Why is Michigan automotive insurance coverage so pricey? It is a query plaguing many Michiganders. This deep dive explores the standards in the back of Michigan’s hefty auto insurance coverage premiums, evaluating them to different states. We’re going to discover the original rules, declare histories, and marketplace dynamics that give a contribution to the excessive prices.

Michigan’s insurance coverage panorama is a fancy mixture of state rules, using behaviors, and marketplace forces. Working out those parts is essential to navigating the often-confusing international of auto insurance coverage within the mitten state. This research will permit you to make knowledgeable selections about your protection.

Components Influencing Michigan Auto Insurance coverage Prices: Why Is Michigan Automobile Insurance coverage So Dear

Michigan’s auto insurance coverage premiums usally rank some of the best within the country, a scenario influenced by means of a fancy interaction of things. Those components, whilst now not distinctive to Michigan, manifest in ways in which give a contribution to a better price of protection. Working out those parts is the most important for comprehending the demanding situations confronted by means of Michigan drivers.

Geographic Components and Declare Frequency

Michigan’s various geography performs a vital position in shaping insurance coverage prices. The state’s mixture of rural and concrete spaces, blended with its difficult iciness stipulations, contributes to a better frequency of injuries and claims. Critical climate occasions, similar to blizzards and ice storms, continuously disrupt transportation, resulting in extra injuries. Moreover, the superiority of icy roads and deficient visibility will increase the danger of collisions, thereby elevating insurance coverage charges for all drivers within the state.

This contrasts with states with much less excessive climate patterns or a better emphasis on using on transparent roads.

Riding Behaviors and Protection Report

Riding behaviors considerably have an effect on insurance coverage premiums in Michigan, as in different states. Prime charges of rushing, reckless using, and competitive maneuvers give a contribution to a better menace profile for insurers. Michigan, like different states, implements a gadget the place drivers with a historical past of site visitors violations or injuries face increased premiums. This displays the insurer’s wish to organize menace successfully.

As an example, a driving force with a couple of rushing tickets will most likely face a better top class than a driving force with a blank document. In a similar fashion, injuries, particularly the ones leading to accidents or vital assets injury, will have an effect on the driving force’s insurance coverage charges in the long run.

Demographic Components and Riding Historical past, Why is michigan automotive insurance coverage so pricey

Demographics additionally give a contribution to Michigan’s auto insurance coverage panorama. Age, location, and using historical past all play a the most important position in figuring out premiums. More youthful drivers, usally perceived as increased menace, generally face considerably increased premiums. That is in part because of their inexperience and probably increased propensity for injuries. Moreover, drivers dwelling in spaces with increased coincidence charges or crime charges may revel in higher premiums.

The using historical past of a driving force, together with any prior injuries or site visitors violations, at once influences the top class. Insurers use this information to evaluate the danger related to insuring a selected driving force.

State Rules and Monetary Balance

Michigan’s particular rules and the monetary steadiness of insurance coverage firms are the most important components in figuring out premiums. The state’s rules, whilst meant to give protection to shoppers, would possibly have an effect on the full price of insurance coverage. Variations in state rules around the nation give a contribution to the difference in insurance coverage charges. As an example, states with stricter rules on minimal protection quantities would possibly result in increased premiums.

Insurers assess the monetary well being and steadiness of businesses prior to providing protection. Insurers with a more potent monetary place would possibly be offering extra aggressive charges. The state’s rules at the quantity of protection required for drivers additionally performs a job.

Desk: Important Components Influencing Michigan Auto Insurance coverage Prices

| Issue | Description | Have an effect on on Premiums |

|---|---|---|

| Geographic Components | Mixture of rural and concrete spaces, difficult iciness stipulations | Upper declare frequency, higher menace of injuries |

| Riding Behaviors | Rushing, reckless using, competitive maneuvers | Greater menace profile, increased premiums |

| Demographic Components | Age, location, using historical past | More youthful drivers and drivers in high-risk spaces face increased premiums |

| State Rules | Minimal protection quantities, different rules | Affect general price of insurance coverage, probably impacting charges |

| Monetary Balance of Insurance coverage Corporations | Monetary power and steadiness of insurers | More potent monetary place may end up in extra aggressive charges |

Particular Rules and Regulations in Michigan

Michigan’s auto insurance coverage panorama is formed by means of a fancy interaction of state rules and regulations, considerably impacting the premiums drivers pay. Those rules, usally influenced by means of the will for monetary accountability and public protection, create a framework that insurers use to evaluate menace and calculate premiums. Working out those particular rules is the most important to comprehending the full price of insurance coverage within the state.

Monetary Accountability Regulations

Michigan’s monetary accountability regulations mandate that drivers deal with good enough legal responsibility insurance plans to give protection to themselves and others in case of injuries. Failure to conform ends up in consequences, together with suspension of using privileges. This felony requirement at once influences insurance coverage premiums. Drivers with a historical past of injuries or violations, or those that have had their using privileges suspended for failing to deal with enough insurance coverage, face considerably increased premiums.

Insurers view those drivers as higher-risk folks, necessitating a better top class to offset the prospective monetary burden. The state’s monetary accountability regulations, coupled with the consequences for non-compliance, create a gadget the place keeping up insurance coverage is the most important for each the driving force and the insurance coverage corporate.

No-Fault Insurance coverage

Michigan’s no-fault insurance coverage gadget performs a pivotal position in figuring out the price of auto insurance coverage. Below the program, the injured celebration in an coincidence receives reimbursement from their very own insurer, without reference to fault. The program impacts premiums by means of requiring insurers to hide claims for accidents and assets injury without reference to fault. Whilst protective shoppers, it does have an effect on the price of insurance coverage, as insurers wish to account for a much wider vary of possible claims of their top class calculations.

The no-fault gadget, by means of design, shifts the point of interest from figuring out fault to compensating the injured celebration promptly.

Minimal Protection Necessities

Michigan has established minimal protection necessities for auto insurance coverage insurance policies. Those minimums, which range in accordance with the kind of coverage, affect the price of insurance coverage. Insurance policies with decrease minimums, regardless that assembly the felony necessities, may disclose the insured to larger menace must an coincidence happen. This at once affects insurers, as they’ve to make sure that the premiums for those insurance policies can nonetheless duvet possible claims inside the required minimums.

As an example, insurance policies falling under the minimal necessities may lead to increased premiums to verify the corporate can nonetheless meet its contractual responsibilities to the insured.

Desk of Particular Rules and Their Have an effect on

| Law | Description | Have an effect on on Value |

|---|---|---|

| Monetary Accountability Regulations | Drivers will have to deal with good enough legal responsibility insurance coverage. | Upper premiums for drivers with a historical past of injuries or violations; increased premiums for insurance policies falling under minimums. |

| No-Fault Insurance coverage | Injured events obtain reimbursement from their very own insurer, without reference to fault. | Greater premiums to hide possible claims, without reference to fault. |

| Minimal Protection Necessities | State-mandated minimums for legal responsibility and different coverages. | Premiums could also be decrease if insurance policies meet minimums, however increased menace to the insured if insurance policies fall under minimums. |

| Contemporary Legislative Adjustments | Regulation impacting charge changes or particular coverages. | Adjustments can have an effect on the fee in accordance with the character of the adjustments, similar to introducing new rules or editing current ones. |

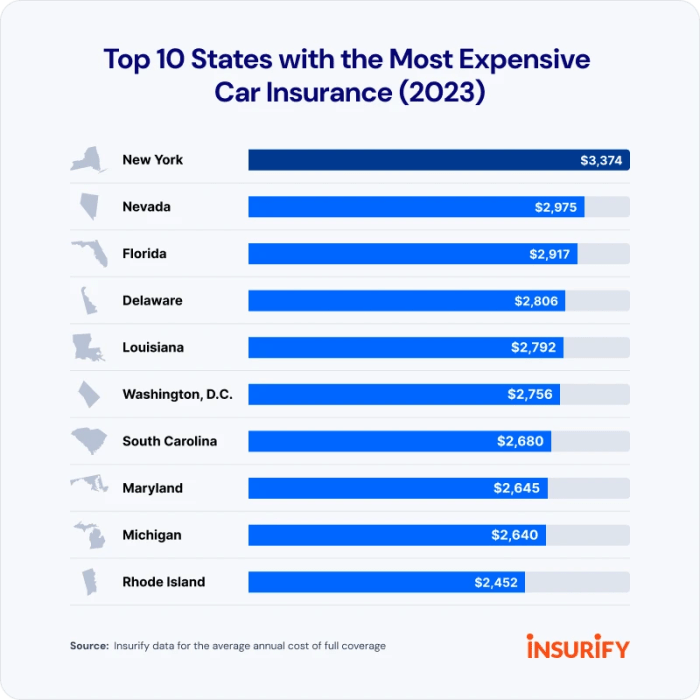

Comparability to Different States

Michigan’s auto insurance coverage rules, together with its no-fault gadget and minimal protection necessities, fluctuate from the ones in different states. This modification in rules ends up in differing top class constructions. Evaluating Michigan to states with identical demographics and coincidence charges, like the ones within the Midwest, unearths variations in top class ranges, reflecting the original traits of every state’s insurance coverage marketplace. This comparability underscores how particular rules considerably have an effect on the full price of insurance coverage inside a specific state.

Claims Historical past and Frequency

Michigan’s auto insurance coverage premiums are considerably influenced by means of the frequency and severity of claims filed. Working out the connection between claims historical past and insurance coverage prices is the most important for assessing the full insurance coverage panorama and its have an effect on on drivers. This phase delves into the specifics of declare frequency in Michigan, evaluating it to different states, and examining how coincidence severity and former claims have an effect on long run premiums.

Dating Between Declare Frequency and Insurance coverage Prices

Declare frequency, the velocity at which insurance coverage claims are filed, is a significant component in figuring out insurance coverage premiums. Prime declare frequency signifies a better menace for insurers, prompting them to regulate premiums upward to hide possible losses. Conversely, low declare frequency suggests a decrease menace, resulting in probably decrease premiums. This correlation between declare frequency and insurance coverage price is a basic idea in actuarial science, which insurers use to evaluate menace and set suitable premiums.

Comparability of Claims Frequency Information in Michigan to Different States

Direct, publicly to be had comparative information on declare frequency throughout states is usally restricted. On the other hand, normal tendencies will also be noticed. Michigan, together with different states experiencing excessive inhabitants density, probably increased charges of site visitors congestion, or recognized climate patterns contributing to extra injuries, usally see increased declare frequencies in comparison to states with decrease inhabitants density or much less excessive climate.

Detailed research of particular declare information for Michigan calls for gaining access to insurance coverage trade experiences and information units, which is probably not readily to be had to the general public.

Have an effect on of Twist of fate Severity on Insurance coverage Charges

The severity of injuries considerably affects insurance coverage charges. A minor fender bender ends up in a fairly low declare price in comparison to a significant collision or a multi-vehicle coincidence. The severity of the coincidence, together with the level of accidents, assets injury, and different components, at once influences the declare quantity. Insurers use statistical fashions to account for the severity of claims when calculating premiums, making sure that premiums mirror the actual menace related to several types of injuries.

Have an effect on of Earlier Claims Historical past on Long term Premiums

A driving force’s earlier claims historical past is a the most important think about figuring out long run premiums. Drivers with a historical past of common claims are regarded as higher-risk, main to raised premiums. Insurers analyze declare information to spot patterns and expect long run declare frequency. The selection of claims, the kind of claims, and the time frame over which claims came about all give a contribution to the danger review.

As an example, a driving force with a couple of claims inside a brief length could also be assigned a better menace ranking than a driving force with a unmarried declare years in the past.

Correlation Between Claims Frequency and Insurance coverage Prices in Michigan

An instantaneous, definitive correlation between declare frequency and insurance coverage price is advanced for example with a easy desk, as quite a lot of different components affect pricing. On the other hand, a normal development is observable. Upper declare frequencies in Michigan usally correlate with increased insurance coverage prices. A simplified desk can simplest constitute a restricted point of view.

| Declare Frequency (in step with 100 drivers) | Estimated Have an effect on on Top rate (approximate share build up) |

|---|---|

| Low (e.g., <10) | Minimum (0-5%) |

| Reasonable (e.g., 10-20) | Reasonable (5-15%) |

| Prime (e.g., >20) | Important (15%+ build up) |

Visible Illustration of Declare Information Over Time in Michigan

A visible illustration of declare information over the years in Michigan, probably the use of a line graph, may display tendencies in declare frequency. The x-axis would constitute time (e.g., years), and the y-axis would constitute the selection of claims in step with length (e.g., in step with 100 drivers). This visible help may spotlight classes of upper or decrease declare frequency and probably display correlations with exterior components similar to financial stipulations, climate patterns, or adjustments in site visitors regulations.

Information would wish to be moderately interpreted and introduced with right kind context to keep away from deceptive conclusions.

Availability and Pageant within the Marketplace

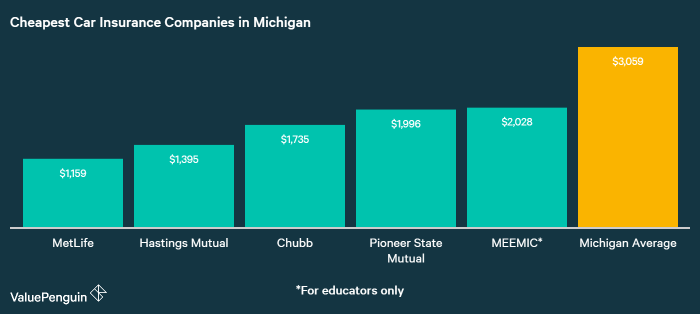

The supply and degree of pageant amongst insurance coverage suppliers considerably have an effect on Michigan auto insurance coverage prices. A aggressive marketplace, with a couple of suppliers providing quite a lot of plans, generally ends up in decrease costs and extra possible choices for shoppers. Conversely, restricted pageant usally ends up in increased premiums and diminished client choices. Working out those dynamics is the most important for comprehending the full price construction of Michigan auto insurance coverage.The Michigan auto insurance coverage marketplace gifts a combined image on the subject of pageant.

Whilst a number of huge nationwide carriers function within the state, the presence of smaller, regional insurers varies. This asymmetric distribution of suppliers can have an effect on the full aggressive panorama, probably impacting worth sensitivity and client selection.

Degree of Pageant

The extent of pageant amongst insurance coverage suppliers in Michigan varies by means of area and particular forms of protection. Whilst main nationwide avid gamers deal with a robust presence, smaller, in the community targeted firms would possibly be offering extra adapted plans and probably aggressive charges. On the other hand, the loss of a extremely fragmented marketplace, not like another states, may prohibit the level of worth differentiation amongst suppliers.

Components Influencing Availability

A number of components affect the supply of insurance coverage choices in Michigan. Those come with regulatory necessities, profitability concerns, and the presence of state-specific mandates. As an example, necessary minimal protection necessities can have an effect on the viability of a few protection choices for smaller firms. The price of claims processing and adjusting in Michigan, in addition to the full monetary steadiness of insurers, additionally performs a job.

Pricing and Protection Variations

Important variations in pricing and protection exist amongst quite a lot of suppliers. Those diversifications stem from components similar to menace review methodologies, underwriting practices, and claims revel in. Insurers make use of other algorithms to calculate menace profiles for person drivers, and those algorithms would possibly believe components like using historical past, location, car sort, or even age. Those discrepancies may end up in considerable worth diversifications for identical protection.

Other suppliers may additionally be offering quite a lot of add-on coverages or reductions, additional complicating comparisons.

Have an effect on of Restricted Pageant

Restricted pageant at once affects client possible choices and prices. When fewer suppliers are provide, shoppers face a discounted vary of choices and could also be not able to safe essentially the most favorable charges. This state of affairs may end up in increased premiums as suppliers can set costs with much less worry for marketplace pressures. It additionally limits shoppers’ skill to buy round for the most productive deal.

Geographic Permutations

Geographic diversifications in insurance coverage availability and pricing are noticeable in Michigan. Spaces with increased charges of injuries or particular demographic profiles may revel in increased premiums in comparison to spaces with decrease coincidence charges. Rural spaces, particularly, could have restricted insurer availability, as the price of servicing those areas can outweigh the prospective earnings.

Pricing Comparability

| Insurance coverage Supplier | Top rate for Elementary Legal responsibility Protection (Instance) | Top rate for Complete Protection (Instance) |

|---|---|---|

| Insurer A | $1,200 | $1,800 |

| Insurer B | $1,150 | $1,750 |

| Insurer C | $1,350 | $2,000 |

| Insurer D | $1,280 | $1,900 |

Word: Those figures are illustrative examples and don’t constitute precise premiums. Premiums can range considerably in accordance with person driving force profiles and particular protection alternatives. Information for this desk is hypothetical and does now not mirror particular marketplace stipulations.

Sorts of Protection and Their Have an effect on

Michigan auto insurance coverage premiums are influenced considerably by means of the forms of protection decided on. Working out the quite a lot of protection choices and their related prices is the most important for making knowledgeable selections. Other ranges of protection translate to various ranges of economic coverage within the tournament of an coincidence or injury for your car.

Evaluate of To be had Protection Varieties

Michigan drivers have get right of entry to to a spread of protection sorts, every designed to handle particular dangers. Elementary protection choices come with legal responsibility, collision, and complete. Legal responsibility protection protects towards damages you purpose to others, whilst collision protection can pay for damages for your car without reference to who’s at fault. Complete protection, then again, compensates for injury for your car from non-collision occasions, similar to robbery, vandalism, or climate occasions.

Have an effect on of Protection Alternatives on Premiums

The choice of protection sorts and ranges at once affects insurance coverage premiums. Upper ranges of protection usally lead to increased premiums, as they supply broader monetary coverage. As an example, a coverage with increased legal responsibility limits and complete protection will usually be dearer than one with simplest elementary legal responsibility protection. It’s because the insurer assumes larger menace with extra complete protection.

The price of insurance coverage is in the long run a stability between the extent of coverage desired and the related monetary burden.

Value Implications of Other Protection Ranges

The price of quite a lot of protection choices varies significantly. Legal responsibility protection, essentially the most elementary type of coverage, usually carries the bottom top class. Including collision and complete protection considerably will increase the fee. The level of the protection (e.g., legal responsibility limits) additional affects the top class. Upper legal responsibility limits imply larger monetary accountability for the insurer, therefore the upper top class.

Correlation Between Protection and Declare Chance

A powerful correlation exists between the selection of protection and the chance of injuries and claims. Drivers with complete and collision protection are much less more likely to revel in vital monetary losses within the tournament of an coincidence or injury. Complete and collision protection usally ends up in fewer claims, because the insurance coverage corporate at once compensates for damages to the insured car, lowering the monetary burden at the driving force.

Drivers with simplest legal responsibility protection are extra at risk of considerable out-of-pocket bills within the tournament of an coincidence.

Comparative Value Research of Protection Choices

The desk under gifts a normal comparability of protection choices and their estimated prices for the standard driving force in Michigan. Word that those figures are estimates and precise prices would possibly range in accordance with person instances.

| Protection Kind | Description | Estimated Value (in step with 12 months) |

|---|---|---|

| Legal responsibility Most effective | Covers damages to others in an coincidence the place you might be at fault. | $500 – $1500 |

| Legal responsibility + Collision | Covers damages for your car and to others in an coincidence the place you might be at fault. | $1000 – $2500 |

| Legal responsibility + Collision + Complete | Covers damages for your car and to others, without reference to fault, and for non-collision occasions. | $1500 – $3500 |

Word: Those are estimates. Exact prices depends upon components similar to using document, car sort, location, and deductibles.

Position of Insurance coverage Corporations in Michigan

Insurance coverage firms play a important position within the Michigan auto insurance coverage marketplace, appearing as intermediaries between drivers and the prospective monetary dangers related to automotive injuries. Their operations surround menace review, top class calculation, claims processing, and general marketplace steadiness. Working out their practices and techniques is the most important in examining the excessive price of insurance coverage within the state.Pricing methods hired by means of Michigan insurance coverage firms are multifaceted and sophisticated.

Those methods usally contain a mixture of things, together with actuarial research of coincidence information, demographics of drivers in particular spaces, and the price of claims settlements. Insurance coverage firms goal to stability profitability with affordability, a stability usally tough to reach within the context of excessive coincidence charges or particular regulatory necessities.

Pricing Methods and Strategies

Insurance coverage firms use quite a lot of the way to resolve premiums, usally incorporating an advanced mix of knowledge issues. A key issue is the research of historic claims information, which permits firms to spot high-risk drivers or geographic spaces liable to injuries. Moreover, driving force demographics similar to age, using historical past, and placement are factored into the calculation. Top rate calculations additionally believe the kind of car insured, protection ranges decided on, and the monetary steadiness of the insurance coverage corporate itself.

This intricate procedure guarantees that businesses are adequately compensated for the danger they think.

Monetary Balance and Popularity of Corporations

The monetary steadiness and recognition of insurance coverage firms considerably affect the pricing of car insurance coverage in Michigan. Corporations with a robust monetary ranking, as decided by means of unbiased companies like A.M. Highest or Usual & Deficient’s, generally be offering decrease premiums because of their skill to maintain possible claims. Conversely, firms with weaker scores may rate increased premiums to make amends for a perceived increased menace of insolvency.

This menace review displays the arrogance of the insurance coverage marketplace and the shoppers depending on those firms to satisfy their responsibilities.

Comparability of Pricing Methods

Direct comparability of pricing methods amongst Michigan insurance coverage firms unearths substantial variance. Components like the particular actuarial fashions hired, the objective buyer base, and the geographic focal point of every corporate affect their pricing selections. Some firms may focal point on providing decrease premiums for particular demographic teams, whilst others may prioritize complete protection applications at increased worth issues. The marketplace pageant is a important component on this dynamic pricing panorama.

Examples of Corporate Practices Contributing to Prices

A number of practices give a contribution to the price of automotive insurance coverage in Michigan. As an example, the expanding price of hospital treatment following injuries at once affects claims settlements, probably expanding premiums. In a similar fashion, emerging fraud charges in insurance coverage claims require firms to include further safeguards and alter pricing accordingly. Moreover, regulatory necessities, similar to the ones associated with minimal protection ranges, additionally play a vital position in influencing pricing.

Abstract of Main Insurance coverage Corporations in Michigan

| Corporate | Monetary Ranking (e.g., A.M. Highest) | Pricing Technique Center of attention | Protection Choices |

|---|---|---|---|

| Corporate A | A++ | Aggressive pricing, complete protection | Complete protection choices, reductions for protected drivers |

| Corporate B | A+ | Emphasis on bundling insurance coverage merchandise | Number of applications, focal point on multi-policy reductions |

| Corporate C | A | Center of attention on particular demographics (younger drivers, and so forth.) | Adapted protection choices, possible for increased premiums for particular teams |

Word: Monetary scores are illustrative and must be verified at once from respected ranking companies. The desk represents a generalized comparability and does now not come with each and every insurance coverage corporate working in Michigan. Pricing methods and protection choices are matter to switch.

Finishing Remarks

In conclusion, Michigan’s automotive insurance coverage prices stem from a mixture of things, together with particular rules, declare frequency, and marketplace dynamics. Whilst the explanations are multifaceted, figuring out those parts can empower you to make a choice the suitable protection on the proper worth. Armed with this data, you’ll make savvy possible choices to navigate Michigan’s insurance coverage marketplace.

Questions and Solutions

What in regards to the impact of climate on insurance coverage charges?

Michigan’s harsh winters and probably hazardous highway stipulations give a contribution to raised insurance coverage premiums. Extra injuries and claims associated with iciness using can push up reasonable prices for everybody.

How does my using document have an effect on my insurance coverage?

A blank using document without a injuries or site visitors violations usually ends up in decrease premiums. Conversely, previous incidents, like rushing tickets or injuries, considerably have an effect on charges.

Are there any reductions to be had?

Sure, many insurers be offering reductions for protected using, just right scholar standing, and defensive using classes. Investigating to be had reductions can probably decrease your top class.

How does pageant have an effect on insurance coverage costs?

Restricted pageant within the insurance coverage marketplace may end up in increased costs for shoppers. A extra aggressive marketplace usally ends up in extra possible choices and higher pricing.