New York apartment automobile insurance coverage legislation governs the principles and rules surrounding automobile leases inside the state. Working out those nuances is the most important for each renters and apartment firms to make sure compliance and keep away from attainable prison headaches. This information delves into the specifics of protection, tasks, and attainable exemptions, offering a complete evaluation of the prison panorama surrounding apartment cars in New York.

The legislation Artikels the various kinds of insurance coverage required, from legal responsibility to collision and complete protection, and units minimal requirements for protection. It additionally main points the tasks of each the renter and the apartment corporate in case of injuries. Moreover, it explores exemptions, contemporary adjustments, and illustrative eventualities to supply a sensible working out of the legislation’s utility.

Evaluation of New York Apartment Automobile Insurance coverage Regulation

Navigating the arena of apartment automobile insurance coverage in New York can really feel like a treasure hunt. However worry no longer, intrepid traveler! Working out the particular necessities and duties for each renters and apartment firms will be sure a clean and worry-free go back and forth. This evaluation will demystify the legislation, revealing the the most important parts that give protection to you and the corporate.Apartment automobile insurance coverage in New York differs considerably from the insurance coverage required for private cars.

Whilst private insurance policies be offering various ranges of protection, apartment automobile rules are extra explicit, specializing in the wishes of the brief consumer. This distinction stems from the brief nature of apartment agreements and the desire for transparent responsibility between the renter and the corporate.

Core Necessities for Apartment Automobile Insurance coverage in New York

Apartment automobile firms are obligated to supply legal responsibility insurance coverage to hide injuries involving the apartment car. This insurance coverage protects the renter and any 3rd events keen on an coincidence, in addition to the apartment corporate. Moreover, New York legislation mandates a minimal stage of protection for those circumstances. This guarantees a point of monetary safety for all events.

Variations Between Private and Apartment Car Insurance coverage

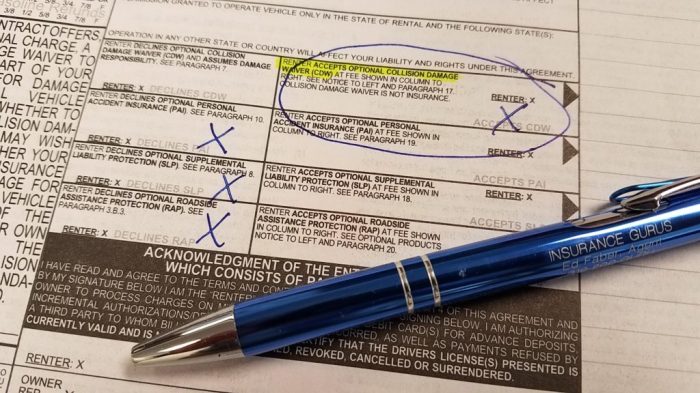

Private auto insurance coverage insurance policies ceaselessly supply broader protection, together with collision, complete, and uninsured/underinsured motorist coverage. Apartment automobile insurance coverage, alternatively, in most cases focuses totally on legal responsibility protection. The renter is generally liable for damages exceeding the legal responsibility protection equipped by way of the apartment corporate. This adapted way displays the brief nature of the apartment settlement and the want to steadiness protection with the renter’s explicit wishes.

Particular Insurance coverage Responsibilities of Apartment Automobile Corporations in New York

Apartment automobile firms in New York are liable for offering a minimal stage of legal responsibility insurance coverage, encompassing physically damage and belongings injury. This implies the corporate is in command of monetary reimbursement in case of injuries the place their car is concerned. Failure to fulfill those necessities may just result in prison repercussions. Moreover, firms should supply renters with transparent details about the protection integrated within the apartment settlement.

Key Insurance coverage Provisions for More than a few Apartment Eventualities

The insurance coverage necessities can range relying at the duration of the apartment. A brief-term apartment would possibly require a special stage of protection in comparison to a long-term hire. The next desk summarizes the important thing insurance coverage provisions for various apartment eventualities:

| Apartment State of affairs | Legal responsibility Protection | Further Protection Choices | Renter’s Duties |

|---|---|---|---|

| Quick-Time period Leases (e.g., a weekend go back and forth) | Complete legal responsibility insurance coverage in most cases equipped by way of the apartment corporate. | Collision, uninsured/underinsured motorist protection ceaselessly to be had for an extra rate. | Working out the phrases of the apartment settlement, paying any further charges for added protection, and riding responsibly. |

| Lengthy-Time period Leases (e.g., work journeys, prolonged holidays) | Identical legal responsibility protection as momentary leases. | Further choices, like complete and collision, may well be to be had at an extra price. | Reviewing the apartment settlement moderately and confirming the extent of protection, paying for any further insurance coverage if wanted. |

Protection Varieties and Limits

Navigating the arena of apartment automobile insurance coverage in New York can really feel like navigating a bustling town side road. Working out the quite a lot of protection sorts and their limits is the most important to make sure you’re adequately safe. This phase will delve into the various kinds of insurance coverage, minimal necessities, examples of insurance policies, and commonplace exclusions.Apartment automobile insurance coverage insurance policies in most cases come with legal responsibility, collision, and complete protection.

Legal responsibility protection protects you should you purpose injury to someone else’s belongings or injure them. Collision protection protects you in case your apartment automobile is broken in an coincidence, irrespective of who’s at fault. Complete protection protects you from injury for your apartment automobile brought about by way of occasions as opposed to collisions, akin to robbery, vandalism, or climate occasions.

Legal responsibility Protection

Legal responsibility protection is a elementary element of apartment automobile insurance coverage. It safeguards you financially in case you are discovered liable for inflicting hurt to someone else or their belongings all over a apartment length. This sort of protection can pay for damages to others as in step with the legislation. It is the most important for shielding you from attainable proceedings.

Collision Protection

Collision protection comes into play when your apartment car sustains injury in an coincidence, irrespective of who’s at fault. This protection compensates for the restore or substitute prices of your apartment automobile. It is the most important safeguard in opposition to really extensive monetary losses from an coincidence.

Complete Protection

Complete protection protects your apartment automobile from damages stemming from occasions past injuries, akin to robbery, vandalism, hail injury, or hearth. It supplies a monetary cushion for those sudden occasions, making sure that you’re not only liable for the prices.

Minimal Protection Necessities

New York State legislation mandates minimal protection necessities for apartment automobile insurance coverage. Those necessities goal to make certain that renters have a fundamental stage of coverage whilst riding. Those minimums are designed to safeguard in opposition to monetary burdens within the match of an coincidence or incident.

Examples of Insurance coverage Insurance policies and Protection Main points

An ordinary apartment automobile insurance coverage would possibly come with legal responsibility protection with a prohibit of $100,000 in step with individual and $300,000 in step with coincidence. Collision protection would possibly have a $1,000 deductible, that means you would pay the primary $1,000 in case your automobile is broken in a collision. Complete protection in most cases has a identical deductible construction. Insurance policies range considerably in keeping with the apartment corporate and explicit phrases.

Not unusual Exceptions and Exclusions

Sure scenarios will not be lined underneath your apartment automobile insurance coverage. Pre-existing injury to the apartment car, injury brought about by way of intentional acts, or use of the car for unlawful actions are regularly excluded. Figuring out those exclusions is very important for making knowledgeable choices.

Comparability of Protection Choices for Other Apartment Automobile Varieties

| Apartment Automobile Kind | Legal responsibility Protection | Collision Protection | Complete Protection |

|---|---|---|---|

| Financial system | Same old Limits | Same old Limits, Deductible | Same old Limits, Deductible |

| Luxurious SUV | Upper Limits | Upper Limits, Deductible | Upper Limits, Deductible |

| Compact | Same old Limits | Same old Limits, Deductible | Same old Limits, Deductible |

Observe: The desk above supplies a normal comparability. Particular protection main points rely at the apartment corporate and the selected coverage.

Legal responsibility and Accountability

Navigating the complexities of auto leases, particularly in a prison framework like New York’s, calls for working out the tasks of each the renter and the apartment corporate. Injuries can get up from quite a lot of cases, tough a transparent comprehension of legal responsibility to make sure honest solution for all events concerned. This phase delves into the intricacies of renter and apartment corporate responsibility in coincidence eventualities, outlining the prison implications and procedures for reporting such incidents.Injuries involving apartment automobiles, whilst unlucky, are sadly no longer unusual.

This phase supplies perception into who’s held in command of damages and accidents. This contains the prison duties for renters and the apartment firms in several coincidence scenarios. Working out those tasks is the most important for each events to navigate the method successfully.

Duties of the Renter

The renter holds a vital accountability underneath New York’s apartment automobile insurance coverage legislation. They’re essentially chargeable for the car’s operation and should adhere to all visitors regulations. This encompasses riding safely, averting reckless conduct, and making sure the car is maintained in a protected situation. Failing to agree to those duties can result in vital prison ramifications.

Duties of the Apartment Automobile Corporate

The apartment automobile corporate, as the landlord, additionally bears tasks within the match of an coincidence. Those tasks ceaselessly revolve across the car’s situation and the insurance policy equipped. The corporate’s accountability contains keeping up the car in a protected and roadworthy state prior to freeing it to the renter.

Criminal Implications for Renters

Non-compliance with New York’s apartment automobile insurance coverage regulations carries prison penalties for the renter. Those penalties might come with private legal responsibility for damages and accidents, attainable fines, and different consequences. A contravention of the insurance coverage necessities can create a extra sophisticated prison panorama, impacting the renter’s private monetary steadiness. For instance, if a renter does no longer raise the specified insurance coverage and reasons an coincidence leading to accidents, they could also be held in my view chargeable for the whole extent of the damages.

Comparability of Renter and Proprietor Legal responsibility

Evaluating the legal responsibility of the renter and the landlord (apartment corporate) calls for a nuanced working out of the coincidence’s cases. For instance, if the coincidence effects from a pre-existing mechanical defect within the car, the apartment corporate might undergo a better accountability. Alternatively, if the coincidence is because of the renter’s negligence, the renter’s legal responsibility is usually upper. In the end, the particular cases of every coincidence dictate the allocation of accountability.

Coincidence Reporting Procedures in New York

Reporting injuries involving apartment automobiles in New York follows usual procedures. This comes to submitting an coincidence document with the suitable government, exchanging essential data with the opposite events concerned, and documenting the incident completely. Failure to document an coincidence may have severe prison implications.

Criminal Recourse for Sufferers

| Coincidence State of affairs | Possible Criminal Recourse for Sufferers |

|---|---|

| Coincidence brought about by way of renter’s negligence | Sufferers can pursue prison motion in opposition to the renter and/or the apartment corporate, relying at the explicit cases. |

| Coincidence because of a pre-existing defect within the apartment automobile | Sufferers could have a more potent case in opposition to the apartment corporate because of the car’s faulty situation. |

| Coincidence involving uninsured/underinsured renter | Sufferers could have restricted recourse, depending on their very own insurance coverage or pursuing different to be had prison avenues. |

Exemptions and Particular Cases

Navigating the complexities of New York apartment automobile insurance coverage may also be tough. Whilst the legislation usually mandates insurance policy, sure exemptions and particular cases exist. Working out those nuances can save renters from needless burdens and make sure compliance.

Possible Exemptions

New York’s apartment automobile insurance coverage regulations are designed to give protection to all events concerned. Alternatively, some exemptions exist. Those exemptions ceaselessly contain scenarios the place the renter isn’t the principle consumer of the car or the place particular cases practice.

- Diplomatic Cars: Diplomatic missions ceaselessly have their very own insurance coverage preparations. If a apartment car is utilized by a diplomatic consultant, the insurance coverage necessities may well be treated throughout the diplomatic venture, thus doubtlessly exempting the renter from the usual insurance coverage necessities.

- Executive-Owned Cars: In a similar fashion, authorities businesses ceaselessly have their very own car insurance coverage insurance policies. If a apartment car is government-owned or leased for legitimate use, the federal government’s insurance coverage would possibly duvet attainable liabilities, making renter insurance coverage necessities beside the point.

- Cars Used for Transient Transportation: In sure scenarios, cars may well be rented for brief transportation, akin to for a momentary clinical shipping. The insurance coverage necessities may well be adjusted in keeping with the specifics of the brief use and the period of the apartment.

- Cars Rented for Quick Sessions: Leases for an excessively brief period, like a couple of hours, would possibly have explicit insurance coverage concerns that vary from longer leases.

Particular Cases Affecting Insurance coverage

Past normal exemptions, explicit cases can modify the renter’s insurance coverage tasks. This phase main points how other scenarios would possibly have an effect on insurance coverage necessities.

- Cars with Present Protection: If the apartment automobile already has insurance policy (e.g., a car owned by way of an organization), the renter’s insurance coverage tasks may well be lessened. Alternatively, the specifics of the present protection should be clarified with the apartment corporate.

- Cars Used for Particular Functions: A car rented for a selected goal (e.g., transferring, building paintings) would possibly cause further insurance coverage concerns past the usual necessities.

Renter Accountability and Further Insurance coverage

Working out when a renter isn’t totally liable for insurance coverage and when further insurance coverage may well be essential is the most important.

- Renter No longer Totally Accountable: In scenarios involving diplomatic cars, government-owned cars, or cars with present insurance coverage, the renter’s accountability for insurance coverage may well be decreased or solely eradicated.

- Further Insurance coverage Required: The renter would possibly want further insurance coverage if the apartment falls outdoor the usual protection limits, like in industrial use, long-term leases, or if the renter needs additional coverage in opposition to legal responsibility exceeding the minimal necessities.

Insurance coverage Necessities Desk

This desk summarizes quite a lot of scenarios and their related insurance coverage necessities or exemptions.

| Scenario | Insurance coverage Necessities |

|---|---|

| Apartment of a private car by way of a diplomatic consultant | Possible exemption; insurance coverage treated by way of the diplomatic venture |

| Apartment of a government-owned car | Possible exemption; insurance coverage treated by way of the federal government company |

| Apartment for momentary clinical shipping | Insurance coverage necessities may well be adjusted in keeping with the specifics of the brief use |

| Apartment for industrial use | Further insurance coverage past the minimal necessities is most likely wanted |

| Apartment of a car already lined by way of present insurance coverage | Insurance coverage tasks may well be lessened, contingent at the phrases of the present coverage |

Enforcement and Consequences

Navigating the complexities of New York’s apartment automobile insurance coverage regulations may also be tough. However worry no longer, fellow drivers! Working out how those regulations are enforced and what the repercussions are for non-compliance will assist you to keep away from attainable complications. This phase delves into the mechanisms for making sure adherence to the principles, outlining the consequences for violations, and showcasing real-world examples of enforcement.Enforcement of New York’s apartment automobile insurance coverage rules is a multi-faceted procedure.

The main accountability lies with the New York State Division of Motor Cars (DMV), which matches to care for compliance via quite a lot of avenues. This contains proactive tracking of apartment firms and their insurance coverage insurance policies, in addition to responding to court cases and investigations.

Enforcement Mechanisms

The DMV makes use of a mixture of methods to make sure compliance with apartment automobile insurance coverage necessities. This contains regimen audits of apartment firms, inspecting their insurance coverage insurance policies to verify they meet the essential conditions. Moreover, the DMV actively investigates court cases filed by way of people who consider a apartment corporate has did not agree to the legislation. A machine of reporting lets in electorate to flag attainable violations.

Consequences for Violations

Non-compliance with New York’s apartment automobile insurance coverage regulations carries a spread of penalties, from fines to attainable suspension of industrial licenses. Those consequences are designed to discourage violations and inspire accountable apartment practices.

Examples of Enforcement Movements

Sadly, explicit examples of enforcement movements taken in opposition to people or apartment firms don’t seem to be readily to be had within the public area. Alternatively, you must notice that the DMV actively displays and investigates attainable violations, taking suitable motion when essential. This guarantees that the legislation is continually carried out.

Abstract of Possible Consequences, The big apple apartment automobile insurance coverage legislation

| Violation | Possible Penalty |

|---|---|

| Failure to care for ok insurance policy | Fines starting from a number of hundred to a number of thousand greenbacks, doubtlessly impacting the corporate’s license to perform. |

| Misrepresentation of insurance policy | Important fines, suspension or revocation of industrial license. |

| Failure to agree to reporting necessities | Fines, attainable suspension of industrial license. |

| Repeated violations | Greater fines, suspension of industrial license, or different critical consequences. |

Observe: Particular consequences can range relying at the severity and nature of the violation.

Fresh Adjustments and Updates to the Regulation

Navigating the intricate global of apartment automobile insurance coverage in New York can really feel like a treasure hunt. The principles, whilst supposed to give protection to everybody concerned, may also be complicated. Fresh adjustments and updates to the legislation replicate an ongoing effort to explain tasks and make sure honest remedy for each renters and apartment firms.Apartment automobile insurance coverage regulations are repeatedly evolving, reflecting converting societal wishes and financial realities.

This evolution is important to keeping up a steadiness between the protection of the general public and the monetary steadiness of the companies concerned. Working out those adjustments is very important for each renters and apartment firms to keep away from attainable pitfalls and make sure compliance.

Legislative Updates

Fresh legislative updates have fascinated by clarifying the scope of protection and tasks in quite a lot of eventualities. Those adjustments goal to supply better readability and scale back ambiguity, resulting in a extra predictable and clear machine. The specifics of those updates range, touching upon the whole thing from protection limits to the dealing with of claims.

- In 2023, a brand new legislation was once enacted that calls for apartment firms to supply a transparent abstract of protection choices on the time of reserving, making sure transparency and knowledgeable decision-making for renters. This variation is designed to stop disputes and make sure renters perceive the main points of the protection.

- A contemporary modification has clarified the appliance of the legislation in circumstances involving renters who don’t seem to be the principle drivers of the car. This replace objectives to unravel ambiguity surrounding legal responsibility in circumstances the place a 3rd birthday party is working the apartment automobile.

Courtroom Circumstances

Courtroom circumstances play a the most important position in deciphering and refining the appliance of apartment automobile insurance coverage regulations. Fresh circumstances supply treasured insights into how courts are making use of the legislation and the way they’re deciphering explicit clauses and provisions.

- A notable case in 2022 addressed the problem of protection limits in scenarios the place the renter was once no longer the principle motive force. The court docket’s ruling established a precedent that might have an effect on long run circumstances and doubtlessly affect insurance coverage premiums.

- Every other case in 2023 targeted at the accountability of apartment firms for making sure correct reporting of wear claims. This ruling highlighted the significance of transparency and responsibility inside the apartment insurance coverage framework.

Have an effect on on Insurance coverage Premiums

Fresh adjustments and court docket rulings can without delay have an effect on insurance coverage premiums for each renters and apartment firms. This have an effect on is complicated and will range relying on a number of elements.

- Greater readability and standardization within the utility of the legislation can doubtlessly scale back premiums if it lowers the collection of disputed claims. Then again, new necessities would possibly result in an building up in premiums in the event that they require firms to provide further protection or building up their protection limits.

- For instance, if a brand new legislation mandates a better minimal protection quantity for private damage coverage (PIP), this may result in an building up in premiums for renters. The precise have an effect on is determined by the main points of the brand new legislation and the way the insurance coverage marketplace responds.

Timeline of Key Legislative Updates

Monitoring the evolution of New York apartment automobile insurance coverage regulations is very important for each renters and apartment firms. This timeline supplies a snapshot of vital legislative updates.

| Yr | Tournament | Have an effect on |

|---|---|---|

| 2022 | Rationalization on Protection Limits for Non-Number one Drivers | Possible have an effect on on insurance coverage premiums relying at the specifics of the ruling. |

| 2023 | Modification on Correct Harm Declare Reporting | Greater transparency and responsibility for apartment firms. |

Illustrative Eventualities: New York Apartment Automobile Insurance coverage Regulation

Navigating New York’s apartment automobile insurance coverage regulations can really feel like a maze. However working out commonplace eventualities is helping transparent the trail. Those examples light up how the legislation applies in quite a lot of scenarios, making sure you might be well-prepared to power responsibly and legally.

Renter’s Accountability in an Coincidence

Consider Amelia, a customer to New York, rents a automobile and, because of a temporary lapse in focus, reasons a minor fender bender. Amelia is simply liable for the coincidence. This contains any injury to the opposite car, and attainable accidents.

- Amelia’s apartment insurance coverage most likely covers the wear to the opposite car as much as its coverage limits.

- Alternatively, Amelia is in my view liable for any prices exceeding the ones limits. This contains clinical bills of the opposite birthday party if their accidents exceed the insurance coverage payout.

The renter is in most cases held liable for any coincidence, until explicitly exempted by way of the apartment settlement or appropriate legislation.

Exemptions from Insurance coverage Necessities

Let’s assume Ben, a New York resident, rents a automobile for a quick go back and forth inside the state. He’s insured underneath his personal coverage. On this case, the apartment corporate would possibly waive the extra insurance coverage requirement.

Apartment Corporate’s Accountability

Imagine a state of affairs the place Chloe, a renter, reviews a pre-existing mechanical defect within the apartment automobile, however the apartment corporate fails to handle it. Later, the defect reasons an coincidence. On this example, the apartment corporate is most likely held accountable, as they did not care for the car’s protected situation.

- The renter would have a more potent case for containing the apartment corporate liable if they are able to end up the defect was once identified to the corporate.

- A transparent document of reporting the defect would bolster the renter’s place considerably.

The apartment corporate’s accountability is tied to the car’s situation on the time of apartment and their movements in accordance with identified or moderately foreseeable defects.

Further Renter Insurance coverage Duties

David rents a automobile for a cross-country street go back and forth. His apartment insurance coverage has restricted protection. To have complete protection, David will have to imagine buying supplemental insurance coverage.

- This supplemental insurance coverage may just duvet damages or accidents past the apartment corporate’s coverage limits.

- David is liable for working out the bounds of the apartment insurance coverage and making sure he’s adequately lined.

Whilst the apartment corporate supplies fundamental protection, renters are inspired to discover supplemental choices for extra complete coverage.

Comparability with Different States

Navigating the complicated global of apartment automobile insurance coverage generally is a headache, particularly when touring throughout state strains. Working out how New York’s rules stack up in opposition to different states’ regulations is the most important for accountable renters. This comparability highlights key similarities and variations, empowering vacationers to make knowledgeable choices.New York’s apartment automobile insurance coverage necessities, whilst complete, might vary considerably from the ones in different states.

This comparability finds the nuances of those rules and emphasizes the significance of checking native regulations prior to embarking on a street go back and forth, making sure you might be compliant and safe.

Key Similarities in Apartment Automobile Insurance coverage Regulations

Apartment automobile insurance coverage regulations throughout the United States usually proportion commonplace objectives: protective drivers and selling street protection. Maximum states require renters to be insured or to exhibit enough protection, fighting monetary hardship for coincidence sufferers. The idea that of number one insurance coverage for renters is prevalent, aiming to carry the renter in command of damages or accidents.

Key Variations in Apartment Automobile Insurance coverage Regulations

The precise necessities for protection range broadly between states. Some states could have stricter regulations relating to minimal protection quantities, whilst others could have extra versatile provisions. A key space of distinction comes to the provision of “supplemental” insurance coverage choices that apartment firms ceaselessly be offering. Some states could have rules in regards to the availability and enforceability of such supplemental insurance coverage.

Apartment Automobile Insurance coverage Regulations Throughout US States

An immediate comparability throughout a lot of US states is gifted beneath. Observe that those main points are for illustrative functions simplest and don’t seem to be exhaustive. Precise necessities can range, and it is the most important to seek the advice of the particular state’s Division of Motor Cars or an identical company for probably the most present and correct data.

| State | Minimal Legal responsibility Protection Necessities | Supplemental Insurance coverage Availability | Exemptions/Particular Cases |

|---|---|---|---|

| New York | Particular minimums for physically damage and belongings injury legal responsibility. | Apartment firms ceaselessly be offering supplemental protection; state might control phrases. | Sure exemptions might practice for explicit cases, akin to diplomatic immunity or legitimate authorities cars. |

| California | Upper minimal legal responsibility limits than some states. | Apartment firms regularly be offering supplemental applications, ceaselessly obligatory or with restrictions. | Particular regulations practice to industrial cars and sure varieties of renters. |

| Florida | Minimal legal responsibility necessities, doubtlessly less than different states. | Supplemental insurance coverage readily to be had from apartment firms. | Particular provisions for self-insured renters. |

| Texas | Decrease minimal legal responsibility necessities when put next to a few different states. | Supplemental insurance coverage broadly presented, however state rules might have an effect on choices. | Restrictions on protection in keeping with car kind. |

| Illinois | Minimal legal responsibility limits related to different states. | Supplemental protection regularly presented, with various phrases and stipulations. | Particular necessities for sure varieties of cars. |

Implications for Renters Touring Between States

When touring throughout state strains, working out those variations is important. A motive force renting a automobile in a single state after which riding to some other would possibly in finding themselves topic to other insurance coverage necessities. For instance, a motive force with ok protection in New York would possibly want further protection in Florida. Renting a automobile in a state with decrease legal responsibility limits would possibly result in a better monetary burden in case of an coincidence.

It is all the time prudent to study the particular necessities of every state prior to touring, to make sure compliance and fiscal coverage.

Remaining Phrase

In conclusion, navigating New York apartment automobile insurance coverage legislation calls for cautious attention of quite a lot of elements, from protection sorts to attainable liabilities. This information has equipped a complete evaluation, empowering readers with the information to know their rights and tasks when renting a automobile in New York. By way of working out the specifics, renters can keep away from attainable prison pitfalls and make sure a clean and protected apartment enjoy.

Useful Solutions

What are the minimal insurance coverage necessities for a apartment automobile in New York?

New York legislation mandates explicit minimal legal responsibility protection. The precise necessities can differ; seek the advice of probably the most present legitimate documentation for the best figures.

What occurs if I wouldn’t have the specified insurance coverage for a apartment automobile?

Failure to agree to the minimal insurance coverage necessities can result in fines and attainable prison motion. Apartment firms ceaselessly have insurance policies that require the renter to have ok protection. Seek the advice of the apartment settlement for specifics.

What are my tasks as a renter if an coincidence happens with a apartment automobile?

Your tasks in most cases come with reporting the coincidence promptly to the government and the apartment corporate, in addition to cooperating with any investigations. At all times confer with the apartment settlement for detailed details about your duties.

Are there any exemptions to New York’s apartment automobile insurance coverage legislation?

Sure, explicit exemptions would possibly exist for sure cars or cases, akin to diplomatic cars. Consulting the present law is the most important for working out any attainable exemptions.