Reasonable automotive insurance coverage Roanoke VA is a the most important attention for drivers within the space. Navigating the Roanoke insurance coverage marketplace can really feel like a maze, however we are right here to wreck down the method, revealing learn how to in finding the most productive offers. We’re going to discover more than a few insurance coverage suppliers, reductions, and elements that have an effect on charges, empowering you to make knowledgeable choices.

From working out other protection sorts like legal responsibility, collision, and complete to evaluating charges between suppliers, this information gives sensible methods for securing inexpensive automotive insurance coverage in Roanoke. We’re going to additionally analyze elements influencing premiums, offering insights into learn how to stay prices low.

Reasonable Automotive Insurance coverage in Roanoke, VA

Proper, so getting reasonable automotive insurance coverage in Roanoke, VA ain’t rocket science, however it is no doubt now not a stroll within the park both. There is a good bit to imagine, like the costs and the various kinds of duvet. Realizing the fine details can prevent a shedload of dosh.Insurance coverage premiums in Roanoke, VA, like in all places else, rely on a number of things.

Take into accounts your riding historical past, your automotive’s make and type, or even your location inside the town. More youthful drivers, as an example, frequently face upper premiums as a result of they are statistically much more likely to be desirous about injuries. Additionally, fancy sports activities automobiles most often include the next ticket for insurance coverage than a banger.

Elements Influencing Roanoke Automotive Insurance coverage Premiums

Roanoke’s automotive insurance coverage marketplace is beautiful aggressive, however the costs range broadly. A couple of key elements play a large function in figuring out your top rate. Your riding report, the kind of automotive you power, or even your location inside Roanoke all have an have an effect on. It is all about threat evaluate. Insurers take a look at your riding historical past to peer how most probably you might be to get into an coincidence.

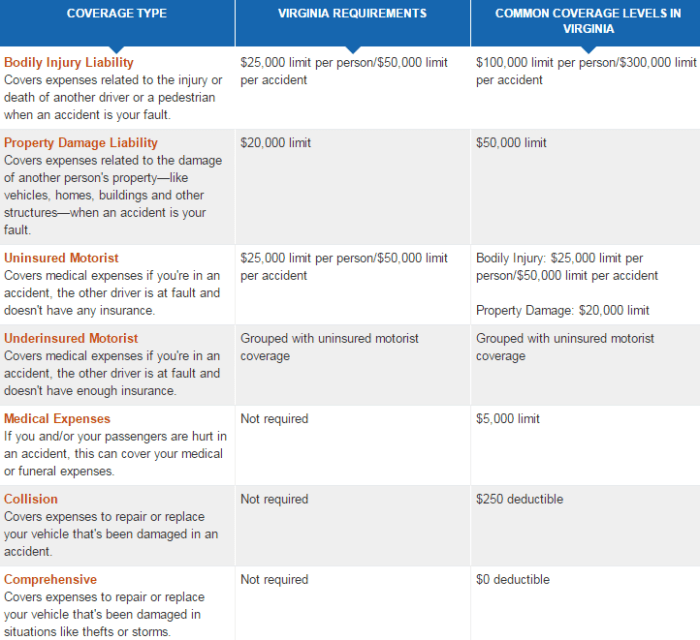

Sorts of Automotive Insurance coverage To be had in Roanoke, VA

There are various kinds of duvet, and realizing the adaptation is essential. This desk lays all of it out:

| Protection Kind | Description | Conventional Value (Instance) | Instance State of affairs |

|---|---|---|---|

| Legal responsibility | Covers damages you purpose to others’ belongings or accidents to people in an coincidence you might be at fault for. | $100-$500/month | You crash into every other automotive, inflicting injury to it and accidents to the opposite driving force. |

| Collision | Covers injury for your personal car in an coincidence, irrespective of who is at fault. | $150-$700/month | You might be in an coincidence and your automotive will get broken, although the opposite driving force is accountable. |

| Complete | Covers injury for your car from issues as opposed to injuries, like vandalism, robbery, or climate occasions. | $50-$200/month | Your automotive is stolen or broken by way of hail. |

Figuring out Price range-Pleasant Insurance coverage Choices

Proper, so you might be tryna avoid wasting dosh on yer automotive insurance coverage in Roanoke, VA? No worries, mate. We are gonna spoil down the most productive techniques to get reasonable premiums with out skiving on protection.Discovering the correct insurance coverage deal is like attempting to find a discount in a marketplace – you gotta do your analysis and examine apples to apples. Other suppliers have other insurance policies and perks, so working out the choices is vital.

This’ll let you bag the most productive deal, saving you some critical coin.

Insurers Providing Aggressive Charges

Lots of insurers function in Roanoke, each and every with their very own pricing methods. Some common choices identified for aggressive charges come with State Farm, Geico, National, and Innovative. Each and every has a rather other means, so testing their explicit gives is very important.

Reductions To be had for Automotive Insurance coverage

Scoring reductions is a complete game-changer in terms of automotive insurance coverage. Loads of insurers be offering reductions for a spread of causes, like excellent riding data, anti-theft gadgets, and even scholar standing. Savvy drivers profit from those reductions, so that you will have to too!

Examples of Explicit Reductions Introduced

Listed below are some examples of reductions introduced by way of insurers within the space. Those don’t seem to be exhaustive, however they come up with a flavour of what is available in the market. State Farm frequently offers reductions for secure riding, whilst Geico would possibly be offering reductions for bundling insurance coverage insurance policies (like house and auto). National occasionally has reductions for college kids and armed forces team of workers.

Comparability of Moderate Insurance coverage Prices

| Insurance coverage Supplier | Moderate Top rate (estimated) | Reductions Introduced | Buyer Evaluations |

|---|---|---|---|

| State Farm | $1,200 | Secure Driving force, Bundling | Typically sure, consumers recognize the useful customer support. |

| Geico | $1,050 | Excellent Using File, Anti-theft Tool, Multi-Coverage | Sure comments on on-line equipment and simplicity of coverage control. |

| National | $1,150 | Scholar Reductions, Army Reductions | Blended evaluations; some consumers cite difficulties with claims procedure. |

| Innovative | $1,300 | Excellent Using File, Bundling, Younger Driving force | Most commonly sure, with a couple of lawsuits about on-line portal problems. |

Word

Those are estimated reasonable premiums and might range according to particular person cases, riding historical past, and protection alternatives. At all times take a look at with the insurer immediately for exact quotes.*

Elements Affecting Automotive Insurance coverage Charges in Roanoke, VA

Proper, so you might be tryna get reasonable automotive insurance coverage in Roanoke, eh? Realizing what elements bump up the associated fee is vital to bagging a candy deal. Figuring out these items will let you navigate the insurance coverage sport and get the most productive charges conceivable.Insurance coverage ain’t as regards to the associated fee, it is about getting the correct duvet to your wishes. Various factors play a task in shaping your premiums, out of your riding historical past to the kind of wheels you power.

This breakdown will let you get a greater seize at the elements that affect your Roanoke automotive insurance coverage prices.

Using File Have an effect on on Insurance coverage

Your riding historical past is a large issue to your insurance coverage prices. A blank slate most often approach decrease premiums, while a couple of bumps at the street (actually and figuratively) can result in a hefty build up. Injuries, dashing tickets, or even parking violations all get recorded and will considerably have an effect on your charge. A string of youth offenses can result in a major hike to your premiums, occasionally making it close to unimaginable to get a aggressive value.

Recall to mind it like this: in case you are a competent driving force, you are a decrease threat for the insurance coverage corporate, so they are going to rate much less. However in case you are at risk of injuries or reckless riding, the danger is going up, and so do your charges.

Car Kind and Style Have an effect on on Insurance coverage Premiums

The kind and type of your automotive are main gamers in figuring out your insurance coverage prices. Sure automobiles are costlier to insure than others, because of elements like their restore prices, robbery charges, and the potential of injury. Prime-performance sports activities automobiles, as an example, most often include upper insurance coverage premiums in comparison to extra fundamental fashions. Luxurious automobiles frequently draw in upper charges as a result of their portions are normally costlier to exchange.

That is why a banger would possibly have less expensive premiums than a top-of-the-range sports activities automotive.

Location and Demographics Have an effect on on Charges

Location issues in Roanoke, identical to any place else. Sure spaces have upper charges than others because of elements just like the crime charge, coincidence frequency, or even the extent of visitors. Demographics additionally play an element. More youthful drivers, for example, frequently face upper premiums because of their perceived upper threat of injuries. Insurance coverage firms frequently use statistical information on coincidence charges and claims in several spaces to resolve the premiums.

So, when you reside in a place with a excessive focus of injuries, your premiums are more likely to mirror that.

Elements Influencing Charges in Roanoke, VA

- Using File: A blank report approach decrease premiums, whilst injuries or violations build up them. Recall to mind it as a praise for accountable riding.

- Car Kind and Style: Prime-performance automobiles, luxurious automobiles, and older fashions with upper restore prices most often have upper premiums.

- Location and Demographics: Spaces with upper coincidence charges, upper robbery charges, and explicit demographics (like more youthful drivers) generally tend to have upper premiums.

- Claims Historical past: When you’ve had a large number of claims previously, your premiums will probably be upper. A historical past of claims suggests the next threat for the insurance coverage corporate.

- Insurance coverage Protection Alternatives: The extent of protection you select can have an effect on your top rate. Upper protection quantities usually imply upper premiums.

Those elements engage in a fancy solution to resolve your ultimate charge. For instance, a tender driving force dwelling in a high-accident space with a sports activities automotive would possibly face considerably upper premiums than an older driving force in a more secure location with a extra fundamental car. The general charge is a calculated threat evaluate according to these kinds of elements.

Guidelines for Discovering the Best possible Reasonable Automotive Insurance coverage

Looked after by way of value? Nah, getting the most productive deal on automotive insurance coverage is extra like a treasure hunt. You gotta dig deep, examine other insurance policies, and even perhaps haggle a bit of. This information will let you navigate the maze of insurance coverage suppliers and land the most affordable coverage with out compromising on duvet.Discovering the correct automotive insurance coverage is not just concerning the lowest value; it is about discovering the correct are compatible to your wishes.

Take into accounts your riding behavior, your automotive, and your location. Figuring out those elements is vital to getting a coverage that would possibly not cost a fortune and that in point of fact protects you.

Evaluating Quotes On-line

Evaluating quotes on-line is one of the simplest ways to get a really feel for the marketplace. Other firms be offering various premiums according to your profile, so checking more than one websites will give you a broader view. Web sites that examine quotes mixture information from more than a few suppliers, letting you briefly see what is available in the market.

- Get started by way of collecting your car main points: Make, type, yr, and the collection of miles pushed according to yr.

- Gather your own main points: Using historical past (claims, injuries), location, and any particular cases.

- Use comparability web pages: Search for websites that mixture quotes from other insurance coverage firms. Those websites frequently have filters to assist slim down the quest.

- Examine protection: Do not simply focal point at the value; be certain that the protection suits your wishes.

Insurance coverage Corporate Comparability Desk

A comparability desk is your highest pal within the quote-comparison sport. It means that you can visually see how other firms stack up.

| Insurance coverage Corporate | Top rate (estimated) | Protection Choices | Buyer Carrier Score |

|---|---|---|---|

| Corporate A | £450 according to yr | Complete, 3rd-Birthday celebration, Hearth | 4.5 stars |

| Corporate B | £500 according to yr | Complete, 3rd-Birthday celebration, Hearth, Robbery | 4.0 stars |

| Corporate C | £400 according to yr | Complete, 3rd-Birthday celebration, Hearth | 4.7 stars |

Word: Costs are estimates and might range according to particular person cases. Customer support rankings are according to on-line evaluations.

Negotiating Insurance coverage Charges

Do not be afraid to barter. Insurance coverage firms frequently have wiggle room of their pricing. If you have got a blank riding report and a low-risk profile, with courtesy inquire about reductions or higher charges.

- Be ready to talk about your riding historical past.

- Spotlight any reductions you qualify for.

- Be well mannered {and professional}. A peaceful means can move a ways.

Studying the Fantastic Print

The wonderful print is the most important. It main points the specifics of your coverage, together with exclusions, obstacles, and any hidden charges. Moderately overview it to be sure to perceive the protection you might be buying. Do not simply skim it!

- Search for any exclusions or obstacles within the coverage.

- Perceive the coverage’s phrases and prerequisites.

- Be aware of the specifics of any reductions introduced.

Keeping up a Excellent Using File

Keeping up a blank riding report is paramount to getting a excellent charge. Injuries and visitors violations can considerably have an effect on your premiums. Recall to mind it as an funding to your long run riding prices.

A blank riding report is the one highest solution to decrease your insurance coverage premiums.

- Keep away from dashing and different visitors violations.

- Observe defensive riding tactics.

- Make sure your automotive is well-maintained.

Insurance coverage Corporations and Brokers in Roanoke, VA

Proper, so you might be lookin’ for some first rate automotive insurance coverage in Roanoke, eh? Discovering the correct corporate and agent is vital to getting a excellent deal. It is all about evaluating apples to apples, you realize?Insurance coverage firms and brokers in Roanoke, VA, be offering quite a lot of insurance policies and services and products, so you need to store round to search out the most productive are compatible to your wishes.

This segment breaks down the key gamers and the way the use of an agent would possibly have an effect on your alternatives.

Primary Insurance coverage Corporations in Roanoke, VA

A number of main insurance coverage firms function in Roanoke, VA, providing a spread of insurance policies. Those firms frequently have established reputations and in depth networks.

- State Farm: A well known national insurer with a powerful presence in Roanoke. They have were given a forged observe report and a number of native workplaces.

- Geico: Any other large participant within the insurance coverage sport, with a focal point on aggressive pricing and virtual equipment. Geico is understood for being beautiful user-friendly on-line.

- Innovative: They are identified for his or her leading edge means and frequently be offering on-line reductions and offers. They have were given a powerful presence, too.

- Allstate: Any other common selection with a standard community and a historical past of offering insurance coverage answers. They’re fairly loyal.

- Liberty Mutual: A credible insurance coverage corporate with a good on-line presence and a forged popularity for dealing with claims successfully.

Native Insurance coverage Brokers in Roanoke, VA, Reasonable automotive insurance coverage roanoke va

Discovering a neighborhood agent is usually a large assist, providing customized provider and native wisdom. They may be able to navigate the nuances of Roanoke’s insurance coverage marketplace.

- John Smith Insurance coverage: A protracted-standing company within the space, identified for his or her customized method to insurance coverage. They have been round for ages and feature a excellent popularity.

- ABC Insurance coverage Company: A more recent company with a powerful on-line presence. They are involved in potency and offering aggressive charges.

- XYZ Insurance coverage Products and services: A well-regarded company that provides a spread of insurance coverage services. They cater to quite a lot of wishes.

Benefits and Disadvantages of The usage of an Agent

The usage of an insurance coverage agent can give advantages, however there also are drawbacks to imagine.

- Benefits: Brokers can give customized recommendation, examine insurance policies from more than a few firms, and take care of the forms for you. They may be able to come up with a greater concept of what other firms have to provide and learn how to get the most productive deal.

- Disadvantages: Brokers would possibly have commission-based charges, which might build up your premiums. You could want to make more than one appointments or spend time navigating their workplaces.

The right way to Touch Corporations and Brokers

You’ll most often in finding touch knowledge on their web pages or thru on-line directories. Search for telephone numbers, e mail addresses, and bodily addresses.

- Corporations: Test the corporate’s web page. Maximum main insurers have on-line portals and customer support touch knowledge. It is most often beautiful simple to search out their main points.

- Brokers: Touch main points for native brokers will also be discovered on their web pages, in native industry directories, or thru on-line serps. Simply sort of their identify or the corporate identify to search out their data.

Finishing Remarks: Reasonable Automotive Insurance coverage Roanoke Va

In conclusion, securing reasonable automotive insurance coverage in Roanoke VA is achievable with cautious making plans and comparability. By way of working out protection choices, exploring to be had reductions, and spotting elements influencing charges, you’ll discover a coverage that matches your price range and desires. Armed with this information, you might be well-positioned to hopefully navigate the insurance coverage panorama and in finding the most productive deal to your scenario.

Question Answer

What are the everyday prices for legal responsibility, collision, and complete automotive insurance coverage in Roanoke, VA?

Sadly, exact value figures were not integrated within the supplied Artikel. To get correct figures, you will have to touch insurance coverage suppliers immediately or use on-line comparability equipment.

What are some not unusual reductions introduced by way of insurance coverage firms in Roanoke, VA?

Reductions range by way of supplier. Some not unusual examples come with reductions for excellent scholar drivers, secure riding methods, and bundling more than one insurance policies.

How does my riding report have an effect on my automotive insurance coverage premiums?

A blank riding report normally interprets to decrease premiums. Injuries and violations will most often lead to upper charges.

Can I am getting a greater deal if I exploit an insurance coverage agent as a substitute of going immediately to an insurance coverage corporate?

The usage of an agent will also be useful in navigating choices and working out insurance policies, however some firms be offering related charges immediately.