Backdating Request

| Step | Description |

|---|---|

| 1. Coverage Software | Buyer initiates the backdating request with a complete utility shape, offering detailed details about the required coverage efficient date and supporting documentation. |

| 2. Documentation Evaluate | Insurance coverage corporate evaluations the submitted documentation for accuracy and completeness, making sure compliance with coverage phrases and prison necessities. |

| 3. Underwriting Evaluation | The request is classed by way of the underwriting staff to decide the suitability of the backdated protection and the related possibility. |

| 4. Approval or Denial | The underwriting staff approves or denies the backdating request according to the review and related coverage phrases. Causes for denial are obviously communicated. |

| 5. Coverage Modification | If authorized, the insurance coverage corporate amends the coverage to replicate the backdated efficient date. |

| 6. Coverage Issuance | The amended coverage is issued, and the buyer receives a affirmation of the up to date protection. |

Heading off Not unusual Pitfalls

Navigating the complexities of backdating automotive insurance coverage insurance policies may also be tough. Figuring out the prospective pitfalls can prevent from expensive errors and make sure a clean procedure. This phase highlights key spaces to be careful for when soliciting for a backdated coverage, emphasizing the significance of meticulous documentation and transparent communique.Cautious consideration to element is paramount when coping with backdated insurance coverage insurance policies.

Mistaken data or lacking documentation may end up in delays, denied claims, or even prison problems. Through working out the average pitfalls, you’ll be able to keep away from those problems and make sure your coverage is correctly backdated and efficient from the required get started date.

Possible Problems with Backdating Insurance policies

Backdating a automotive insurance coverage, whilst infrequently essential, can provide a number of demanding situations. Those vary from administrative difficulties to doable prison ramifications if now not treated as it should be. The method calls for precision and adherence to precise tips to verify the coverage’s validity and protection.

Not unusual Errors in Backdating Requests

Shoppers ceaselessly make mistakes in backdating requests, probably resulting in coverage invalidation or disputes. Those errors usually stem from a lack of information in regards to the particular necessities or the significance of correct documentation.

- Offering misguided dates or information about the car or the policyholder.

- Failing to supply entire and correct documentation, akin to evidence of possession or cost data.

- Filing incomplete or poorly arranged forms, which will obstruct the processing of the backdating request.

- Now not contacting the insurance coverage supplier promptly to talk about the precise necessities and procedures for backdating insurance policies.

Significance of Correct Documentation

Exact documentation is significant for a a hit backdating procedure. This guarantees that the insurance coverage corporate can check the coverage’s validity from the asked get started date. Thorough record-keeping all through all of the procedure minimizes doable disputes and guarantees the accuracy of the backdated coverage.

- Deal with copies of all related paperwork, together with evidence of acquire, registration, and cost data.

- Make sure all dates and main points are as it should be recorded and verified towards authentic paperwork.

- Retailer those paperwork securely and feature get entry to to them on every occasion wanted.

Penalties of Neglecting Backdating Necessities

Ignoring the precise necessities for backdating may end up in important repercussions. Those can come with coverage invalidation, denied claims, and doable prison motion. Figuring out those doable penalties is very important to keep away from pointless headaches.

- The insurance coverage is also deemed invalid, which means no protection is supplied for incidents that came about right through the backdated length.

- Claims associated with injuries or damages that came about earlier than the professional coverage get started date is also denied.

- Insurance coverage corporations would possibly impose consequences or charges for filing misguided or incomplete forms.

Heading off Backdating Disputes and Claims

Through diligently following the insurance coverage supplier’s directions and keeping up thorough data, consumers can considerably cut back the chance of disputes. Transparent communique and meticulous record-keeping are key to a clean and a hit backdating procedure.

- Keep in touch at once with the insurance coverage corporate’s customer support representatives to explain any questions or considerations in regards to the backdating procedure.

- Examine that the entire essential paperwork are correct and entire earlier than filing the request.

- Deal with a transparent checklist of all communications with the insurance coverage supplier.

Choices to Backdating

Navigating the complexities of vehicle insurance coverage ceaselessly leads us to discover quite a lot of avenues for securing the required protection. Whilst backdating would possibly look like a simple answer, you need to take into account that selection strategies can be offering related advantages and probably alleviate one of the most demanding situations related to the backdating procedure. Those selection methods may also be extra suitable in particular cases and must be moderately regarded as along backdating.Selection answers supply a variety of choices for acquiring retroactive automotive insurance policy, each and every with its personal set of benefits and drawbacks.

Those strategies intention to reach the similar function – offering protection for a length previous to the coverage’s efficient date – however thru other mechanisms. Figuring out those possible choices lets in for a extra complete method to insurance coverage procurement and control.

Selection Answers for Retroactive Protection

A number of selection answers assist you to succeed in retroactive automotive insurance policy. Those strategies ceaselessly contain operating at once together with your insurer or exploring other coverage choices. Figuring out those possible choices assist you to in finding the most efficient way on your state of affairs.

Examples of Scenarios The place Choices are Extra Suitable

Selection answers may well be extra appropriate than backdating in quite a lot of eventualities. For example, if you are a brand new driving force in quest of protection, purchasing a brand new automotive with present insurance coverage, or coping with an opening in protection, those possible choices can ceaselessly supply a smoother and extra environment friendly answer.

Advantages and Drawbacks of Selection Answers

Selection answers be offering distinct advantages in comparison to backdating. They are able to ceaselessly simplify the method, keep away from doable headaches, and result in extra predictable prices. Alternatively, some answers would possibly have barriers on the subject of protection length or particular cases. Those answers may also be adapted to fulfill person wishes and cases, probably decreasing the complexity and uncertainty related to backdating.

Comparability of Selection Answers with Backdating

A an important side of working out selection answers is evaluating them to the backdating procedure. Backdating ceaselessly comes to a fancy and probably dangerous process, that may be matter to scrutiny or rejection by way of insurers. Selection strategies ceaselessly streamline the method, decreasing the chance of rejection or headaches. This streamlined way ceaselessly lets in for faster protection graduation.

Desk: Selection Strategies of Acquiring Retroactive Protection

| Selection Manner | Professionals | Cons |

|---|---|---|

| Coverage Alternate/Modification | Regularly simple if the alternate is inside a cheap time frame. | Might not be appropriate for really extensive protection adjustments. Can have further prices relying at the insurer’s coverage. |

| Hole Insurance coverage | In particular designed to hide gaps in protection. | Will not be appropriate for all cases. Premiums for hole insurance coverage may well be upper. |

| Buying an Prolonged Coverage Length | Permits for protection again to a selected date. | Further price for the prolonged length. |

| Retroactive Endorsement | Might duvet pre-existing prerequisites or incidents. | Now not all insurers be offering retroactive endorsements. The method may also be long. |

| Negotiating a Refund/Changes | Doubtlessly get well prices from earlier insurance policies if suitable. | Calls for a transparent case and documentation. Reliance on excellent religion from the insurer. |

Remaining Phrase

In conclusion, securing backdated automotive insurance coverage calls for cautious attention of prison implications, protection affects, and doable prices. Figuring out the procedures, commonplace pitfalls, and selection answers empowers you to make knowledgeable choices. This complete information equips you with the information to navigate the backdating procedure with a bit of luck and effectively.

FAQ Compilation: Automotive Insurance coverage That Again Dates

What’s the definition of “backdating” within the context of vehicle insurance coverage?

Backdating in automotive insurance coverage refers to converting the efficient date of a coverage to a date previous to the real coverage acquire date. This ceaselessly comes to adjusting protection to use retroactively.

What are commonplace causes for desiring backdated automotive insurance coverage?

Not unusual causes come with desiring protection for a length earlier than the coverage used to be issued, akin to satisfying prison necessities or setting up evidence of insurance coverage for a selected period of time.

How does backdating affect the price of insurance coverage premiums?

Backdating can considerably have an effect on premiums, probably expanding them relying at the period of the backdated length and the precise cases.

What are some possible choices to backdating automotive insurance coverage?

Choices would possibly come with buying a short lived coverage, acquiring evidence of insurance coverage from a prior coverage, or using different insurance coverage paperwork.