Sioux Falls SD automotive insurance coverage is a an important facet of car possession within the house. Working out the present marketplace panorama, not unusual insurance coverage varieties, and related prices is important for making told choices. This information explores the standards influencing premiums, compares insurance coverage suppliers, main points protection choices, and gives guidelines for locating reasonably priced insurance policies. From legal responsibility to complete protection, we will quilt the whole lot you wish to have to navigate the arena of vehicle insurance coverage in Sioux Falls, SD.

This complete useful resource supplies an in depth assessment of Sioux Falls SD automotive insurance coverage, enabling drivers to make well-informed choices referring to their coverage and monetary duty. We’re going to discover quite a lot of facets, from the marketplace assessment to the specifics of protection choices, reductions, and influencing elements.

Evaluation of Sioux Falls SD Automotive Insurance coverage

The Sioux Falls automotive insurance coverage marketplace is an attractive aggressive scene, mate. Plenty of choices available in the market, however the costs can range wildly relying in your explicit state of affairs. Working out the panorama and what elements have an effect on your premiums is essential to getting the most efficient deal.

Marketplace Panorama

The Sioux Falls marketplace for automotive insurance coverage is relatively aggressive, with more than one insurers vying for patrons. This pageant steadily interprets into a spread of pricing methods and protection choices. Insurers are continuously adjusting their methods to satisfy the evolving wishes of drivers and the entire financial local weather within the area.

Insurance coverage Varieties

A spread of insurance coverage varieties are to be had in Sioux Falls, together with complete protection, collision protection, legal responsibility protection, and uninsured/underinsured motorist coverage. Each and every sort addresses other dangers, and the most efficient mixture of coverages will depend on your riding conduct and private monetary state of affairs. Complete protection usually protects your car from injury led to by way of such things as hail, fireplace, or vandalism. Collision protection handles injury on account of an twist of fate, despite the fact that you might be at fault.

Legal responsibility protection covers the opposite birthday party’s damages in case you’re concerned about an twist of fate and are discovered accountable. Uninsured/underinsured motorist coverage is an important, because it steps in if the opposite driving force lacks insurance coverage or does not have sufficient to hide the overall extent of the damages.

Price Concerns

Automotive insurance coverage prices in Sioux Falls range considerably in response to a number of elements, together with driving force demographics and car sort. More youthful drivers, as an example, steadily face increased premiums because of their statistically increased twist of fate menace profile. Cars which can be regarded as higher-risk, like sports activities automobiles or the ones with a better price, may additionally command increased premiums. Moreover, your riding document and credit score historical past play a significant position.

A blank document and just right credit score steadily result in decrease premiums. Premiums in Sioux Falls usually fall inside of a definite vary, influenced by way of those quite a lot of elements.

Influencing Elements, Sioux falls sd automotive insurance coverage

A large number of elements have an effect on automotive insurance coverage premiums in Sioux Falls, together with your riding document, age, and site. A blank riding document normally results in decrease premiums. In a similar way, older drivers with a historical past of protected riding steadily recover charges. Location too can affect premiums, as positive spaces could be related to increased twist of fate charges.

Specialised Insurance coverage Choices

Specialised insurance coverage choices are to be had for explicit cars or eventualities. Vintage automotive insurance coverage, as an example, gives coverage for collector cars, steadily adapted to hide their distinctive wishes and price. Bike insurance coverage steadily comes with a better top rate, as bikes are regarded as higher-risk cars because of their smaller dimension and loss of passenger coverage. Insurers steadily supply choices for this actual phase of the marketplace.

Insurance coverage Corporate Comparability

| Corporate | Protection A | Protection B | Protection C |

|---|---|---|---|

| Instance Co. | Instance main points, adapted for younger drivers | Instance main points, emphasizing complete protection | Instance main points, providing a better payout prohibit |

| Instance Co. 2 | Instance main points, emphasizing reductions for protected drivers | Instance main points, together with quite a lot of add-ons | Instance main points, that specialize in coverage in opposition to uninsured drivers |

Observe: This desk supplies a simplified comparability. Exact protection main points and pricing range a great deal amongst corporations and person insurance policies. At all times overview the precise phrases and stipulations of any coverage sooner than you decide.

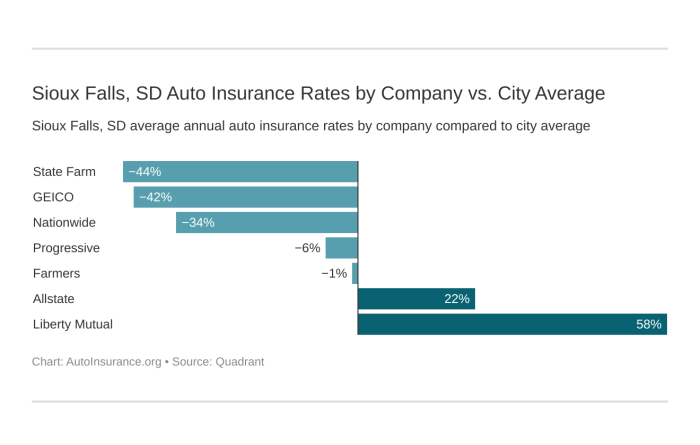

Comparability of Insurance coverage Suppliers

Navigating the insurance coverage jungle in Sioux Falls generally is a proper ache. Other corporations be offering various insurance policies, services and products, and costs. Working out those nuances is essential to getting the most efficient deal. Understanding the strengths and weaknesses of every supplier, their recognition, and claims dealing with processes can prevent a hefty chew of money and a large number of bother.The insurance coverage marketplace is fiercely aggressive, and Sioux Falls is not any exception.

Each and every corporate tries to trap you in with horny offers and reductions. Alternatively, it is an important to dig deeper than simply the preliminary gross sales pitch. A cast working out of every supplier’s provider choices and buyer comments will assist you to make an educated choice.

Primary Insurance coverage Suppliers in Sioux Falls

The most important avid gamers within the Sioux Falls insurance coverage marketplace be offering a spread of applications, every with its personal benefits and drawbacks. Each and every corporate goals to cater to a selected buyer profile, whether or not you are a younger driving force, a circle of relatives, or a trade proprietor. Elements like your riding document, car sort, and site will affect which coverage is right for you.

- Corporate A: Recognized for its aggressive premiums and intensive community of restore retail outlets, Corporate A boasts a cast recognition for speedy claims dealing with, regardless that some consumers have reported quite longer wait instances for advanced instances. They’re specifically well-liked amongst more youthful drivers.

- Corporate B: Corporate B, steadily favoured by way of households, emphasises complete protection applications and a spread of reductions. They are recognized for a extra non-public way to customer support, even if their claims dealing with procedure can from time to time really feel a bit of bureaucratic. Their top rate charges are steadily quite increased than Corporate A’s.

- Corporate C: Corporate C is famend for its flexibility and suppleness, specifically with customisable add-ons for quite a lot of wishes, like roadside help or enhanced legal responsibility protection. Their on-line portal for coverage control and claims submitting is normally user-friendly, an important merit. Alternatively, customer support representatives from time to time want extra coaching on explicit coverage intricacies.

Buyer Provider and Recognition

Customer support and recognition are an important when opting for an insurance coverage supplier. An organization with a historical past of superb provider and sure critiques is most probably to offer a smoother revel in all through your coverage’s length.

- Corporate A: Certain comments for his or her customer support is steadily reported, highlighting responsiveness and helpfulness. Alternatively, some customers have expressed frustration with the complexity in their on-line platform.

- Corporate B: Corporate B’s sturdy customer support is steadily praised for its personalized contact, and their brokers are persistently described as an expert and useful. Alternatively, critiques from time to time point out longer wait instances at the telephone.

- Corporate C: Corporate C has a blended recognition. Some consumers laud their on-line portal, however others have had unfavorable reviews with their customer support representatives, specifically regarding explicit protection queries.

Claims Dealing with Procedure

The claims dealing with procedure is a crucial facet of any insurance coverage. A clean and environment friendly claims procedure can considerably cut back rigidity and make sure well timed reimbursement.

- Corporate A: Corporate A normally handles claims briefly and successfully, with transparent communique all through the method. Alternatively, some customers have reported that documentation necessities can also be overly advanced.

- Corporate B: Corporate B is steadily praised for its thorough and complete claims dealing with procedures, making sure all facets of the declare are addressed. Alternatively, some consumers have discussed the bureaucracy procedure can also be tedious.

- Corporate C: Corporate C’s claims dealing with is normally simple and well-organised, particularly for minor claims. Alternatively, for extra advanced instances, there is also delays in communique or processing.

Bargain Comparability Desk

Reductions can considerably cut back your insurance coverage premiums. Evaluating the reductions introduced by way of other suppliers is an important find the most efficient deal.

| Corporate | Bargain Sort | Bargain Main points |

|---|---|---|

| Instance Co. | Secure Driving force | 5% bargain |

| Instance Co. 2 | Bundled Services and products | 10% bargain |

| Instance Co. 3 | More than one Cars | 7% bargain |

Elements Influencing Insurance coverage Prices

Insurance coverage ain’t reasonable, particularly in Sioux Falls. It is all concerning the dangers you provide, and the corporate’s were given to issue ’em all in. Out of your riding document to the make of your trip, all of it performs a component in how a lot you can fork over for protection. Your location or even your credit score ranking could have an have an effect on.

It is a advanced recreation, however working out the standards let you store smarter.The price of automotive insurance coverage in Sioux Falls, SD, is not only a random quantity. It is calculated in response to quite a lot of elements that replicate the prospective menace you pose to the insurer. A complete working out of those elements is an important for someone in quest of reasonably priced automotive insurance coverage. Working out those elements let you navigate the insurance coverage panorama and to find the most efficient deal.

Riding Report

Riding data are a significant component in figuring out automotive insurance coverage charges in Sioux Falls. A blank document, loose from injuries and violations, usually leads to decrease premiums. Conversely, a historical past of injuries or visitors violations will build up your insurance coverage prices considerably. It is because a historical past of injuries and violations demonstrates a better probability of long run claims.

Insurers use this knowledge to evaluate menace.

Automobile Sort and Style

The sort and style of your car additionally affect insurance coverage premiums. Top-performance automobiles, sports activities automobiles, or luxurious cars steadily include increased insurance coverage charges. Those fashions are perceived as increased menace because of their attainable for extra injury or robbery. Conversely, extra usual or older fashions can have decrease premiums, all issues being equivalent.

Location inside of Sioux Falls, SD

Location inside of Sioux Falls additionally performs a job. Positive spaces can have increased charges because of elements like increased crime charges, increased twist of fate charges, or greater visitors density. This is not all the time evident and will depend on the precise insurance coverage corporate. It is any other piece of the puzzle to believe when evaluating quotes.

Riding Historical past

An in depth riding historical past is meticulously scrutinized by way of insurers. Injuries, even minor ones, are moderately evaluated. Visitors violations, regardless of how reputedly minor, can give a contribution to a better top rate. Insurers use this knowledge to evaluate the possibility of long run claims. This is helping them organize menace successfully.

Elements Affecting Insurance coverage Prices

- Riding document: A blank document in most cases manner decrease premiums, whilst a historical past of injuries or violations will considerably build up them.

- Automobile sort: Top-performance or luxurious cars steadily have increased premiums because of perceived increased menace.

- Location: Spaces with increased crime charges, twist of fate charges, or visitors density can have increased insurance coverage prices.

- Protection: Upper protection ranges normally lead to increased premiums.

- Age of driving force: More youthful drivers steadily have increased premiums because of a perceived increased menace.

- Credit score ranking: A decrease credit score ranking would possibly from time to time correlate with increased premiums.

- Claims historical past: A historical past of claims, whether or not massive or small, can build up insurance coverage prices.

Impact of Other Riding Data on Insurance coverage Premiums

| Riding Report | Top class Build up (%) |

|---|---|

| Blank Report | 0% |

| Minor Violations | 10% |

| Primary Violations | 20% |

Protection Choices and Main points

Taken care of during the insurance coverage jungle, we are breaking down the several types of automotive insurance coverage to be had in Sioux Falls, SD. Working out those choices is an important for securing the best coverage in your trip and peace of thoughts at the streets. From legal responsibility to complete, collision, and uninsured/underinsured motorist protection, we will map out the terrain and spotlight the benefits and prices.

Legal responsibility Protection

Legal responsibility protection is the bedrock of any automotive insurance coverage. It protects you financially in case you are at fault for inflicting an twist of fate that leads to injury to someone else’s car or accidents. Alternatively, legal responsibility protection has boundaries. It usually most effective covers the opposite birthday party’s losses as much as a specific amount. This implies that you must be in my opinion chargeable for exceeding the coverage limits.

As an example, in case your coverage has a $25,000 legal responsibility prohibit and the twist of fate leads to $40,000 in damages, you may be chargeable for the variation. Crucially, legal responsibility insurance coverage does

no longer* quilt injury in your personal car.

Complete Protection

Complete protection extends past legal responsibility, safeguarding your car in opposition to perilsnot* associated with injuries. This comprises such things as vandalism, robbery, fireplace, hail injury, or even falling gadgets. Complete protection generally is a profitable funding, particularly for more moderen cars or the ones parked in high-risk spaces. The associated fee is usually not up to collision protection. For example, a small dent on your automotive because of a stray buying groceries trolley can also be lined by way of complete.

Collision Protection

Collision protection kicks in when your car is broken in an twist of fate, without reference to who is at fault. It will pay for upkeep or substitute of your automotive, making sure you might be no longer left keeping the monetary bag after a fender bender or a extra severe crash. Collision protection is a great selection for drivers who need complete coverage and don’t seem to be completely assured of their talent to steer clear of collisions.

It is particularly an important for drivers with older cars, as upkeep or replacements can also be pricey.

Uninsured/Underinsured Motorist Protection

What occurs if the opposite driving force in an twist of fate does not have insurance coverage or their protection is not sufficient to hide the damages? Uninsured/underinsured motorist protection steps in to offer protection to you in such situations. It covers clinical bills and car upkeep despite the fact that the at-fault driving force is not correctly insured. This protection is a an important safeguard in opposition to monetary hardship in such eventualities, appearing as a security internet.

As an example, a hit-and-run incident may depart you with considerable prices; uninsured/underinsured motorist protection can mitigate those.

Protection Choices and Prices

| Protection Sort | Description | Instance Price (per 30 days) |

|---|---|---|

| Legal responsibility | Covers damages to others | $100 |

| Complete | Covers damages in your car (non-collision) | $20 |

| Collision | Covers injury in your car in an twist of fate | $30 |

| Uninsured/Underinsured Motorist | Covers damages if the at-fault driving force is uninsured or underinsured | $15 |

Those are simply instance prices; exact premiums will range in response to a number of elements, together with your riding document, car sort, and site inside of Sioux Falls.

Pointers for Discovering Inexpensive Insurance coverage

Navigating the concrete jungle of vehicle insurance coverage in Sioux Falls can really feel like looking for a parking spot on a Saturday night time. However with a little of boulevard smarts and a few savvy methods, you’ll be able to protected a deal that would possibly not cost a fortune. Working out the sport is essential to getting the most efficient charges.The price of automotive insurance coverage is influenced by way of a spread of things, out of your riding document to the kind of automotive you personal.

Understanding how those elements engage permits you to proactively regulate your top rate.

Evaluating Quotes Like a Professional

Getting more than one quotes is an important. Other suppliers have other pricing constructions, so evaluating apples to apples is very important. Use on-line comparability gear to briefly collect quotes from quite a lot of corporations. This permits for a complete assessment of to be had choices, serving to you to make an educated choice. Do not prohibit your self to only the massive names; smaller, specialised suppliers may be offering aggressive charges.

Negotiating Charges Like a Hustler

Do not be afraid to barter. Insurance coverage corporations are steadily prepared to regulate charges in case you provide a compelling case. Overview your coverage totally and search for spaces the place you’ll be able to doubtlessly cut back your premiums. A well mannered, assertive method can steadily yield higher effects. If an organization does not budge, store round once more – your bargaining energy will increase with extra choices.

Bundling Your Insurance policies for Financial savings

Bundling your automotive insurance coverage with different insurance policies, reminiscent of house or lifestyles insurance coverage, can steadily result in vital reductions. This technique is a vintage instance of leveraging more than one services and products to protected higher charges. By means of appearing you are a valued buyer with more than one wishes, you steadily obtain a greater deal.

Keeping up a Blank Riding Report

A blank riding document is paramount. Visitors violations and injuries at once have an effect on your insurance coverage premiums. Each and every level in your document provides in your value. Keeping up a great riding document is an funding in long-term affordability.

A Step-by-Step Information to Inexpensive Sioux Falls Automotive Insurance coverage

- Accumulate Knowledge: Collect all related information about your car, riding historical past, and desired protection choices. This may occasionally be certain a complete way to evaluating quotes.

- Make the most of Comparability Equipment: Leverage on-line comparability web pages to obtain quotes from more than one insurance coverage suppliers. Do not simply focal point at the maximum outstanding names; believe smaller insurers, too.

- Overview Coverage Main points: Moderately read about every quote’s protection, deductibles, and exclusions. Perceive what’s incorporated and what isn’t, sooner than committing to a selected supplier.

- Negotiate with Suppliers: Do not hesitate to touch insurance coverage corporations and request a overview of your top rate. Spotlight any elements that can justify a decrease charge. Provide a transparent and well mannered argument to maximise your possibilities of good fortune.

- Package deal Insurance policies (if appropriate): If imaginable, package deal your automotive insurance coverage with different insurance policies to doubtlessly unencumber further reductions. This method can also be extremely efficient for lowering general prices.

- Care for a Secure Riding Report: This can be a an important part for reaching long-term affordability. Keep away from injuries and violations to deal with a blank riding document.

- Overview Often: Periodically overview your insurance coverage to make sure you are receiving essentially the most aggressive charges. This may occasionally assist you to to deal with probably the greatest insurance coverage plan in your explicit instances.

Ultimate Abstract

In conclusion, securing the best automotive insurance coverage in Sioux Falls, SD, comes to working out the marketplace dynamics, evaluating suppliers, and opting for suitable protection. This information has supplied a complete assessment, enabling you to navigate the method successfully. Take into account to issue on your riding document, car sort, location, and desired protection when making your ultimate choice. By means of evaluating quotes, negotiating charges, and keeping up a just right riding document, you’ll be able to considerably cut back your insurance coverage prices whilst making sure good enough coverage.

FAQ Abstract: Sioux Falls Sd Automotive Insurance coverage

What are the most typical kinds of automotive insurance coverage in Sioux Falls, SD?

The most typical varieties come with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Legal responsibility covers injury to others, collision covers injury in your car in an twist of fate, complete covers injury in your car from different occasions (no longer injuries), and uninsured/underinsured motorist protects you if any other driving force is at fault however does not have insurance coverage.

How do riding data have an effect on automotive insurance coverage premiums in Sioux Falls, SD?

Riding data are a significant component. A blank document normally leads to decrease premiums, whilst violations, particularly main ones, result in increased premiums. The severity of violations at once affects the top rate build up.

Are there any reductions to be had for automotive insurance coverage in Sioux Falls, SD?

Sure, many insurance coverage suppliers be offering reductions, reminiscent of protected driving force reductions, bundled services and products reductions, and reductions for positive car varieties or just right credit score. It is profitable checking with other corporations to peer which reductions would possibly follow to you.

What are some methods for evaluating automotive insurance coverage quotes in Sioux Falls, SD?

Use on-line comparability gear, request quotes from more than one suppliers, and evaluate coverages and prices. Be thorough in comparing the nice print and exclusions.