Unum longer term care insurance coverage – Unum long-term care insurance coverage – a the most important attention for long term well-being. Navigating the complexities of long-term care can also be daunting, however working out the choices to be had can ease the weight. This complete information dives deep into Unum’s choices, evaluating them with competition and exploring the most important concerns for coverage variety.

Unraveling the intricacies of long-term care insurance coverage can really feel overwhelming. Alternatively, armed with the fitting wisdom, you’ll be able to make knowledgeable selections that safeguard your long term and peace of thoughts. This information will wreck down the specifics of Unum’s plans, providing transparent comparisons and treasured insights that can assist you navigate the method.

Creation to Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage is an important tool for securing monetary enhance all the way through prolonged classes of disability. It supplies a security web, protective people from the really extensive monetary burdens related to long-term care wishes, comparable to nursing domestic remains or in-home help. Working out the several types of insurance policies and their protection is the most important for making knowledgeable selections.This record Artikels the elemental facets of long-term care insurance coverage, overlaying coverage varieties, advantages, and the most important comparability components.

A complete working out of those parts empowers people to navigate the complexities of long-term care making plans successfully.

Working out Lengthy-Time period Care Insurance coverage Insurance policies

Lengthy-term care insurance coverage insurance policies are designed to pay for the prices of care that can be required over a longer length because of an sickness or damage that limits day-to-day actions. The insurance policies quilt bills for quite a lot of varieties of care, comparable to nursing properties, assisted residing amenities, or in-home care services and products.

Varieties of Lengthy-Time period Care Insurance coverage Insurance policies

Other coverage varieties cater to numerous wishes and budgets. Quite a lot of choices exist, providing various ranges of protection and premiums. The commonest varieties come with:

- Person Insurance policies: Those insurance policies are adapted to the precise wishes of a person, providing flexibility in protection and premiums. They permit for personalisation of advantages and protection quantities, ceaselessly offering a better level of regulate over the plan.

- Team Insurance policies: Introduced via employers or different organizations, those insurance policies supply protection to a bunch of people. They ceaselessly have standardized advantages and premiums, making them a extra available possibility for the ones with employer-sponsored systems.

- Hybrid Insurance policies: Combining parts of each person and workforce insurance policies, hybrid plans be offering a steadiness of customization and accessibility. They may be able to supply better flexibility in protection whilst keeping up a undeniable degree of affordability.

Advantages and Protection Choices in Lengthy-Time period Care Insurance coverage

Lengthy-term care insurance coverage insurance policies usually quilt a variety of services and products, serving to to relieve monetary burdens all the way through extended classes of want. Commonplace advantages come with:

- Nursing House Care: Supplies monetary enhance for the price of nursing domestic remains, together with room and board, hospital therapy, and different related bills. This protection ceaselessly varies by means of the extent of care wanted, from fundamental assisted residing to professional nursing.

- House Healthcare: Covers bills associated with in-home care services and products, comparable to non-public care, medicine reminders, and different help had to take care of independence inside the house surroundings.

- Grownup Day Care: Covers bills for grownup day care services and products, which give supervised actions and enhance for people wanting help all the way through the day.

Evaluating Coverage Sorts

A complete working out of the quite a lot of coverage varieties is very important to picking essentially the most appropriate plan. The next desk Artikels key traits of various coverage varieties.

| Coverage Kind | Advantages | Premiums | Exclusions |

|---|---|---|---|

| Person Coverage | Top degree of customization; adapted to express wishes | Premiums can range very much relying on age, well being, and desired protection | Pre-existing stipulations, positive varieties of care, or explicit geographic places is also excluded. |

| Team Coverage | Usual advantages and premiums, probably extra reasonably priced | Regularly in accordance with employer contribution and worker participation | Restricted customization choices; won’t quilt all doable wishes |

| Hybrid Coverage | Mixture of customization and affordability | Premiums are generally someplace between person and workforce insurance policies | Protection choices could be restricted compared to a person coverage |

Unum Lengthy-Time period Care Insurance coverage Specifics

Unum’s long-term care insurance coverage be offering plenty of choices for people in search of coverage towards the monetary burdens of long-term care wishes. Working out the precise options, plan choices, prices, and comparisons with competition is the most important for making an educated resolution. Those plans are designed to assist be sure monetary safety all the way through a probably difficult time.Unum’s plans are sparsely structured to supply protection for quite a lot of eventualities, from helping with day-to-day actions to extra extensive care.

The plans’ strengths and weaknesses are introduced to facilitate a complete working out of the goods. An in depth desk Artikels the other plan choices, their corresponding protection quantities, and related premiums.

Explicit Options of Unum’s Plans

Unum’s long-term care insurance coverage merchandise supply a variety of advantages and contours. Those options are adapted to fulfill person wishes, together with protection for knowledgeable nursing amenities, assisted residing amenities, and residential healthcare services and products. Insurance policies usually be offering choices for inflation coverage, permitting protection to stay tempo with emerging healthcare prices.

Plan Choices Introduced by means of Unum

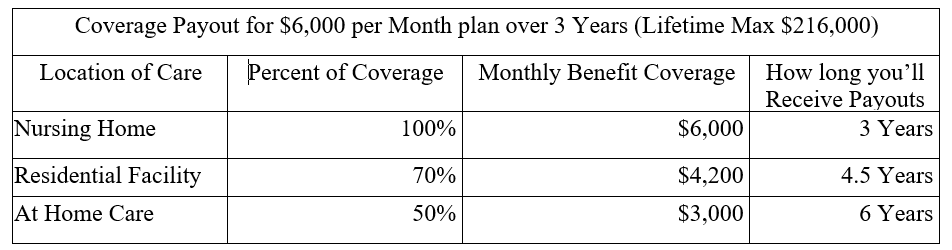

Unum provides a number of long-term care insurance coverage plan choices. Each and every plan is designed to handle explicit wishes and fiscal eventualities. Plan choices cater to various ranges of protection and top class quantities.

Standard Prices and Premiums

The prices and premiums related to Unum’s plans range relying on components like the chosen protection quantity, the insured’s age and well being, and the selected receive advantages length. Premiums are usually calculated in accordance with actuarial information and possibility overview. As an example, a more youthful, more fit person would most probably pay decrease premiums than an older person with pre-existing stipulations.

Comparability with Competition

Unum’s long-term care insurance coverage are in comparison with the ones of different main suppliers available in the market. Components like protection quantities, receive advantages classes, and top class buildings are regarded as. This comparability is helping shoppers perceive the price proposition of Unum’s choices relative to competition. Variations in administrative charges and claims processing procedures also are key parts within the comparability.

Strengths and Weaknesses of Unum’s Plans

Unum’s long-term care insurance coverage have strengths and weaknesses. Strengths ceaselessly come with complete protection choices, aggressive premiums, and a name for dependable provider. Weaknesses may come with restricted availability of positive plan choices or various buyer pleasure rankings. Those components will have to be regarded as along person wishes.

Unum’s Plan Choices, Protection, and Premiums

| Plan Identify | Day by day Get advantages Quantity | Most Get advantages Length (months) | Annual Top class (instance) |

|---|---|---|---|

| Unum Safe Care Plan | $200 | 36 | $1,500 |

| Unum Premier Care Plan | $300 | 60 | $2,200 |

| Unum Elite Care Plan | $400 | 84 | $3,000 |

Be aware: Premiums are estimated and would possibly range in accordance with person components. This desk supplies a common representation.

Advantages and Protection Research

Marga ni Unum Lengthy-Time period Care Insurance coverage, ipataridaon ma narima ni sipak na manfaat na sipar roha na. Marpansingon do inangka ni manfaat na, jala patut do diparrohahon angka naeng mambahen keputusan na patut.

Lined Varieties of Care

Unum Lengthy-Time period Care Insurance coverage mambahen protection di angka jenis perawatan na berbeda, laho mangurupi angka pemegang polis di situasi na susah. Jenis perawatan na dibahen protection i termasuk professional nursing care, assisted residing, dan domestic well being care. Professional nursing care iparsatongon do angka pelayanan perawatan medis na rumit, na laho mangurupi angka pasien na butuh pengawasan na ketat.

Assisted residing, ipataridaon do lingkungan na nyaman jala mendukung, na mangurupi pemegang polis na membutuhkan bantuan di angka kegiatan sehari-hari. House well being care iparsatongon do pelayanan kesehatan di rumah, na mangurupi pemegang polis na naeng dirawat di rumah. Protection ni berbeda-beda targantung di angka perjanjian na dibahen.

Protection Quantities

Jumlah protection na dibahen Unum Lengthy-Time period Care Insurance coverage dapat berubah-ubah, tergantung di jumlah premi na dibayar, usia, dan jenis perawatan na dipilih. Untuk memastikan angka protection na tepat, penting do menghubungi agen Unum untuk informasi lebih lanjut.

Coverage Exclusions and Barriers

Adong do angka pengecualian dan batasan na patut diparrohahon. Angka pengecualian i termasuk perawatan na disebabkan oleh kecelakaan, penyakit psychological, atau perawatan na di luar cakupan polis. Penting do membaca dengan teliti angka syarat dan ketentuan na tertera di polis, agar dapat memahami dengan jelas angka batasan dan pengecualian na berlaku.

Examples of Scenarios The place Protection Would Be Really useful

Unum Lengthy-Time period Care Insurance coverage dapat bermanfaat di berbagai situasi, contohnya ketika pemegang polis membutuhkan perawatan jangka panjang karena sakit kronis, stroke, atau cedera serius. Protection ni dapat membantu memenuhi kebutuhan perawatan medis, biaya hidup, dan angka pengeluaran lainnya, na dapat mengurangi beban keuangan di keluarga. Contoh lain, ketika seseorang na butuh bantuan di angka kegiatan sehari-hari, protection ni dapat membantu membayar biaya assisted residing atau domestic well being care.

Adjusting Protection Quantities

Jumlah protection na dapat disesuaikan, tergantung di kebutuhan na diperlukan. Pemilik polis dapat memilih angka protection na berbeda-beda, laho menyesuaikan dengan kondisi keuangan mereka. Jumlah protection ni dapat diubah, namun ada syarat dan ketentuan na berlaku. Penting do menghubungi agen Unum untuk mendiskusikan angka perubahan protection ni.

Abstract Desk, Unum longer term care insurance coverage

| Jenis Perawatan | Jumlah Protection (Contoh) |

|---|---|

| Professional Nursing Care | Rp 10.000.000 in keeping with bulan |

| Assisted Dwelling | Rp 5.000.000 in keeping with bulan |

| House Well being Care | Rp 3.000.000 in keeping with bulan |

Catatan: Jumlah protection na tertera hanyalah contoh dan dapat berubah-ubah tergantung pada polis dan perjanjian na dibuat.

Coverage Issues and Comparisons

Marhite marhite, within the realm of long-term care insurance coverage, diligent attention is vital. Working out the nuances of quite a lot of insurance policies, particularly Unum’s choices, is the most important for making knowledgeable selections. Choosing the proper protection calls for cautious analysis of person wishes and fiscal eventualities.Comparing long-term care insurance coverage insurance policies is a multifaceted procedure. Components comparable to protection quantities, premiums, and exclusions should be scrutinized.

Comparisons with different insurers are crucial to grasp the aggressive panorama and the price proposition of Unum’s insurance policies. Moreover, the facility to tailor a coverage to express instances is paramount, as are riders and add-ons for enhanced protection. A deep dive into the motivations in the back of buying long-term care insurance coverage finds not unusual components, comparable to expecting doable long term wishes and making sure monetary safety all the way through a difficult time.

Components to Believe When Comparing Insurance policies

Comparing long-term care insurance coverage insurance policies necessitates a complete means. Attention of protection quantities, top class prices, and coverage exclusions are elementary. Components just like the insured’s age, well being standing, and way of life are necessary for assessing doable dangers and tailoring protection accordingly. The period of protection and the varieties of care coated are the most important parts to believe. In the end, the monetary implications of various coverage choices, together with top class bills and doable payouts, should be completely analyzed.

Evaluating Unum’s Insurance policies with Different Insurers

Evaluating Unum’s long-term care insurance coverage insurance policies with the ones of different main insurers is necessary. This comparability necessitates an in depth research of quite a lot of facets, together with premiums, protection quantities, and coverage exclusions. This type of comparability supplies a complete working out of the aggressive panorama and is helping doable policyholders make knowledgeable selections. Unum’s choices should be evaluated along the ones of competition to evaluate price and have compatibility for person wishes.

Tailoring a Coverage to Explicit Instances

Tailoring a long-term care insurance coverage to person wishes is paramount. Components just like the insured’s age, well being, and way of life affect the sort and quantity of protection required. Adjusting protection in accordance with those components guarantees the coverage successfully addresses person wishes. This contains concerns of the extent of care wanted, the predicted period of care, and the monetary implications.

Significance of Coverage Riders and Upload-ons

Coverage riders and add-ons are necessary elements of long-term care insurance coverage. They supply alternatives to customise protection to fulfill explicit wishes. As an example, a rider for inflation coverage safeguards towards emerging healthcare prices. Different add-ons would possibly cope with explicit care wishes, comparable to specialised nursing care or domestic healthcare. Those riders and add-ons give a boost to the coverage’s flexibility and make sure it successfully addresses doable long term wishes.

Commonplace Causes for Opting for Lengthy-Time period Care Insurance coverage

Folks make a choice long-term care insurance coverage for a large number of causes. A number one motivator is the will to take care of monetary safety all the way through a length of doable dependency and prime healthcare prices. The safety from escalating healthcare bills is a major factor. Moreover, making sure high quality care and keeping up dignity also are the most important concerns. The anticipation of long term wishes and a want for peace of thoughts are ceaselessly cited as key motivations.

Comparative Research of Coverage Choices

| Function | Unum Coverage A | Unum Coverage B | Main Insurer X | Main Insurer Y |

|---|---|---|---|---|

| Top class (Annual) | $2,500 | $3,000 | $2,800 | $2,750 |

| Protection Quantity (Day by day) | $200 | $300 | $250 | $350 |

| Coverage Exclusions | Pre-existing stipulations (aside from positive exceptions) | Pre-existing stipulations (aside from positive exceptions) | Positive continual stipulations, domestic changes | Care in a nursing facility, domestic changes |

Be aware

* This desk supplies a simplified comparability. Explicit coverage main points and exclusions would possibly range. Visit a monetary consultant for personalised steerage.

Working out the Advantages of Lengthy-Time period Care Insurance coverage

Marga ni, naeng, dipaima marhite-hite paruhuman ni angka ulaon ni ngolu on. Aek ni ngolu on martimbang, jala sai naeng mambahen parsalisian tu bangku. Ulaon ni ngolu on, ulaon na mandorang, jala adong ma hasusaan na boi mambahen sitaonon na legan. Marhite-hite paruhuman ni ulaon ni ngolu on, naeng ma taulas taringot tu pertahanan ni ngolu on, jala songon dia pelean ni pertahanan ni ngolu on.Di bagasan angka na masa di ngolu on, adong ma angka hasusaan na martimbang na boi mambahen sitaonon tu bangku.

Hasusaan on boi mambahen angka parsalisian di ngolu on. Pardos ni angka parsalisian on, sai naeng ma taulas jala dipaima taringot tu pertahanan ni ngolu on, jala songon dia pelean ni pertahanan ni ngolu on. Paruhuman ni pertahanan ni ngolu on, naeng ma tajadi parsalisian na rumit.

Lengthy-Time period Monetary Implications of Desiring Lengthy-Time period Care

Hasonangan ni angka ulaon ni ngolu on, naeng ma martimbang jala naeng ma mambahen parsalisian. Adong ma angka parsalisian na legan di ngolu on, jala naeng ma adong angka pertahanan di ngolu on. Hasusaan ni ngolu on, naeng ma taruhum jala tarpatuduhon. Angka parsalisian di ngolu on, naeng ma taruhum jala tarpatuduhon. Paruhuman ni parsalisian on, naeng ma tarpatuduhon.Piga-piga halak boi mardongan hasusaan na rumit, naeng ma taruhum.

Di naeng ma tarpatuduhon parsalisian on, naeng ma martimbang. Adong ma angka parsalisian na rumit na boi mambahen angka parsalisian di ngolu on.

How Lengthy-Time period Care Insurance coverage Protects Towards Monetary Pressure

Ulaon ni ngolu on, sai naeng ma mambahen parsalisian. Marhite-hite pertahanan ni ngolu on, naeng ma mambahen parsalisian na rumit. Pertahanan ni ngolu on, naeng ma martimbang jala naeng ma mambahen angka parsalisian. Pertahanan ni ngolu on, naeng ma mambahen pertahanan.Pertahanan ni ngolu on, naeng ma taruhum jala naeng ma tarpatuduhon. Pertahanan ni ngolu on, naeng ma mambahen parsalisian na rumit.

Pertahanan ni ngolu on, naeng ma mambahen parsalisian. Pertahanan ni ngolu on, naeng ma mambahen parsalisian na rumit.

Actual-Global Examples of How Lengthy-Time period Care Insurance coverage Can Assist Households

Paruhuman ni angka ulaon ni ngolu on, naeng ma tarpatuduhon. Angka contoh ni, naeng ma martimbang. Angka contoh ni, naeng ma tarpatuduhon. Angka contoh ni, naeng ma mambahen parsalisian.Angka contoh ni, naeng ma mambahen parsalisian na rumit. Angka contoh ni, naeng ma mambahen parsalisian.

Angka contoh ni, naeng ma taruhum. Angka contoh ni, naeng ma tarpatuduhon. Angka contoh ni, naeng ma mambahen parsalisian.

Attainable Financial savings from Keeping off Out-of-Pocket Bills

Sai naeng ma angka pertahanan ni ngolu on martimbang. Marhite-hite pertahanan ni ngolu on, naeng ma taruhum jala tarpatuduhon. Angka pertahanan ni ngolu on, naeng ma mambahen parsalisian. Marhite-hite pertahanan ni ngolu on, naeng ma taruhum jala tarpatuduhon.

Paruhuman ni ngolu on, naeng ma taruhum jala naeng ma tarpatuduhon. Marhite-hite paruhuman ni ngolu on, naeng ma tarpatuduhon angka parsalisian.

Attainable Monetary Burden of Lengthy-Time period Care With out Insurance coverage

Naeng ma tarpatuduhon angka parsalisian di ngolu on. Di naeng ma taruhum jala tarpatuduhon. Angka pertahanan ni ngolu on, naeng ma tarpatuduhon. Angka parsalisian di ngolu on, naeng ma tarpatuduhon.

- Biaya perawatan jangka panjang dapat mencapai jutaan rupiah in keeping with tahun, tergantung pada tingkat perawatan yang dibutuhkan.

- Biaya ini dapat mencakup biaya perawatan medis, perawatan di rumah, dan fasilitas perawatan lansia.

- Biaya ini dapat menguras tabungan dan aset finansial, menyebabkan kesulitan finansial bagi keluarga.

Coverage Variety and Buying Procedure

Marhitek marhitek, memilih asuransi perawatan jangka panjang (long-term care) memang proses yang penting. Membutuhkan pertimbangan matang dan wawasan yang luas. Proses ini bukan hanya tentang memilih produk, tapi juga memahami kebutuhan finansial jangka panjang Anda.

Steps in Buying a Lengthy-Time period Care Insurance coverage Coverage

Working out the stairs occupied with buying a long-term care insurance coverage is the most important for making an educated resolution. It is like navigating a winding street, every step a important milestone.

- Evaluate of Wishes: This preliminary step comes to a complete analysis of your present and expected long term healthcare wishes. Believe your age, well being standing, doable for long term sicknesses, and fiscal assets. This cautious analysis guarantees you choose a coverage that adequately addresses your long-term care necessities. Components such because the estimated period of care, and expected prices also are the most important concerns.

- Analysis and Comparability of Insurance policies: Thorough analysis is necessary. Examine other insurance policies introduced by means of quite a lot of insurance coverage suppliers, noting protection main points, premiums, and exclusions. Read about the advantages and boundaries of every coverage to make sure it aligns along with your explicit wishes. This cautious scrutiny guarantees you do not fail to remember any vital main points.

- Session with a Monetary Marketing consultant: In search of steerage from a monetary consultant focusing on insurance coverage is very really helpful. They may be able to supply skilled recommendation adapted on your person instances. A monetary consultant can assist navigate the complexities of long-term care insurance coverage, making sure the most productive have compatibility on your scenario.

- Coverage Variety: In accordance with your wishes and the consultant’s suggestions, make a selection a coverage that provides good enough protection and suits your price range. The coverage will have to obviously Artikel the advantages, boundaries, and related prices.

- Utility and Approval: Entire the appliance procedure completely, offering all important data. The insurance coverage supplier will then evaluate your utility and decide in case your coverage request is licensed. This the most important step comes to verifying your data and comparing your eligibility for protection.

- Coverage Evaluate and Cost: Totally evaluate the coverage paperwork, making sure readability on protection main points and fiscal tasks. Pay the premiums consistent with the coverage phrases. Be sure that the fee construction aligns along with your monetary capability. This evaluate procedure prevents any doable misunderstandings or problems later.

Significance of Consulting with a Monetary Marketing consultant

A monetary consultant performs a very important function in navigating the complexities of long-term care insurance coverage. Their experience is helping you are making knowledgeable selections, making sure the most productive imaginable consequence on your monetary long term. They may be able to mean you can evaluate insurance policies and make a selection essentially the most suitable one on your wishes.

- Experience in Insurance coverage: A monetary consultant focusing on insurance coverage possesses in-depth wisdom of quite a lot of insurance coverage merchandise, together with long-term care insurance coverage. Their experience guarantees that you simply obtain personalised steerage, adapted on your explicit wishes and instances.

- Function Evaluate of Wishes: Monetary advisors can objectively assess your monetary scenario and healthcare wishes. This goal research is helping you are making knowledgeable selections, fending off doable pitfalls.

- Working out Your Monetary Scenario: A monetary consultant allow you to know the way long-term care insurance coverage suits inside your total monetary plan. This holistic working out guarantees you are making selections that align along with your long-term monetary objectives.

- Coverage Comparability and Variety: Advisors can evaluate quite a lot of long-term care insurance coverage insurance policies, making an allowance for components like protection quantities, premiums, and exclusions. This comparability guarantees you choose essentially the most appropriate coverage on your wishes.

Examples of Monetary Advisors Focusing on Insurance coverage

More than a few varieties of monetary advisors concentrate on insurance coverage, every with explicit spaces of experience. Figuring out the fitting consultant is very important for adapted steerage.

- Insurance coverage Agents: Those advisors constitute more than one insurance coverage firms, taking into account complete comparisons of quite a lot of insurance policies. They mean you can navigate the complexities of the insurance coverage marketplace, making sure you choose the most productive coverage on your scenario.

- Qualified Monetary Planners (CFPs): Those execs ceaselessly have in depth wisdom of economic making plans, together with insurance coverage methods. They may be able to incorporate long-term care insurance coverage into your total monetary plan.

- Chartered Lifestyles Underwriters (CLUs): Those advisors concentrate on existence insurance coverage and comparable monetary merchandise. They may be able to be offering steerage on quite a lot of insurance coverage merchandise, together with long-term care insurance coverage.

Commonplace Inquiries to Ask an Insurance coverage Supplier

Asking the fitting questions is the most important for acquiring correct details about long-term care insurance coverage insurance policies. Transparent verbal exchange is vital.

- Protection Main points: Inquire concerning the explicit varieties of care coated, together with professional nursing care, assisted residing, and residential healthcare. Obviously working out the scope of protection is necessary.

- Coverage Exclusions: Establish any doable exclusions or boundaries within the coverage. This proactive means prevents any surprises in a while.

- Top class Construction: Perceive the top class fee time table and its affect to your price range. Realizing the top class construction is helping you organize your budget successfully.

- Coverage Management: Inquire concerning the declare procedure, the coverage management, and the procedures for making claims. Having a transparent working out of the declare procedure is vital.

Evaluating Insurance policies In accordance with Person Wishes

Evaluating insurance policies in accordance with person wishes comes to a meticulous procedure. Believe your individual scenario to make sure you make the most productive resolution.

- Protection Quantity: Believe the quantity of protection wanted in accordance with your expected healthcare bills. This attention guarantees that the coverage adequately addresses your long-term care wishes.

- Top class Value: Assess the top class price and its affect to your price range. This step guarantees that the top class price aligns along with your monetary capability.

- Coverage Barriers: Assessment the coverage’s boundaries and exclusions. This analysis is helping the precise boundaries of the coverage.

Step-by-Step Information to Opting for the Proper Coverage

This step by step information supplies a framework for selecting the proper long-term care insurance coverage.[Visual representation (flowchart)

cannot be created here]

Claims Procedure and Repayment

Marhitei Unum long-term care insurance coverage, prosesi declare and compensation, penting dipelajari untuk memastikan pemahaman lengkap tentang hak dan tanggung jawab. Proses ini menentukan bagaimana klaim diproses dan bagaimana pembayaran dilakukan. Pemahaman yang jelas akan membantu dalam menghadapi situasi yang mungkin muncul.

Unum Lengthy-Time period Care Insurance coverage Claims Procedure Review

Unum long-term care insurance coverage declare proses biasanya dimulai dengan pengajuan permohonan tertulis yang lengkap. Dokumen-dokumen yang dibutuhkan akan bervariasi, tergantung pada jenis klaim dan kondisi yang dialami. Hal ini penting untuk menghindari penundaan atau penolakan klaim.

Eventualities Requiring Declare Submitting

Berikut beberapa contoh skenario di mana klaim mungkin diajukan:

- Pasien membutuhkan perawatan di fasilitas perawatan jangka panjang karena stroke.

- Pasien membutuhkan bantuan dalam aktivitas sehari-hari seperti makan, mandi, dan berpakaian.

- Pasien mengalami cedera yang memerlukan perawatan intensif di rumah sakit.

- Pasien membutuhkan bantuan dalam kegiatan mobilitas.

Standard Declare Processing Time frame

Waktu pemrosesan klaim untuk Unum long-term care insurance coverage dapat bervariasi, tetapi umumnya membutuhkan beberapa minggu. Waktu yang dibutuhkan bergantung pada kompleksitas kasus, kelengkapan dokumen, dan kesiapan pihak-pihak terkait. Penting untuk memahami bahwa proses ini mungkin memerlukan waktu, dan penting untuk berkomunikasi secara efektif dengan perusahaan asuransi.

Repayment Procedure and Related Prices

Proses pengembalian dana umumnya mengikuti prosedur yang telah ditetapkan oleh Unum. Biaya administrasi dan biaya lain yang terkait dengan proses tersebut, jika ada, akan dijelaskan dalam polis asuransi. Untuk menghindari kebingungan, sebaiknya Anda berkonsultasi dengan perwakilan Unum untuk mendapatkan informasi lebih lanjut.

Desk of Claims Procedure Levels

Berikut tabel yang menjelaskan tahapan-tahapan dalam proses klaim:

| Tahap | Deskripsi |

|---|---|

| Pengajuan Klaim | Pengumpulan dokumen-dokumen yang diperlukan dan pengirimannya ke Unum. |

| Evaluasi Klaim | Tim Unum akan mengevaluasi kelengkapan dan keabsahan dokumen. |

| Pemeriksaan Medis (Jika dibutuhkan) | Jika diperlukan, Unum mungkin meminta pemeriksaan medis tambahan untuk memastikan validitas klaim. |

| Keputusan Klaim | Unum akan memberikan keputusan terkait klaim (disetujui atau ditolak). |

| Pembayaran | Jika klaim disetujui, Unum akan melakukan pembayaran sesuai dengan ketentuan polis. |

Lengthy-Time period Care Insurance coverage Developments and Long term Outlook

Di masa kini, industri asuransi perawatan jangka panjang mengalami perubahan yang dinamis. Faktor-faktor seperti demografi, kemajuan teknologi, dan pergeseran preferensi pelanggan turut membentuk lanskap industri ini. Pemahaman akan tren saat ini dan proyeksi masa depan sangat penting untuk para pemangku kepentingan, termasuk nasabah dan penyedia asuransi.

Present Developments within the Lengthy-Time period Care Insurance coverage Business

Tren-tren terkini di industri asuransi perawatan jangka panjang menunjukkan peningkatan kesadaran akan pentingnya perencanaan perawatan jangka panjang. Semakin banyak orang yang menyadari kebutuhan untuk melindungi diri mereka dan keluarga dari biaya perawatan jangka panjang yang tinggi. Permintaan untuk polis asuransi perawatan jangka panjang yang lebih fleksibel dan terjangkau juga meningkat, seiring dengan kebutuhan individu untuk menyesuaikan dengan gaya hidup dan kondisi keuangan mereka.

Penyedia asuransi terus berinovasi dengan menawarkan produk-produk yang lebih terintegrasi dengan layanan kesehatan dan pilihan perawatan yang beragam.

Attainable Long term Trends and Adjustments

Perkembangan masa depan dalam industri asuransi perawatan jangka panjang diprediksi akan didorong oleh peningkatan kebutuhan perawatan jangka panjang seiring dengan bertambahnya populasi lansia. Inovasi teknologi, seperti penggunaan kecerdasan buatan (AI) dan perangkat telemedis, diantisipasi dapat meningkatkan efisiensi dan aksesibilitas layanan perawatan jangka panjang. Pilihan perawatan yang lebih non-public dan terintegrasi, seperti layanan perawatan di rumah, akan menjadi semakin penting.

Pilihan pembayaran yang lebih beragam dan fleksibel, seperti pembayaran berbasis nilai, juga diantisipasi akan muncul di masa depan.

Technological Developments and Their Have an effect on

Kemajuan teknologi akan sangat berpengaruh pada industri asuransi perawatan jangka panjang. Penggunaan perangkat telemedis dan kecerdasan buatan dapat meningkatkan efisiensi layanan perawatan dan menurunkan biaya perawatan. Sistem manajemen perawatan yang terintegrasi dapat memantau kondisi pasien secara real-time dan memberikan intervensi yang tepat waktu. Hal ini dapat mengurangi beban pada sistem perawatan kesehatan dan meningkatkan kualitas hidup pasien.

Have an effect on of Growing old Populations

Pertumbuhan populasi lansia secara signifikan akan meningkatkan kebutuhan akan asuransi perawatan jangka panjang. Angka harapan hidup yang meningkat dan perubahan pola hidup akan berpengaruh terhadap kebutuhan perawatan jangka panjang. Peningkatan jumlah individu yang membutuhkan perawatan jangka panjang akan menciptakan tantangan dan peluang bagi industri asuransi perawatan jangka panjang.

Predicted Lengthy-Time period Care Insurance coverage Prices

Berikut adalah perkiraan biaya asuransi perawatan jangka panjang di masa depan, dengan mempertimbangkan beberapa skenario:

| Skenario | Perkiraan Biaya (Tahun 2030) | Perkiraan Biaya (Tahun 2040) |

|---|---|---|

| Skenario Standar | Rp 100 juta – Rp 200 juta | Rp 200 juta – Rp 400 juta |

| Skenario Tinggi | Rp 200 juta – Rp 300 juta | Rp 400 juta – Rp 600 juta |

Catatan: Biaya di atas merupakan perkiraan dan dapat bervariasi tergantung pada berbagai faktor, termasuk kesehatan individu, jenis perawatan yang dibutuhkan, dan lokasi geografis.

Result Abstract

In conclusion, Unum long-term care insurance coverage supplies a treasured protection web for long term wishes. Through working out the other plan choices, prices, and advantages, you’ll be able to make knowledgeable selections to offer protection to your monetary well-being and the well-being of your family members. This information acts as a place to begin for additional analysis and consultations with monetary advisors. Be mindful, your selection will have to align with your personal instances and long-term objectives.

Query & Solution Hub: Unum Lengthy Time period Care Insurance coverage

What are the everyday prices related to Unum’s long-term care insurance coverage?

Premiums range considerably relying at the selected plan, age, well being standing, and protection quantities. A complete quote comparability is very important to grasp the monetary implications of various choices.

What are the several types of care coated by means of Unum?

Unum usually covers professional nursing, assisted residing, and residential well being care. Explicit protection main points will have to be reviewed throughout the coverage paperwork.

How can I evaluate Unum’s plans with different insurers?

Complete comparability tables, readily to be had on-line, can assist assess top class prices, protection quantities, and coverage exclusions. Visit a monetary consultant for personalised steerage.

What are the stairs occupied with buying a Unum long-term care insurance coverage?

Usually, you can want to entire an utility, supply clinical data, and pay the preliminary top class. Consulting a monetary consultant is very really helpful.