Non proprietor automobile insurance coverage nevada – Non-owner automobile insurance coverage Nevada is a very powerful for many who power automobiles they do not personal. This information supplies a complete assessment of insurance policies, eligibility, prices, and the claims procedure, making sure you realize your rights and tasks.

Navigating the complexities of vehicle insurance coverage can also be daunting, particularly when you find yourself no longer the automobile proprietor. This useful resource simplifies the method, offering transparent explanations and actionable insights that can assist you protected the suitable protection.

Evaluate of Non-Proprietor Automotive Insurance coverage in Nevada

Non-owner automobile insurance coverage in Nevada is a a very powerful type of protection for many who don’t personal a automobile however steadily use one. This sort of coverage protects drivers from monetary legal responsibility within the tournament of an coincidence, irrespective of automobile possession. It is a crucial attention for many who hire, borrow, or differently function a automobile that is not theirs.

Definition of Non-Proprietor Automotive Insurance coverage

Non-owner automobile insurance coverage is designed for many who don’t personal the automobile they function. It supplies legal responsibility coverage in case of an coincidence, protecting doable damages or accidents to others whilst riding a automobile no longer legally owned by way of the policyholder. That is distinct from an ordinary automobile insurance plans, which generally covers each the automobile and the driving force.

Varieties of Non-Proprietor Automotive Insurance coverage Insurance policies in Nevada

Nevada gives more than a few non-owner automobile insurance coverage choices to fit other wishes and scenarios. A key difference is whether or not the coverage is for infrequent or widespread use of the automobile.

Protection Choices in Non-Proprietor Insurance policies

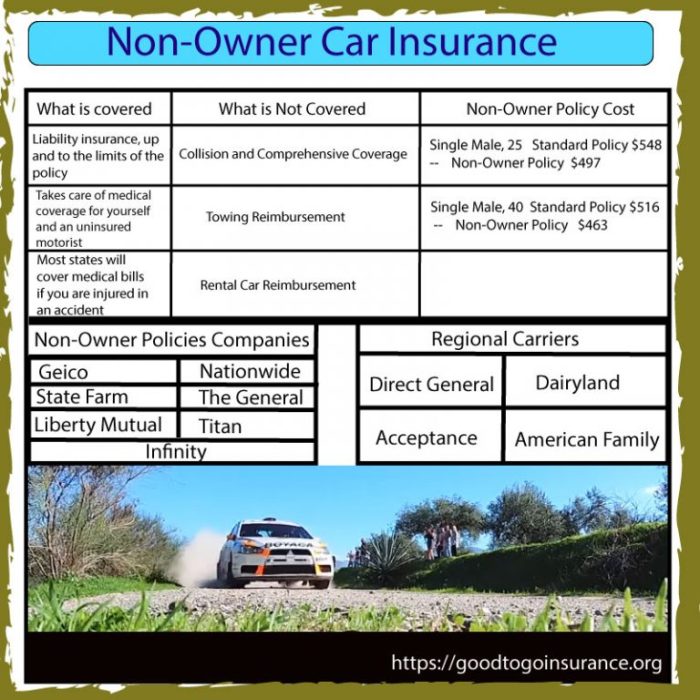

Non-owner insurance policies generally come with legal responsibility protection, protective the driving force and the automobile’s proprietor from monetary accountability in case of injuries. This protection is a very powerful to safeguard the policyholder and others concerned. Further choices, akin to uninsured/underinsured motorist protection, could also be added for complete coverage.

Comparability of Coverage Sorts

| Coverage Kind | Protection | Value (estimated) |

|---|---|---|

| Fundamental Legal responsibility | Covers physically damage and assets harm legal responsibility to others in an coincidence. | $100-$500 per 30 days (relying on elements like riding historical past and boundaries). |

| Enhanced Legal responsibility | Comprises fundamental legal responsibility protection, plus choices for uninsured/underinsured motorist coverage. | $150-$700 per 30 days (relying on elements like riding historical past and boundaries). |

| Complete Protection (with further endorsements) | Complete protection together with fundamental legal responsibility, uninsured/underinsured motorist, and collision protection. | $200-$1000 per 30 days (relying on elements like riding historical past, limits, and add-ons). |

Observe: Prices are estimated and will range considerably in line with particular person instances, together with the precise automobile getting used, the driving force’s riding file, and the selected protection limits. You have to touch more than one insurance coverage suppliers for customized quotes.

Eligibility Necessities for Non-Proprietor Automotive Insurance coverage in Nevada

Non-owner automobile insurance coverage in Nevada supplies protection for many who do not personal the automobile they are riding. This sort of protection is a very powerful for scenarios the place an individual steadily makes use of a automobile that is not theirs, like a pal’s or circle of relatives member’s automobile. Figuring out the precise necessities guarantees suitable coverage and avoids doable monetary burdens.This protection is customized to give protection to the automobile’s proprietor from monetary loss if the non-owner motive force is fascinated about an coincidence.

This insurance coverage isn’t designed to hide the non-owner’s doable legal responsibility, however relatively to give protection to the automobile proprietor’s pursuits.

Particular Standards for Acquiring Non-Proprietor Protection

To acquire non-owner automobile insurance coverage in Nevada, candidates will have to reveal a sound want for the protection. This comes to offering information about their dating with the automobile proprietor and the frequency of use. Components akin to the aim of riding the automobile, whether or not it is for private use or work-related actions, are crucial to guage the insurance coverage wishes.

Who’s Eligible for Non-Proprietor Automotive Insurance coverage?

Eligibility for non-owner automobile insurance coverage is essentially made up our minds by way of the applicant’s dating to the automobile proprietor. This generally comes to people who steadily use a automobile that is not registered to them. Examples come with members of the family, roommates, or people who power the auto for explicit functions, like a pupil riding their guardian’s automobile to university.

Age Restrictions and Riding Document

Age restrictions and riding file necessities for non-owner automobile insurance coverage are in large part dictated by way of the insurance policies of the insurance coverage supplier. Some corporations could have upper premiums for more youthful drivers or the ones with a historical past of site visitors violations. Usually, the landlord’s riding file could have a better affect at the coverage phrases than the non-owner’s.

Eventualities Requiring Non-Proprietor Insurance coverage

Non-owner automobile insurance coverage is especially helpful in scenarios the place an individual steadily makes use of a automobile that is not their very own. This is able to come with faculty scholars the usage of their oldsters’ automobiles, staff the usage of corporation automobiles, or folks borrowing a automobile from a pal or circle of relatives member. The desire for protection arises when the use is widespread sufficient to warrant the security of the automobile’s proprietor’s pursuits.

Examples of Eventualities Requiring Non-Proprietor Protection

- A pupil who drives their guardian’s automobile to university and extracurricular actions day-to-day wishes non-owner insurance coverage to give protection to the guardian’s automobile.

- A roommate who steadily drives a automobile belonging to any other roommate calls for protection to give protection to the automobile proprietor in case of an coincidence.

- An worker the usage of an organization automobile for trade functions wishes non-owner insurance coverage to make sure the corporate’s pursuits are secure.

Not unusual Causes for Non-Proprietor Automotive Insurance coverage

| Reason why | Description |

|---|---|

| Common Use | The person regularly drives a automobile that isn’t registered to them. |

| Transient Use | The person drives a automobile for a restricted length, akin to borrowing it for a weekend shuttle. |

| Designated Motive force | The person is designated as the driving force for a particular tournament or instance, like a circle of relatives collecting. |

| Paintings-Similar Use | The person makes use of a automobile for paintings functions, akin to turning in programs or transporting items. |

Prices and Premiums for Non-Proprietor Automotive Insurance coverage in Nevada

Non-owner automobile insurance coverage in Nevada, whilst offering protection for drivers who do not personal the automobile, comes with various premiums in line with a number of elements. Figuring out those elements is a very powerful for estimating the associated fee and making knowledgeable choices. This phase delves into the important thing components influencing premiums, providing a spread of estimates and insights into how your riding historical past, automobile sort, and different elements affect the general worth.Components like your riding file, the kind of automobile, and the positioning the place you reside all play a task in figuring out your insurance coverage prices.

This makes calculating an actual worth vary tough, however this phase goals to supply a realistic assessment of the possible prices and issues.

Components Influencing Non-Proprietor Automotive Insurance coverage Premiums

A number of key elements affect the price of non-owner automobile insurance coverage in Nevada. Those elements aren’t distinctive to Nevada however are usual issues for insurers international. A excellent riding file, as an example, generally ends up in decrease premiums.

- Riding Document: A blank riding file, freed from injuries and violations, usually ends up in decrease premiums. Injuries, rushing tickets, or DUI convictions, however, considerably build up the associated fee. For example, a motive force with a historical past of reckless riding will most likely face considerably upper premiums in comparison to a motive force with a blank file.

- Car Kind: The kind of automobile insured additionally affects the top class. Top-performance or luxurious automobiles have a tendency to have upper premiums than usual fashions, as they’re regarded as dearer to fix or substitute within the tournament of an coincidence. That is because of the upper price of portions and doable for larger harm.

- Location: The positioning the place you reside and power can affect your top class. Spaces with upper coincidence charges or larger publicity to dangers incessantly include upper insurance coverage prices. For instance, a motive force residing in a town with a large number of site visitors congestion might face upper premiums than a motive force in a rural house.

- Protection Quantity: The extent of protection you select affects the top class. Upper protection quantities generally result in upper premiums. For instance, opting for complete protection that comes with coverage towards harm from climate occasions or vandalism, or legal responsibility protection with upper limits, will build up the top class.

- Deductibles: The volume you pay out-of-pocket ahead of insurance plans kicks in, referred to as the deductible, at once impacts the top class. The next deductible ends up in a decrease top class, however you can wish to pay extra out-of-pocket you probably have an coincidence.

- Credit score Rating: Whilst no longer at all times an immediate issue, a decrease credit score ranking may somewhat build up the top class. Insurers incessantly imagine creditworthiness as a hallmark of monetary accountability.

Estimated Top class Levels

Estimating exact premiums is difficult because of the advanced interaction of things. On the other hand, normal levels can also be useful for making plans. Take into account that those are simply estimations, and your precise top class might range.

- Reasonable Vary (with a blank riding file): $50-$150 per 30 days for fundamental legal responsibility protection.

- Upper Vary (with minor violations or injuries): $150-$300 per 30 days for fundamental legal responsibility protection. It will differ considerably in line with the severity of the violations or injuries.

- Top Vary (with primary violations or injuries): $300-$500+ per 30 days for fundamental legal responsibility protection. This vary displays a considerable build up in premiums because of a historical past of primary violations or injuries.

Comparability of Non-Proprietor Insurance coverage Prices

A comparability desk can lend a hand illustrate the relative prices of non-owner insurance coverage as opposed to different varieties. This desk demonstrates the estimated price variations, spotting that those figures are approximations.

| Insurance coverage Kind | Value (estimated) | Protection |

|---|---|---|

| Non-Proprietor Automotive Insurance coverage (fundamental legal responsibility) | $50-$500+/month | Covers legal responsibility for harm to others’ assets or accidents to others in an coincidence. |

| Complete Protection Automotive Insurance coverage (proprietor) | $100-$500+/month | Covers the automobile and legal responsibility, together with doable harm to the insured automobile. |

| Motorbike Insurance coverage | $50-$250+/month | Covers legal responsibility for motorbike injuries. |

Claims and Dispute Solution Procedures in Nevada

Submitting a declare with a non-owner automobile insurance plans in Nevada follows a normal procedure, very similar to different insurance coverage claims. Figuring out the stairs concerned can lend a hand be certain a easy and environment friendly solution to any incident. This phase main points the declare procedure, commonplace claims, and dispute solution choices.

Submitting a Declare

Step one within the claims procedure comes to reporting the incident to the insurance coverage corporation. This generally comes to contacting the corporate at once, both by way of telephone or on-line, and offering information about the coincidence, together with the date, time, location, and concerned events. Essential data such because the police document quantity (if appropriate) and any witness touch data will have to even be equipped.

Steered reporting is a very powerful for starting up the investigation and collecting vital proof.

Conventional Steps within the Claims Procedure

This procedure generally comes to a number of phases. First, the insurance coverage corporation will examine the declare. This comes to reviewing the reported data, collecting proof, and probably contacting the concerned events. The insurance coverage corporation might request additional info or paperwork to fortify the declare. Following the investigation, the insurance coverage corporation will assess the validity and extent of the declare.

If the declare is authorized, the insurance coverage corporation will supply reimbursement or advantages as Artikeld within the coverage. If the declare is denied, the policyholder will obtain a written clarification detailing the explanations for the denial, and the method for interesting the verdict.

Not unusual Claims and Dealing with

Not unusual claims in non-owner automobile insurance coverage insurance policies come with assets harm, physically damage, and legal responsibility claims. Belongings harm claims incessantly contain harm to the insured’s automobile or any other automobile fascinated about an coincidence. Physically damage claims duvet clinical bills and misplaced wages for people injured in an coincidence. Legal responsibility claims cope with scenarios the place the insured is deemed liable for an coincidence and will have to compensate the opposite celebration concerned.

Each and every declare is treated in my view, with a radical investigation and review of the coverage phrases and appropriate regulations.

Dispute Solution Procedures

In circumstances the place the policyholder disagrees with the insurance coverage corporation’s determination, Nevada legislation Artikels dispute solution procedures. This may occasionally contain contacting the insurance coverage corporation to attraction the verdict or search mediation or arbitration. Policyholders will have to moderately overview their coverage and any related state regulations referring to dispute solution. Figuring out the dispute solution choices to be had can lend a hand navigate disagreements successfully.

Instance Claims

Imagine a state of affairs the place a non-owner motive force, insured underneath a Nevada non-owner coverage, reasons minor harm to any other automobile. The insurance coverage corporation would examine the declare, accumulate main points of the incident, and assess the level of the wear. If the declare is legitimate, the corporate would duvet the damages as much as the coverage limits. Every other instance is a declare for clinical bills after an coincidence.

The insurance coverage corporation will assess the clinical expenses and misplaced wages. They’ll request clinical information to validate the bills and resolve protection.

| Step | Description | Timeline |

|---|---|---|

| Reporting the Incident | Touch the insurance coverage corporation and supply information about the coincidence. | Right away |

| Investigation | Reviewing data, collecting proof, contacting concerned events. | Inside a couple of days to every week |

| Declare Evaluation | Figuring out the validity and extent of the declare. | Inside every week to a couple of months |

| Reimbursement/Advantages | Offering fee for authorized claims. | Relying at the declare complexity |

| Denial and Enchantment | Receiving written clarification of denial and attraction choices. | Inside a couple of weeks |

Protection Boundaries and Exclusions

Non-owner automobile insurance coverage insurance policies in Nevada, whilst offering a a very powerful protection web, aren’t with out barriers. Figuring out those restrictions is very important to steer clear of surprises when creating a declare. This phase will Artikel commonplace exclusions and barriers to make sure you’re acutely aware of the protection’s scope.

Not unusual Boundaries and Exclusions

Non-owner automobile insurance coverage insurance policies generally have barriers to outline the scope of coverage. Those barriers and exclusions are a very powerful to know to steer clear of sadness when a declare is made. Understanding what’s and is not lined is helping you’re making knowledgeable choices about your automobile use and coverage wishes.

Instances Protection May No longer Practice

Protection underneath a non-owner automobile insurance plans is contingent upon explicit instances. This phase main points scenarios the place protection may no longer observe. For instance, protection may well be voided if the insured is riding a automobile that they don’t have permission to function or if the automobile is getting used for industrial functions. It’s important to seek the advice of your coverage paperwork for exact main points.

Varieties of Damages In most cases Coated and Excluded

This phase clarifies the sorts of damages generally lined and excluded underneath a non-owner automobile insurance plans. In most cases, damages to the insured celebration’s personal automobile, if fascinated about an coincidence with a automobile they don’t personal, aren’t lined. Additional, protection won’t lengthen to incidents that happen whilst the automobile is being utilized in violation of the legislation, akin to riding inebriated or medicine.

Significance of Reviewing Coverage Paperwork Completely

Thorough overview of the coverage report is paramount. The coverage report will comprise the specifics of protection, exclusions, and barriers. It is very important to know those phrases to forestall any misunderstandings throughout a declare. It’s smart to seek the advice of the coverage report, and preferably, an insurance coverage skilled to interpret advanced clauses or to make sure readability.

Not unusual Exclusions

Figuring out the precise exclusions for your coverage is important. This desk supplies a normal assessment of commonplace exclusions in non-owner automobile insurance coverage insurance policies. Seek the advice of your coverage report for exact main points.

| Exclusion | Description |

|---|---|

| Non-public Use Exclusions | Protection won’t observe if the automobile is used for trade functions or for actions no longer lined within the coverage phrases. |

| Violation of Regulation | If the insured is working a automobile in violation of the legislation (e.g., riding underneath the affect), protection won’t observe. |

| Pre-existing Prerequisites | Damages to a automobile due to a pre-existing situation, akin to mechanical failure, is probably not lined. |

| Car No longer Owned | Protection is generally restricted to incidents involving a automobile no longer owned by way of the insured. |

| Uninsured/Underinsured Motorist | Protection won’t lengthen to incidents involving uninsured or underinsured motorists if the coverage does not in particular come with this protection. |

| Harm to Insured’s Personal Car | Damages to the insured’s personal automobile when fascinated about an coincidence involving a automobile they don’t personal are incessantly excluded. |

| Changes/Alterations | Any changes or alterations to the automobile that have an effect on its protection or operational traits may just void protection. |

Comparability with Different Varieties of Automotive Insurance coverage

Non-owner automobile insurance coverage in Nevada supplies a a very powerful selection to conventional proprietor’s insurance coverage, catering to precise wishes and instances. Figuring out the distinctions between those insurance policies is very important for making knowledgeable choices. This comparability will spotlight the important thing variations in protection, price, and eligibility, aiding folks in deciding on the best option.

Protection Variations

Non-owner automobile insurance coverage generally covers legal responsibility for injuries involving the automobile, protective the policyholder from monetary accountability if they’re at fault. It does no longer duvet harm to the automobile itself, in contrast to proprietor’s insurance coverage. Proprietor’s insurance coverage, however, supplies complete coverage for the automobile, together with harm from injuries, robbery, or vandalism. It additionally incessantly comprises collision protection, paying for harm to the insured automobile irrespective of who’s at fault.

Value Comparability

The price of non-owner automobile insurance coverage in Nevada is usually less than proprietor’s insurance coverage, reflecting the lowered protection. Components influencing premiums come with the driving force’s age, riding file, and the automobile’s make and style. For instance, a tender motive force with a up to date coincidence will most likely face upper premiums underneath any form of coverage, however non-owner insurance policies can be extra reasonably priced than proprietor’s insurance policies.

Premiums too can range in line with the precise protection limits selected.

Eligibility Standards

Eligibility necessities vary between the 2 sorts of insurance policies. Non-owner automobile insurance coverage generally calls for the person to be an authorized motive force, whilst proprietor’s insurance coverage in most cases calls for possession of the automobile. For non-owner insurance coverage, the insured is probably not the automobile proprietor, however they will have to be riding the automobile in query.

Eventualities Suited for Each and every Coverage

Non-owner automobile insurance coverage is perfect for many who borrow, hire, or power automobiles that aren’t their very own. For example, a faculty pupil riding a pal’s automobile or an individual borrowing a automobile for a brief length. Proprietor’s insurance coverage is extra suitable for many who personal the automobile and search complete coverage towards harm, robbery, and different incidents.

Desk Evaluating Insurance coverage Sorts

| Insurance coverage Kind | Protection | Value (estimated) | Eligibility |

|---|---|---|---|

| Non-owner | Legal responsibility protection for injuries involving the automobile. Does no longer duvet harm to the automobile. | Less than proprietor’s insurance coverage | Approved motive force; riding a automobile no longer owned. |

| Proprietor’s | Complete coverage for the automobile, together with harm from injuries, robbery, or vandalism; incessantly comprises collision protection. | Upper than non-owner insurance coverage | Proprietor of the automobile. |

Assets for Discovering Non-Proprietor Automotive Insurance coverage in Nevada

Securing non-owner automobile insurance coverage in Nevada comes to navigating more than a few sources and working out the stairs to acquire a coverage. This phase supplies a realistic information to discovering appropriate protection.Discovering the suitable non-owner automobile insurance plans comes to cautious analysis and comparability. Figuring out the to be had sources and the stairs fascinated about acquiring quotes could make the method a lot smoother.

Dependable Assets for Non-Proprietor Automotive Insurance coverage in Nevada

A lot of avenues allow you to to find non-owner automobile insurance coverage in Nevada. Those sources supply get entry to to quotes and data, facilitating the collection of the most productive coverage in your wishes.

- Insurance coverage Firms’ Internet sites: Immediately visiting insurance coverage corporation web pages is a treasured place to begin. Those websites incessantly function on-line quoting equipment, permitting you to check charges from more than a few suppliers. For example, you’ll to find quotes for non-owner automobile insurance coverage on Geico.com, State Farm.com, and Modern.com.

- On-line Comparability Internet sites: Devoted comparability web pages simplify the method of discovering and evaluating non-owner automobile insurance coverage insurance policies. Those websites combination quotes from more than one suppliers, enabling a complete assessment of to be had choices. Examples come with Insurify.com, Evaluate.com, and others. Those websites permit you to enter your main points, they usually supply customized quotes from more than one insurers.

- Impartial Insurance coverage Brokers: Impartial insurance coverage brokers focus on matching purchasers with essentially the most appropriate insurance coverage insurance policies. They incessantly have in-depth wisdom of more than a few insurance coverage merchandise, serving to you navigate the method and select an appropriate coverage.

- Native Insurance coverage Agents: Native insurance coverage agents supply customized carrier and incessantly have intensive wisdom of the native marketplace. They are able to information you during the choices to be had and can help you choose the most productive protection in your explicit wishes.

Acquiring Quotes from Insurance coverage Suppliers

Acquiring quotes is a a very powerful step in securing non-owner automobile insurance coverage. The method comes to offering correct data to insurance coverage suppliers.

- Accumulate Data: Assemble all vital main points, together with the automobile’s 12 months, make, style, and the driving force’s age, riding historical past, and any appropriate reductions. You will have to even have your touch data readily to be had.

- Use On-line Gear: Many insurance coverage corporations supply on-line quoting equipment. Those equipment permit you to input the desired main points to obtain an quick quote. For instance, on a web page, you’ll enter details about the automobile, the driving force, and the protection desired.

- Touch Insurance coverage Suppliers: You’ll additionally touch insurance coverage suppliers at once by means of telephone or e mail to request a quote. That is in particular helpful for clarifying questions or explicit wishes. An agent could have extra detailed details about explicit insurance policies.

Evaluating Insurance policies and Suppliers

Evaluating other insurance policies and suppliers is very important for making an educated determination. Imagine elements past simply the top class.

- Protection Limits: Assessment the level of protection each and every coverage gives. Perceive the boundaries for legal responsibility, collision, and complete protection.

- Deductibles: Assessment the deductibles related to each and every coverage. The next deductible usually ends up in decrease premiums, however you can wish to pay extra out-of-pocket within the tournament of a declare.

- Reductions: Search for reductions presented by way of other suppliers, akin to reductions for excellent drivers, protected riding behavior, or for bundling insurance coverage insurance policies. For instance, you probably have house insurance coverage with the similar supplier, you could get a cut price in your automobile insurance coverage.

- Claims Procedure: Know how each and every supplier handles claims, together with the procedures for submitting and determination. Learn evaluations and testimonials concerning the claims dealing with revel in of the insurance coverage corporations.

Opting for the Absolute best Coverage for Person Wishes

In moderation imagine your explicit wishes when opting for a non-owner automobile insurance plans. Imagine your riding behavior, the automobile you can be the usage of, and your monetary state of affairs.

- Assess Your Riding Conduct: Imagine your riding file and behavior. If in case you have a blank riding file, you could qualify for higher charges.

- Assessment Car Utilization: Imagine the frequency and length of the usage of the automobile. Extra widespread utilization might require the next degree of protection.

- Assessment Monetary Scenario: Assessment your finances and monetary features when deciding on a coverage. Imagine the top class quantities and deductibles.

Insurance coverage Firms Providing Non-Proprietor Insurance policies in Nevada

This desk supplies a kick off point for researching insurance coverage corporations that supply non-owner automobile insurance coverage in Nevada.

| Corporate | Touch Data | Website online |

|---|---|---|

| State Farm | (800) 846-2929 | www.statefarm.com |

| Modern | (800) 444-7287 | www.revolutionary.com |

| Geico | (800) 841-3466 | www.geico.com |

| Allstate | (800) 846-2929 | www.allstate.com |

| Liberty Mutual | (800) 235-5468 | www.libertymutualgroup.com |

Illustrative Case Research

Non-owner automobile insurance coverage in Nevada supplies a very powerful protection for many who do not personal a automobile however steadily function one. Figuring out how this protection purposes in more than a few eventualities is very important for making knowledgeable choices. This phase items sensible examples, highlighting the advantages and barriers of this insurance coverage sort.

Scholar Riding a Pal’s Automotive

A commonplace state of affairs the place non-owner automobile insurance coverage is advisable comes to a pupil riding a pal’s automobile. This sort of insurance coverage is in particular designed for such scenarios, providing coverage when injuries happen.

State of affairs: A pupil riding a pal’s automobile and fascinated about an coincidence.

The scholar, whilst no longer the automobile’s proprietor, is legally liable for the automobile’s operation and any damages incurred throughout its use. Non-owner protection steps in to give protection to the scholar and the good friend.

- Coverage Activation: The scholar’s non-owner coverage can be activated upon reporting the coincidence to their insurance coverage supplier. The coverage’s protection relies on the specifics of the coverage and whether or not the scholar was once the usage of the automobile with the landlord’s consent.

- Declare Procedure: The scholar must promptly notify their insurance coverage corporation concerning the coincidence, offering main points like the positioning, time, different concerned events, and the level of the wear.

- Reimbursement: The insurance coverage corporation will examine the incident. If the scholar’s movements had been deemed negligent or reckless, the protection may well be lowered or denied. If the incident is roofed, the insurance coverage corporation will settle claims as according to coverage phrases, protecting damages to the concerned automobiles and any accidents sustained by way of the ones concerned.

- Legal responsibility: If the scholar is deemed liable for the coincidence, their non-owner coverage will duvet the damages to the opposite automobile and any accidents to the opposite events concerned, as much as the coverage limits.

Worker Riding a Corporate Car, Non proprietor automobile insurance coverage nevada

An organization worker who steadily makes use of an organization automobile may require non-owner automobile insurance plans. This protection extends coverage within the tournament of an coincidence whilst working the corporate automobile.

- Coverage Protection: Non-owner insurance policies for company-driven automobiles are adapted to hide scenarios the place the worker isn’t the landlord. The coverage will specify the level of protection, together with legal responsibility limits and different sides of the settlement.

- Declare Procedures: Reporting the coincidence to the insurance coverage corporation, offering the vital details about the incident, and cooperating with the investigation are crucial steps.

- Coverage Limits: The insurance coverage corporation will evaluation the incident and resolve if the coverage applies in line with the specifics of the settlement. This comprises reviewing if the worker was once working the automobile inside the scope in their employment.

Transient Visitor Riding a Car

Non-owner protection too can offer protection to people who are quickly borrowing or riding a automobile, like a visitor riding a pal’s automobile for a brief length. The protection will lengthen to injuries throughout this era.

- Scope of Protection: The coverage’s phrases and stipulations will resolve whether or not the visitor’s movements throughout the usage of the borrowed automobile are lined. Components akin to consent from the automobile proprietor are key.

- Declare Submission: The visitor will have to notify the insurance coverage corporation concerning the coincidence, together with related information about the automobile’s utilization and the incident’s instances.

- Coverage Limits: Coverage limits will resolve the level of reimbursement for damages to the automobile and accidents to these concerned.

Concluding Remarks

In conclusion, working out non-owner automobile insurance coverage in Nevada empowers you to make knowledgeable choices about your protection. By way of taking into account elements like eligibility, prices, and protection barriers, you’ll choose a coverage that best possible meets your wishes. Bear in mind to completely overview your coverage paperwork and search skilled steering if wanted.

Question Solution: Non Proprietor Automotive Insurance coverage Nevada

Q: What are the everyday protection choices incorporated in non-owner insurance policies?

A: Conventional protection choices incessantly come with legal responsibility insurance coverage, which protects you if you happen to purpose an coincidence, and probably uninsured/underinsured motorist protection, which gives coverage if the at-fault motive force is not insured or does not have sufficient protection.

Q: Who’s generally eligible for non-owner automobile insurance coverage in Nevada?

A: Eligibility incessantly relies on elements like your age, riding file, and the precise coverage. People who steadily power a automobile they do not personal are generally eligible.

Q: How does riding historical past have an effect on the price of non-owner insurance coverage?

A: A deficient riding file can considerably build up the price of non-owner insurance coverage in Nevada. That is very similar to different sorts of insurance coverage, the place a historical past of injuries or violations affects premiums.

Q: What are commonplace causes somebody may want non-owner automobile insurance coverage in Nevada?

A: Not unusual causes come with borrowing a automobile from a pal or circle of relatives member, riding an organization automobile, or the usage of a automobile for paintings or private errands. Scholars who power a automobile they do not personal may additionally require this kind of protection.