Reasonable automobile insurance coverage McAllen TX items a posh panorama for drivers in quest of reasonably priced protection. The marketplace’s aggressive nature steadily hides pitfalls for unsuspecting customers. This overview examines the criteria influencing premiums, compares main suppliers, and provides actionable methods to navigate the method.

McAllen’s explicit demographic and site visitors patterns give a contribution to the original traits of its automobile insurance coverage marketplace. This overview delves into the nuances, offering a complete review that will help you to find the most efficient deal.

Evaluate of Reasonable Automobile Insurance coverage in McAllen, TX

The McAllen, TX, automobile insurance coverage marketplace items a posh panorama for customers in quest of reasonably priced protection. Whilst the area provides aggressive charges from more than a few suppliers, figuring out the influencing elements and to be had methods is a very powerful for securing favorable premiums. This review will element the demanding situations and alternatives out there, highlighting the important thing elements that form insurance coverage prices and the methods hired by way of insurers to supply aggressive charges.The automobile insurance coverage marketplace in McAllen, TX, is influenced by way of a number of key elements.

Those elements come with demographics, site visitors patterns, and coincidence charges, all of which play a vital function in figuring out the chance profile related to insuring automobiles within the house. Demographic elements, such because the age and riding historical past of citizens, at once affect the possibility of injuries and claims, in the end influencing top rate calculations. Moreover, explicit site visitors patterns, together with the quantity and nature of site visitors drift, along coincidence information, supply a concrete figuring out of the prospective dangers inherent within the native riding surroundings.

Those elements, when thought to be in combination, give a contribution to a nuanced image of the insurance coverage marketplace in McAllen, TX.

Elements Influencing Automobile Insurance coverage Premiums

A number of elements at once impact automobile insurance coverage premiums in McAllen, TX. Those elements surround demographic information, coincidence statistics, and site visitors stipulations, offering a complete figuring out of the marketplace’s dynamics. Using historical past, as an example, is a a very powerful issue, with drivers displaying a historical past of injuries or violations dealing with upper premiums. This can be a mirrored image of the higher menace related to those drivers.

The age and gender of drivers additionally play a vital function, as actuarial information signifies various coincidence charges throughout other demographics. Moreover, site visitors stipulations, together with congestion ranges and coincidence charges, are factored into the chance evaluate, at once impacting the top rate. This evaluate considers the precise site visitors patterns distinctive to the area. Those elements give a contribution to the entire charge of insurance coverage, impacting the premiums charged to drivers in McAllen, TX.

Methods Hired by way of Insurance coverage Suppliers

Insurance coverage suppliers in McAllen, TX, make use of a number of methods to supply aggressive charges whilst managing menace successfully. A number one technique comes to in moderation comparing and examining menace profiles of attainable purchasers, the usage of complex actuarial fashions to evaluate coincidence information, riding historical past, and demographics. Some other key technique comes to offering reductions to drivers who show protected riding conduct, equivalent to the ones with accident-free riding information or those that have taken defensive riding classes.

Insurance coverage suppliers may additionally be offering bundled services and products, equivalent to bundling auto and house owners insurance coverage to supply decrease general prices for the customer.

Varieties of Automobile Insurance coverage and Price Levels

The provision of vehicle insurance coverage varieties in McAllen, TX, includes a vary of choices, each and every adapted to express wishes and menace profiles. Figuring out those choices is a very powerful for making knowledgeable selections relating to insurance policy.

| Form of Insurance coverage | Standard Price Vary (USD/Month) |

|---|---|

| Legal responsibility Simplest | $25 – $60 |

| Collision | $40 – $100 |

| Complete | $30 – $75 |

| Uninsured/Underinsured Motorist | $10 – $25 |

| Complete Protection (Legal responsibility + Collision + Complete) | $75 – $150 |

The associated fee levels offered within the desk are approximate and will range in accordance with particular person elements, equivalent to riding file, car kind, and protection choices selected. It’s a must to observe that those figures are common estimates and will have to be verified with particular person insurance coverage suppliers.

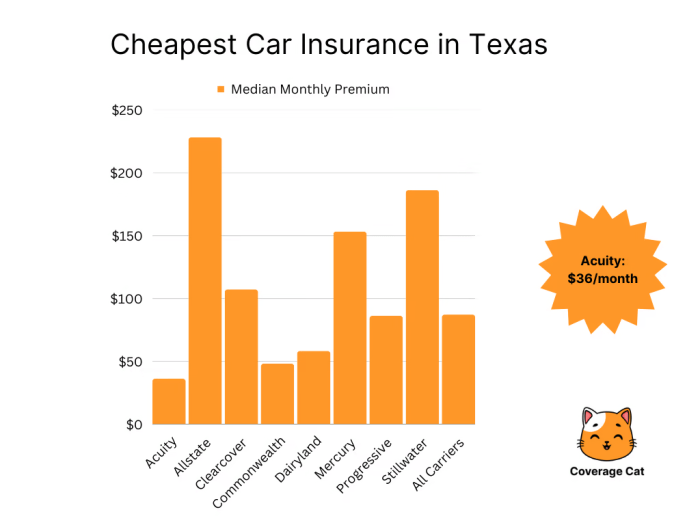

Evaluating Insurance coverage Suppliers in McAllen, TX: Reasonable Automobile Insurance coverage Mcallen Tx

Securing reasonably priced and dependable automobile insurance coverage is a very powerful for drivers in McAllen, TX. Figuring out the pricing methods, customer support reputations, and distinctive choices of various suppliers is very important for making an educated resolution. This research examines 3 distinguished insurance coverage corporations within the McAllen marketplace, highlighting their aggressive benefits and attainable drawbacks.

Pricing Methods of Primary Suppliers

Insurance coverage corporations make use of more than a few pricing fashions to resolve premiums. Elements equivalent to riding historical past, car kind, location, and protection choices affect the general charge. Other corporations would possibly emphasize other facets of those elements of their pricing calculations.

- State Farm: Continuously cited for its complete protection choices and established popularity, State Farm ceaselessly makes use of a data-driven way to calculate premiums, examining menace elements and ancient claims information. This can result in premiums that align with perceived menace, probably being upper for drivers with coincidence histories or the ones riding high-risk automobiles. Their pricing technique steadily displays a broader menace evaluate somewhat than a focal point on purely aggressive pricing.

- Geico: Geico, identified for its competitive advertising and marketing campaigns, has a tendency to supply aggressive charges, particularly for drivers with blank information and explicit car varieties. Their pricing style steadily comprises reductions for more than a few elements like protected riding conduct, bundled services and products, and anti-theft gadgets. Geico ceaselessly adjusts its premiums in accordance with marketplace tendencies and competitor pricing.

- Modern: Modern steadily emphasizes reductions for usage-based insurance coverage methods. Their technique steadily comprises motive force habits tracking to evaluate menace. Drivers with constant protected riding conduct may have the benefit of decrease premiums. They steadily be offering a variety of reductions to incentivize consumers to undertake their methods.

Buyer Carrier Recognition

Customer support popularity performs a vital function within the insurance coverage variety procedure. A favorable popularity steadily correlates with a smoother claims procedure and responsive strengthen. Recognition will also be influenced by way of on-line opinions, word-of-mouth suggestions, and direct interactions with the corporate.

- State Farm: State Farm most often maintains a robust popularity for customer support, in particular in claims dealing with and agent strengthen. Their in depth community of brokers in McAllen, TX, may give customized help and strengthen.

- Geico: Geico’s customer support has confronted some criticisms relating to responsiveness and readability, in particular within the on-line platform. Whilst Geico steadily boasts superb customer support, the client revel in may not be uniform throughout all interactions.

- Modern: Modern’s customer support is steadily praised for its potency in dealing with on-line inquiries and claims. They usually deal with a extra streamlined on-line machine, even supposing buyer revel in may range relying at the explicit interplay.

Distinctive Promoting Propositions (USPs)

Every supplier emphasizes other facets of affordability. Figuring out those USPs can information the choice procedure for drivers in quest of the most efficient price.

- State Farm: State Farm’s USP steadily revolves round complete protection choices and the familiarity in their logo. This will also be sexy to drivers in quest of in depth coverage.

- Geico: Geico’s USP is steadily the aggressive pricing for drivers with blank information. Their emphasis on competitive pricing is a key promoting level.

- Modern: Modern’s USP is steadily tied to reductions for usage-based insurance coverage, interesting to drivers who prioritize protected riding conduct and price the prospective charge financial savings.

Protection Choices and Prices

| Insurance coverage Supplier | Protection Possibility | Estimated Price (according to yr) |

|---|---|---|

| State Farm | Complete, Legal responsibility, Collision | $1,800 – $2,500 |

| Geico | Complete, Legal responsibility, Collision | $1,500 – $2,200 |

| Modern | Complete, Legal responsibility, Collision | $1,600 – $2,300 |

Word: Estimated prices are in accordance with hypothetical motive force profiles and would possibly range considerably in accordance with particular person instances. Those figures are for illustrative functions simplest.

Elements Affecting Automobile Insurance coverage Premiums in McAllen, TX

Automobile insurance coverage premiums in McAllen, TX, like different areas, are influenced by way of a posh interaction of things. Figuring out those elements is a very powerful for customers in quest of reasonably priced protection and for insurance coverage suppliers managing menace. This phase delves into the important thing determinants of vehicle insurance coverage prices within the house, that specialize in demographics, car traits, geographic location, and declare historical past.

Motive force Demographics and Insurance coverage Premiums

Motive force demographics, together with age, gender, and riding historical past, considerably affect insurance coverage premiums. More youthful drivers are usually assigned upper premiums because of their statistically upper coincidence charges in comparison to older, extra skilled drivers. This displays the higher menace related to inexperience and a loss of riding historical past. In a similar way, the gender of the motive force is usually a issue, even supposing the variation is steadily much less pronounced and varies by way of area and insurer.

A blank riding file, demonstrating accountable riding conduct, most often leads to decrease premiums. Conversely, drivers with a historical past of injuries or site visitors violations face upper premiums, as they constitute the next menace to the insurance coverage corporate.

Automobile Sort and Type Affect on Insurance coverage Prices

The kind and style of a car play a considerable function in figuring out insurance coverage premiums. Prime-performance sports activities vehicles and comfort automobiles, steadily dearer to fix, are ceaselessly related to upper premiums. The price of the car may be a essential attention. Insurance coverage suppliers assess the chance of robbery and injury in accordance with the car’s make, style, and estimated substitute charge.

Decrease-value automobiles most often have decrease premiums, reflecting the decrease monetary loss to the insurer within the match of wear or robbery.

Geographic Location and Insurance coverage Premiums in McAllen, TX

Geographic location inside McAllen, TX, can affect insurance coverage premiums. Spaces with upper reported coincidence charges or crime charges, steadily correlated with upper site visitors volumes or explicit street stipulations, may revel in upper premiums. Moreover, spaces with the next focus of high-value automobiles, like the ones close to upscale residential communities, may also see top rate will increase.

Have an effect on of Previous Claims on Insurance coverage Charges, Reasonable automobile insurance coverage mcallen tx

Previous claims have a considerable and lasting affect on long run insurance coverage premiums. Insurance coverage corporations meticulously assess declare historical past to resolve the chance profile of a motive force. A historical past of injuries or claims signifies the next chance of long run claims, leading to higher premiums. Insurance coverage suppliers alter top rate charges to replicate the chance they think with drivers who’ve a historical past of submitting claims.

Insurers in moderation analyze the character of previous claims, taking into consideration elements such because the severity of the wear and tear, the reason for the coincidence, and the motive force’s involvement.

Abstract Desk of Elements Affecting Automobile Insurance coverage Prices

| Issue | Relative Significance | Clarification |

|---|---|---|

| Motive force Age | Prime | More youthful drivers most often have upper coincidence charges, main to raised premiums. |

| Motive force Gender | Reasonable | Slight variations exist, however affect varies by way of area and insurer. |

| Using Historical past | Prime | Injuries and violations point out upper menace, leading to higher premiums. |

| Automobile Sort/Type | Reasonable | Prime-performance or dear automobiles steadily lift upper premiums because of restore prices and robbery menace. |

| Geographic Location | Reasonable | Spaces with upper coincidence charges or crime charges could have upper premiums. |

| Previous Claims | Prime | A historical past of claims signifies the next chance of long run claims, resulting in really extensive top rate will increase. |

Guidelines for Discovering Reasonable Automobile Insurance coverage in McAllen, TX

Securing reasonably priced automobile insurance coverage in McAllen, TX, calls for a strategic means. Figuring out the criteria influencing premiums and using fine comparability tactics are a very powerful for acquiring aggressive charges. This phase supplies sensible methods for attaining cost-effective automobile insurance coverage within the area.

Comparative Quote Research

Evaluating quotes from more than one insurance coverage suppliers is paramount for locating the most efficient conceivable charges. This comes to collecting quotes from more than a few corporations and comparing their protection applications and premiums. A meticulous comparability lets in drivers to spot essentially the most appropriate insurance coverage plan. The usage of on-line comparability gear or contacting insurers at once are not unusual strategies for acquiring numerous quotes.

Bundling Products and services for Financial savings

Bundling automobile insurance coverage with different services and products, equivalent to house or lifestyles insurance coverage, steadily leads to discounted premiums. This means leverages the insurer’s current courting to supply a mixed bundle at a decrease general charge. By way of combining insurance policies, customers can probably save a vital quantity on their insurance coverage bills.

Using Client Sources

A number of sources are to be had to customers in McAllen, TX, to lend a hand them to find reasonably priced insurance coverage. Those sources come with unbiased insurance coverage brokers, client coverage businesses, and on-line comparability web pages. Those platforms may give independent data and help in navigating the insurance coverage marketplace.

Steps in Acquiring Quotes from Quite a lot of Suppliers

| Step | Motion |

|---|---|

| 1 | Accumulate private data, together with car main points (make, style, yr), riding historical past (coincidence information, violations), and desired protection ranges. |

| 2 | Make the most of on-line comparability gear or touch insurance coverage suppliers at once to request quotes. Examine protection choices, premiums, and deductibles introduced by way of other suppliers. |

| 3 | Totally overview each and every quote to grasp the precise phrases, stipulations, and exclusions. Word any variations in protection, deductibles, or coverage limits. |

| 4 | Imagine the entire price proposition of each and every quote, together with the top rate charge and the comprehensiveness of the protection. |

| 5 | Make a choice the coverage that perfect meets particular person wishes and funds constraints. |

Illustrative Case Research of Inexpensive Automobile Insurance coverage in McAllen, TX

Securing reasonably priced automobile insurance coverage in McAllen, TX, steadily calls for a strategic means, taking into consideration more than a few elements. This phase items illustrative case research, highlighting a hit methods and the contributing elements in attaining cost-effective protection. Those examples show that discovering reasonably priced insurance coverage is doable thru proactive measures and knowledgeable decision-making.

Case Learn about 1: The Younger Skilled

This situation learn about specializes in a tender skilled, Maria, not too long ago relocating to McAllen for a brand new process. She sought reasonably priced protection for her newly bought car. Maria known the significance of complete protection, however first of all confronted excessive premiums because of her age and riding historical past. To mitigate those elements, she opted for a excessive deductible, which considerably decreased her top rate.

She additionally enrolled in a defensive riding route, making improvements to her riding file and therefore qualifying for a cut price. Additional, she explored the opportunity of a multi-car cut price, taking into consideration her circle of relatives’s current insurance plans. The mix of a excessive deductible, defensive riding route, and multi-car reductions ended in really extensive financial savings.

Case Learn about 2: The Circle of relatives with More than one Cars

This situation learn about illustrates the prospective financial savings achievable for households with more than one automobiles. The Rodriguez circle of relatives, dwelling in McAllen, had 3 automobiles desiring insurance policy. They first of all sought particular person insurance policies, resulting in really extensive premiums. Spotting the prospective financial savings from bundled insurance policies, they opted for a multi-car coverage. This technique lowered their general insurance coverage prices.

Moreover, they explored more than a few reductions, together with reductions for paying premiums yearly. The Rodriguez circle of relatives discovered that the bundled coverage and annual fee cut price ended in a substantial aid of their overall insurance coverage expenditure.

Case Learn about 3: The Price range-Mindful Scholar

This situation learn about profiles a budget-conscious pupil, Jose, attending a school in McAllen. Jose required insurance coverage for his automobile, essentially for commuting to and from campus. Spotting the will for reasonably priced protection, Jose researched other insurance coverage suppliers and in comparison quotes. He sought insurance policies with the bottom conceivable premiums, whilst keeping up a degree of protection that met his wishes.

He in comparison protection limits and deductibles throughout other suppliers, figuring out the trade-offs between decrease premiums and ok protection. The comparability procedure and meticulous collection of a coverage adapted to his wishes ended in really extensive financial savings for Jose.

Case Learn about 4: The Skilled Motive force

This situation learn about specializes in an skilled motive force, David, a long-time resident of McAllen. David had a blank riding file and a powerful historical past of protected riding. He sought reasonably priced protection that mirrored his low-risk profile. David researched insurance coverage suppliers providing reductions for protected drivers and applied on-line comparability gear to spot essentially the most aggressive quotes. He effectively secured a coverage reflecting his protected riding historical past and coffee menace profile, leading to important charge financial savings.

Comparability of Case Research

| Case Learn about | Person/Circle of relatives Profile | Methods Hired | Elements Contributing to Luck | Attainable Demanding situations | Consequence |

|---|---|---|---|---|---|

| Younger Skilled | Younger, new motive force | Prime deductible, defensive riding route, multi-car cut price | Decrease premiums, advanced riding file | Upper preliminary premiums because of age and riding historical past | Important financial savings |

| Circle of relatives with More than one Cars | Circle of relatives with more than one automobiles | Multi-car coverage, annual fee cut price | Bundled coverage, reductions | Upper preliminary premiums for particular person insurance policies | Important financial savings |

| Price range-Mindful Scholar | Scholar with restricted funds | Coverage comparability, lowest conceivable premiums | Analysis, comparability gear | Balancing protection and price | Considerable financial savings |

| Skilled Motive force | Skilled motive force with blank file | Researching suppliers with reductions for protected drivers, on-line comparability gear | Protected riding historical past, low menace profile | Discovering suppliers spotting protected riding historical past | Important financial savings |

Attainable Reductions and Financial savings Alternatives

Securing reasonably priced automobile insurance coverage in McAllen, TX steadily comes to figuring out and leveraging to be had reductions. Figuring out the more than a few cut price choices introduced by way of insurance coverage suppliers and proactively in quest of them out can considerably cut back premiums. This phase main points not unusual reductions, the significance of reviewing coverage phrases, strategies for uncovering hidden reductions, and ceaselessly requested questions to assist customers in maximizing financial savings.Insurance coverage corporations make use of quite a few methods to incentivize policyholders and praise accountable riding behaviors.

Those reductions, when mixed with proactive movements by way of customers, can considerably cut back the entire charge of vehicle insurance coverage.

Not unusual Reductions To be had

Insurance coverage suppliers ceaselessly be offering reductions in accordance with more than a few elements, together with policyholder demographics, riding historical past, and car options. Those reductions can result in really extensive financial savings, probably lowering premiums by way of a substantial proportion. Not unusual reductions come with:

- Multi-policy reductions: Bundling more than one insurance coverage insurance policies (e.g., auto, house, lifestyles) with the similar supplier can lead to discounted charges. This means can considerably cut back general insurance coverage prices.

- Excellent pupil reductions: Drivers enrolled in a highschool or school program would possibly qualify for a cut price in the event that they deal with a adequate instructional file. This displays the lowered menace profile of more youthful drivers who’re much more likely to be supervised and insured by way of folks.

- Defensive riding classes: Finishing a defensive riding route can show a dedication to protected riding practices and cut back the perceived menace related to the policyholder, which steadily ends up in a cut price.

- Protected motive force reductions: Insurers steadily praise drivers with accident-free riding information thru reductions, incentivizing accountable habits and lowering premiums.

- Anti-theft gadgets: Putting in anti-theft gadgets on insured automobiles can qualify for a cut price, reflecting the lowered menace of robbery.

Significance of Reviewing Coverage Phrases

In moderation reviewing coverage phrases is a very powerful for figuring out attainable financial savings alternatives. Insurance coverage insurance policies can come with more than a few clauses and provisions that may qualify the policyholder for reductions now not explicitly marketed.

- Hidden Reductions: Insurance policies steadily comprise hidden reductions for explicit traits or behaviors. Cautious studying can discover those alternatives. As an example, reductions may well be to be had for sure car fashions or explicit security features. A complete overview can result in unanticipated financial savings.

How one can In finding Hidden Reductions

Discovering hidden reductions steadily comes to proactive analysis and communique with insurance coverage suppliers. Strategies come with:

- Contacting insurers at once: Achieve out to insurance coverage suppliers at once and inquire about attainable reductions. Suppliers steadily have specialised groups devoted to addressing such inquiries.

- Checking insurer web pages: Many insurance coverage corporations have on-line portals or sources that element reductions to be had to policyholders. Reviewing those sources may give insights into attainable financial savings.

- Evaluating coverage paperwork: In moderation overview coverage paperwork to spot hidden clauses or provisions associated with reductions. An in depth research of the coverage phrases and prerequisites can divulge unadvertised financial savings alternatives.

Regularly Requested Questions on Reductions

- How lengthy do reductions usually ultimate? The length of reductions varies in accordance with the precise cut price and insurer insurance policies. Some reductions is also everlasting, whilst others is also time-limited or depending on explicit stipulations. You need to ascertain the length with the insurance coverage supplier.

- Are there reductions for explicit car varieties? Sure, some insurance coverage corporations be offering reductions for explicit car varieties or options, equivalent to hybrid or electrical automobiles, or the ones with enhanced security features. A overview of the insurance coverage supplier’s site or touch with their representatives can ascertain to be had reductions for explicit car varieties.

- Can I mix more than one reductions? It’s steadily conceivable to mix more than one reductions, even supposing the precise laws range by way of insurance coverage supplier. Contacting the insurer can explain the applicability of mixing reductions.

Bargain Comparability Desk

| Insurance coverage Corporate | Multi-Coverage Bargain | Excellent Scholar Bargain | Defensive Using Bargain | Protected Motive force Bargain |

|---|---|---|---|---|

| Corporate A | 10% | 5% | 5% | 8% |

| Corporate B | 12% | 6% | 6% | 10% |

| Corporate C | 15% | 7% | 7% | 12% |

Word: Reductions are illustrative and would possibly range in accordance with particular person instances. All the time ascertain specifics with the insurance coverage corporate.

Figuring out Automobile Insurance coverage Insurance policies in McAllen, TX

Automobile insurance coverage insurance policies in McAllen, TX, like the ones national, are designed to give protection to drivers and their automobiles from monetary losses because of injuries or injury. Figuring out the more than a few coverages inside those insurance policies is a very powerful for making knowledgeable selections and making sure ok coverage. Other insurance policies be offering various ranges of coverage, so a complete figuring out is essential to heading off sudden monetary burdens.

Varieties of Protection in Standard Insurance policies

Automobile insurance coverage insurance policies usually come with a number of key coverages, each and every addressing other attainable dangers. Those coverages are designed to offer monetary strengthen for a variety of instances. Figuring out those components will allow a motive force to judge the level in their coverage and resolve if further protection is wanted.

Legal responsibility Protection

Legal responsibility protection is a basic element of any automobile insurance plans. It protects the policyholder from monetary duty for damages led to to others in an coincidence. This protection usually comprises physically damage legal responsibility and belongings injury legal responsibility. Physically damage legal responsibility can pay for clinical bills and misplaced wages for the ones injured in an coincidence the policyholder led to. Assets injury legal responsibility covers damages to the opposite birthday party’s car or belongings.

For example, if a motive force rear-ends every other car, inflicting $5,000 in injury to the opposite car, the legal responsibility protection would pay for the maintenance, as much as the coverage limits.

Collision Protection

Collision protection can pay for damages to the insured car, irrespective of who led to the coincidence. If the insured car is considering a collision, this protection will atone for maintenance or substitute, as much as the coverage limits. As an example, if a motive force’s automobile is considering a collision and sustains $3,000 in injury, the collision protection pays for the maintenance, supplied the wear and tear isn’t exceeding the coverage limits.

Complete Protection

Complete protection protects the insured car in opposition to losses now not involving a collision, equivalent to robbery, vandalism, hearth, hail, or climate injury. This protection will also be in particular treasured in spaces with excessive incidences of robbery or herbal screw ups. As an example, if a motive force’s automobile is stolen, complete protection would lend a hand atone for the lack of the car, topic to coverage limits.

Coverage Exclusions and Barriers

It is very important to grasp the exclusions and barriers inside a automobile insurance plans. Exclusions are explicit instances the place protection is not going to follow, equivalent to intentional acts of wear or use of the car for unlawful actions. Barriers steadily contain predefined financial caps or protection limits for more than a few claims. For example, a coverage could have a prohibit at the quantity it’s going to pay for clinical bills.

Figuring out those barriers and exclusions is significant to keep away from any misunderstandings or disappointments when submitting a declare.

Protection Choices and Implications

| Protection Sort | Description | Implications |

|---|---|---|

| Legal responsibility | Covers damages to others in an coincidence. | Protects in opposition to monetary duty for accidents or belongings injury to others. |

| Collision | Covers injury to the insured car, irrespective of fault. | Supplies monetary strengthen for maintenance or substitute of the insured car in case of a collision. |

| Complete | Covers injury to the insured car from non-collision occasions. | Protects in opposition to losses from robbery, vandalism, hearth, or climate injury. |

Evaluation of Client Stories and Evaluations on Automobile Insurance coverage Suppliers

Client opinions supply treasured insights into the stories of people with automobile insurance coverage suppliers in McAllen, TX. Those opinions be offering an instantaneous point of view at the high quality of provider, pricing, and general delight, permitting attainable consumers to make knowledgeable selections. Examining those opinions is helping establish strengths and weaknesses of various suppliers, helping within the collection of essentially the most appropriate insurance coverage plan.Figuring out client comments is a very powerful for comparing the effectiveness of more than a few insurance coverage corporations in McAllen.

Evaluations, steadily detailed and explicit, spotlight facets like declare processing, customer support responsiveness, and coverage readability. By way of synthesizing those views, a complete image emerges, showcasing the various stories and expectancies of vehicle insurance coverage consumers within the area.

Abstract of Client Comments on Automobile Insurance coverage Suppliers

Client opinions steadily supply an in depth and nuanced account in their stories. This phase summarizes the overall comments patterns seen throughout more than a few suppliers working in McAllen, TX. Those insights supply a comparative research in their strengths and weaknesses, serving to customers navigate the insurance coverage marketplace successfully.

- Declare Processing: Evaluations constantly spotlight the significance of well timed and environment friendly declare processing. Certain opinions emphasize fast responses, transparent communique, and a clean solution procedure. Conversely, detrimental opinions ceaselessly point out delays, loss of communique, and headaches in resolving claims.

- Buyer Carrier: The responsiveness and helpfulness of purchaser provider representatives are important elements in client delight. Certain comments underscores the willingness of brokers to handle inquiries and unravel problems promptly and successfully. Conversely, detrimental comments steadily issues to unresponsive or unhelpful brokers, lengthy wait instances, and issue in achieving strengthen.

- Coverage Readability and Transparency: Evaluations ceaselessly point out the significance of transparent and concise coverage phrases and prerequisites. Certain opinions applaud easy-to-understand insurance policies, whilst detrimental opinions specific confusion or frustration relating to coverage specifics, protection limits, and hidden charges.

- Pricing and Price: Shoppers ceaselessly evaluate the associated fee and protection of more than a few plans. Certain opinions steadily point out aggressive pricing and price for the introduced protection. Unfavorable comments from time to time mentions excessive premiums with out enough protection or loss of transparency in pricing buildings.

Not unusual Subject matters in Client Evaluations

Research of client opinions unearths a number of ordinary subject matters that form perceptions of vehicle insurance coverage suppliers in McAllen. Those ordinary patterns are treasured in figuring out the entire delight and dissatisfaction ranges.

- Price for Cash: Shoppers ceaselessly evaluate the price of premiums to the extent of protection supplied. Suppliers perceived as providing aggressive pricing and ok protection obtain sure comments.

- Accessibility and Comfort: The convenience of on-line get entry to to coverage data, on-line declare submitting, and on-line fee choices considerably affects buyer delight. Certain comments emphasizes user-friendly on-line platforms and cell apps.

- Declare Answer Time: The velocity and potency of declare solution processes are ceaselessly discussed. Suppliers with fast turnaround instances and easy processes obtain favorable opinions.

Buyer Pride Scores

Buyer delight rankings, whilst now not at all times at once quantifiable from opinions, supply a common indication of purchaser sentiment. Combining qualitative and quantitative information provides a richer figuring out of the insurance coverage panorama in McAllen. A common pattern of dissatisfaction with explicit suppliers will also be seen within the detrimental comments.

| Insurance coverage Supplier | Buyer Pride Score (Qualitative Abstract) | Comments Abstract |

|---|---|---|

| Supplier A | Combined; Some superb provider, others file problems with claims processing. | Prime quantity of sure opinions for customer support, however some file lengthy declare solution instances. |

| Supplier B | Typically Certain; Sturdy customer support and clear insurance policies. | Prime rankings for readability of insurance policies and responsiveness to inquiries. |

| Supplier C | Unfavorable; Many court cases about declare processing delays. | Ordinary problems with claims, lengthy wait instances, and loss of communique. |

Remaining Level

In conclusion, securing reasonable automobile insurance coverage in McAllen TX calls for cautious comparability buying groceries, figuring out particular person elements affecting charges, and leveraging to be had reductions. This overview supplies a framework for knowledgeable decision-making, empowering you in finding essentially the most appropriate coverage on your wishes. Then again, remember that discovering absolutely the most cost-effective choice would possibly not at all times yield the most efficient general price.

Solutions to Not unusual Questions

What elements maximum affect automobile insurance coverage premiums in McAllen, TX?

Motive force age, riding historical past, car kind, and placement inside McAllen are key elements. Previous claims considerably affect charges, or even apparently minor infractions can lead to really extensive top rate will increase.

Are there any explicit reductions to be had in McAllen, TX?

Sure, reductions like multi-policy reductions, excellent pupil reductions, and protected motive force incentives are not unusual. Insurers may additionally be offering reductions in accordance with car options or riding conduct.

How can I successfully evaluate quotes from other insurance coverage suppliers?

Use on-line comparability gear or paintings with a professional unbiased insurance coverage agent. Evaluating quotes at once from suppliers’ web pages, or the usage of specialised on-line comparability gear, lets in for a complete review of more than a few insurance policies.

What sorts of protection are usually integrated in a automobile insurance plans in McAllen, TX?

Legal responsibility, collision, and complete protection are same old. Figuring out the specifics of each and every protection kind and the coverage’s exclusions is a very powerful for knowledgeable decision-making.