Will my automotive get repossessed if I would not have insurance coverage? This crucial exam delves into the advanced courting between automobile insurance coverage and the opportunity of repossession. The prison framework surrounding repossession varies considerably by means of state, frequently with stringent necessities tied to mortgage agreements. Working out those nuances is an important for heading off monetary hardship and attainable lack of your automobile.

The results of missing insurance coverage prolong past the rapid danger of repossession. A loss of insurance coverage can negatively have an effect on your credit score ranking, making long run borrowing tougher and costly. This research explores the criteria influencing lenders’ selections, the precise clauses in mortgage agreements, and the significance of working out your rights and duties in those eventualities.

Prison Framework for Repossession

Yo, peeps! Let’s get right down to brass tacks about automotive repossessions. Realizing the foundations of the sport is essential to heading off the ones nasty surprises. It is all about working out the prison hoops concerned, and the way insurance coverage performs a an important function in retaining your journey protected.This ain’t no fairy story, repossession is a major trade. It comes to a sequence of occasions, from defaulting to your mortgage to the real towing of your journey.

Working out the prison framework allow you to navigate the method and probably save you a repo. Insurance coverage, or lack thereof, frequently performs an important section on this drama.

Prison Procedures Occupied with Repossession

Repossession is not only a few random snatching of your wheels. There is a procedure lenders need to practice, generally specified by your mortgage settlement. This frequently comes to a realize length, supplying you with time to settle your dues. In case you fail to take action, the lender can begin the repossession procedure, which frequently comes to contacting a repo company. They will then in most cases try to find the automobile and organize for its towing.

Crucially, there are prison restrictions on when and the way they are able to do that, which range by means of state.

Position of Insurance coverage in Fighting Repossession

Insurance coverage is your first defensive line in opposition to repo. A complete insurance coverage, with the right kind protection, protects you in opposition to more than a few cases that would possibly result in repossession, reminiscent of injuries or robbery. This fashion, if one thing occurs that would cause a declare to your mortgage, the insurance coverage corporate steps in to repay the lender and save you repossession.

It is a large peace of thoughts.

Particular State Regulations Relating to Automobile Repossession

State rules range considerably in relation to automobile repossession procedures. Other states have other regulations referring to realize classes, strategies of repossession, and the rights of the borrower. That is an important as a result of a lender can not simply waltz in and take your automotive.

Insurance coverage Necessities vs. No-Insurance coverage Eventualities

The desire for insurance coverage frequently hinges to your mortgage settlement and the precise cases. When you’ve got a mortgage with particular necessities, insurance coverage could be necessary. In circumstances the place you might be no longer required to hold insurance coverage, the lender would possibly nonetheless attempt to get better their losses thru different approach, which might probably result in repossession. It is a gamble. It is best to all the time have insurance coverage.

Comparability Desk: Insurance coverage Necessities and Repossession Procedures, Will my automotive get repossessed if i would not have insurance coverage

| State | Insurance coverage Necessities | Repossession Procedures |

|---|---|---|

| California | Steadily required by means of lenders, even supposing no longer mandated by means of state legislation. | Strict realize necessities, probably involving court docket orders. |

| Florida | Lenders frequently require evidence of insurance coverage. | Repossession frequently follows a proper procedure Artikeld in state legislation. |

| Texas | Mortgage agreements ceaselessly mandate insurance coverage. | Transparent procedures, emphasizing due procedure for the borrower. |

| New York | Insurance coverage necessities range relying at the lender and mortgage phrases. | Particular procedures Artikeld by means of state legislation, probably involving court docket intervention. |

| … | … | … |

Word: It is a simplified assessment. Particular cases and mortgage agreements might range. All the time visit a prison skilled or your lender for exact main points. You must all the time consult with a qualified to your particular scenario.

Affect of No Insurance coverage on Repossession

Yo, peeps! So, you might be in a sticky scenario together with your journey and no insurance coverage? Let’s discuss how that no-insurance transfer can severely up your possibilities of getting repo’d. It is a general game-changer, and we’re going to destroy down why.Lenders, they ain’t precisely enjoying video games in the case of their investments. Having insurance coverage to your automotive is a an important a part of securing the mortgage.

Call to mind it as a security web, protective each you and the lender from surprising upkeep or injuries. With out it, the lender’s possibility skyrockets, making repo a much more likely end result.

Correlation Between Loss of Insurance coverage and Repossession

The absence of insurance coverage immediately correlates with a better possibility of repossession. Lenders view it as an important danger to their funding. They are searching for techniques to reduce the opportunity of monetary loss, and insurance coverage is a significant component in that equation. A automotive with out insurance coverage is sort of a ticking time bomb, probably costing the lender much more cash down the street.

Elements Influencing Repossession Choices by means of Lenders

Lenders do not simply repossess willy-nilly. They’ve particular standards and an entire tick list to believe. Loss of insurance coverage is a huge crimson flag, particularly if there are different caution indicators, like neglected bills or a historical past of issues. Such things as the price of the auto, the duration of the mortgage, and the entire monetary well being of the borrower additionally play a task.

A lender is not only having a look at your insurance coverage standing, they are comparing all of your monetary image.

Clauses in Mortgage Agreements Addressing Insurance coverage

Mortgage agreements generally have particular clauses about insurance coverage. Those clauses Artikel the lender’s necessities for keeping up insurance policy. Those are frequently very transparent, so you must learn them moderately whilst you signal. They in most cases specify the minimal degree of protection wanted and who is accountable for keeping up it. A large number of those clauses come with the lender’s proper to require insurance coverage if it isn’t already provide.

Lender’s Rights and Duties in Repossession Eventualities

Lenders have particular rights and duties in the case of repossession. They are no longer simply grabbing your automotive; they’ve to practice a prison procedure, and it is an important that you know this. They are additionally obligated to correctly maintain the repossessed automobile and maintain any related problems. There is a particular protocol lenders will have to practice, so you’ll want to know what it’s.

Comparability Desk: Insurance coverage vs. No Insurance coverage

| Issue | With Insurance coverage | With out Insurance coverage |

|---|---|---|

| Chance of Repossession | Decrease | Upper |

| Lender’s Chance Evaluation | Decrease possibility | Upper possibility |

| Mortgage Settlement Compliance | Compliant | Doubtlessly non-compliant |

| Monetary Affect on Borrower | Much less critical (typically) | Doubtlessly critical (repossession) |

Possible choices to Save you Repossession

Yo, peeps! So, your journey’s at the line, and you might be lookin’ for methods to steer clear of that repo scene? Concern no longer, fam! We have now were given some respectable strikes to stay your wheels below your keep watch over. Let’s dive in and spot easy methods to keep out of bother.

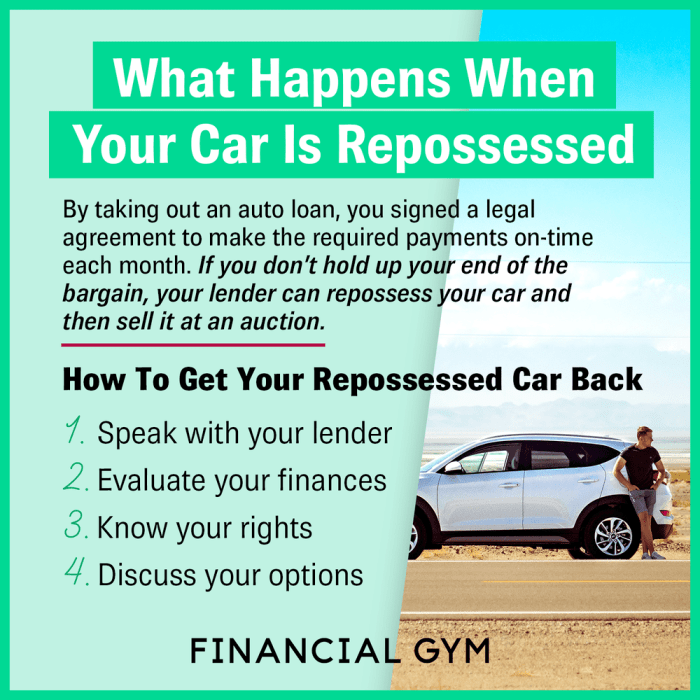

Doable Answers for Folks With out Insurance coverage

Dealing with a repossession danger with out insurance coverage can really feel like a complete bummer, however there are alternatives. Do not panic; there are methods to get again on target and stay your journey. First issues first, you gotta display lenders that you are dedicated to paying up.

- Demonstrating Monetary Duty: Lenders worth consistency and reliability. Display them you might be enthusiastic about making bills by means of sticking to a agenda, even supposing it is a bit tight. If you are suffering, discover choices like putting in a cost plan with the lender. Honesty and open communique pass some distance in those eventualities. Additionally, stay your credit score ranking in test – it is an important for securing long run loans and heading off repossession.

- Choice Insurance coverage Choices: If conventional insurance coverage is not an possibility, believe selection insurance coverage suppliers, particularly the ones catering to people with less-than-perfect credit score histories. There are specialised corporations that supply insurance policy at other worth issues. Do exactly your analysis and examine quotes to seek out the most productive deal to your wishes.

- Brief Insurance coverage: Every now and then, a brief insurance coverage is all you wish to have to shop for you time. Those insurance policies generally duvet a brief length, permitting you to get again on target with a typical insurance coverage plan. Do not wait till the final minute! Proactively discover those choices whilst you come upon repossession threats.

Significance of Well timed Insurance coverage Bills

Making well timed insurance coverage bills is admittedly an important. It is a signal of accountable monetary control and displays the lender that you just worth your automobile. Lacking bills may just cause the repossession procedure. If you are dealing with monetary hardship, keep in touch together with your insurance coverage supplier once conceivable to discover choices for adjusting your cost plan.

Flowchart for Dealing with Repossession Threats

This flowchart Artikels the stairs to take when dealing with repossession threats:

| Step | Motion |

|---|---|

| 1 | Assess the location: Acquire all related paperwork, reminiscent of mortgage agreements and cost historical past. Perceive your lender’s insurance policies referring to repossession. |

| 2 | Touch your lender in an instant: Give an explanation for your scenario and discover conceivable answers, reminiscent of a cost plan or brief insurance coverage. |

| 3 | Search skilled recommendation: Believe consulting with a legal professional or monetary consultant for personalised steering to your particular scenario. |

| 4 | Download brief insurance coverage: Discover selection insurance coverage choices, reminiscent of brief insurance policies, to steer clear of repossession. |

| 5 | Put in force the cheap plan: Create a sensible finances to control your funds and make sure constant bills. |

Sensible Issues

Yo, automotive fam! Navigating the repossession jungle is usually a genuine headache. Realizing your rights and duties is essential, and working out the sensible steps you’ll take to steer clear of that repo guy knocking to your door is an important. Let’s dive into the nitty-gritty!

Working out Your Mortgage Settlement

Your mortgage settlement is your bible. It Artikels the phrases and prerequisites of your automotive mortgage, together with the insurance coverage necessities. Do not simply skim it; learn it totally. Pay shut consideration to clauses specifying insurance policy and the effects of no longer keeping up it. Realizing the tremendous print will save you you from being blindsided.

That is your roadmap to heading off bother.

Verifying Insurance coverage Necessities with the Lender

Do not simply think your lender is relax about your insurance coverage. Succeed in out and make sure the precise insurance coverage necessities. That is your protection web. Do not depend on imprecise guarantees; get it in writing. You’ll be able to ask for a replica in their insurance coverage necessities or name their buyer beef up.

This guarantees that you are not unintentionally breaking any regulations and avoids any misunderstandings.

Keeping up Automobile Insurance coverage Tick list

Staying on most sensible of your insurance coverage is like retaining your automotive blank – it is a necessity. Here is a easy tick list that will help you keep insured:

- Renew your insurance coverage on time. Do not let it lapse. Set reminders and use auto-pay to steer clear of last-minute drama.

- Stay your insurance coverage card readily to be had. That is your evidence of protection. Stay it for your glove compartment or to your dashboard for speedy get admission to all over roadside exams.

- Evaluate your insurance coverage frequently. Be sure that your protection nonetheless meets your wishes and the lender’s necessities. Test for adjustments in coverage or protection limits. Realizing what is coated and what is no longer is essential. This prevents any nasty surprises.

- File any adjustments in your insurance coverage supplier in an instant. In case your cope with, using file, or monetary scenario adjustments, notify your insurance coverage corporate. This prevents issues down the street.

Monetary Penalties of No longer Having Insurance coverage

No longer having insurance coverage can result in hefty fines and consequences. However it is going past that. You may face a expensive repossession. Consider your automotive long gone and your cash down the drain. It is a genuine monetary hit.

Do not underestimate the results. It might break your monetary status.

Speaking with Lenders

If you are dealing with a lapse in insurance coverage, touch your lender ASAP. Give an explanation for the location and discover attainable answers. Do not forget about the problem; keep in touch obviously. That is your probability to give you the chance to stop repossession. A snappy dialog can prevent from a large number of bother.

Insurance coverage Protection and Repossession Implications

Here is a fast desk outlining the several types of insurance coverage and their have an effect on on repossession:

| Insurance coverage Kind | Protection | Implications on Repossession |

|---|---|---|

| Complete | Covers damages no longer associated with injuries, like vandalism or climate occasions. | Steadily protects in opposition to repossession because of injury that is not your fault. |

| Collision | Covers damages from injuries involving your automobile. | Protects in opposition to repossession because of accident-related damages. |

| Legal responsibility | Covers damages you purpose to others in an coincidence. | Does indirectly save you repossession. It will lend a hand if there may be an coincidence that reasons injury to someone else’s automobile, however the lender would possibly not believe it. |

| Uninsured/Underinsured Motorist | Protects you if you are in an coincidence with any person who does not have insurance coverage or does not have sufficient protection. | Can save you you from being held answerable for damages in your automotive if you are in an coincidence with any person who is not insured. |

Keeping off Long run Problems

Staying out of repo-trouble ain’t rocket science, fam. It is all about sensible strikes and retaining your funds on level. Call to mind it as development a citadel in opposition to repo-geddon. Let’s get into the nitty-gritty of heading off long run repo eventualities.Construction a cast monetary basis is essential to heading off repo problems down the street. It is like having a backup plan for existence’s curveballs.

Monetary Control Methods

Managing your funds successfully is an important for heading off repo eventualities. A cast finances and working out your spending behavior are like having a secret weapon in opposition to monetary tension. Realizing the place your cash is going is helping you steer clear of overspending and construct a buffer for surprising bills.

- Create a sensible finances: Monitor your source of revenue and bills meticulously. Establish spaces the place you’ll scale back. A spreadsheet or budgeting app may also be your best possible pal right here.

- Prioritize debt reimbursement: Take on high-interest money owed first. This minimizes the curiosity you pay over the years, releasing up extra money float.

- Emergency fund status quo: Put aside a large emergency fund to hide surprising bills like automotive upkeep or scientific expenses. This monetary protection web can save you you from depending on high-interest loans or falling into debt traps that can result in repo problems.

Keeping up a Wholesome Credit score Rating

Your credit score ranking is like your monetary popularity. A just right credit score ranking opens doorways to higher mortgage phrases and is helping you steer clear of repo eventualities. Paying your expenses on time and retaining your credit score usage low are very important steps.

- Pay expenses on time: You’ll want to’re assembly your whole cost duties promptly, whether or not it is to your automotive mortgage, bank cards, or different money owed.

- Observe your credit score file frequently: Evaluate your credit score file for any inaccuracies or mistakes. In case you in finding any errors, promptly dispute them with the credit score bureaus.

- Stay credit score usage low: Intention to stay your credit score usage under 30% to care for a wholesome credit score ranking. This implies retaining your bank card balances rather low in comparison to your to be had credit score.

Securing and Keeping up Automobile Insurance coverage

Insurance coverage is sort of a protection web to your automotive. It protects you from monetary break if one thing is going improper, like an coincidence or injury. Getting and retaining insurance coverage is an important to steer clear of repo problems.

- Follow for insurance coverage in an instant: In case your insurance coverage lapses, act rapid to get protection reinstated. Do not wait till the final minute. Discover a dependable insurance coverage supplier who provides aggressive charges.

- Perceive insurance coverage phrases: Moderately evaluation your insurance coverage to grasp your protection and duties. Ask questions if you are not sure about anything else.

- Incessantly evaluation and replace your coverage: Be sure that your coverage adequately covers your wishes, particularly in case your using behavior or automobile worth adjustments.

Staying Knowledgeable About Prison Adjustments

Staying up to date on prison adjustments is essential to heading off any surprising repo eventualities. The rules round repossession can alternate, so retaining abreast of updates is very important.

- Regulate prison updates: Apply information and assets from shopper coverage businesses, or prison help organizations for adjustments in automobile repossession rules.

Keeping up Open Conversation with Lenders

Open communique together with your lender is sort of a lifeline. Stay them knowledgeable about your monetary scenario, they usually may be able to paintings with you to steer clear of repossession.

- Deal with constant communique: If you are having bother making bills, touch your lender promptly. Give an explanation for your scenario and discover attainable answers in combination.

Illustrative Eventualities: Will My Automotive Get Repossessed If I Do not Have Insurance coverage

Yo, peeps! Let’s dive into some real-world examples of ways automotive insurance coverage ties into repossession drama. It is all about appearing you the way those eventualities play out in the true international, so you’ll higher perceive the dangers and easy methods to steer clear of them.This ain’t simply principle; that is straight-up, relatable stuff. We are breaking down eventualities the place other folks dodged repo and others…

effectively, did not. Get in a position to be informed!

Keeping off Repossession: A Luck Tale

A tender woman named Sarah was once in a decent spot. Her automotive mortgage was once bobbing up, however she’d misplaced her task and could not come up with the money for insurance coverage. As a substitute of panicking, she in an instant contacted her lender. She defined her scenario in truth and introduced a cost plan for her insurance coverage premiums, even supposing it was once a smaller quantity. The lender, working out her plight, agreed to a brief association, permitting her to stay her automotive.

This demonstrates that transparent communique and a willingness to paintings with the lender can now and again save the day, even if insurance coverage is missing.

Repossession: A Cautionary Story

Consider Mark, who left out his insurance coverage bills. He concept he may just escape with it, however his lender, being the sensible cookie they’re, stuck on. A couple of neglected bills later, the repo guys confirmed up at Mark’s doorstep. The automobile was once long gone, and Mark was once left with a hefty invoice and a dent in his credit score ranking.

This case hammers house the significance of retaining your insurance coverage present – it is a necessary a part of protective your journey.

Mortgage Amendment: A Trail to Preservation

Let’s assume you might be dealing with a repossession danger on account of insurance coverage problems. A mortgage amendment may well be your price ticket to retaining the wheels turning. This comes to renegotiating your mortgage phrases together with your lender. Perhaps you’ll decrease your per 30 days bills or prolong the mortgage’s reimbursement length. This fashion, you might be higher in a position to come up with the money for your automotive and insurance coverage, fighting the feared repossession.

Conversation Plan: Chatting with Your Lender

When insurance coverage problems stand up, a well-thought-out communique plan is essential. Succeed in out in your lender promptly, give an explanation for your scenario, and suggest an answer. Do not disguise, do not play video games. Fair communique is your best possible wager. Here is a template:

- Topic: Insurance coverage Fee Factor

- Frame: “Pricey [Lender Name], I’m writing to let you know that I’m experiencing problem keeping up my automotive insurance coverage bills because of [brief explanation, e.g., job loss]. I’m dedicated to resolving this factor and would respect the chance to talk about a cost plan that works for either one of us. I’m to be had to talk about this additional at your comfort.”

Constant Insurance coverage Bills: A Protect Towards Repo

Keeping up constant insurance coverage bills is like having a defend in opposition to repossession. It demonstrates duty and reliability in your lender. This, in flip, strengthens your place and makes you much less prone to face the repo guy. Consistency displays that you are enthusiastic about your monetary duties.

Insurance coverage and Repossession Chance: An Infographic

Consider a easy infographic with a visible illustration of the correlation between insurance coverage bills and repossession possibility. The infographic must have a bar graph exhibiting the proportion of repossessions for drivers with constant insurance coverage bills in comparison to the ones with inconsistent bills. The graph must visually illustrate the considerably decrease possibility of repossession for drivers who care for constant insurance coverage.

The infographic must additionally come with a brief caption explaining that keeping up insurance coverage is a an important step to steer clear of repossession.

Ultimate Abstract

In conclusion, the danger of repossession when missing automobile insurance coverage is considerable and varies a great deal in response to native rules and mortgage agreements. Proactive measures, reminiscent of working out your mortgage settlement, verifying insurance coverage necessities with the lender, and keeping up constant insurance coverage bills, are paramount. This research supplies a complete assessment, empowering readers to navigate those advanced problems and steer clear of probably devastating monetary penalties.

Query & Solution Hub

Does my lender have a selected time frame for notifying me about attainable repossession if I would not have insurance coverage?

Lender notification procedures range. Evaluate your mortgage settlement moderately for particular main points referring to realize classes. Steadily, a lender will have to adhere to established prison processes inside their state.

What if I will be able to’t come up with the money for insurance coverage? Are there any monetary help techniques to be had?

Exploring choices like brief insurance coverage, temporary monetary help techniques, or contacting your lender for help is an important. Do not hesitate to hunt beef up to stop repossession.

Can I am getting brief insurance coverage to steer clear of repossession?

Sure, brief insurance coverage choices exist, even though protection is also restricted. Touch your insurer or a dealer to talk about brief insurance policies and conceivable protection restrictions.

If my insurance coverage lapses, how lengthy does the lender need to begin repossession court cases?

Repossession timelines are ruled by means of state rules and Artikeld for your mortgage settlement. Delays is also conceivable relying at the specifics of your case and your jurisdiction.